Forex trading is a lucrative and attractive endeavor for many individuals. It has the potential to generate substantial income in a relatively short period of time.

This article examines the possibility of making one thousand dollars per day through forex trading, exploring what it takes to achieve this goal and whether it is attainable. The implications of such an achievement are also discussed, as well as how others who have accomplished this may provide guidance moving forward.

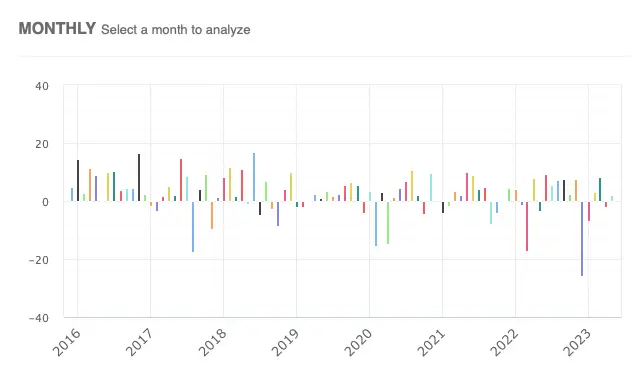

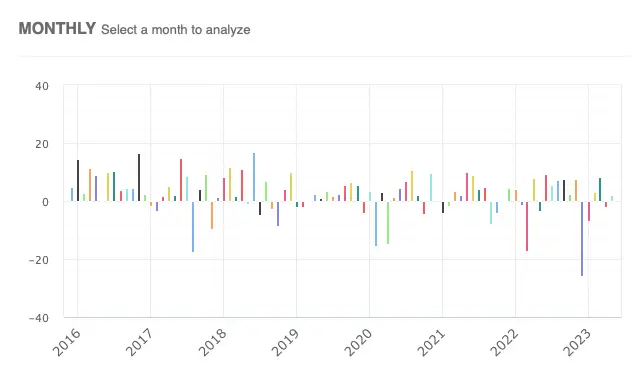

It is possible to make 1k a day trading forex, but it is not easy. Most traders will never manage to earn this. Profits are hard to obtain daily in the forex markets – most successful traders look at a longer term view, such as monthly or quarterly profits.

A thorough exploration will be conducted to discover if earning one thousand US Dollars each day from Forex is possible or merely a pipe dream.

Is It Possible To Make 1k A Day From Forex Trading

Forex trading can be a lucrative activity, however, it is important to understand the risks and rewards associated with the market before attempting to make 1K a day.

One of the pros of forex trading is the potential for high returns, depending on the market conditions. However, there are also cons to trading forex, such as high leverage which can lead to large losses.

To mitigate the risks of trading, it is important to employ risk management strategies such as setting stop losses, managing leverage, and diversifying the portfolio.

Pros And Cons Of Forex Trading

The question of whether it is possible to make 1k a day from Forex trading is one that has been asked by many traders.

In order to answer this, the pros and cons of Forex trading should be weighed carefully. On one hand, there are some advantages when it comes to Forex trading: high liquidity in the market making entry and exit decisions easier; access to leverage which allows for higher reward potential; low transaction fees compared to other forms of investments; and no restrictions on short selling.

However, as with any form of investment, there are risks associated with Forex trading such as risk-reward imbalance due to leverage exposure; psychological discipline required since emotions can drive bad decision making; and capital management through proper risk mitigation strategies necessary for mitigating losses.

Ultimately, while it is theoretically possible to make 1K a day from Forex trading (or even make 1% per day from trading forex) – though highly unlikely – caution must still be taken and appropriate measures put into place in order for successful trades over time.

As such, investors should take their time familiarizing themselves with the market conditions before engaging in active trading.

Risk Management Strategies

When trading Forex, the risk of losses can be minimized through proper money management and by following sound risk management strategies.

Risk tolerance should be firmly established before entering a trade to ensure that any potential losses are within acceptable limits.

Leverage usage should also be considered carefully as it increases both rewards and risks in equal measure.

In addition, emotional control is essential when making trades since emotions can often drive bad decisions.

Lastly, chart analysis skills are necessary for predicting price movements that affect entry/exit points of trades.

By utilizing these various risk management strategies, traders will gain an edge over their competitors while minimizing the probability of heavy financial losses.

99.9% Of Forex Traders Will Never Make 1k Per Day

Forex trading can be a difficult venture, as evidenced by the fact that only 9% of traders are able to make 1K per day.

Common mistakes that traders make include not having a solid strategy, not managing risks, and not having adequate capital to invest.

To have a better chance of achieving 1K per day, traders should develop a trading plan, set realistic goals, and diversify their investments.

It is also important to identify market trends and develop a disciplined approach to trading.

Common Mistakes Traders Make

Beginning with risk management, one of the most common mistakes traders make is underestimating or ignoring it. Without properly managing their risks, for example setting leverage rules and stop-losses, traders are exposing themselves to large losses that can quickly eliminate any gains made from trading.

To ensure long-term success in Forex trading, proper financial planning must be done before entering into a trade. This includes understanding the market conditions and having an appropriate trading strategy set in place so that profits can be maximized while minimizing potential losses.

Technical analysis is also another important aspect of Forex trading that many beginners overlook. By using technical indicators such as moving averages and MACD, traders can gain insight into how prices may move in the future which helps them decide when to enter and exit trades. Although technical indicators should not replace fundamental analysis completely, they provide useful information on identifying trends and support/resistance levels which could give investors an edge over other traders who do not use these tools.

Successful Forex Trading often requires patience and discipline; two qualities not possessed by all aspiring day traders looking to make 1K per day. Many novice traders allow emotions like greed or fear to influence their decisions leading them down a path of failure or disappointment. With this being said having a well thought out plan beforehand will help you stay disciplined even when faced with difficult decisions during times of high volatility.

In conclusion, although making 1K per day through forex trading may seem attainable at first glance, doing so requires knowledge about numerous aspects including risk management, leveraging rules, technical analysis and financial planning along with a robust yet flexible trading strategy. On top of all this comes the need to possess emotional intelligence – avoiding impulsive decision making – something only experienced professional traders understand how to manage effectively.

Strategies To Achieve 1k Per Day

In order to achieve the goal of making 1K per day in Forex trading, an effective strategy must be put into place.

This includes having a sound risk-reward ratio and being able to control emotions during times of high volatility.

Additionally, traders should have a clear entry and exit plan as well as proper money management techniques that allow for consistent profits over time.

Developing discipline is also essential since it allows traders to stay focused on their strategies and not become overwhelmed by the market’s movements.

Lastly, understanding the psychology behind trading can help traders maintain composure even when faced with difficult decisions or losses.

All these factors combined form the foundation needed for successful Forex trading where large sums of money are made consistently each day.

Think Long Term Profits, Not Daily Profits

Investing in Forex requires a long-term perspective in order to be successful.

Achieving daily profits should not be the primary focus for traders as this can lead to excessive risk-taking and impatience.

Instead, traders should focus on patient investing and consistent strategic planning in order to maximize their long-term profits.

Such an approach requires an understanding of market conditions and the ability to identify opportunities for sustained profits over the long-term.

Patient Investing

Investing in the foreign exchange (Forex) markets can be a lucrative endeavor, but it is not without its risks. Those looking to make a profit from Forex trading need to think long term and focus on patient investing rather than daily profits.

This approach requires effective risk management, emotional control, technical analysis, practice trading, and money management strategies. To maintain profitability over time, investors must temper their expectations and learn how to manage stop losses and take-profit levels correctly. It also involves having realistic goals that are achievable with proper money management techniques like setting position size according to individual account balance or risk appetite.

Finally, one should hone their skills by using demo accounts for practice until they are comfortable with real trades on live accounts. Not only will this help in minimizing losses due to mistakes caused by inexperience, it will also provide valuable insights into the market dynamics which aid in successful trading decisions. With dedication and commitment to these practices, an investor has the potential of creating sustainable gains through Forex trading over time.

Strategic Planning

In order to achieve long-term profits from Forex trading, strategic planning is also essential.

This involves assessing the risk associated with each trade and setting realistic goals for position size according to individual account balance or risk appetite.

Additionally, market analysis should be conducted in order to identify trends and make informed decisions about when to enter or exit a position.

Technical indicators can help by providing signals that suggest potential entry or exit points.

Furthermore, it is important to consider the psychological factor of trading as this can have an impact on decision making – managing emotions such as fear and greed so they do not interfere with good judgement is essential.

Having a sound money management strategy in place is key too; this will ensure proper capital preservation over time while allowing traders to maximize their gains through leverage where appropriate.

With these measures in place, investors are better equipped to capitalize on opportunities within the foreign exchange markets and generate consistent returns over time without excessive exposure to unnecessary risks.

Capital Needed To Earn 1k Per Day In Trading Profits

Risk management is an essential component of trading profits, as it is necessary to minimize losses and maximize gains.

Capital requirements must be taken into account when trading, as a larger capital base can increase the potential for higher profits and reduce the risk of margin calls.

Leverage should also be considered in order to maximize profits, but must be managed carefully, as it can increase the risk of losses if not used appropriately.

Many traders making 1k a day use funded trading accounts from prop firms

Lastly, adequate knowledge of the financial markets is necessary in order to effectively manage risk and capital requirements in order to earn a daily profit of 1K.

Risk Management

Trading profits of one thousand dollars per day can be achieved with careful capital investment and risk management

Money management is a key factor in controlling the amount of money that needs to be invested, as well as determining which markets are most suitable for trading strategies.

Practice trading can help traders develop an understanding on how each market behaves and what kind of leverage levels will yield the best results.

Market analysis should also form part of any risk management strategy when aiming at achieving daily trading profits up to one thousand dollars; such analysis includes looking at stop losses, cost averaging techniques and other means to protect against market volatility.

Finally, it is important to remember that learning from mistakes made during practice sessions will provide invaluable knowledge for real-world scenarios.

Capital Requirements

Capital requirements are an important part of any successful trading plan when attempting to earn one thousand dollars per day.

Leverage trading, in particular, is a viable option for traders who want to maximize their profits while minimizing risks associated with high capital expenditure.

Additionally, money management should be employed as it can help control the amount invested and determine which markets are most suitable for the trader’s strategy.

Risk management strategies must also incorporate market analysis through careful examination of stop losses and cost averaging techniques; this will ensure protection against volatility in case of adverse market conditions.

Furthermore, understanding how each market behaves and developing good trading psychology skills by learning from mistakes made during practice sessions can all contribute towards achieving consistent daily profits up to one thousand dollars.

Conclusion

It is possible to achieve 1K per day in trading profits, but it requires a significant amount of capital and long-term commitment.

There are few traders who can make this kind of money on the Forex market, as most will not reach this level of success due to lack of knowledge or experience.

To become one of these successful traders, there must be hard work and dedication put into understanding the markets and developing strategies that generate consistent returns over time.

With patience and perseverance, however, it is possible to achieve financial freedom through Forex trading.