You won’t find a profitable retail forex trader that isn’t either trading on a funded trading account or has at least dabbled in receiving prop firm funding.

It’s a no brainer! Take your profitable trades on a large funded account and receive a huge amount more in profits than you would on your own capital.

Well, due to its appeal, the prop firm industry has exploded since 2020 and there are now over 50+ prop firms

In this article, we are going to be taking a look at Blue Guardian

Let’s get into it!

Lux Trading Firm

Lux Trading Firm are a highly rated prop firm offering initial funding of up to $1,000,000 with a 75% profit split.

They offer an amazing scaling program up to $10M, with multiple industry-leading features such as their unique offering to trade on TradingView’s charts, large selection of CFD’s, 500 Crypto’s, 12,000 Stocks, Elite Packages, and no time limits make it the perfect funding option!

Lux Trading is one of the few online prop firms offering real trading capital, and trading with a regulated A-book broker!

- Real Money Funding

- Brick & Mortar Business

- Great Reputation

- Funding Up To $10,000,000

Who Are Blue Guardian?

Blue Guardian

I’ve known of these guys for a long while, as they used to provide education to retail traders before rebranding and moving into the prop firm space in 2021.

With an 85% profit split, good leverage and a simple funding challenge, it’s clear to see why traders are flocking to Blue Guardian and filling our inbox with questions about the firm!

Could this be the funded trading account for you? Let’s take a deeper look…

Blue Guardian

Blue Guardian are a fairly new UK based prop firm offering traders up to $200,000 in trading capital. With an 85% profit split, 1:100 leverage, realistic profit targets and relaxed rules, it’s obvious why Blue Guardian have got such positive reviews!

- Great Reputation

- High Levels Of Funding

- 85% Profit Split

- FOREXBROKERREPORT – Discount Code

How Do I Get Funding From Blue Guardian?

So, this is what you’re here for – I imagine! The funding!

In terms of price point, the funded trading accounts are actually fairly reasonable and well priced. In fact, they’re cheaper than some of the big players in the industry – so that’s always a bonus!

The funded accounts range from $10,000 to $200,000, depending on how much you’re looking to spend. For traders unsure of their profitability, I’d recommend one of the smaller packages – but for profitable traders, going in at the $200,000 maybe a time saver for you.

The challenge is split into 2 phases:

Phase 1

In this phase, you will have 40 days to net a profit of 8%. You will not be allowed to lose more than 4% in a day or 10% total! You have to trade for a minimum of 5 days, proving you didn’t just get lucky on one huge trade – this is industry standard.

Phase 2

In phase 2 you will have 80 days to net a profit of just 4%. You will, much like in phase 1, be able to lose a maximum of 10% and 4% daily before you lose the account.

Once you pass this stage, you’ll be a funded trader! You will no longer have profit targets or time durations, just a maximum loss and maximum daily drawdown to contend with.

What Makes Blue Guardian Different From Other Prop Firms In The Industry?

Blue Guardian isn’t just another cookie cutter FTMO – which we liked! In fact, there are a few key attributes that make this firm slightly different from the norm.

These differentiators are:

- Bi-Weekly payouts

- No restrictions on weekend trading, trade copying, EA trading, news trading etc

- Small profit targets

- Capital protector built in, to stop traders blowing through maximum loss

- Scaling plan

- Huge amount of payment/withdrawal options

The most interesting of these differentiators, in our opinion, are the lack of trading restrictions, alongside the capital protection feature. Many news traders, scalpers and even swing traders are hamstrung by a lack of opportunity with prop firms. This might mitigate those issues!

Guardian Protector Feature – What Is This?

One of the unique selling points, and what drew us to this firm in the first place, is their risk management functionality.

There is a built in (optional) drawdown protector which makes it impossible for you to accidentally hit your maximum loss. Of course, you still can hit the maximum loss, but you’d know about it!

We haven’t seen this with any other prop firm and it could really make the difference for some traders out there.

Note, it’s something we had to manually turn on – don’t just expect it to be turned on for you! It was in the dashboard area.

For those overtrades and emotional traders, there is also a way (in the dashboard) to block your trading account until the next day, meaning you cannot revenge trade or taking anything that voids your trading plan!

Is Funding From Blue Guardian Realistic? Will You Pass Their Challenge?

Let’s look at the funding model itself. The offerings of prop firms always tend to look great on the surface but of course, all of this is pointless if the model makes it as tricky as possible for you to get funded!

Luckily, Blue Guardian have stuck with the tried and tested prop firm model – the model that works! This is the simple 2 step verification model, whereby you take an initial challenge. Once complete, there will be an easier verification stage to get through. Then, you’ll receive your funding!

In answer to the question ‘is it realistic to pass’, yes, it is, if you’re a profitable trader! The offering is slightly easier than those of FTMO and some of the larger prop firms.

Blue Guardian offer longer to pass challenges, with nearly double the trading duration as some firms, alongside having their built in capital protection feature too.

MyFundedFx

MyFundedFx is proving to be one of the worlds most popular prop firms, taking over the industry in the last few months. MyFundedFx offer an innovative 1-step funding process, allowing traders to get funded from just 1 trade, potentially!

- Great Reputation

- High Levels Of Funding

- 1 Step Funding

Blue Guardian Scaling Plan

Scaling plans are hugely important, in our opinion. If you’re trading with a prop firm that is never looking to increase your capital, it throws a red flag into my head – why aren’t they interested in developing their profitable traders?

Regardless, Blue Guardian offers a great scaling program up to $2,000,000 in funded capital!

As you can see, if you average 4% monthly for a quarter, you’ll be eligible for the capital growth in 30% chunks.

Frankly, it’s too early for us to know how this works as we haven’t been working with the firm for long enough, however, it’s a great option to have.

Note, this won’t effect withdrawals – you’ll still be able to withdraw bi-weekly and be eligible for the scaling plan.

Blue Guardian Reviews – Is It A Scam?

If you’re a regular of the blog, you’ll know how seriously we take reviews from other traders. Of course, with our online presence, if a prop firm catches wind of us looking to funding, we could receive a different experience than most traders do – which isn’t fair.

For this reason, we like to include reviews from traders in our reviews, to provide a more complete story!

On TrustPilot

I mean it when I say this is brilliant, seeing so many traders satisfied with a prop firm is rare but gives us a lot of hope for this firm in the coming years.

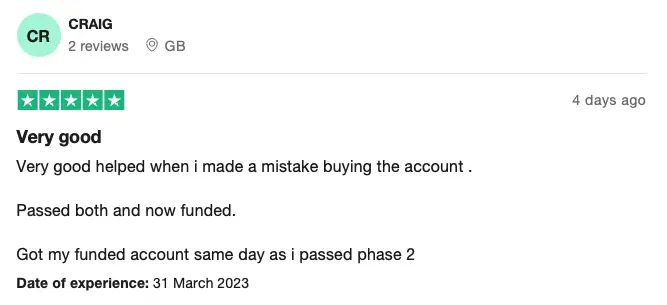

Craig here made a mistake when buying the account and had to reach out to the support team, presumably. I also had to leverage the support function and had replies rapidly – which is nice to see!

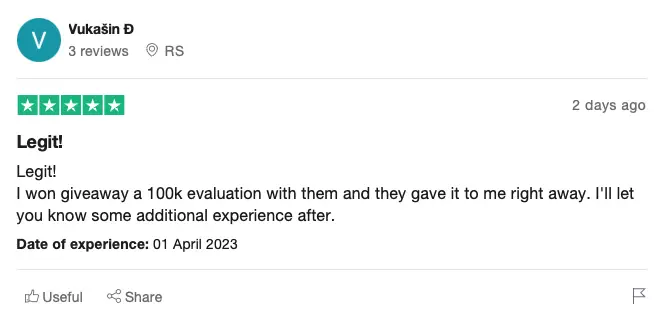

Vukasin has just been funded as well – another positive!

Obviously, we won’t overlook the fact that there are only 50 reviews. Some of the largest prop firms in the industry have 10,000+ reviews – so we’re clearly looking at a brand new/fairly small firm.

With that being said, the small firms with a lot to prove can sometimes offer the best trading conditions and most fruitful payouts as they usually need the good PR much more than the largest firms do!

If you have any experience trading with Blue Guardian, please contact us so I can add it to this review!

As with all of our prop firm reviews

Blue Guardian Reviews On YouTube

Due to the nature of the industry we’re in, there are already a huge amount of videos online talking about Blue Guardian. Although some of these will be a waste of time, it’s great to see the publicity building and traders withdrawals being shown.

Blue Guardian also have their own YouTube channel where they periodically release videos with traders or further detailing changes to their offering. It might be worth checking this out, if you’re looking to keep up to date!

In Summary – Should You Be Trading With Blue Guardian?

In conclusion, Blue Guardian are a great prop firm, offering funding of $200,000, scaling up to $2M for consistently profitable traders.

With bi-weekly payouts, 85% profit share, a risk management system to limit drawdown and multiple trading platforms to choose from, it’s clear to see how they’re doing so well in the space!

They currently have great reviews, sitting at 4.8/5 stars – however, there isn’t a great deal of reviews just yet. The firm is newer than some of the large players in the industry, so they will most likely continue to grow over the coming months and we’ll keep this review updated as this happens!

Have you received funding from Blue Guardian? Let me know in the comments down below!