The FTMO Challenge is one of the best opportunities for forex traders to get funded and reach that next level in their trading journey. FTMO is allowing traders to go from hobby traders to having up to $400,000 in funding in just a few weeks.

The FTMO challenge is renowned for being hard to pass and leaves traders wondering, how do you actually pass the challenge? In this article we are going to look at how to pass the FTMO challenge, from the rules, the risk management and even a trading strategy that could help you get there! Let’s find out more…

FTMO

FTMO is the worlds leading prop firm and has really taken the industry by storm over the last few months with the famous $100,000 account challenge. FTMO have the best reputation in the industry, great support for traders, a 70% profit share, a range of top brokers to choose from, simple trading rules and funding up to $400,000 for top traders!

- Industry leader

- Established prop firm

- 70% profit split

- No time limit on challenges

- Funding up to $400,000

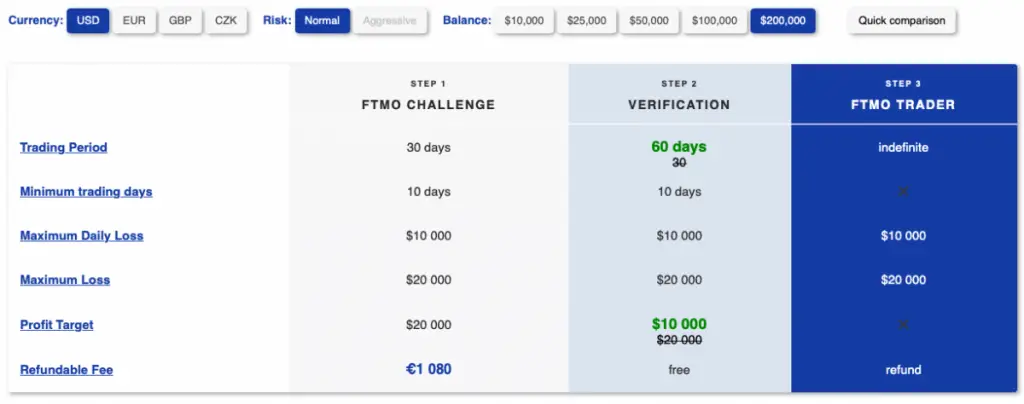

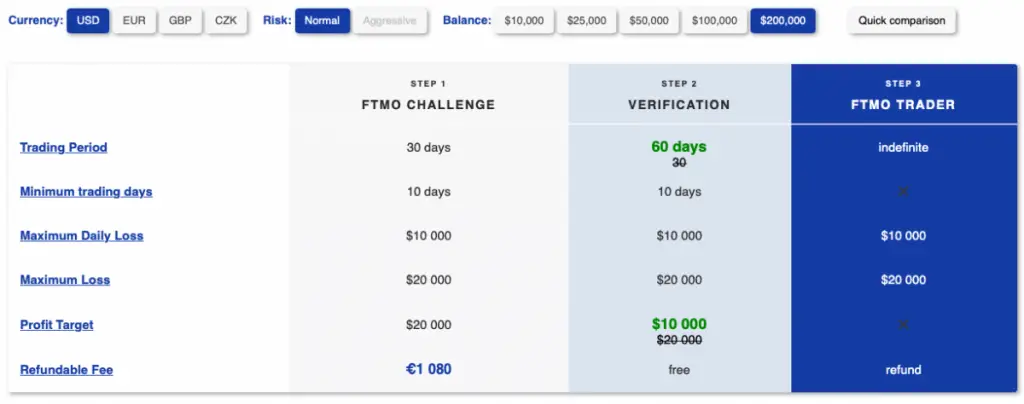

The FTMO Challenge Rules

One of the reasons that traders are failing to get FTMO funding

What You’ll Need

- A profitable trading system that could bank 10% in one month.

- Great levels of risk management that can keep you from losing 5% in one day.

- The consistency to repeat the process.

The Rules

- No weekend holding (unless you ask for permission)

- Overnight holding is allowed during the trading week

- A trading period of 30 days (20 trading days roughly)

- Minimum of 10 trading days (you can just open 0.01s if you pass the profit targets early)

- Maximum daily loss of 5%

- Maximum overall loss of 10%

- Profit target of 10%

It’s important to note that there is also an element of luck in passing the FTMO challenge

Compared to some of the other prop firms on our Top Prop Firms list

A Trading Strategy To Pass The FTMO Challenge

So now we have looked at the rules and the actual challenge that lays ahead of us, we need to find a trading strategy that will get us across the line. There are literally THOUSANDS of trading strategies online and it can be so hard to figure out which strategies work over time and more importantly, which trades will help you pass the FTMO Challenge

We are going to look at a very simple price action strategy, very similar to those methods that can be learned through various forums such as Babypips

1. Top down analysis (higher time frames, down to lower time frames).

We can immediately see there is a support/resistance zone on the weekly. Price has managed to break through this zone due to the huge bullish pressure and now price is retesting the area as support. In this area, we would be looking to take buys and follow the momentum up.

2. Daily confluences to support the weekly bias.

On the D1 time frame we can clearly see a bullish trend line that has been in effect for over a year. This trend line has 6 good taps, making it a significant area that we need to be looking at. We can also see the beginnings of a double bottom pattern forming on the daily, giving us a lot of confluence for buys. However, at this point, no entries are ready as we really need to see a bit more confirmation on the daily time frame before taking our positions.

3. Development on the intraday timeframes once confirmation is there.

So, now the daily time frame is really painting a picture for us. We have a double bottom confirmed (since the neckline has been broken), and a trend line has also formed. At this point, our trade is 100% ready to take, we just need to find out entries. It’s important to remain extremely patient here, as a lot of traders will prematurely jump in without a pullback and end up getting a bad price for their orders.

4. Entry orders confirmed.

Price has pulled back perfectly to our trend line level on the 8H time frame, giving us a great opportunity for an entry to the upside. By placing a Fibonacci on the charts as well, we are able to gauge more accurately where we want to be buying. The perfect levels for this retracement will be the 0.5 and 0.62 levels, which line up perfectly with our trend lines. By using the Fibonacci extension and relevant high on the left, we can plot a profit target to give us a RR of 1:3.8, with a stop loss safely behind the 200 EMA.

5. Playing out the trade.

Our first position went nicely into profits before reaching a minor supply zone and falling back to retest the trend line, again. This isn’t a problem for us as the trend line was never broken, the structure was still bullish and our idea was still completely valid. In fact, it gave us the opportunity to add another 1-2% risk position on the trade as we had the trend line confluence, combined with the 200 EMA and the Fibonacci level. This position had a slightly wider stop loss, giving it a RR of 1:2.5.

6. Scaling into the position.

Now the trade is moving in the right direction, we have good profit floating and the trade is clearly doing what we expect it to do. When this happens, we have the opportunity to scale into trades and earn more money for our analysis. We removed the risk on the first two positions, so our net risk is now 0%. A perfect break and retest opportunity came along on the 8H time frame, so we took another entry with 1% risk, just aiming for a 1:1 with a relatively large stop loss to avoid losing the trade in consolidation if the momentum slowed down.

7. Profit target.

Just like that, our profit targets have been hit. In this trade, with 2% risk on the first two positions, and 1% risk on the scale in position, we have gained a profit of 13.6%. In this example trade, this is enough profits to pass the FTMO Challenge and get funded

It’s important to note that this strategy is very discretionary. Different traders will see trades differently, economic impacts will effect trades and there’s of course absolutely no guarantee that you will pass the FTMO challenge using any methods that anyone can teach you. You must do your own due diligence and backtest a method for hundreds of hours to be able to effectively execute it consistently within the markets.

If you are not already a profitable trader, just looking at a strategy and piecing together random analysis won’t make you profitable. I would recommend learning fundamental analysis, alongside advanced technical analysis to allow you to take trades like this. FTMO offers a free trial

Conclusion – How Do You Pass The FTMO Challenge?

In summary, you can pass the FTMO challenge by sticking to the maximum drawdown rules, trading duration and reaching the profit target. To achieve this, you’ll need a profitable trading plan, a risk management strategy, a grasp of the rules and a little bit of luck.

If you’re concerned about potentially failing the FTMO challenge

If you’ve passed the challenge please let me know how you traded in the comments down below to help our readers!