There isn’t a retail forex trader online that hasn’t heard of forex prop firms in 2023. With the explosion in funded trading accounts, there is a huge amount of opportunity for traders to further their careers and growing their capital under management.

With over 50+ prop firms

With that being said, in this article we are going to be reviewing ForexPropFirm. They’re a relatively new firm and do exactly what they say on the tin! We’ve recently been funded by these guys, so we’ll give you everything you need to know to make an informed call as to whether they’re the firm for you!

Lux Trading Firm

Lux Trading Firm are a highly rated prop firm offering initial funding of up to $1,000,000 with a 75% profit split.

They offer an amazing scaling program up to $10M, with multiple industry-leading features such as their unique offering to trade on TradingView’s charts, large selection of CFD’s, 500 Crypto’s, 12,000 Stocks, Elite Packages, and no time limits make it the perfect funding option!

Lux Trading is one of the few online prop firms offering real trading capital, and trading with a regulated A-book broker!

- Real Money Funding

- Brick & Mortar Business

- Great Reputation

- Funding Up To $10,000,000

Who Are ForexPropFirm?

ForexPropFirm

We were actually asked to delve into ForexPropFirm and by a few traders in our emails not too long ago as their instant funding accounts

To that end, we can see why they have a flawless reputation… Let’s find out more.

ForexPropFirm

ForexPropFirm are a fairly new prop firm offering traders capital of up to $10,000,000 with a 90%+ profit split! You’ll have access to either a 2-step challenge, a 1-step challenge or an instant funding account with leverage, weekend holding allowed and relaxed trading rules!

- Huge Payouts

- 90% Profit Split

- 1 Step Challenge

How To Get A Funded Trading Account From ForexPropFirm?

There are multiple ways to get a funded trading account from FPF, depending on which route you’d like to go down…

1. The 2-Step Challenge

The 2-step challenge is very similar to the standard challenges you would be familiar with in the industry if you’ve worked with other prop firms previously.

In phase 1, you have a profit target of 8%, with no daily drawdown limits but a maximum drawdown of 12% – quite lenient! You’ll need to trade for a minimum of 5 days and a maximum of 35 days. You will still be receiving a profit split for your trading efforts during evaluation, providing you pass!

In phase 2, you have a profit target of 5%, with the same drawdown rules as in phase 1. You’ll have 60 days to pass this phase, rather than 35 days. Again, you’ll have a 5% profit split during this time and if you pass, you will receive 100% of your fee within your first withdrawal.

2. The 1-Step Challenge

The 1-step funding model is very similar to the 2-step model, beyond the fact you won’t need to complete that second verification stage.

The rules are very simple, with a profit target of 10%, daily drawdown limit of 4% and a total drawdown limit of 6%. There are no minimum trading days or time limits, which is great!

As per the other 2 models, weekend holding, signals and EA’s are allowed. The challenge fee is refunded in the first withdrawal, providing you pass the challenge and get funded.

ForexPropFirm

ForexPropFirm are a fairly new prop firm offering traders capital of up to $10,000,000 with a 90%+ profit split! You’ll have access to either a 2-step challenge, a 1-step challenge or an instant funding account with leverage, weekend holding allowed and relaxed trading rules!

- Huge Payouts

- 90% Profit Split

- 1 Step Challenge

3. Instant Funding Model

The instant funding model provides an opportunity for profitable traders to get funded same day and start earning profits on their funded trading account.

The starting capital ranges from $10,000 to $200,000, of course ranging in price too. You won’t have a profit target or time duration, but you will need to manage drawdown to a maximum of 5% on the account.

You will have to trade for a minimum of 5 days each month in order to keep the account and weekend holding is allowed, for all of our swing trader friends!

It’s worth mentioning that you’ll need to start at at least $25,000 in capital if you wish to participate in the scaling program.

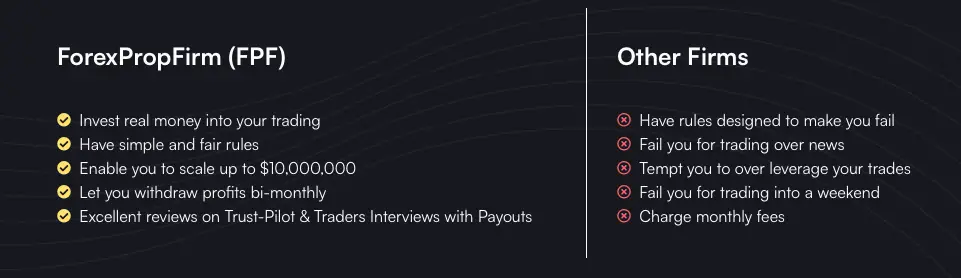

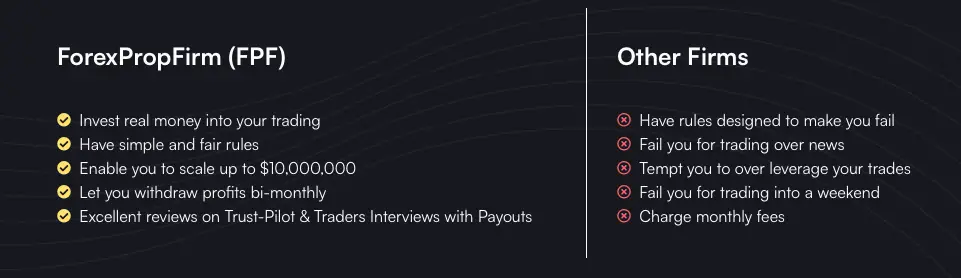

What Makes ForexPropFirm Different From Other Prop Firms?

ForexPropFirm isn’t a cookie cutter of the usual FTMO model which we often see – which is great! There are certainly some USP’s that make it really worth considering working with FPF for your funded trading account.

Firstly, they offer withdrawals twice per month – unheard of in the industry.

They also offer a much better scaling opportunity than many firms, which allows traders to grow to over $10,000,000 in funded trading capital.

FPF also have much more relaxed rules, in the sense that you’re able to hold trades over the weekends, use EA’s and also hedge on your accounts – something many traders have been penalised for with other prop firms.

They also offer the one step funding account, which a lot of firms don’t! This enables traders a higher chance of succeeding and obviously allows you to obtain capital much faster.

Is Getting An Account From ForexPropFirm Realistic?

It’s all well and good offering funding of up to $10M for traders but if we aren’t ever likely to obtain a funded trading account, it’s all pointless! So, is it achievable?

In terms of feasibility, ForexPropFirm offers a 1 step trading account, alongside the usual 2 step challenge. This is obviously going to be much easier for traders to pass and get funded as they’ve only got to jump through the one hoop, rather than two.

Looking at the trading rules, you’re allowed EA’s, hedging and weekend position holding – making it suitable and possible for all kinds of traders!

There are no minimum trading days and no time limits too, meaning you aren’t being forced into taking subpar setups as your back is against the wall to get funded in a short period of time.

Also, you have a maximum drawdown limit of 6% for the one step challenge and a daily drawdown limit 4%. These are fairly industry standard numbers to be honest, which is great to see!

To that end, the one step challenge is certainly suitable for all profitable traders and it should be slightly easier to pass than other challenges in the industry!

MyFundedFx

MyFundedFx is proving to be one of the worlds most popular prop firms, taking over the industry in the last few months. MyFundedFx offer an innovative 1-step funding process, allowing traders to get funded from just 1 trade, potentially!

- Great Reputation

- High Levels Of Funding

- 1 Step Funding

The ForexPropFirm Scaling Plan

If you’ve read any of our other prop firm reviews, you’ll know that we only like to work with firms that offer scaling opportunities so you can continue growing your capital once funded.

ForexPropFirm have a fairly aggressive scaling plan

Once funded, you will work on 10% profit milestones. Essentially, for every 10% profit you earn, the company will double your trading account balance!

This is by far the best scaling program we have seen and it reminds us of the old DT4X funding potential that everyone took advantage of many years ago!

As we progress in our funded account journey, we’ll keep this article updated on how the scaling is going!

ForexPropFirm Partnership With Eightcap

Like many of the industry leading prop firms, ForexPropFirm partner with Eightcap to provide their trading accounts and liquidity.

This is pretty much the industry standard at this point, which is great news! We all know by now that Eightcap is a very respected broker and offer some very good trading conditions, with over 1000+ currency pairs and tight spreads.

ForexPropFirm Reviews & Reputation – What Do Traders Think?

If you’ve read any of our prop firm reviews over the last few years, you’ll know that we really value the opinions of other traders and always look to include these in our reviews!

ForexPropFirm have a flawless reputation on Trustpilot

All prop firms do tend to have some negative reviews, as do forex brokers, as traders that fail the challenges like to give bad reviews – which is understandable, I guess!

Mohit here mentioned the support team, which we can confirm is great! Also, Mohit mentioned the price point being slightly less than other prop firms.

Sam here also had a great experience, passing the 1 step evaluation mentioned above – one of the USP’s of the company!

The tight stop loss rule, as mentioned, is great for keeping traders in line and adhering to risk management that should help you keep your funded account for longer!

We won’t link all of the YouTube videos but there are a huge amount of YouTube videos reviewing ForexPropFirm, which may be worth taking a look at!

In Summary – Are ForexPropFirm A Scam?

In conclusion, ForexPropFirm are not a scam and they’re a great choice of prop firm for traders looking at obtaining funding rather quickly! The leverage, relaxed rules, scaling opportunities, one step funding and great reputation make it a no brainer for traders.

We’ll keep this review updated, should anything change over the coming months but the company looks to be going from strength to strength!

Have you worked with ForexPropFirm? If so, let us know and we’ll add any comments you may have!