Forex trading has become a viable source of income for many individuals. The potential to earn $300 per day trading forex is an enticing prospect that warrants exploration.

This article will delve into the question: Can I earn $300 per day trading forex? It will examine how aspiring traders can develop their skills and make informed decisions in order to maximize profits.

An overview of risk management strategies, as well as key considerations when entering the market, will be discussed. Ultimately, this analysis aims to provide readers with all the necessary information they need to understand if it is possible to earn $300 or more through forex trading each day.

It is possible to earn $300 daily trading forex but it will be very hard to do! It’s very uncommon to have a ‘green day’ every day in the markets and you should look to consider profits over the long term, rather than being concerned about making $300 each day.

Let’s find out more…

You Can Earn $300 Daily Trading Forex?

- Forex trading offers a variety of benefits, such as 24-hour trading, high liquidity and access to a wide range of markets.

- A possible strategy for earning $300 daily with forex trading is to use a risk-adjusted approach, allocating capital to currency pairs with strong fundamentals.

- Another strategy is to use a price action approach, focusing on technical analysis of price movements in the forex market.

- Additionally, a trader may look for opportunities in news-based trading, taking advantage of short-term price movements in response to news announcements.

- It is important to note that forex trading carries a high degree of risk. Leverage can both increase the potential gains and losses that a trader may experience.

- As such, it is important to understand the risks of forex trading before getting involved in the market.

Benefits Of Forex Trading

Forex trading offers many potential benefits, including the ability to earn a substantial income. The proper risk management strategies must be employed in order to maximize one’s profit while minimizing any potential losses.

Leverage usage can also lead to greater returns if utilized properly by skilled traders. Trading psychology plays an important role when it comes to successfully managing trades; it is vital for traders to remain disciplined during their market analysis and throughout the entire trade execution process.

You might benefit from trading with an instant funding prop firm if you’re looking to increase your capital under management, thus increasing daily profits.

if you’re looking to increase your capital under management, thus increasing daily profits.

Demo trading is ideal for those new or inexperienced with forex trading as it allows them to practice trading in a simulated environment without risking real capital.

Ultimately, forex trading presents ample opportunities for individuals who are willing to commit time and effort into mastering its various aspects such as risk management, leverage usage, trading psychology and market analysis.

Strategies For Earning $300 Daily

Achieving the goal of earning $300 daily trading forex requires dedication and effort to master various strategies.

Scalping rules, for instance, involve a trader executing quick trades in order to capitalize on small market price movements; this strategy is often used by day traders looking to make frequent profits over short periods of time.

Money management plays a key role when it comes to scalping as proper risk assessment must be employed in order to keep losses at a minimum while maximizing potential returns.

Market analysis is vital when utilizing any type of trading strategy; trend following can help identify entry and exit points which could lead to successful trades.

In conclusion, there are many techniques traders employ with the aim of achieving their desired financial goals from forex trading.

Risks Of Forex Trading

Despite the potential of earning $300 daily trading forex, there are risks associated with it.

Managing risk is essential when it comes to successful currency trading since leverage can amplify losses as well as profits.

Emotional control and maintaining a risk/reward ratio that works for each individual trader are important factors in managing such risks.

Market analysis should always be done before entering any trade to help identify opportunities while minimizing exposure to possible losses.

Therefore, it is critical for traders to understand the various risks involved when engaging in forex trading in order to maximize their chances of achieving financial success.

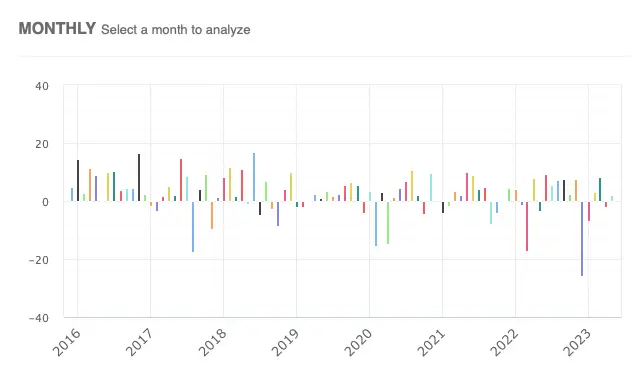

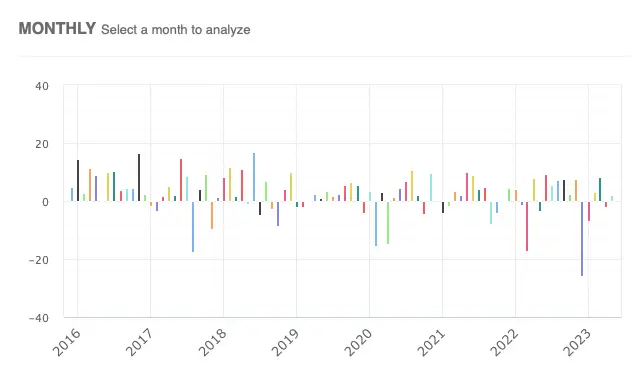

Looking At Profits Should Be Done Monthly, Not Daily

Forex profits can be earned on a monthly basis, and this method of trading has some advantages over daily profits.

One advantage of monthly profits is that it allows traders to focus on long-term trends in the market, which is important for reducing risk.

Additionally, monthly profits are less susceptible to market volatility than daily profits.

On the other hand, daily profits can provide traders with a greater degree of control over their trading decisions, as well as the opportunity to capitalize on short-term market changes.

Furthermore, daily profits also provide traders with more frequent feedback about their trading performance.

However, daily profits also come with greater risks and require more frequent monitoring.

Ultimately, traders should consider their individual trading goals and risk tolerance when determining whether to pursue monthly or daily profits.

Monthly Forex Profits

The potential for earning profits from trading the forex markets is a desirable outcome for many traders.

However, one should never look only at daily returns when assessing their performance, but rather focus on how much profit they are making over a month or longer period of time.

Risk management and careful use of leverage ratios can help to ensure capital preservation while using trading tools properly will assist with market analysis and understanding the bigger picture.

By taking this approach, traders may find that even if they don’t make $300 per day in profits, focusing on monthly gains gives them an overall more accurate assessment of their performance.

One must also take into account the costs associated with forex trading such as commissions and spreads which can further reduce profitability over shorter periods.

To sum up, it is important to have realistic expectations based on sound risk management principles when deciding whether to pursue forex trading as a means of income generation.

Advantages Of Monthly Profits

Focusing on monthly profits can be advantageous for traders in many ways.

Firstly, shifting one’s focus from daily returns to longer time frames allows for better risk management; losses become easier to manage and absorb when spread over a month as opposed to occurring all at once.

Furthermore, diversifying strategies across different time frames reduces the chances of having too much money exposed during volatile market conditions.

In addition, this approach gives traders more opportunities to adjust their positions without being forced into making decisions quickly due to fear of incurring large losses within shorter periods.

Ultimately, by taking a long-term view based on sound risk management principles, traders are likely to have greater success in achieving consistent profitability compared with those who rely only on short-term gains.

Disadvantages Of Daily Profits

It is important to consider the potential drawbacks of focusing on daily profits, as opposed to looking at them from a monthly perspective.

While short-term gains can be attractive for traders who are not equipped with risk management strategies and proper capital requirements, they often come with greater time commitment and emotional control.

Daily trading requires more discipline than longer term investments which may prove too challenging for some. Furthermore, it presents an increased chance of losses due to market volatility within shorter periods.

Thus, it is essential that traders evaluate their goals thoroughly before determining whether day or long-term trading is the most suitable approach in order to achieve consistent profitability over time.

Finding A Trading Strategy To Earn Consistent Profits

When developing a trading plan, it is essential to create a plan that is tailored to the individual’s trading style and goals.

Additionally, it is important to research the various types of trading strategies, such as day trading, swing trading, and scalping, to find which one is best suited for the individual’s trading strategy.

Identifying trading patterns is another important component of a successful trading strategy; this involves looking for patterns in the market to determine areas of support and resistance and to identify entry and exit points.

Additionally, using technical analysis tools like chart patterns, indicators, and trend lines can help traders identify trading patterns in the market.

Developing A Trading Plan

Developing an effective trading plan is essential for achieving consistent profits when engaging in forex trading.

Risk management strategies, such as leveraging risks and demo trading are key components of any comprehensive plan. This can help traders to manage risk while gaining exposure to the markets.

Additionally, technical analysis provides valuable insight into potential trades based on historical data and market movements.

Psychological factors also play a major role when it comes to managing emotions that may arise during volatile periods or after losses have occurred.

To successfully build a long-term strategy, developing discipline and concentration skills is paramount in order to remain focused even during high pressure situations.

Ultimately, by effectively utilizing various tools available, traders can create successful plans with clear objectives that lead to profitable results over time.

Identifying Trading Patterns

Once a trading plan has been established and the trader is comfortable with their strategy, it’s important to identify patterns in the financial markets.

Technical analysis can be used to assess how different factors interact and inform potential trades.

Leverage trading allows traders to maximize risk-reward ratios by using gearing or margin requirements when entering positions. This helps reduce exposure levels while still allowing them to benefit from profitable opportunities.

Risk management strategies should also be implemented so that losses are minimized if the trade moves against expectations.

Demo trading can help familiarize traders with various platforms before investing real money into the market.

By understanding these concepts, traders have a better chance of spotting potential patterns which may provide an advantage over time.

Through careful examination of price movements and other trends, traders can gain insights that ultimately allow for more informed decisions based on probabilities rather than guesswork.

Work With A Funded Trading Account To Increase Daily Profits

Leveraging trades is a strategy employed by traders in order to increase their profits by using borrowed capital to increase the size of a position. Risk management strategies must be employed in order to guard against the potential losses associated with leveraging trades.

Capitalizing on volatility is a profitable strategy employed by traders when market conditions are particularly volatile, as price movements can be significant. Leveraging trades can be a profitable strategy when used in tandem with risk management strategies to ensure that losses are minimized.

Capitalizing on volatility can also be a profitable strategy, however, traders must be aware of the potential for heightened risks associated with this type of trading. To maximize profits, it is recommended that traders use a combination of leveraging trades and capitalizing on volatility, while utilizing risk management strategies to protect against potential losses.

Leveraging Trades

Trading with a funded trading account

Additionally, traders must have proper money management skills and maintain an objective mindset when making decisions to keep emotions from clouding judgement. Market analysis plays a role in leveraging trades but having the right trading psychology is paramount for success. To maximize rewards while limiting risk, traders need to focus on controlling their behavior by following pre-determined rules and strategies that they deem will lead them towards their desired goals.

Risk Management Strategies

When trading with a funded account, risk management strategies are of utmost importance.

Risk/reward ratios should be established prior to any leverage trades and the potential reward must justify taking on the additional risk.

Leverage/margin can be used in order to allow traders to open larger positions without needing more capital; however, limits/stops should also be put into place in anticipation of unexpected market conditions.

Trading within an appropriate timeframe is key as well as understanding volatility/volumes that may affect the trade’s outcome.

With this information, traders will have insight into how much they stand to gain or lose based on their analysis and decisions made thus giving them control over which direction their profits take.

Ultimately, by having proper risk management strategies in place when leveraging trades, traders can set themselves up for success while managing risks along the way.

Capitalizing On Volatility

Volatility can be a key factor in increasing daily profits when trading with a funded account. By understanding how to capitalize on price movements, traders will have the opportunity to increase their returns while managing risk.

Scalping tactics are commonly used by day traders who look for quick openings and exits of positions in order to take advantage of short-term fluctuations. Risk management is still important as leverage use must be monitored closely due to potential losses that could occur if market analysis or price action goes against the trader’s favor.

Therefore, it is crucial that traders understand the importance of proper risk management strategies when leveraging trades and scalping tactics within an appropriate timeframe in order to maximize profitability from volatility shifts.

Conclusion

Trading forex can be a lucrative endeavor, however profits should not be looked at on a daily basis. Rather, traders should focus on consistency in the long term by finding an appropriate trading strategy and working with funded accounts to increase their potential for higher returns.

By focusing on consistent profitability over time, instead of day-to-day gains, traders have the best chance of achieving success and earning $300 per day from their trading activities.