If you want to take your trading career seriously, you’ll most likely be trading with a forex prop firm

With over 50+ prop firms in the industry, it’s important to know which firm is best for you so you can match your trading style to the perfect company!

In this article, we’re going to be talking about Finotive Funding

Are these guys the best prop firm for you? Let’s find out now…

Lux Trading Firm

Lux Trading Firm are a highly rated prop firm offering initial funding of up to $1,000,000 with a 75% profit split.

They offer an amazing scaling program up to $10M, with multiple industry-leading features such as their unique offering to trade on TradingView’s charts, large selection of CFD’s, 500 Crypto’s, 12,000 Stocks, Elite Packages, and no time limits make it the perfect funding option!

Lux Trading is one of the few online prop firms offering real trading capital, and trading with a regulated A-book broker!

- Real Money Funding

- Brick & Mortar Business

- Great Reputation

- Funding Up To $10,000,000

Who Are Finotive Funding?

Finotive Funding

Moving the lovely branding aside, what draw me to the company as a potential funding option for my own trading strategies were the instant verification accounts. This reminds me of the old BluFx accounts – something that worked very well for me!

So, is this the right prop firm for you? Let’s keep reading…

How Do I Get Funding From Finotive Funding?

Having all of the funded accounts and great trading conditions are great but how can you get your hands on them? Well, there are 3 different options for us to look at…

1. Instant Funding Account

The option I chose is the instant funding account, purely because I’m very impatient! These remind me of the old BluFx accounts, where you can have no capital at 13:30 and have a funded account by 14:30.

The instant funding model allows you to buy an account right now. It comes with either standard or aggressive. This dictates your risk allowance, in terms of drawdown and equity.

I must mention that there is a responsible trading policy, which means you always need to trade with a stop loss and not risk 100% of your trading capital. Full details are to be found on their website, I won’t bore you with them!

2. One Step Funding

The one step challenge is someone in the middle ground between the standard two step funding and the instant funding model!

In the one step challenge, there isn’t a valuation stage. You just need to reach the 10% profit target, with unlimited duration, without breaching the 4% daily drawdown and 7.5% total loss limit.

Again, much like in the instant funding model, you must abide by the responsible trading policy

The profit split is 95%, which is above standard for the industry.

3. Two Step Funding

The challenge account is very similar to many of the industry leading funding challenges you see in the industry! The main difference is the fact that there is no maximum duration for these challenges!

This, in theory, makes it easier for us to pass.

The drawdown limits, equity drawdown and profit target is very similar to the industry standard and you’ll find this is fairly normal. Of course, the edge comes from the fact that there is no maximum duration.

Many firms, as you’ll be aware, have a 20 day limit – making it much harder for traders to achieve funding!

Is Funding From Finotive Realistic?

Yes, achieving funding from Finotive is very achievable. In fact, depending which account you go for, you don’t even need to try!

If you’re looking at the one step or the two step challenges, the trading rules are exactly the same as the industry standard. Many of the top prop firms have the exact same rules in these challenges, in terms of drawdown and profit targets.

The added value here with Finotive is the fact these challenges do not have a time limit. So instead of us traders needing to complete a 7.5% profit target in 20 trading days, now we can take months or even years – something much more achievable, in my opinion.

The next and most obvious way to obtain a funded trading account is to use the instant funding model! This is what personally draw me to the firm and I admit to having received a fair amount of emails about this model before I bothered looking into it!

With the funding model you pay for a trading account, like we used to do with BluFx, then would just get paid profits straight out of these accounts. Typically, these are more expensive, however!

Above is a video, detailing the Responsible Trading Policy. It goes without saying that adhering to this policy will be key to getting funded and is something to bear in mind as a trader.

The benefit of having this so clearly outlined, for us, is that you should be able to stick to this and not risk losing your funding account challenge due to a lack of understanding – something I know happens with some firms!

What Makes Finotive Different From Any Other Prop Firm?

For me, the main difference Finotive has over the market is the instant funding model. This is something that a few prop firms have played around with, but never really committed to. This, truthfully, is what draw me to seeking funding from these guys in the first place – I’m not patient!

The instant funding account means that you can essentially get a large funded account within minutes. Obviously, you’re going to have to remain within the risk management and trading rules to maintain that account but for us profitable traders, that shouldn’t be an issue.

I would say that the other challenge accounts and trading rules are similar to the industry standard with just small variations in percentages and pricing.

Finotive Pricing – How Much Does It Cost?

Finotive is actually one of the cheapest, if not the cheapest prop firm funded account in the industry.

Why?

Well, they offer trading capital as low as $2,500. This may seem tiny to some traders, but being able to dip their toe with a $50 fee is a great way to get started!

From this perspective, it’s incredibly cheap and will cost you much less than a lot of the firms right now.

Finotive Account Scaling

If you’re a regular reader, you’ll know how much value I place upon scaling plans in prop firms. I think they’re so important and I wouldn’t even dream of trading with a firm that didn’t offer one!

Finotive offer a great scaling plan which competes with some of the larger players in the industry.

Finotive Funding Platform Choices

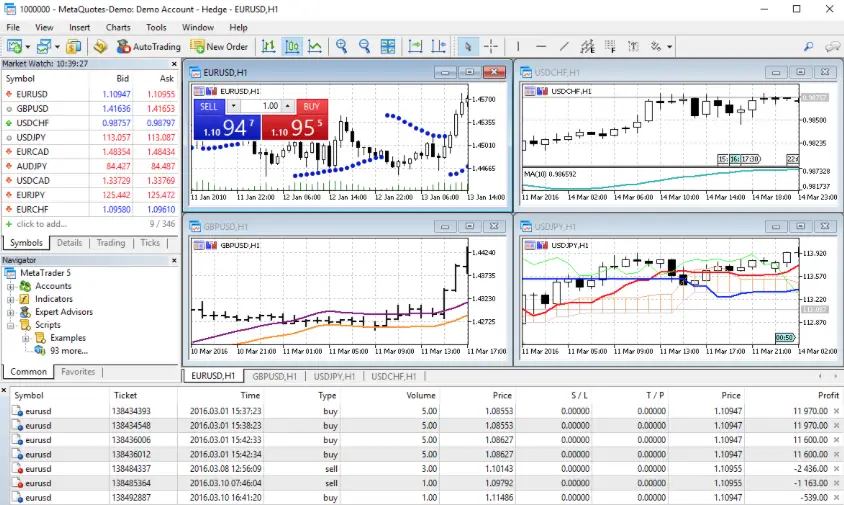

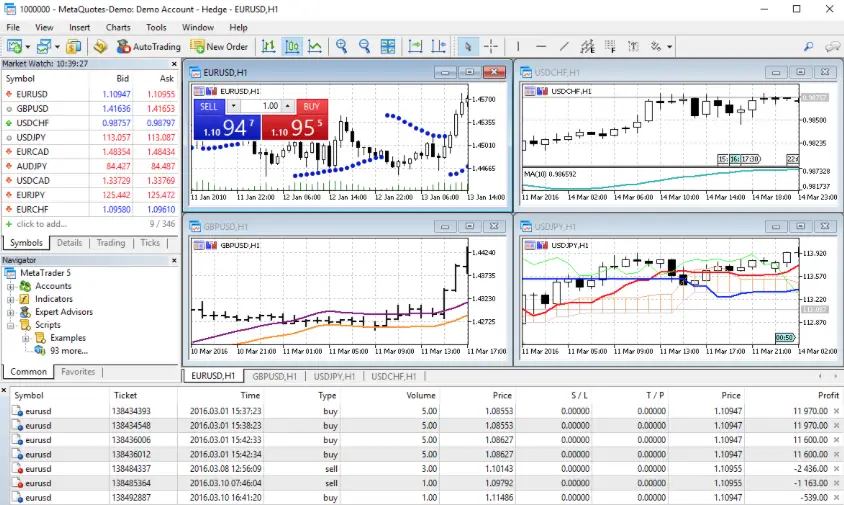

Finotive offer MetaTrader 5

Within the backend of your client portal, Finotive provide a risk management/trade management portal, whereby you can have access to all of your account stats and metrics.

This makes the trading account much easier to manage, knowing I could always stay within the limits!

Finotive Funding Reviews – Are They A Good Prop Firm?

Again, if you’re a regular on this site, you’ll know the value I place on reviews from other traders. Just because the team and I had a great experience trading on a funded account, doesn’t mean other traders will!

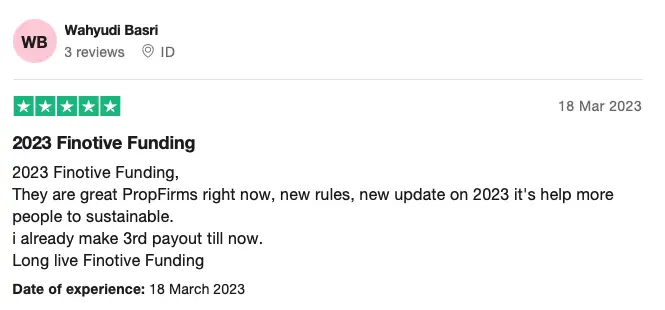

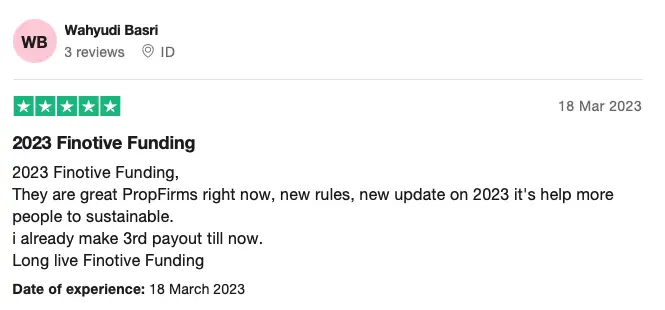

For this, we usually consult TrustPilot and the forums for traders opinions…

On Trustpilot

I would say, in the grand scheme of it – this isn’t a huge amount of reviews. Of course, the prop firm hasn’t been open for 3+ years like some of the largest prop firms in the industry – so that’s worth bearing in mind.

So, what did traders think?

Wahyudi here had received his 3rd payout from the firm and seems to be a dedicated supporter!

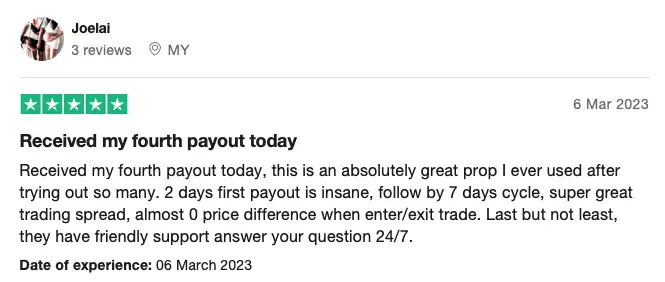

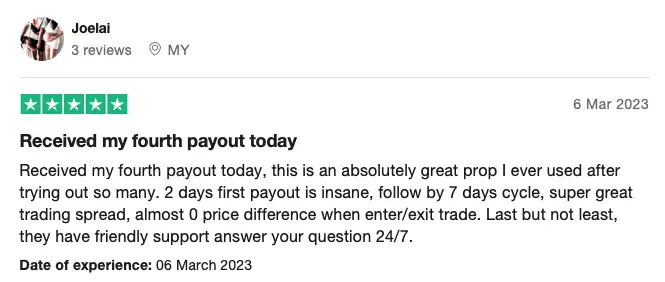

Joelai has also received a payout – really good to see!

It’s worth mentioning that Finotive seem to be braised for their trading conditions for forex trading bots

Again, there isn’t a huge amount of reviews but this is worth keeping an eye on. I’ll keep this article updated for how the reviews look over the coming months and years of being in business.

In Summary – Is Finotive Funding A Legit Prop Firm?

In conclusion, Finotive seems to be a great prop firm for forex traders looking to get funded quickly! The one step funding and instant funding are certainly huge selling points and exactly why I chose to try to get funded from these guys.

And the accounts up to $200,000 help too!

If you’re wanting to get funded quickly, try Finotive Funding

I’d be really curious to know about your trading experience with them down in the comments below, so I can update this review if needed.