The pin bar candle is one of the most commonly known candlestick patterns in forex trading. This is due to the fact they’re seen absolutely everywhere and they’re known for signalling either a bullish or bearish rejection.

However, with so many pin bar candles on the charts, it’s really hard to figure out which are worth trading and which should just be ignored.

In this article we are going to look at everything you need to know when it comes to trading pin bars. From how to spot them, to how to trade them, to increasing win rate and avoiding losses associated with pin bars!

Let’s get into the article…

What Is A Pin Bar Candlestick Pattern?

The pin bar is a very simple forex candlestick pattern that are found on all timeframes, on all currency pairs and typically in all kinds of market conditions. They’re known for indicating a potential reversal is taking place within the markets. The pin bar is a staple in price action trading strategies .

.

Pin bar candlesticks actually have no edge on their own, so they need to be combined with other forms of price action and fundamental analysis to be worth trading.

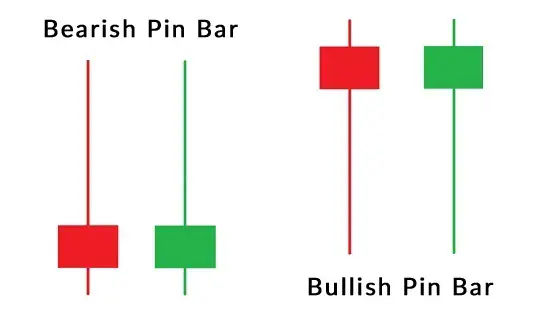

There are two types of pin bars: the bullish pin bar, indicating that price may move to the upside, and the bearish pin bar, indicating that price may move to the downside.

- Bullish Pin Bar – This candle can either be bullish or bearish, it doesn’t matter. It’ll also have a small candle body, somewhere at the top of the candle. It’ll have a large lower tail, showing where price tried to push down lower, then ended up closing much higher after rejecting the area.

- Bearish Pin Bar – This candle can be either bearish or bullish too, the colour the candle closes is not relevant to the setup. It’ll have a small candle body at the bottom of the candle, with a large upper tail. The tail shows where price tried to push up, before rejecting the area and closing at a much lower price.

As shown on this Tradingview

How To Trade A Pin Bar – Trading Strategies

Let’s get to actually trading the pin bar candle… We are going to take a look at the most common ways traders are using the candles in their forex trades.

1. Pin Bar Rejection From Key Levels

The most popular way to trade a pin bar is to look at key levels and wait for a rejection of the level in the form of a pin bar. As shown above on this GBPUSD

Price then proceeded to fall from this level. Using risk management and a good risk to reward ratio, you could have taken advantage of this opportunity and taken a short position to the downside, once the momentum had been confirmed further.

2. Pin Bar To Scale Into Trades

One of the more advanced trading methods used by forex traders is scaling into trades and dollar cost averaging

If you scale into trades properly, every trade you add a new order, you’ll remove the risk from the previous position. This means that your net potential loss will not change but your net profit will be massively increased. It’s a very advanced technique because frankly it’s very hard to pull off but if you get lucky, the markets can make this very lucrative.

Pin bars can get used to get additional entries and scale in positions into trades. Again, it’s a very advanced technique but you can use the pin bar to time your entries and dramatically increase your profits!

3. Pin Bar To Give Directional Bias

On this chart, we have a pin bar on the left, showing a huge amount of bearish rejection. Now we can use this to give us some directional bias. From seeing this large pin bar, I’m going to assume that we have tapped into an area of price or the bulls have given up, so we may see a move to the downside soon.

It’s not set in stone and there’s 0 guarantee that it’ll happen at all, however, it gives me a directional bias which is needed to form a trading idea.

Price consolidates for a while after the candle, then proceeds to move to the downside as expected. The price breaks through a strong support level

How To Increase Win Rate Trading Pin Bars?

Pin bars, like all other types of candlestick patterns

I soon realised that this was not the case, at all!

Pin bars indicate a POSSIBLE reversal, they don’t reverse the price.

What I mean by this is, pin bars don’t mean a whole lot in the grand scheme of things. If banks and institutions have been buying up GBPUSD for the past 3 months, with price aggressively trending to the upside, does it make sense that a 4H time frame pin bar can reverse all of that? No, of course not.

So, how can you increase the win rate of a pin bar trading setup?

By using them as just an extra confluence in a trading setup! Let’s take an example…

On the left here, we had a huge hourly support area and an area I suspect had a huge amount of liquidity. As price tapped into the area, we rejected with a fairly large bullish pin bar. The pin bar on it’s own was not enough, but combined with the zone on the left, we were starting to build a picture of where the market was going to be heading potentially.

Price then consolidated

In this trade, the confluences were:

- 1H Support level

- 30M Pin bar rejecting the level

- Break of a resistance level

See how this is much stronger than just using a pin bar rejection on it’s own?

Using Context To Avoid Losses With Pin Bars

Building on my point from above, using context is incredibly important if you’re looking at pin bar candles. Meaning, if we are in a very steep down trend on the H4 time frame and you see a M15 pin bar showing bullish rejection, you cannot enter the trade just based on this.

New forex traders that focus on pin bars are usually falling victim to the saying ‘trying to catch a falling knife

How To Trade A Pin Bar In The Forex Markets – Frequently Asked Questions

Do pin bar candles work on all time frames?

Yes, a pin bar will work just as well on the M5 time frame as it does the H4 time frame. It’s important to remember that on their own, the pin bar will not be useful on any time frames, though.

Can I just enter trades based on pin bars?

You can just take trades purely from pin bars, but I certainly wouldn’t recommend doing so as this has no edge.

Do pin bars come up frequently?

You’ll see pin bars forming in the charts every day, all day. There are indicators on Tradingview

Is the pin bar the most powerful candlestick pattern?

No candlestick patterns are powerful as they don’t actually mean anything, or make price move. They’re just a way for traders to help add context to a trade and build an entry. As far as candlestick patterns go, I don’t believe any have an edge on their own.

Are pin bars the same as shooting stars or hammer candles?

Pin bar candles more or less the exact same as a shooting star

In Conclusion – Trading The Pin Bar

In this article, we have looked at the pin bar candle pattern and covered everything you need to know to start trading it! With any kind of forex setup, I’d recommend putting a huge amount of time into backtesting the logic

We covered:

- What is a pin bar candle.

- How to spot a pin bar.

- How to trade a pin bar properly.

- How to avoid extra losses by using context.

- Important questions that crop up when trading pin bars.

I really hope you found this useful. Are you going to trade pin bar rejections? Have you got a strategy that includes pin bars?