With forex trading becoming mainstream over the last 5-10 years, brokers are now offering huge leverages to draw in new investors and market speculators. Retail traders have less to lose and are looking for much bigger returns, even looking to double their trading accounts – something never even thought about by traditional funds. This begs the question, can you actually double a forex trading account?

Simply, yes, due to high leverage offered by forex brokers it’s very much possible to double a forex trading account. This will require a lot of risk and shouldn’t be attempted by the majority of traders, as the resulting drawdown could be huge. Let’s break down if it’s actually possible to double a trading account, realistically..

The Most Realistic Way To Double Your Trading Capital

I know that a lot of new traders don’t want to hear it but if you’re going to be in this industry for a long time and take forex seriously, you’re not going to be doubling your trading account every month. Doubling a trading account can take a very long time and it really shouldn’t even be your goal, if you’re serious about this industry.

Your main priority as a forex trader or investor is to manage your risk. Your capital is key to your survival, if you run out of capital, how are you going to trade? You want to put yourself in the highest quality trades, manage your risk, limit your drawdown and keep your psychology on point through the whole of your trading career – doubling accounts should just be a byproduct of your success.

How Many Forex Traders Double Their Accounts?

Firstly, it’s important to understand that 70-90% of forex traders lose money. In this article by Balance

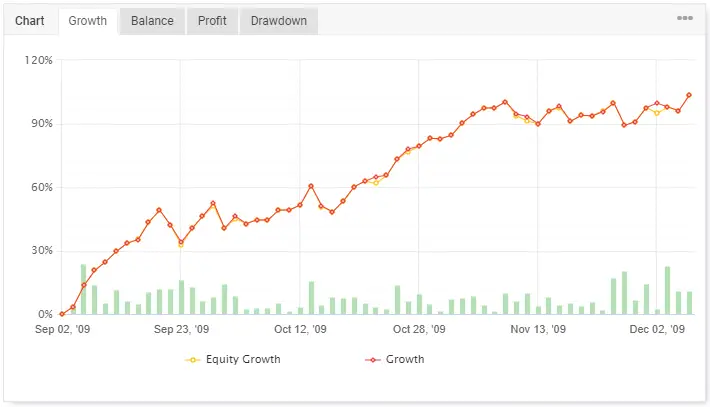

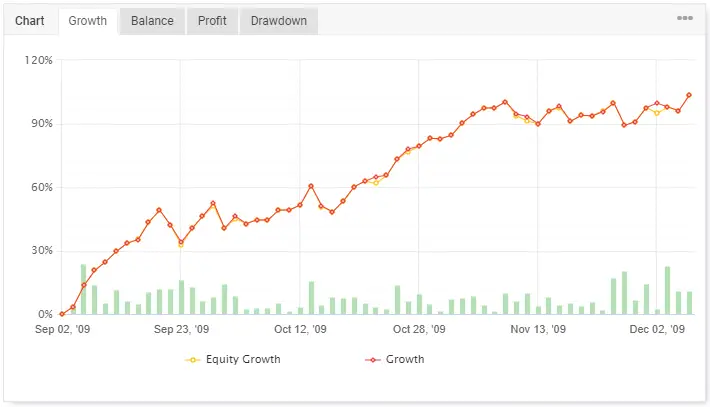

The majority of profitable forex traders will risk around 1% per trade and average around 5-7% return on average per month. So let’s look at how long it’ll take to double your account, by trading safely...

| Month | Account Balance | End Of Month (7% Gain) |

| 1 | 1000 | 1070 |

| 2 | 1070 | 1144 |

| 3 | 1144 | 1225 |

| 4 | 1225 | 1310 |

| 5 | 1310 | 1402 |

| 6 | 1402 | 1500 |

| 7 | 1500 | 1605 |

| 8 | 1605 | 1718 |

| 9 | 1718 | 1838 |

| 10 | 1838 | 1967 |

| 11 | 1967 | 2104 |

By trading realistically and safely, using 1% risk per trade, you’re looking at 11-12 months in order to double your trading account. This would make you a very good trader and frankly if you can keep these results up for years, you’re going to be having investors throw capital at you.

When looking to double a forex account you’re also going to have to bare in mind, compounding. If you’re constantly withdrawing profits, it’s going to take you much longer to double the account balance so most traders choose to leave their profits in the account to trade with. However, if you’re someone looking to deposit small and risk a huge amount of your capital per trade in order to double your account, this is going to be much less of an issue for you because you’ll either double your account or blow your capital quick.

Using Leverage & Scaling To Double Your Forex Trading Account

The forex market is extremely liquid compared to other markets and does provide a huge amount of trading opportunities every year, or even every day for lower time frame traders. This frequent opportunity is also paired with the fact brokers offer a huge amount of leverage in the forex markets, compared to other markets. If you take a look at our top forex brokers list

I’d say, in my opinion, if you’re going to double a trading account in any market, it’s most likely going to be the forex market. I don’t recommend trading like this at all, I think that long term consistent returns is the key to trading but if you’re looking to double an account you’re going to need to:

- Have a broker offering 1:500 leverage, or more.

- Understand scaling into positions and managing risk.

Let’s take a look at a trade example and how you could have doubled your account by trading it in a more aggressive way…

In this trade, you could have risked 10% of your trading capital over 110 pips, for a net return of 370 pips, 33% gain. This is an absolutely huge trade on the weekly time frame and if you won 3 trades of this size, risking 10% per trade, you could have doubled your trading account. With that being said, 10% per trade is extremely risky and I am not advising that’s what you do.

Taking that exact same trade, what if you scaled into the position using price action?

By using very simple price action, like trend-lines and EMA’s, you were able to take a total of 3 entries into this same move, instead of just 1. The first entry would have a RR of 1:4, the second entry a RR of 1:4 and the third with an RR of 1:1.4. At 10% risk per position, you would be ending up with a total of 100% gain on this trade and actually doubling your forex account in one trade.

Comparing the 100% gain on this move, to the 30% gain on the trade above – it’s clear that scaling in is crucial to doubling a forex account. The KEY to scaling into positions though, is to remove the risk from the previous entries. You can’t be risking 30% in one trade, that’s insane. However, if you risked 10%, moved the stop loss to breakeven, then did that 3 times, you’re never risking more than 10%! This is how accounts are grown, safely.

Increasing Your Trading Capital, Without Over-leveraging?

Let’s take a look into why you actually want to double your trading account? If you’re desperately in need of some money for bills and you’ve never traded forex before – I should say that you’re not going to be able to double an account. In fact, if you’re not a consistent veteran of the markets – I guarantee you’ll lose your whole trading account by trying to shortcut and double it.

Most forex traders think that capital is what’s holding them back. You must need a large account to make large profits, right? Yes, this is true – but there’s much easier ways to get a large account. This is where forex prop firms come in…

Forex prop firms are companies that offer funding to profitable traders. This funding can go all the way into the millions depending on which firm you’re using. I actually have a list of the top prop firms here

Typically, you purchase a trading challenge, like the FTMO challenge

For traders that are in a bit more of a hurry, there are prop firms that will fund you without even having to take a profitability challenge. For example, MyForexFunds has instant funding

I’d definitely recommend going down the funding route if you have a small forex trading account, rather than trying to recklessly double it quickly and end up blowing through the whole account.

Conclusion – Is It Possible To Double My Forex Trading Account?

In summary, it’s very possible do double a forex trading account due to the leverage offered by brokers, paired with the volume of opportunities such a liquid market providers. It would take a consistently profitable trader on average 12 months to double a trading account, with it taking much less time for reckless traders willing to risk more.

If you’re thinking forex is a get rich quick scheme and you could just keep doubling your money, that’s not how it works at all and you’re more likely to lose all of your money. Only consistently profitable traders are able to double accounts, usually after years of studying.

Instead of trying to double a forex account I’d recommend trying to take on additional funding from a prop firm like DT4X Trader