Forex signals are a type of trading alert used by traders looking to gain an advantage in the ever-evolving forex market. With so many opportunities available, it is not surprising that some people may be interested in whether or not they can make a living off them.

This article will explore this possibility and look at what factors must be taken into consideration when trying to achieve this goal. The forex signal industry has grown significantly over the last few years with more products being developed for both retail and institutional investors.

However, despite their popularity, there is still much debate around the legitimacy of forex signals as well as their effectiveness in providing successful trades. Many traders are now using signals to try and get prop firm funded accounts

To get a better understanding of this topic, we will examine the potential benefits and risks associated with using these systems and determine if making a living from them is indeed possible.

Making A Living From Forex Signals

- Forex signals can provide traders with an advantage by providing real-time trade alerts which can help identify trading opportunities.

- Using forex signals, however, can be risky if the signals are inaccurate or untimely.

- A successful trading strategy using forex signals should include a solid risk management plan to limit the potential negative effects of incorrect signals.

- Traders should also select signals that are based on a sound trading strategy and have a good track record for profitability.

- It is important for traders to analyze the results of the signals before making decisions on whether or not to take action on them.

- Finally, traders should consider the overall cost of using forex signals when making a decision to subscribe to a signal service.

Advantages Of Forex Signals

The use of forex signals offers a variety of advantages for traders who are looking to make a living from the market.

The risk reward ratio associated with these signals provides an opportunity for traders to manage their funds more efficiently and reduce losses.

Leverage strategies can be used in combination with forex signals, allowing traders to expand their positions beyond what would normally be available through traditional methods.

Furthermore, by relying on technical and fundamental analysis, as well as taking into account market psychology, forex signals provide information that allows traders to identify entry and exit points when trading.

This helps them better manage their risk management strategy

In essence, using forex signals have become one of the most reliable tools in modern day trading, offering opportunities for those looking to make a living off of it.

As such, utilizing this tool along side other knowledge is essential for success in today’s ever-changing markets.

Challenges Of Forex Signals

Despite the many advantages of utilizing forex signals, there are also challenges that traders must overcome.

There is a learning curve associated with trading in general, and it takes time to master the various techniques used in technical and fundamental analysis as well as market psychology.

Additionally, emotional control can be difficult for some people who struggle to remain disciplined throughout their trading journey.

Furthermore, proper money management and risk management strategies need to be implemented if one wants to maximize potential returns while minimizing losses.

Therefore, successful implementation of these methods requires dedication from those looking to utilize forex signals as part of their overall strategy when making a living from the markets.

Strategies For Trading Signals

In order to maximize potential returns while minimizing risk, traders must develop effective strategies for trading signals.

Risk management and money management are essential components of any successful strategy, as is the ability to analyze technical data accurately and swiftly.

Leverage trading can be a powerful tool in this regard, allowing traders to increase their exposure without taking on unnecessary risks.

Automated trading systems such as Expert Advisors (EAs) may also prove useful, as they allow users to automate certain aspects of their trades based on predetermined parameters.

By combining these elements with sound market analysis and psychological awareness, traders have an opportunity to achieve success when utilizing forex signals.

How To Find Profitable Forex Signal Sellers

Signal providers offer forex signals that can help traders make informed decisions in their trading strategy.

To find profitable sellers, it is important to compare price and quality of the signals.

Checking the signal provider’s reputation and verifying their past performance may also be necessary to ensure that the signals are accurate and reliable.

By taking these measures, traders can find signal providers that can help them become successful in forex trading.

Understanding Signal Providers

In the world of Forex trading, signal providers are becoming increasingly popular amongst retail traders. As such, it is essential to understand what they offer and how they can be beneficial when attempting to make a living off Forex signals.

Risk management and market analysis play an important role in determining the success of any investment strategy. Automated trading systems often rely heavily on these two principles for their accuracy in providing signals; thus, one must weigh the potential gains versus losses before investing in any particular system.

Furthermore, it is also wise to familiarize oneself with the different types of signal providers available as each has its own characteristics which could influence results significantly.

Lastly, researching various signal vendors thoroughly prior to committing capital will prove invaluable in ascertaining whether or not a reliable source exists that can provide profitable Forex signals consistently over time.

Comparing Price & Quality

When searching for a profitable Forex signal seller, it is important to compare the price and quality of their services. The main focus should be on risk management as well as accuracy and frequency of signals provided by them.

Additionally, one must verify the reliability of the signals being sent out; this can be done by researching past results or asking fellow investors who have used the same service before.

Furthermore, due to the volatile nature of currency markets, any reliable signal provider should also offer some degree of customization allowing traders to adjust parameters according to their own trading objectives.

As such, careful consideration should be taken when comparing different vendors in order to determine which will provide the most value for money and prove beneficial over time.

Use Caution When Blindly Trading Forex Signals

False signals in the forex market can lead to financial losses if not properly identified.

The quality of signals is an essential factor to identify profitable trades and minimize losses.

Risk management is a key component of successful trading, as it allows traders to limit potential losses and maximize potential gains.

A good risk management strategy should include the use of stop-loss orders and position sizing.

Additionally, traders should diversify their trading portfolio to reduce the risk of being exposed to a single asset.

It is also important to understand the underlying economic and political factors that can influence the markets.

False Signals

The accuracy of forex signals should be evaluated prior to any trading decisions being made. Market volatility and the nature of the currency markets can make it difficult for traders to rely on signal reliability in predicting possible outcomes.

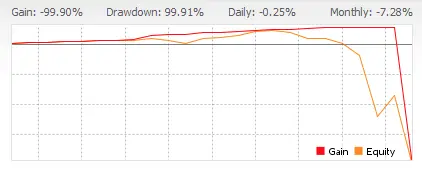

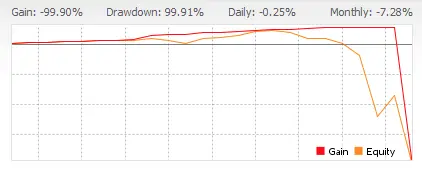

It is important that traders exercise caution when blindly following signals, as they may not always provide an accurate depiction of what will occur in the market. Furthermore, a lack of trading discipline and proper risk management strategies could lead to significant losses if these false signals are acted upon without thorough analysis.

Therefore, it is essential that traders take extra precautions before placing trades based solely off signal recommendations. As such, sound research and fundamental analysis should be conducted beforehand to ensure appropriate levels of protection against financial loss due to inaccurate predictions caused by relying on unreliable signals.

Signal Quality

When trading in the foreign exchange market, signal quality is also an important factor to consider. Various automation tools and strategies can be utilized to help traders assess signal accuracy and improve risk management practices.

Market analysis should be conducted regularly to ensure that signals are reliable indicators of possible outcomes. Understanding these underlying factors will enable them to make informed decisions when formulating their own unique trading plans.

Additionally, leveraging the power of technology by utilizing various automated software programs such as Expert Advisors (EAs) may provide a distinct advantage over manual systems due to its ability to identify profitable opportunities quickly and accurately. With this being said, it is essential that traders remain vigilant while using any type of automated tool as they could lead to losses if not properly managed.

In order for investors to maximize their returns from forex trading, thorough research into all aspects of the market must be done before taking any positions based on signals alone.

Risk Management

Risk management is an essential part of foreign exchange trading, as it helps to protect traders from potential losses.

The risk/reward ratio should be taken into account when formulating a trading plan and setting stop loss orders can provide further protection against large drawdowns.

Leverage control and diversification strategies are also beneficial tools that may help limit exposure to heightened levels of volatility in the market.

Conducting thorough market analysis will enable investors to understand underlying factors which can aid in making informed decisions on their trades while helping to ensure they do not take unnecessary risks with their capital.

Conclusion

Forex signals can be a useful tool for traders to gain insight into the market, but they should not be blindly followed without prior research. Doing so could lead to disastrous results and financial losses.

It is important to thoroughly evaluate signal providers in order to ensure that the signals are profitable over time. By researching past performance records and using caution when trading forex signals, it may be possible to generate a steady income from this strategy.

Ultimately, individual needs and risk preferences will determine whether or not relying on forex signals as a primary source of income is feasible.