Are you looking to take on funding for your forex trading journey? Prop firms are a great way get quick access to large amounts of trading capital, without needing to find investors yourself or have years of track record behind you.

Fidelcrest

They have a really interesting trading model and we have done extensive research into Fidelcrest to see if they’re the best prop firm for you! Let’s find out more..

Lux Trading Firm

Lux Trading Firm are a highly rated prop firm offering initial funding of up to $150,000 with a 75% profit split.

As well as the initial funding, there is no time limit on hitting profit targets, weekend holding is allowed and they offer an amazing scaling program up to $10M, making it a perfect funding option for swing traders and day traders.

- Real Money Funding

- Brick & Mortar Business

- Great Reputation

- Funding Up To $10,000,000

Who Are Fidelcrest?

Fidelcrest is a prop firm founded in 2018, which has been getting a fair amount of coverage online over the last few months as prop firm trading has really found legs in the forex community. They offer the largest profit share ratio in the industry, with you keeping up to 80% of your profits on the trading account.

Fidelcrest is owned by the Fidelcrest Group of Companies

This company is a little more complex and complicated in their phases than the likes of FTMO

With an 80% profit share on the Aggressive Accounts, it sounds like a no-brainer for budding forex traders! Let’s have a look at the finer details to see if Fidelcrest is really as good as it sounds…

Getting Funding From Fidelcrest

Fidelcrest offers essentially 4 different account types for traders to choose from. This starts with the Micro accounts. If you choose to trade the Micro accounts, you’ll have a range of $5000-$20,000 to manage, depending on which funding option you decide on. These come with a one off fee of course, starting at just $99 making it one of the cheapest firms in the market.

They also offer Pro accounts, which start at $50,000 and work all of the way up to $400,000 under management. This is absolutely huge and as far as I am aware, the largest account you can purchase from a prop firm in the world right now. Other companies like 5%ers

Both of the account options come with 2 options, either Normal or Aggressive. They’re fairly self explanatory in nature, if you’re a trader that has large PnL swings, typically larger drawdown but typically larger gains, you may want to opt for the Aggressive account option as this type of trading behaviour is allowed.

Your profit share goes up from 70% to 80% on the Aggressive option, with maximum drawdown increased to 20% and profit target also increased to 20%. The only drawback here is that compared to just the Normal account type, you will have to pay a higher initial fee for the account.

What Makes Fidelcrest Different From Any Other Prop Firm?

Fidelcrest

They offer a maximum initial funding of $400,000! Now this size of account is going to cost you $1,499 in order to take the challenge, which you might not even pass – so it’s certainly not a guaranteed get rich scheme but for profitable and consistent forex traders it is a ticket to the big leagues. If you look at some of the other companies on our Best Forex Prop Firms List

Not only is $400,000 of trading capital accessible, Fidelcrest, much like 5%ers

The scaling plan

Should you be able to achieve this, they will increase your capital by 25% every 3 months. This is an insane rate of growth and is currently capped at a staggering $800,000!

It’s important to note that on the website it mentions the fact that the largest account currently being traded by retail forex traders is $400,000, meaning no one has managed to scale the largest account up to the full $800,00 yet!

Surge Trader

Surge Trader is a highly respected US prop firm offering forex traders a 75% profit split and funding of up to $1,000,000 after the challenge stage.

Unlike most prop firms, the company offer trading on all forex and cryptocurrencies, making it a great option for those traders that like to diversify.

- Great Reputation

- Funding Up To $1M

- 75% Profit Split

Is Getting Fidelcrest Funding Realistic?

When looking at getting funded with prop firms, it can sometimes feel too good to be true so it’s important to understand how realistic it actually is to achieve the targets being set out by these companies.

As far as industry standards go, Fidelcrest is very competitive in regard to the levels of trading standard required to actually pass the challenge and verification stage.

If we take a look at the $50,000 Pro Account for $349, we can get a sense of the conditions we are trading with.

You can trade on MT4 or MT5 with a range of trading brokers and most importantly up to 1:100 leverage. This is in comparison to BluFx

Comparing the program information here, to some of the other prop firms

The 3 step process for getting funded certainly seems very achievable for a profitable forex trader. Initially you have a 30 day trading period to reach a 10% profit target, with a maximum loss of 10% (5% maximum daily loss).

At this point, you fee is refunded and you move onto the next stage. You will again have 30 days to reach a profit of 10%, with a maximum loss of 5% (5% maximum daily loss) – during this stage you will keep 40% of the profit made.

Then you’re onto your funded account, where there is no fixed profit target, you just keep trading!

If you aren’t a fan of having to do a challenge, then a verification, there are companies offering instant funding. For this, I would recommend checking out MyForexFunds

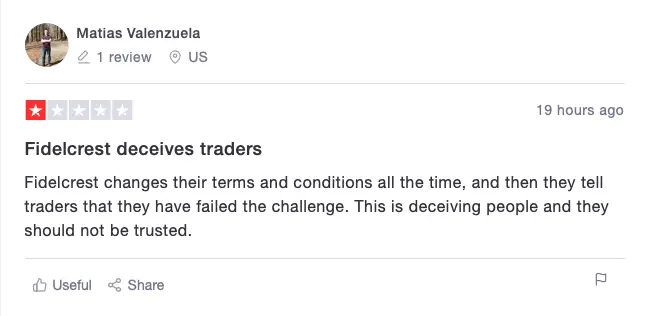

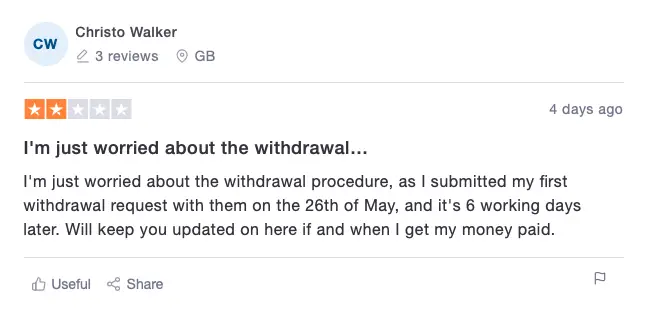

Fidelcrest Reviews – What Are Traders Saying?

If you’re a regular reader of FBR, you’ll know one of the ways we do due diligence on prop firms and brokers alike is to have a look at what other traders are also saying, incase our experience has been vastly different from theirs.

As we can see from Trustpilot

There is a very strong mix of very positive reviews, traders praising the prop firm and being extremely happy with the service offered, to traders feeling cheated out of passing the challenge and even waiting for withdrawals to come.

As it stands, the overall reputation of Fidelcrest within the online forums really doesn’t appear that great as of right now, even though we have not had an issues with them or the customer service team.

Education And Support For Traders

Instead of using online resources like Babypips

Fidelcrest doesn’t really offer much in the way of education or supportive content for traders. They offer a backend area where you are able to track your trading statistics, which is of course very valuable when you are trading to strict deadlines and perimeters. They also offer an Economic Calendar, much like ForexFactory

If we are ignoring educational content and looking at the customer support side of things, Fidelcrest have a 95% satisfaction rating over nearly 7000 reviews on their online support system, which is great to see.

Conclusion – Is Fidelcrest Just A Scam?

With all of the information we have gathered, we certainly have enough to make an informed decision as to whether Fidelcrest is the prop firm for us to be using, or if we should get funded elsewhere.

Let’s start with the fact that Fidelcrest

However, they don’t have the best reputation within the industry, at all. It only takes a look on Trustpilot

With that in mind, I would personally focus my time more with a prop firm like FTMO

I would personally advise having a look around at some of the other Top Prop Firms

Fidelcrest mention on their website that they currently have over 6000 active traders this year with funded accounts, so the firm is definitely growing! I think I will personally revisit them every few months to check for more positive feedback in the forums and when that starts rolling in, go for the $400,000 funding.

If you have any experience trading with this prop firm, please do let us know in the comments below, we are very interested to hear about your experience.