Forex trading has grown massively in popularity over the last few months, especially with many people being stuck at home, looking for things to do online. Compared to other classic forms of investing, like stocks or real estate, forex has the lowest barrier of entry. Some brokers will allow just $10 deposits, then offer traders a huge amount of leverage to play with. But, can you trade forex without using leverage?

You can trade forex without leverage, but you would need a huge amount of capital in your trading account. Institutional players are trading without leverage daily but the average retail forex trader cannot survive from profits of less than 1% per month, hence why leverage is needed.

Forex Trading Without Leverage

It is possible to trade forex without leverage, but it’s not worth doing. Leverage is potentially very dangerous

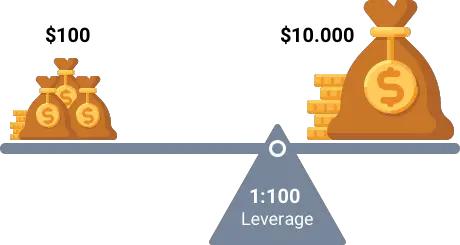

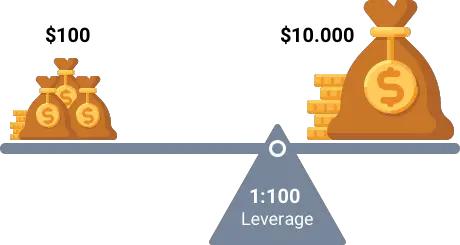

The majority of traders that come into the forex market are coming in with just a few hundred or a few thousand dollars. Without leverage, you would potentially be making 0.05% per month return, if you were an extraordinary trader in the top 1% in the world. With the use of sensible leverage, offered by your broker, you would potentially make 5-10% return in that same month, with the exact same traders.

Brokers offer leverage to traders because it’s needed. If no one needed leverage, brokers wouldn’t offer it – simple. Leverage is very dangerous but without it, your wings are clipped and you would never be able to compound a trading account to the size needed to earn a living from forex trading.

Do All Forex Traders Use Leverage?

Not all forex traders use leverage within the markets. In fact, the largest traders in the industry wouldn’t think of using any leverage at all. Most of the volume in the markets is due to banks, hedge funds and large institutions. All of these players have access to billions in capital and can take trade sizes that dwarf what is possible for retail traders.

In fact, the majority of the volume in the markets is robots and algorithms trading and these certainly wouldn’t be running with any kind of leverage.

It’s safe to say though that all forex traders you are seeing online are using leverage from their brokers. This will be ranging from 1:1, all the way to 1:500.

Trading With The Lowest Leverage Possible

Having leverage is great but it really does work as a double edged sword. Let’s say you’re taking a trade on EURUSD. If you didn’t have any leverage, maybe you were able to make 0.05% on the trade. With 1:10 leverage, maybe you were able to make 0.5% on the trade, before running out of margin from your broker. With 1:500 leverage, you would potentially be able to risk about 20% of your trading capital and make infinitely larger gains.

This needs to be taken with a huge pinch of salt because you could also easily lose 20% of your capital, in minutes, if you’re abusing leverage. Some offshore brokers are now even offering up to 1:2000 leverage, which should be completely outlawed in my opinion.

To stay as safe as possible, use a lower amount of leverage and never over-leverage your account. Don’t risk above 1% in a single trade and don’t let emotions come into your trading!

Conclusion – Can I Trade Forex Without Using Leverage?

In summary, it’s entirely possible to trade forex without leverage but you wouldn’t be able to make more than 0.5% return monthly. Leverage is a tool used by traders to make larger percentage gains on smaller capital within the markets and without leverage, your potential gains are severely limited.

If you have any feedback or questions about leverage please drop a comment down below.