Are you interested in learning more about BlackBull Markets? With so many Forex Brokers online these days, it’s very important to know exactly where you’re putting your money and it can be hard to distinguish a scam broker from a reputable company. We have extensively tested BlackBull Markets, the account processes, trading conditions, deposit/withdrawal methods and taken a deep dive into all of the information about the company. Is this the broker for you? Let’s find out now…

[WPSM_AC id=542]

Who Are BlackBull Markets?

Blackbull Markets was founded in 2014, in Auckland, New Zealand, by professionals within the Forex and Fin-tech sectors. They were already heavily involved in the Forex space for a decade before, serving institutional clients, rather than retail. Blackbull Markets is registered at Level 22, 120 Albert Street, Auckland, New Zealand and has a company registration number of NZBN 94290441417799.

They offer a huge amount of tools for experienced retail traders, with a complete ECN (No dealing desk) experience, combined with a huge depth of liquidity for even the largest of retail traders. Blackbull Markets have data centres, server hubs and offices all around the world, as the company has grown rapidly within the retail sector. In fact, they have been listed on Deloitte Fast 50 Index!

From first glance, they are a very reputable broker in the industry with expert trading conditions for all types of retail forex traders – but let’s dive into more detail.

Trading Conditions

BlackBull Markets is based out of New Zealand, luckily for us. This means they are able to offer 1:500 leverage for the majority of countries, including countries in Europe. You can customise the leverage on your MT4 accounts depending on your needs and risk tolerance, anywhere from 1:1 to 1:500, although I think at default the accounts are set at 1:100 – more than enough for most traders.

| Forex Pairs | 64+ |

| Leveraged Offered | 1:500 |

| Execution Speed | Instant |

| Metals | Yes |

| Spreads | From 0.1 Pips On ECN Prime and 0.8 Pips On Standard |

| Commissions | $6 Per Lot On Prime, $0 On Standard |

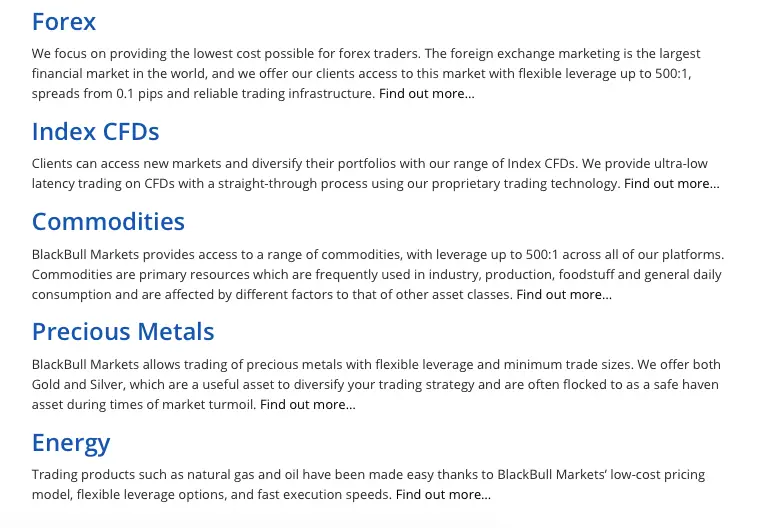

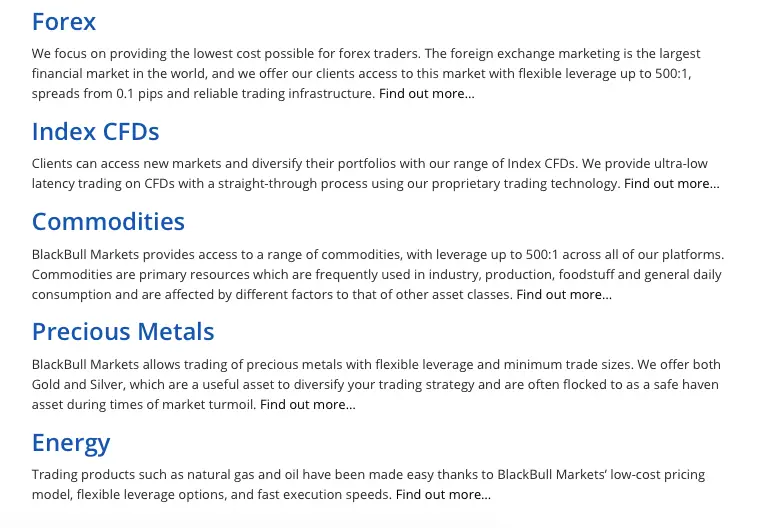

They offer pretty much every pair you will need as a retail forex trader, including majors, minors, index, commodities, energy and metals. There are brokers out there in the markets offering more products and pairs to trade, but for the majority of retail traders the products on offer are more than enough to sink your teeth into.

Spreads are very important when it comes to forex trading, especially for intra-day traders and scalpers – much less so for swing traders as they are taking moves for thousands of pips. With BlackBull Markets, there are a few different account types and these all come with a varying spread. On the most common ‘ECN Standard’ account, you have spreads ranging from 0.8 pips, with $0 commission per trade! This is very similar to the likes of IC Markets are other True ECN Brokers in the market. With the ‘ECN Prime’ account, you have access to spreads from 0.1 pips and a commission of $6 per lot.

In short, the trading conditions with this broker are absolutely perfect for all retail traders. I have personally found the trading conditions very favourable for my day trading styles and swing trading. You will be hard pushed to find any better spreads and commission structure per trade out there in the market from any trusted forex broker.

Like most brokers, they offer a free demo trading account for beginner traders, or experienced retail traders looking to test the trading environment before committing to the broker. If you are considering using BlackBull, I would highly recommend creating yourself a demo account to check the execution speed, spreads and overall conditions that you have access to. Conditions do change from a demo to a live account though, so take that with a pinch of salt.

Account Types

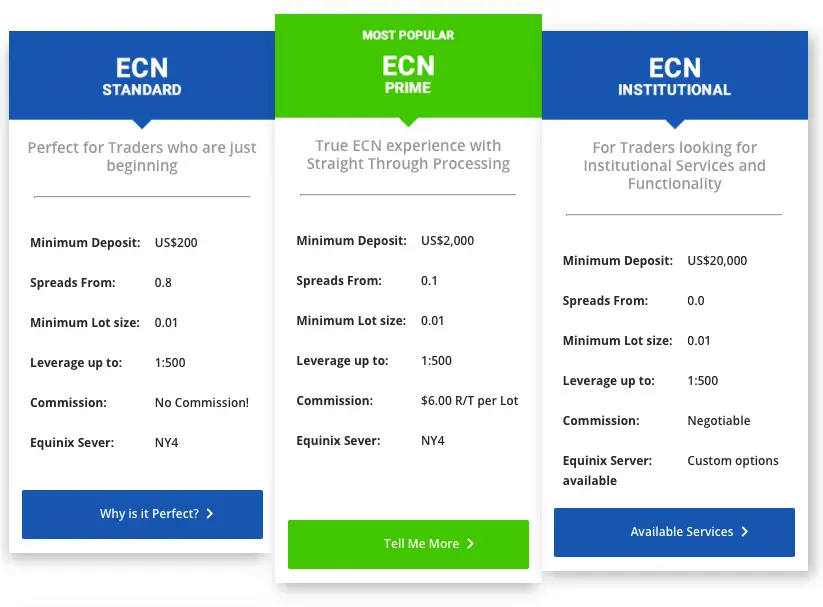

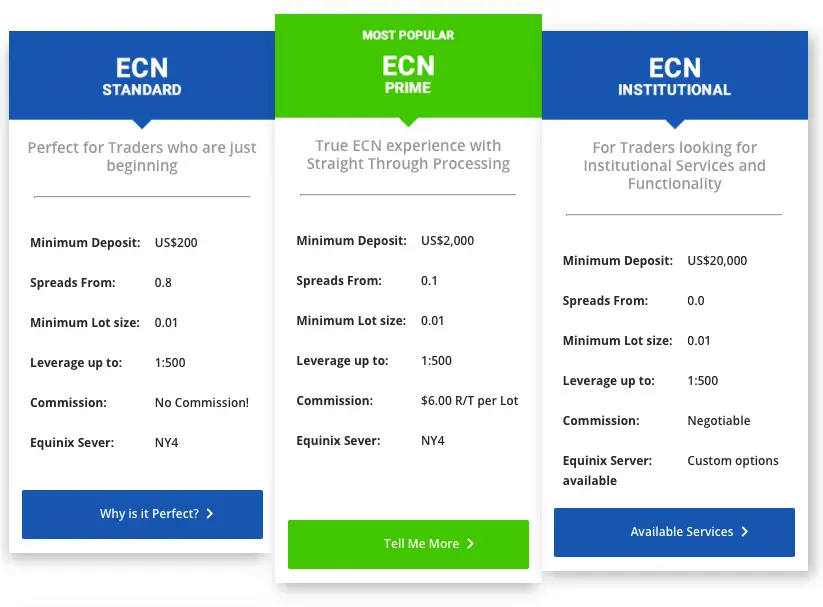

This broker offers 3 different account types, all suiting different types of traders. This ranges from an account that is perfect for newer traders, with competitive spreads and a low minimum deposit, to an account with Institutional level services and functionality that comes with a high minimum deposit threshold. All of these accounts have leverage up to 1:500, more than enough for scalpers, day traders and swing traders alike! Let’s have a look at the account types…

In short, I would highly recommend the ECN Standard and ECN Prime accounts for the majority of traders. If you are professional, coming in with a fairly large deposit, the ECN Prime most certainly has the best trading conditions and fees. However, if you are coming into the markets with a few hundreds dollars, the ECN Standard account will be more than enough to get you started and give you all of the advantages of an ECN experience.

Are BlackBull Markets Regulated?

The most important question to ask when looking for a forex trading broker is, are they regulated? Unregulated brokers can manipulate prices, spreads and steal your money. The sad thing is there are so many out there, fooling unsuspecting traders every day. So, is this broker actually regulated? The answer is yes!

BlackBull are a registered Financial Services Provider in New Zealand (where they are headquartered), with the FSP number 403326 as well as being a member of the Financial Dispute Resolution Act FSCL. BlackBull Group UK is a registered company with the companies number of 9556804.

| Regulation | FSPR |

| Risk | Low risk |

In short, Blackbull markets are a fully trusted and regulated forex trading broker, providing great conditions and segregated client funds, meaning your capital is safe. They are a NDD ECN broker, meaning they pass your trades straight through to the liquidity providers – not influencing the prices or creating a fake market.

It is important to constantly check the regulation of your forex brokers every few months to make sure nothing changes and they are not put on any risk lists by regulators. I will keep this article updated regarding this brokers regulation as I actively trade with this broker, so I’m always on the look out for any signs of regulatory concern.

Trading Platforms

BlackBull Markets offers the MT4 trading platform, sometimes known as MetaTrader 4. MT4 is without a doubt the most common retail forex trading platform, being used by millions of traders and hundreds of brokers around the world. Although MT4 is certainly not the most advanced platform on the market, is it perfect for basic technical analysis and order execution, making it the peoples choice. They also now offer MT5 – a more updated and professional version of MT5.

You can download BlackBulls own MT4 platform from the client area once your account is setup – from there you login using your MT4 details and you will instantly be able to start placing trades. The platform can be downloaded on Mac, Windows, Android and iOS, catering to everyone. When trading, I always have the MT4 platform installed on my laptop/computer, for actually executing orders, whilst having the MT4 app on my mobile phone as well, for monitoring trades whilst I’m on the go.

MT4 & MT5 have some really great features:

- Simple order execution

- Account statistics/analysis

- Charts for price action

- Variety of free tools and indicators

- Multiple time frames

- Great data feeds

- Supports EA’s / VPS trading

Although MT4 and MT5 are the most popular platforms for retail forex traders, there are much better platforms out there like cTrader

Setting Up An Account

Setting up an account with BlackBull Markets is an extremely easy process. In fact, I managed to set up my account within just a few minutes. The process is very much similar to every other forex broker out there, not requiring much from you besides a few simple documents. For my account to be processed and opened, I just had to fill in:

- Basic information about myself

- Provide a drivers license scanned photo

- Provide a recent statement/document proving address

Once you have uploaded those documents, you receive an email saying your account will be opened and verified soon. For me, after uploading the documents, I had a verified BlackBull Markets account with login details within just a few hours, making it one of the quickest brokers I have ever signed up with.

Should you have any issues whilst completing the sign up process, contact the 24/5 live support via the website and they will be able to help you with every step along the way but I would doubt that will be necessary.

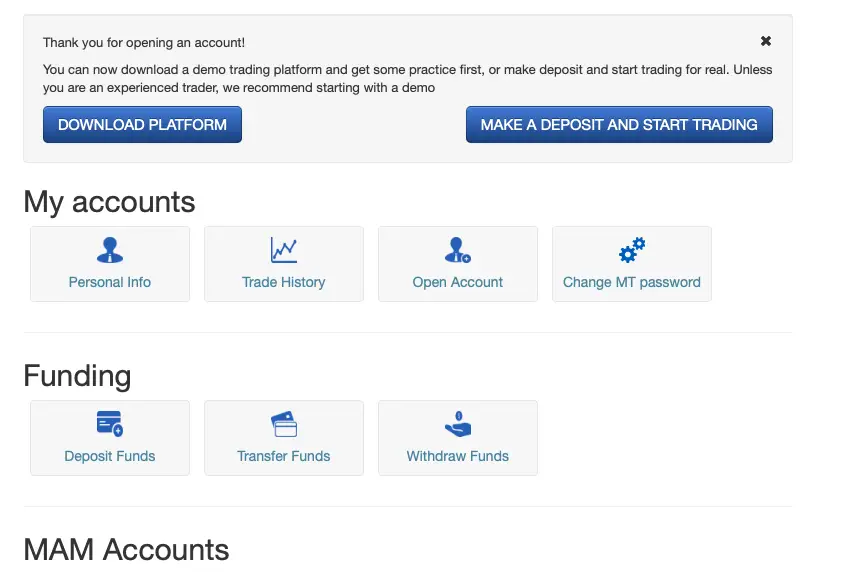

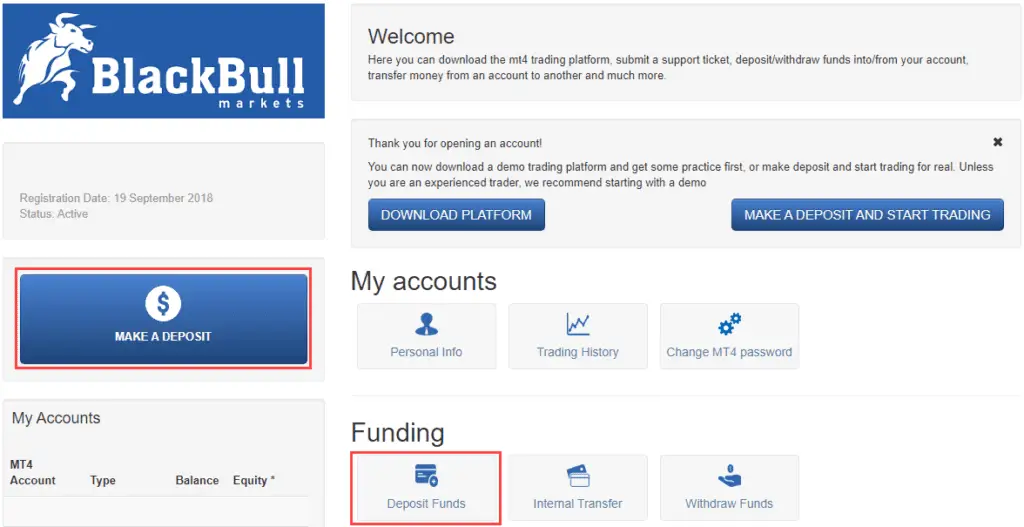

Account Dashboard

Once your login details are sent through to your registered email address, you will be able to login to the back area of BlackBull markets. Some brokers have very overwhelming and complicated back ends, where it’s virtually impossible to workout how to do what you want to do on the account. With that being said, this broker is the complete opposite! The back end is so clean, simple and easy to navigate. You have access to everything you would need as a retail trader.

You can:

- See trade history

- Update/change personal information

- Open new MT4 accounts

- Change passwords

- Deposit/transfer/withdraw funds

- Manage MAM/Investor accounts

- Download MT4

- Access educational material

If you have any issues figuring your way around the client area, the 24/5 chat support is always on hand to assist you, or contact your personal account manager if the issue persists.

Deposits/Withdrawals

BlackBull Markets offers a fairly standard range of deposit and withdrawal options – The methods as of the time of writing are:

| Method | Fees |

| PayPal | $0 |

| Bank Transfer | $20 |

| Skrill | $5 |

| Neteller | $5 |

I tested the PayPal deposit method, very impressive. The deposit went through within less than 5 minutes, with absolutely no hassle or fees. I tested a second deposit on the weekend to see if the deposits were being manually verified, however the deposit went straight through on the weekend too within less than 5 minutes, which is great! The International Bank Transfers do take between 12 and 72 hours, which still is very competitive to other brokers as this is generally how long international transfers take to complete.

BlackBull Markets do charge a small fee on deposits, on all methods besides PayPal. Bank Transfers have a 20 base account currency fee, and Skill/Neteller both have a 5 base account currency fee. The large majority of Forex brokers do charge a small withdrawal fee and the fees charged by BlackBull are very competitive.

Support For Clients

There are a number of easy ways to get in contact with the broker, not that I have had a need to yet. When you sign up to BlackBull Markets they assign you your own account manager, who emails you right away with all of their contact information from their Skype username to their mobile number.

Should you not want to go directly to your account manager, there is a 24/5 live chat which is extremely responsive, as well as multiple phone numbers and a support email address you can contact.

Compared to a lot of the top end brokers out there in the last few years, the support offered at this broker is absolutely brilliant. This won’t apply to international clients, however if you are based in NZ they do publish their address on the website, so you could even potentially make your way to the office for an in person conversation with your account manager.

- Phone : (+64) 9 558 5142

- Email : support@blackbullmarkets.com

Conclusion

In summary, BlackBull Markets is a safe broker and a great one at that. They offer amazing ECN conditions, great execution, a range of perks, very cheap trading costs and have an amazing reputable within the industry. I’ve used so many various brokers over the last 5 years, searching for perfect, and now some of my capital is with BlackBull because of it’s truly unbeatable conditions and safety.

If you are thinking of signing up, I highly recommend it! If you are on the fence, they offer a free demo account to test the MT4 trading platform and conditions of the account, so please do feel free to sign up and try it for yourself.

If you have any questions about this broker, please do feel free to contact me and I will do my very best to answer anything you may want to know!