Forex manages to bring in a huge amount of interest from new investors, due to the low barrier to entry, leverage and large potential profits. Since the forex market is an open 24 hours a day worldwide marketplace, many beginners want to know how much they can earn from forex.

Before you dive headfirst into this potentially lucrative industry, it’s important to understand what factors go into determining your success in terms of how much money you can make trading currencies.

The amount of money you can make from forex depends on many factors. An experienced forex trader with a versatile strategy can earn anywhere from 5%-10% in a month. Traders with more aggressive strategies and higher leverage can gain up to 20% in a month.

How Much Are Forex Typical Forex Traders Making?

Forex traders are typically making an average of 5-10% per month in the markets. If you’re using higher risk and higher leverage, it’s possible make upwards of 20% in a month.

There are a huge amount of factors that influence how well forex traders do, profit wise. It’s not a one size fits all kind of industry, you can trade the markets however you choose to do so. Even if you and I had the exact same trading strategy , our results may still be very different.

, our results may still be very different.

It’s also important to bear in mind that there are now a lot of funding options for forex traders

Traders with profitable trading bots

So while it’s hard to quote a specific percentage that you can expect from trading currencies, we can take a deeper look at some of the factors that determine success.

Risk Management In The Markets

The forex industry is a very tough industry, with over 75% of traders losing more money

Managing your risk is crucial in the markets. It’s advised that you only risk around 1% of trading capital on a single position, and to never risk more than 5% of your trading capital in one session.

For example, a trader with a $1000 trading account would only be able to have a maximum exposure of $10 on any one trade.

With $100,000 your maximum exposure would be $500.

Using the 5% rule as a risk management strategy, if you wanted to have a long term position of $5,000 on EUR/USD and you start with $100,000 in your trading account, you would set an initial stop loss around 10 pips below your entry, or at 1.1040.

You would then also move your initial take profit to around 2-3 pips below or above this level, depending on the size of the trade you want to take to limit loss and give yourself enough room for a well-placed exit.

Access To Leverage In Forex To Increase Profits

Large potential profits are only possible in the forex industry due to brokers offering large leverage. Leverage

You can trade on margin, or with an initial deposit of $5 and borrowing $95 to make a total of $100; essentially doubling your buying power and potential for profits (or losses). If you gain 10% and lost 9%, then this is a net gain of 1%.

Many brokers offer 400:1 leverage, which can give you an initial deposit of $100 and borrow up to $4000, allowing the possibility of making a 40% gain or 94% loss.

Leverage is not always offered to all traders at all brokers. The more leverage you have the easier it is to make money in forex, but also the more money you can lose.

If you are new to forex it is recommended not to start with more than 30:1 leverage, as to avoid blowing through your trading capital in a few trades. You will gain access to more leverage as you prove yourself capable of managing risk and making smart trades.

Some countries are cracking down on regulating the forex industry so leverages are being capped for some traders, but you always have the riskier option of trading with an offshore/unregulated broker

For example, if you’re trading in the U.K it’s advised to use an FCA regulated forex broker

The Difference A Forex Trading Strategy Can Make On Your Profits

Although we can estimate how much money forex traders make per month, it’s very nuance as there are a huge amount of factors that decide one traders profits, compared to another…

Win Rate Of A Trading Strategy

The win rate of your forex trading strategy greatly impacts how much money you’ll make in the markets. If you take 1 trade per month, make 50 pips per trade and win half of your trades, this will result in a 25 pip average monthly profit.

If you win 60%, you’ll make an average monthly profit of around 35 pips; if you win 70% (very high), you can expect to net 45 pips per month on average, and so on.

In short, typically the larger the win rate, the more profit you’ll make from trading forex. Aiming for anywhere above the 50% mark is a good place to start, then look at optimisation.

Average Risk To Reward

The risk to reward ratio

This ETHUSD chart shows the different in risk to reward ratios between a 1:2 and 1:1 trade, for context.

Let’s assume you have an average risk to reward to 1:5. This means that for every $100 you risk in the markets, you’ll average a return of $500.

This is fairly high, with most profitable traders sitting around an average of 1:2. Unprofitable traders all have a negative risk to reward average in common, meaning they risk more in a trade than they’re likely to get. For instance, having a 50 pip stop loss, for a 10 pip take profit would be a negative risk to reward ratio.

In short, the higher your risk to reward average, the more money you’ll make from forex trading.

Trading Capital Available

Although forex brokers allow minimum deposits of as little as $10

Let’s assume you have $200 in your account and you trade 1:1 risk to reward, with 5% risk. This means that your profit would now be $10. Now we look at what happens when we increase the trading capital to $3000; this means that on that trade we can expect to see a profit of $150.

The more money you have at your disposal, the more money you can make each month trading forex.

If you’re looking for more trading capital, you can work with an online prop firm as they offer instant funding to traders of up to $100,000! Have a read here of the top rated forex prop firms

Trading Frequency

The frequency of your trading strategy plays a huge factor on the profits you can make in the forex markets. If you’re only taking one trade per year, you’re going to struggle to make a profit regardless of how good your trading strategy is.

The more trades you place, the more money you can expect to earn from forex trading. Obviously, low frequency strategies will have a little less impact on your earnings than high frequency ones, but it’s still important for you to consider this factor.

Taking On Additional Capital To Increase Trading Profits

Over the last few years there has been a massive increase in prop trading firms. A prop firm is a company that offers traders funded accounts, ranging from $10,000 to $400,000.

There is little risk to yourself as the trader, as you’re remotely trading the companies accounts, at no risk to yourself. You are able to take a large percentage of the profits, usually around 70-80%, in exchange for your trading efforts.

If you’re looking to take on additional trading capital using an online forex prop firm is a much simpler way to scale, opposed to taking on investors for your trading

The most popular option of acquiring new trading capital is to become an FTMO funded trader

Withdrawing Or Compounding Your Profits

When you’re trading your forex accounts, you have the option to either withdraw your profits, or compound them. Long term, compounding

Withdrawing your capital when you are in profit is very common amongst novice traders, but can end up costing them dearly in the long term. With compounding, you grow your capital to an exponentially greater amount than if withdrawing it.

Instead of gaining 10%, you gain 10% on the original investment and the gains you earned, allowing your profit to grow in a snowballing effect.

Some traders have 2 accounts, as most brokers will allow you to open as many accounts as you desire. You can split your trading capital into the 2 accounts, then use a trade copier to mirror your trades on both accounts. The large majority of brokers will allow you to open multiple forex accounts

It’s possible to compound one accounts profits and withdraw the other accounts profits, so you are still reaping the rewards of your hard work.

I actually have a whole article about duplicating forex traders on multiple trading accounts

Putting The Process First – Learning Before Earning

Everyone is always so eager to get going, hit the ground running and make money in the forex markets – which is great! However, it’s not always that simple and we need to established the fundamentals first.

A wise man once said, ‘build a house on stable foundations‘ and nothing could be truer for the investing/trading space. Just because you can setup a trading account in minutes and get trading on real capital, doesn’t mean it’s wise to do so.

Trading A Demo Account First

Before even looking at how much money you can make in forex, it’s crucial to be trading on a demo account

This is usually how the process goes and certainly how it went for me…

- Newbie traders realise that they could make 10% in a single good month.

- Said newbie trader realises if they deposit £5000, they will make £500 that month without really working for it.

- The money is deposited.

- The newbie loses all of that money within a few weeks.

- The newbie claims forex is a scam and they give up for a few years, until an Instagram trader convinces them to get back into it via signals.

Sound familiar? This is what you MUST avoid and this cycle can be broken by trading on a demo or simulated account for a few months.

There has always been this narrative within the forex retail forums that demo accounts are rigged

How Long Does It Take To Learn Forex?

Another factor you need to consider is how long it actually takes to learn forex

When you compare this to the fact that other forms of investors have to go through years of University, studying and exams, it seems a bit farfetched that forex traders would be able to get earth shattering returns overnight.

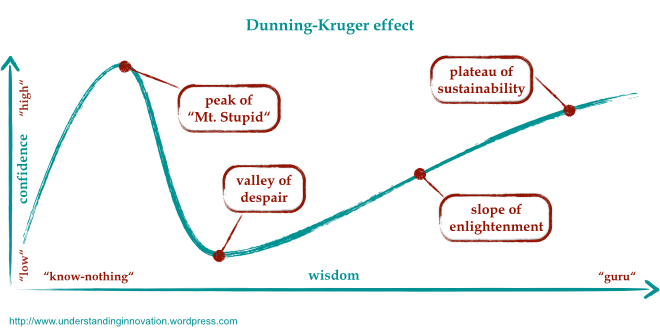

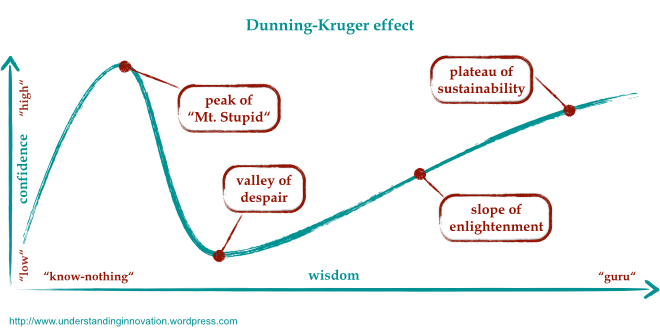

I would highly recommend learning about the Dunning-Kruger effect

The reality is that it takes over a year to learn to trade forex successfully and this needs to be considered before looking at the potential money you could make from forex trading.

This shouldn’t dissuade you, however. Forex can change your life

Learning From A Reputable Source

If you’re looking to shave years off your learning process, it’s important to learn forex trading from a reputable source. Sadly, due to how tricky these markets are, many traders fail and end up selling courses to try and recoup some of their losses in the markets.

I would recommend taking a look at our compiled list of the best forex trading courses

If you’re looking to learn to trade without spending too much money on education, there are a huge amount of great YouTube channels for forex traders

For example, Michael Bamber has a huge amount of extremely valuable content to help traders with their journey after struggling on his own journey for many years. He is now earnings thousands per month in the markets on his prop firm funded account.

In Conclusion – How Much Money Can I Make From Forex Trading?

In summary, forex traders are making an average of 5-10% per month , which equates to around 60-100% per year. It is very possible for you to start making money in the forex markets if you have a high enough risk to reward ratio.

With that being said, it’s important that you take into consideration what your trading capital will be, how frequently your trading strategy will take place, and that you use compounding

If you would like to get started with forex trading, feel free to check out some of the top rated forex courses on the web.