Working with a prop trading firm is by far the quickest way for a forex trader to reach a level of capital that makes full time trading a possibility. They’re a great tool to have and over the last few years, access to forex prop firms has only become easier! There are more firms than ever, each having pros and cons though and it can be a bit of a challenge to find the right funding option for you, as a trader.

In this article we are going to take a look at Alphachain. Alphachain is a relatively new funding option for traders, offering guaranteed funding between $5000 and $40,000! This comes with an aggressive capital scaling program and a huge maximum allocation. Is this the prop firm for you? Let’s find out…

[toc]

Who Are Alphachain?

Alphachain

It sounds like a great offering, right? Well, let’s take a further look into the pros and cons and see if this is the best funding option for you..

Getting Funding From Alphachain Funded Trader Program

Over the last year, Alphachain has offered funding to over 540 traders in over 67 countries, amounting in over $4.7 million in funded accounts. Alphachain offers 2 types of funding for traders and both have their own benefits…

1. Evaluation Model

The evaluation model is fairly typical of all prop firms you find on our best forex funding options list

This is extremely standard at this point and should be very much doable for the majority of profitable traders. You have 1 year from the start date to actually reach your profit targets too!

2. Instant Funding Model

The instant funding model Is more pricey than the evaluation model and the funding is reduced initially but you will have access to up to $20,000 in capital literally within 24 hours! For traders with a low balance this is a great option to quickly increase the amount of trading capital you have available. If you’re able to make 10% for the month, you’re taking a $1000 profit split in the first month and paying back the fee anyway!

Although instant funding is great, if you are not a profitable trader you still won’t be making consistent profits so please do think you’re by passing the challenge to get funded, you will be funded but need to be consistent to earn.

Capital Scaling Model

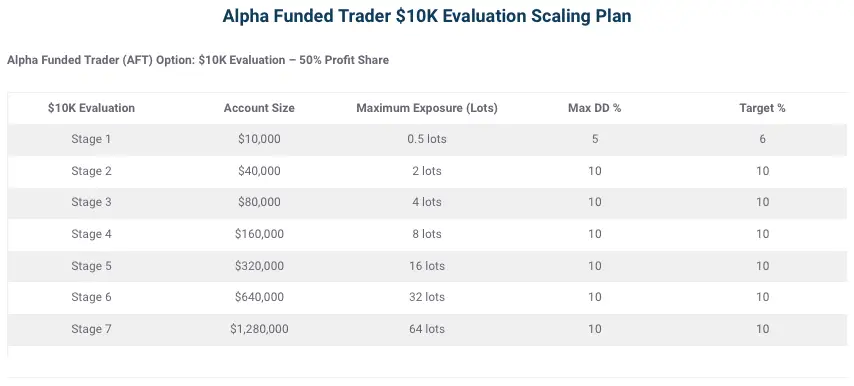

The company offers a huge scaling program for successful traders that can see you trading a huge amount of capital in a relatively short space of time. Once funded, for every 10% profit you make, the company will double your trading capital.

This has been done by a few competitors and traders absolutely love this as in the time you would normally be able to compound 50%, your account has got exponentially bigger in size so the monthly profit share is now huge!

I’m not sure how many of the 500+ funded traders have ever made it to the full $1,000,000 in funding but it’s certainly nice to have that there for the taking.

What Makes Alphachain Different From Other Prop Firms?

The majority of Alphachains

1. Instant Funding

Alongside the standard ‘pass a challenge for funding’ model that most companies use, Alphachain also have an instant funding model. This costs much more than the evaluation model but does literally allow you to have a $20,000 account the same day and start keeping 50% of the profits.

They aren’t the only company offering this, I know that DT4X Trader offer an instant funding

2. Education

Forex trading education has become a bit of a grey area over the last few years with literally thousands of awful courses, fake mentors and just terrible content making its way into the industry. Therefore, I never really take education seriously. However, Alphachain offers a CPD Accredited Trading Program and traders from the program have gone onto trade in institutions like Deutsch Bank

The prop firm arm of the business has only come after the success of the education business as students were taking on funding from the company. This funding has now of course been opened up to any traders online.

Is Getting Funding From Alphachain Realistic?

When looking at prop firms it is incredibly important to focus on not just the offering but how realistic the funding will actually be. If a firm offers $4,000,000 in funding but you need to do a 95% gain per day, this is of course never going to happen.

Alphachain

The evaluation funding option is cheaper but just by nature will be much harder for traders. I still think it’s very realistic and actually a better idea to go for this funding method as if you cannot pass the initial evaluation, you must likely weren’t going to earn any profits from your funding anyway. Nonetheless, the challenge has a 6% profit target with a maximum of 5% drawdown and a 5% weekly risk maximum too.

If you take a look over the top prop firms

Alphachain Reviews – What Are Traders Saying?

If you have checked out some of the competitors in our best forex prop firms list

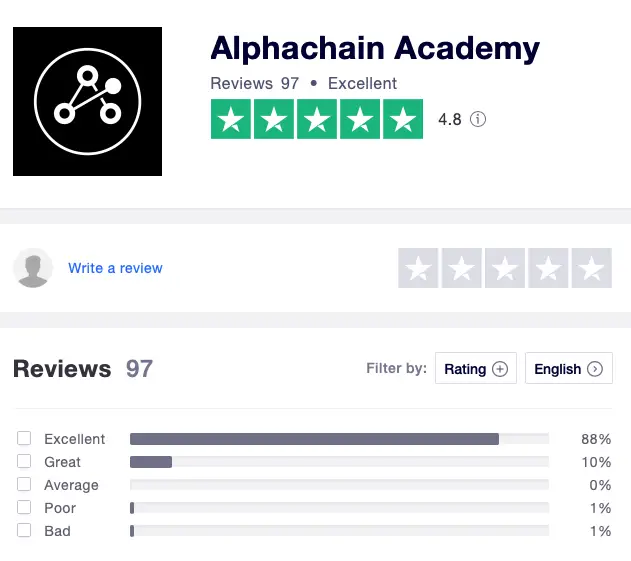

From looking at Alphachains Trustpilot

We have to take the reviews with a pinch of salt because some of these reviews are going to be linked to the education side of the business, rather than just the funding. Although this doesn’t devalue the reviews, it’s something we need to be aware of.

We will continue monitoring the reviews coming in over the next few months to see any trends and gauge the scale at which the prop firm arm of the company is growing.

Diversifying Risk From Alphachain

The reality is that sadly unless you’re using one of the largest few prop firms like FTMO

One of the safest ways to hedge against the potential risks is to use multiple prop firms simultaneously. Since prop firm accounts are rarely compounded by traders, there is no harm is using a few accounts at the same time! If one company goes down, you still have the funding from multiple other companies to keep you afloat.

Opening multiple trades on multiple prop firms manually is a massive pain and scalpers simply don’t have time to do this. I would recommend looking at our top forex trade copiers list

In Summary – Is Alphachain A Scam?

In conclusion Alphachain Funding Program is a great option for traders looking to take on additional funding and rapidly scale their trading accounts. With great rules, easy to follow guidelines, education, a live squawk service and a huge scaling plan it’s an excellent choice.

The prop firm arm of the company is fairly new, so I am personally sitting on the fence for now just until the company is more established and has more reviews. Regardless, I think this is one to keep our eyes on over the next few months and see how the funding side progresses.

If you have any experience with the company, or any questions, please do leave a comment down below, I would love to hear your experiences.