Are you a forex trader looking for better ways to track and analyze your trades? If so, then learning how to use footprint charts in trading is an absolute must.

Footprint charts allow traders to visualize the market activity at any given moment in time, giving them unprecedented insight into their strategies.

In this article, I’m going to explain what footprint charts are and show you exactly how to use them when trading foreign currencies!

Footprint charts have been used by professional traders for years now but only recently have they become available for private investors as well.

This means that everyday traders can take advantage of these powerful tools without needing access to expensive software or subscriptions.

With the right knowledge and understanding, anyone can learn how to read and interpret footprint charts with ease!

Finally, being able to understand and utilize footprint charts effectively can give novice traders a huge leg up when it comes to having an edge over other investors in the forex market – something that could be invaluable in helping them reach success faster.

So if you’re ready to see what all the fuss is about with footprint charting technology, let’s dive right in and get started!

What Is A Footprint Chart?

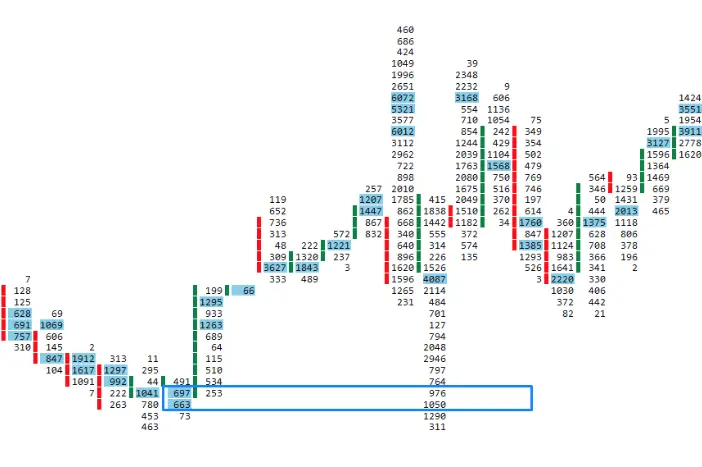

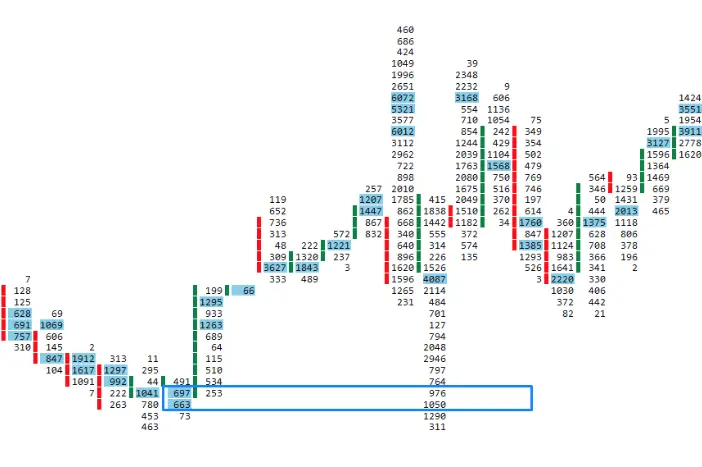

A Footprint chart is a type of trading tool developed by Peter Steidlmayer for futures traders. It’s used to visually display the order flow and volume in each price level during a certain period of time.

The main purpose of this chart is to identify buying and selling pressure, as well as where there could be potential areas of support or resistance in the market.

It also helps you see how much liquidity is available at any given point in time. This is much different from your standard retail trading charts like Renko charts

Footprint charts are created using data from exchanges such as CME Group

This information includes the number of orders placed, their size and the amount they were executed at each price level.

This data can then be used to create an image that displays the activity on these exchanges over a set period of time.

The visual representation provided by footprint charts allows traders to quickly identify key levels in the market that may provide potential entry or exit points for trades.

With this knowledge, traders can make more informed decisions about when to enter or exit positions in their forex trading accounts.

By looking at the overall picture provided by a Footprint chart it becomes easier to spot trends emerging before they become apparent on traditional candlestick charts.

With this edge, forex traders have another powerful tool at their disposal to help them achieve success with their investments.

Many retail forex traders don’t use these charts – I think G7FX

What Are The Benefits Of Using Footprint Charts For Forex?

Footprint charts are a powerful tool for trading forex

Footprints allow traders to see exactly where the market is going and when it will move, enabling them to react quickly and accurately.

This can be especially useful when attempting to capitalize on short term movements or identifying potential entry points or exit points from trades.

Using footprint charts also helps reduce risk by providing insight into trends that may not be visible using traditional charting methods.

Seeing footprints can give traders additional context about how prices have been moving over time, making it easier for them to identify support levels and resistance levels which can help protect their capital from sudden losses.

Furthermore, since footprints display order flow information, they can help traders anticipate changes in sentiment before they happen so that they know when to enter or exit positions for maximum reward potential.

Overall, using footprint charts gives traders access to valuable data which can improve their trading strategies significantly and increase profits.

By being able to gain visibility into both long-term trends as well as short-term price movements, these types of charts offer an unprecedented level of detail which cannot be found elsewhere.

As a result, incorporating this kind of analysis into one’s strategy could potentially lead to greater success while trading forex than ever before.

Despite its advantages though, there are some drawbacks associated with using footprint charts in forex trading as well.

What Are The Drawbacks Of Using Footprint Charts In Forex?

One drawback of using footprint charts in forex trading is the fact that it requires a higher level of expertise.

Footprint charts are not as easy to read as traditional price action or technical indicators, and may take some time for traders to understand how they work.

Additionally, many brokers

Another potential downside is that since there’s no single standard definition for what constitutes a “footprint chart”, different providers may offer varying interpretations of the same data.

This can make it more difficult for traders to compare their results from one platform with another.

Furthermore, because these type of charts often contain a lot of data points, it can be overwhelming for novice traders who are just starting out in forex trading.

Finally, due to its complexity and lack of standardized interpretation across platforms, footprint charts aren’t suitable for all types of trading strategies.

For instance, scalpers

As such, before relying heavily on footprints charts in your trading activities, consider whether they truly add value to your strategy or not.

Another downside of using these charts is the fact you cannot get Footprint Charts on Tradingview

How To Read A Footprint Chart For Trading

Now that you know the drawbacks of using footprint charts in forex trading, it’s time to learn how to read them.

To make sure your trades are successful and profitable, here are some tips on reading a footprint chart:

- Use each bar’s highs and lows as support or resistance levels. Every high will act as a ceiling for prices while every low works as an intermediate bottom before continuing its uptrend.

- Pay attention to volume bars which can indicate buying or selling pressure on the market. If there is more volume than usual, then this may be indicative of strong momentum in either direction.

- More importantly, look at the relationship between price action and volume. When prices jump significantly with no corresponding increase in volume, then this could be a sign of weakness and should be treated cautiously.

Knowing how to interpret a footprint chart allows traders to stay one step ahead in their investments by looking for entry points that have not yet been discovered by other investors.

This can help maximize profits since fewer people would be competing for those same positions. Understanding these principles helps ensure better decision-making when studying market movements and analyzing potential opportunities.

The Different Types Of Footprint Charts

When it comes to forex trading, there are several different ways of using footprint charts. The most common type is the price action chart which shows how prices have moved in relation to each other over time.

This can be useful for identifying trends and making decisions on when to enter or exit trades.

Other types of footprint charts include volume-based footprints, delta footprint charts, and range bar footprints.

Volume-based footprints compare the total amount traded at certain points during a period with that from previous periods. They show whether buyers or sellers were dominant during certain trading sessions and provide insight into market sentiment.

Delta footprint charts measure the size and speed of transactions relative to one another, providing an indication of where pressure lies within the markets.

Finally, range bar footprints record how far away current prices are from their highs and lows over a given time frame, helping traders identify potential entry/exit levels.

Overall, all these types of footprint charts offer valuable information about market dynamics that can help inform trading decisions.

Knowing which type best suits one’s needs is essential as they all provide different insights into what might happen next in the markets.

Delta Footprint Charts

Delta footprint charts are a powerful tool for forex traders as they can provide insight into the order flow of a currency pair.

By displaying how many bids and asks have been placed at each price level, it allows traders to assess liquidity and market sentiment.

This type of chart gives traders an indication of where the market is headed in terms of pricing. It also helps them identify potential turning points when prices start shifting too far away from equilibrium levels.

One advantage of using delta footprints is that they allow traders to track trends over time rather than just looking at one point in time.

This makes it easier to determine whether or not there’s enough momentum behind a trend to make it worth following, without having to wait until after all orders have been filled before making a decision.

Additionally, these types of charts can be used alongside other indicators such as moving averages or volume data to help confirm support/resistance levels or possible entry/exit points.

Finally, delta footprints offer valuable insights that may otherwise go unnoticed by traditional technical analysis methods.

They can be especially beneficial for day-traders who need quick access to information about short-term price movements.

With this knowledge, traders can develop strategies with greater accuracy and precision than ever before – allowing them to take full advantage of the forex markets’ volatility and capitalize on opportunities as soon as they arise.

By understanding bid/ask footprints, traders are better equipped to find optimal entries and exits in any given situation – which often leads to improved trading results overall.

Bid/Ask Footprint Charts

Next up is the Bid/Ask Footprint Charts. These charts provide traders with insight into market liquidity and order flow.

They show where buyers (Bid) and sellers (Ask) have been active, as well as how much of each side is present in the market at any given point in time.

By looking at a Bid/Ask footprint chart, traders can get an idea of which direction the market might move if either side becomes dominant.

This type of analysis allows them to make more informed trading decisions based on real-time data.

The main advantage of using Bid/Ask footprint charts is that they give traders access to detailed information about what’s going on in the markets on both sides: bids and asks.

The bid/ask spread – or difference between the amount offered by buyers versus sellers – will be clearly visible from these types of charts, allowing traders to better identify potential trades before making any commitments.

In addition, it offers visibility into current levels of support and resistance for a particular asset, helping determine where to enter or exit positions for maximum return.

By understanding the buy-side and sell-side order flow dynamics displayed within a Bid/Ask footprint chart, traders are able to capitalize on fleeting opportunities while avoiding costly mistakes due to lack of knowledge or timing issues.

With this valuable tool at their disposal, they can take greater control over their investments and increase their chances of success when trading forex pairs or other instruments.

Transitioning now onto Profile Footprint Charts; these offer even more detail than traditional Bid/Ask footprints do…

Profile Footprint Charts

I’m sure you’ve heard of footprint charts and their use in Forex trading. But, what exactly are they?

They’re basically a type of chart that shows the price action over time, with bars representing different price points throughout the day.

It’s useful for traders because it provides an excellent visual representation of how the market is behaving at any given point in time.

When looking at a profile footprint chart, there are two main components to take into account: volume and price.

Volume is represented by horizontal lines while price is shown through vertical ones. Each bar on the chart represents one hour’s worth of activity from a particular currency pair or asset.

This allows traders to see where buyers and sellers have been active during that period as well as any potential entry and exit points for their trades.

By studying these types of charts, you can get an idea of what direction the market may be headed in and make informed decisions about when to enter or exit your position.

With careful analysis, this type of charting can prove invaluable in helping traders maximize their profits from their trades.

In Summary – Can You Use Footprint Charts For Forex Trading?

The use of footprint charts in forex trading can provide traders with valuable insights into the dynamics of the market and help them make more informed decisions when it comes to their trades.

With an understanding of how to read these charts, traders can take advantage of various types such as delta, bid/ask, and profile footprints to gain an edge over other traders.

Although there are many benefits associated with using footprint charts for forex trading, there are also some drawbacks to keep in mind.

For example, they require a certain level of technical knowledge to interpret correctly and may not be suitable for all traders.

Additionally, due to their complexity, they may have limited usefulness for those who just want a quick overview of the market or need a simple indicator-based approach.

Overall, I believe that incorporating footprint analysis into your trading strategy can be beneficial if you understand how to interpret the data accurately.

If done properly, this type of charting could potentially give you an edge over other traders by providing insight into key aspects of price movement that might otherwise go unnoticed.