Are you interested in learning more about IC Markets and what they offer traders? There are hundreds of brokers these days and this makes it so hard to figure out which brokers are legit and reputable and which could potentially be a scam. I’ve been using IC Markets for over 5 years now and have tested every single part of the retail trading experience from execution speeds to withdrawals and customer support. Is this the broker for you? Let’s have a read…

[WPSM_AC id=488]

Who Are IC Markets?

IC Markets was founded in 2007, in Australia. They are one of the largest and longest standing True ECN Brokers in the industry and still going strong well over a decade later. IC Markets is headquartered in Sydney, with a company registration number of ACN 123 289 109.

They offer a legitimate True ECN experience for forex traders, with absolutely no requotes leading to the tightest spreads, cheapest trading fees, the deepest liquidity and fastest execution in the industry.

This combined with their high leverage and focus on client safety of funds has lead the company to expand massively within the retail space over the last few years – it’s hard to find someone who hasn’t heard of this broker!

At a glance they have the best trading conditions and a flawless reputation for retail traders, but let’s have a look in more detail shall we?

Trading Conditions

Depending on which branch of IC Markets you use, you’ll have access to either 1:30 maximum leverage or 1:500. If you’re using IC in Seychelles then you’ll have the luxury of that 1:500, which can always be customised and even lowered in the client portal, if you head over to accounts summary.

| Forex Pairs | 55 |

| Crypto? | Yes |

| Stocks | Yes |

| Leverage On Forex | 1:500 Max |

| Spreads | 0.2 Pips Avg On Majors |

| Commissions | $6-$7 Per Lot Traded |

| Leverage On Crypto CFDs | 1:5 |

They offer over 64 pairs on all of the accounts, which include majors, minors, commodities, index and even energy and crypto! This is more than enough for the majority of traders, especially forex based traders. If you want to trade a very strange and specific product then I would advise contacting their helpful 24/7 support team for more assistance. Spreads and trading costs is very important to bare in mind when looking for a new broker.

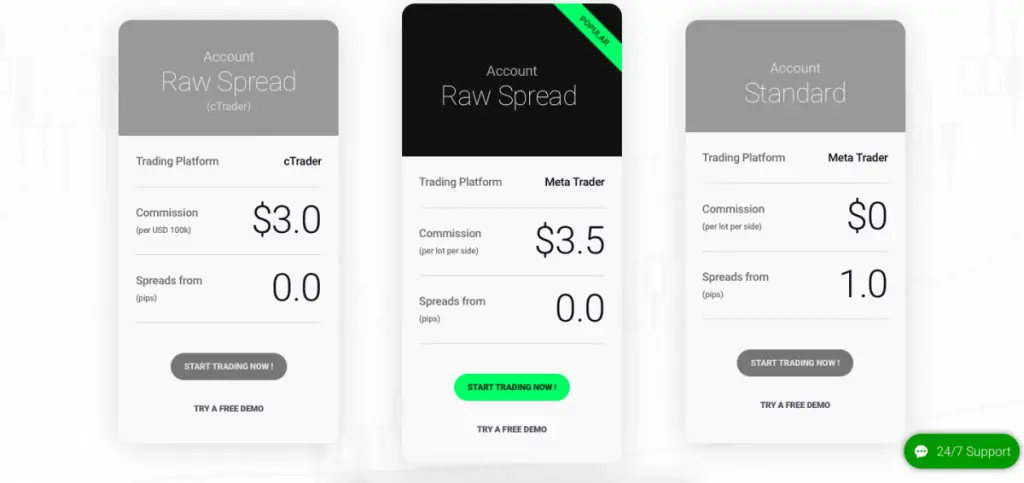

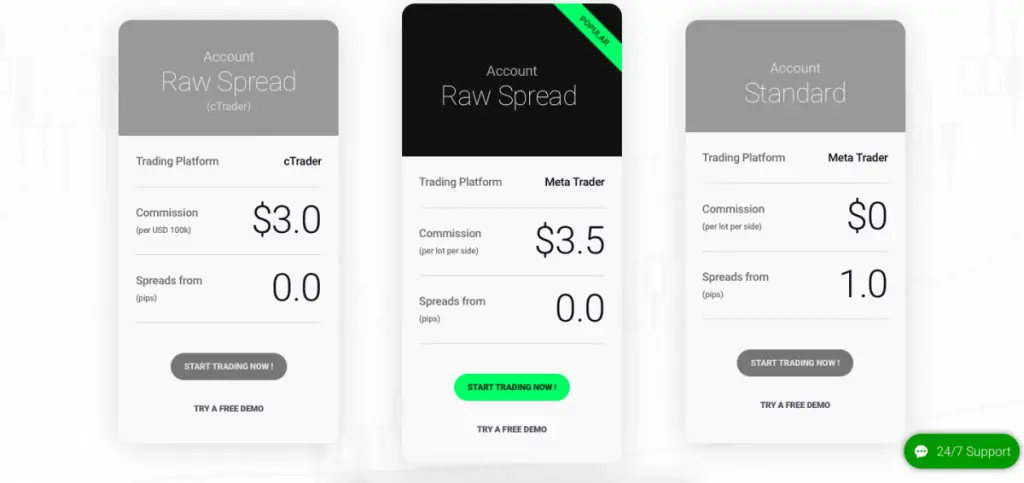

Some brokers look absolutely perfect until you start taking a look into their fees and you realise it’s way too expensive! Luckily, IC Markets remains the cheapest broker in the market right now, thanks to their True ECN model. If you go with the standard account, you’ll be paying $0 commission per lot traded but a spread of around 1 pip per trade on most pairs. However, if you choose a raw spread or cTrader account then you’ll be paying $6-$7 per lot traded in commission but have access to spreads from just 0.0 pips. Most of the time on the major pairs, it won’t even tick above 0.4 pips spread!

The execution speeds are also the fastest I have ever seen in the industry due to the no requotes and state of the art data centres in New York & London. In summary, IC Markets has unrivalled trading conditions in the industry. I’ve been using this broker for 5 years now and I have never been disappointed once by the speed of execution, costs and spreads I’m paying. Not once have I ever been manipulated by an increasing spread and stopped out of a trade prematurely – which says enough in it self!

Account Types

This broker offers 3 different accounts, alongside a free demo account for beginners. These accounts are actually suited to a range of different traders, whether you scalp or hold longer term trades, even EA trades! There is a cTrader account which can only be used on that platform, alongside a Standard MetaTrader account and a Raw Spread account. All 3 of these accounts have a minimum deposit of $200, with very low costs (whether paid through spread or commission), up to 1:500 leverage and over 64 tradable products.

I have personally used the cTrader accounts, the standard account and the raw spread account. My favourite is definitely the cTrader account purely because I love the cTrader platform itself. The account though is identical to the raw spread account in terms of execution and costs. I would highly recommend the raw spread account to all traders, especially those that are trading on lower time frames, so would benefit from a low spread and small commission trading structure.

If you’re a beginner and have not found consistency within the markets just yet, I would advise creating a free demo account to test your strategies in the markets. You can add a balance to the demo account in your client portal back end, and top it up whenever is needed!

Are IC Markets Regulated?

It’s not great to be trading with an unregulated broker as they can manipulate prices, scam you and even not pay out your hard earned withdrawals. So, is this broker regulated? The answer is IC Markets are regulated by various governing bodies to provide financial services. Let’s look into this in more detail because the regulation behind this broker is a bit complicated.

IC Markets was and still is regulated by ASIC, AFSL Number 335692. This is a major governing regulator in Australia and the fact they are regulated by ASIC means we know that client funds are safe and fund segregation is happening, so we can’t get scammed! All transactions are handled by the Bank of Australia and they use various external auditors throughout the process of running the broker.

| Regulation | ASIC, CYSEC, Financial Services Authority of Seychelles |

| Risk | Low Risk |

However, in 2018, ESMA decided the clamp down on leverage in Europe and make it a maximum of 1:30 for all traders, unless they can prove to be a professional trader. This is a big problem for scalpers and traders that like to risk more than 1% per trade, as they rely heavily on the brokers leverage to do this. If you sign up to IC Markets Australia, as a European trader, you’ll now have a maximum of 1:30 leverage. Unless… You use the offshore broker…

Knowing the ESMA changes were happening, IC Markets created a whole new branch of the business based in the Seychelles. Based offshore they don’t have any need to comply with the tight 1:30 leverage cap for traders, meaning they are still able to offer 1:500 to traders even based in Europe! The Seychelles side of the business, Raw Trading Ltd, has a company number of 8419879-2 and are regulated by the Financial Services Authority of Seychelles.

IC Markets EU is also regulated by CySec with a license number of 362/18.

In summary, each division of IC Markets is regulated by a different entity, including CySec, ASIC and the Financial Services Authority of Seychelles. They have moved into the Seychelles due to ESMA regulations and doing this means that this broker can still offer great 1:500 leverage for clients, whilst still being regulated! It’s a very safe broker to be using and clients funds are at no risk here, regardless of whether you’re trading with the Australian entity or Seychelles. Click here to find out more about their regulation.

Trading Platforms

When it comes to trading platforms, this broker has an amazing selection. The platforms offered by IC Markets are:

- MT4 (For desktop, mobile, android and Mac)

- MT5 (For desktop, mobile, android and Mac)

- cTrader (And cTrader Algo)

| MT4 | MT5 | cTrader |

| For Retail Traders | For Retail Or Professional Traders | For Professional Traders |

| Very Basic Tools | Fairly Basic Tools | Advanced Tools |

| Good For EA’s | Good For EA’s | Great For EA’s/Algos |

| Free To Use | Free To Use | Free To Use |

In my opinion you definitely don’t need more platforms than this. MT4 is the most common retail trading forex platform, used by millions of traders across the world. It’s fairly limited in what you’re able to do with it but for the majority of retail traders just starting in the industry, the charts and order execution options are more than competent. MT5 is a much better version of MT4 with all of the bugs fixed, new features added, better DOM, execution and more charting options – great for traders looking to take their trading a bit more seriously. Then we have cTrader, my all time favourite platform! cTrader is perfect for professional traders, fund managers and algo traders, with a huge amount of order execution options, great depth of liquidity, a huge amount of chart options and a great degree of customisation.

For most traders I would advise an MT5 setup, with the app on your mobile and installed on your computer too. It’s fairly hard to trade just on your phone as the small screen can limit your ability to analyse the market properly so having it running on the computer for analysis is a great idea. I personally run cTrader on my PC to actually execute orders on, then keep a check on running positions using the mobile app.

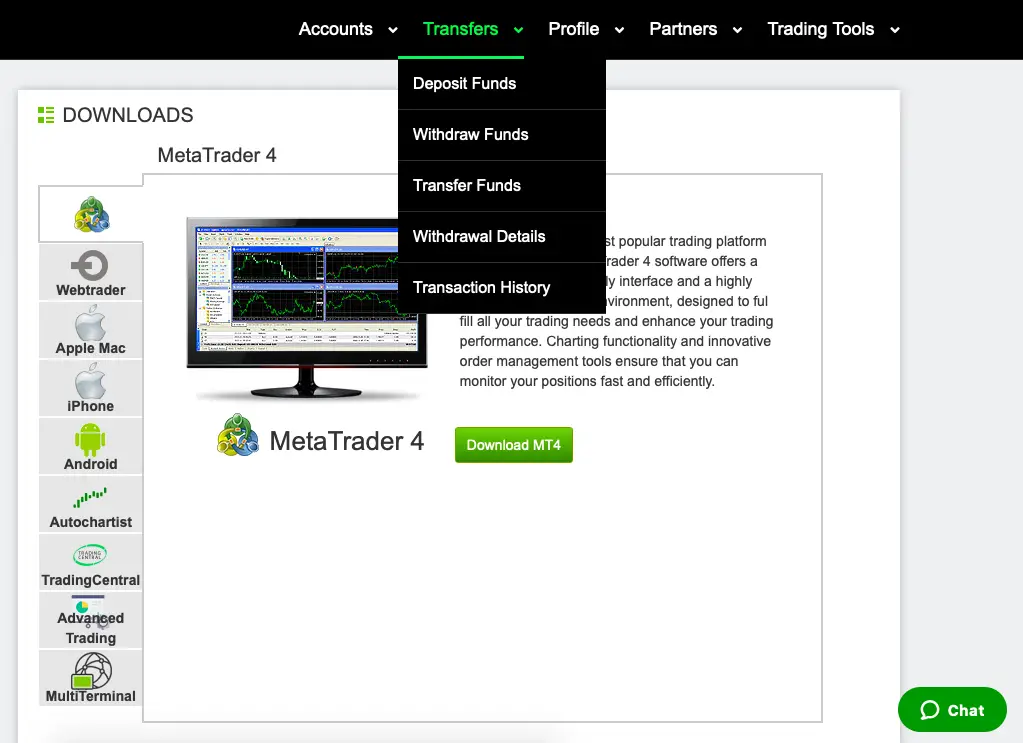

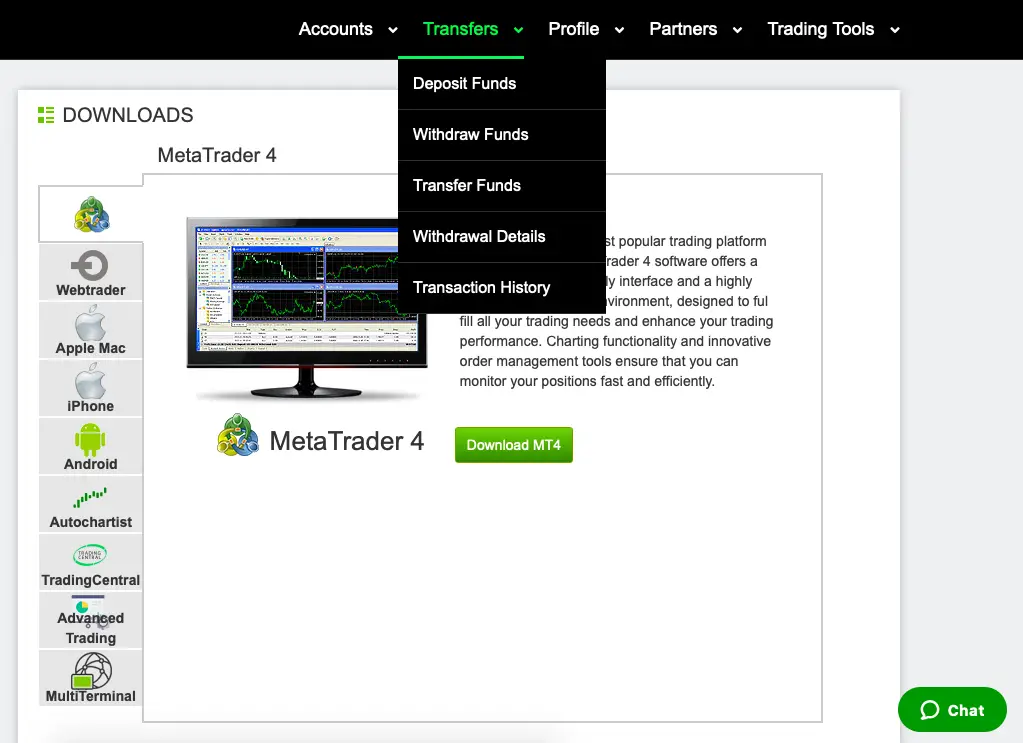

Account Dashboard

Once you have login details for IC Markets, you’ll have access to your secure client portal. A lot of brokers have very complex back ends for clients and some even have extremely basic ones that are fairly useless, but I think IC have got the perfect balance. The account dashboard is clean, easy to use, quick to load and makes it easy to access anything you might need to as a forex trader. You can:

- See trade history

- Update/change personal information

- Open new MT4 accounts

- Create and add balances to demo accounts

- Change passwords

- Deposit/transfer/withdraw funds

- Manage MAM/Investor accounts

- Download MT4

- Access educational material

If you have any issues figuring your way around the client area, the 24/7 chat support is always on hand to assist you, or contact the phone support if you would rather speak to a support agent on the phone.

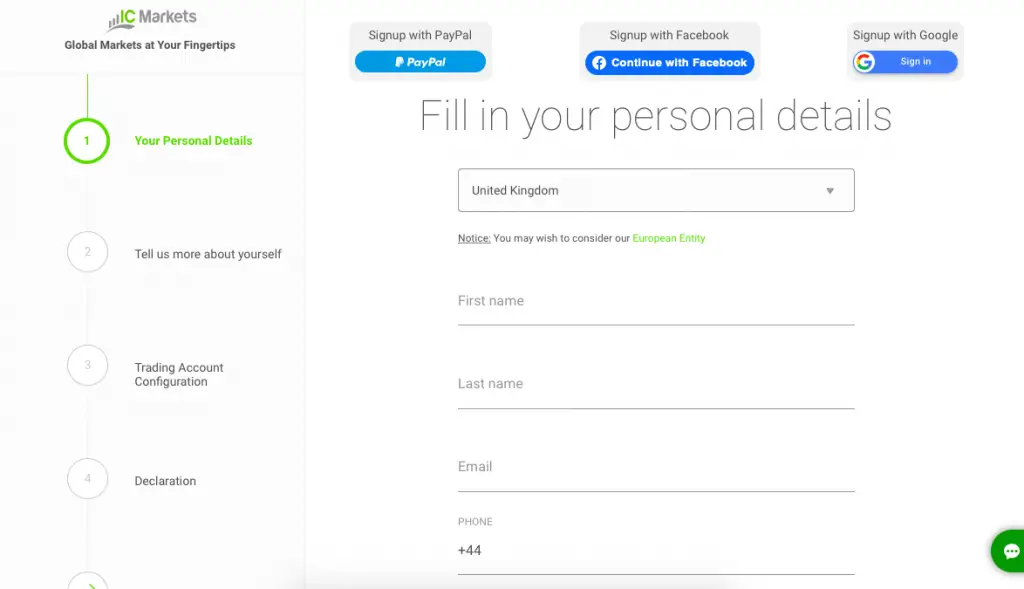

Sign Up Process

Brokers want you to get started trading so they tend to make the set up process fairly easy and simple. IC Markets is no exception to this, you can complete the whole sign up process in less than 10 minutes. Here is all you need to do to sign up…

- Choose your account type (Standard MetaTrader, Raw Spread MetaTrader or Raw Spread cTrader)

- Submit the relevant personal information that is required by the broker (Address, name, basic details)

- Submit the relevant documents needed to prove your identity (Brokers are required to get these for AML purposes)

- Wait for the email confirmation saying your account is verified!

Whilst waiting for verification to begin trading you can log into your client dashboard and have a look around, you just won’t be able to deposit and trade yet. It should take less than 24 hours to get verified as long as your documents are correct however, so don’t worry about missing too many trades!

If you have any issues during this account set up process, the 24/7 live chat support are on hand to help you in any way needed.

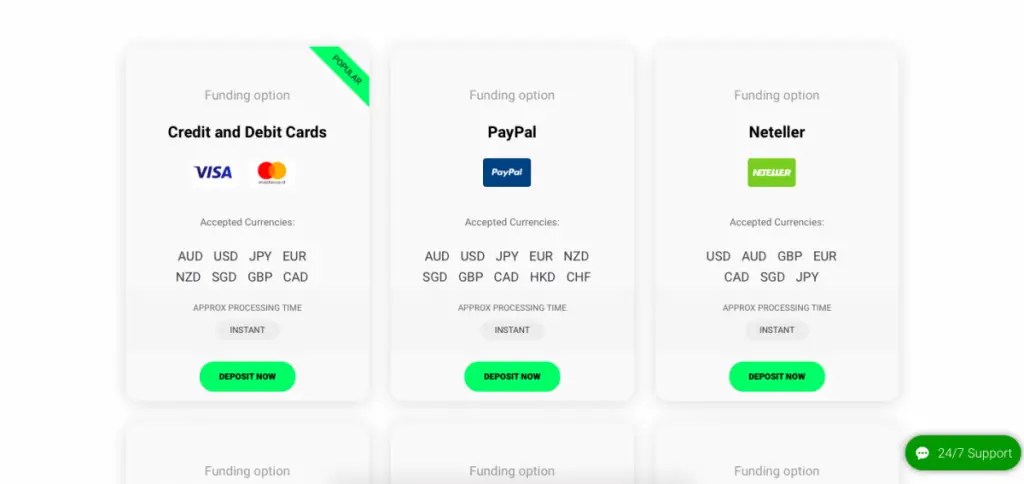

Deposits & Withdrawals

IC Markets offers a big range of 15 deposit and withdrawal methods in 10 different currencies, most of which you would expect from a trading broker in this day and age, both electronic and standard payment methods. The most popular payment methods are:

| Method | Fees |

| Credit Card | $0 |

| Debit Card | $0 |

| PayPal | $0 |

| Neteller | $0 |

| Skrill | $0 |

| UnionPay | $0 |

| Wire Transfer | Fees Subject To Bank |

| Broker To Broker Transfer | $0 |

I have tested many of these methods over the years, with PayPal definitely being my favourite for smaller deposits and withdrawals, then wire transfers for anything larger. The transfers are processed extremely fast with deposits being instant with the online processors and withdrawals being handled within 48 hours! I have had countless withdrawals from IC over the years and they have never taken more than 48 hours to release the funds to me, which is great to see.

There are no fees on the online payment processors, both on the deposit and withdrawal side of things. If you are taking a wire transfer then any fees incurred will be passed onto you from the bank, so do bare that in mind. For this reason it’s not worth using the wire transfer option unless you are trading a fairly large account – if you’re coming into the markets with just a $200 deposit then I would advise using one of the options like PayPal, that do not take any fees!

On the forums I haven’t managed to find anyone having long term withdrawal issues from this broker but I will of course update this article should that start occurring!

Client Support

When you are trusting your money with a forex trading broker, especially one based pretty far away, you want to have the peace of mind of knowing you’ll be able to get in touch with them whenever you have any issues or queries. Luckily, IC Markets has a huge amount of different client support options, so you never have to be worried about not getting in touch with them. I have personally been in contact with IC Markets support probably over 50 times over the last 5 years.

- Email: enquiries@icmarkets.com

- Phone: +61 (0)2 8014 4280

If you have other issues regarding accounts, marketing or affiliate issues there are dedicated email addresses for these departments that you can find on the contact page. Should you need help more urgently, they also offer a 24/7 live chat support feature meaning you can get in touch with IC Markets whenever you want, around the clock.

I’ve used all of the support features multiple times and I would definitely say that the email function is the most useful. The live chat function will normally just put your request through to the right person, unless it’s a fairly easy request that can be fixed by the agent.

Should you actually want to visit their offices in person, on the contact us page they have their office location listed so if you happen to be in the Seychelles you can go and pay them a visit. Although this is highly unlikely, it’s nice to see a broker with transparency of address unlike a lot of the more shady unregulated forex brokers that only have a P.O box as their registered address.

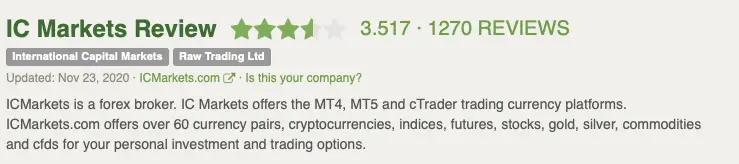

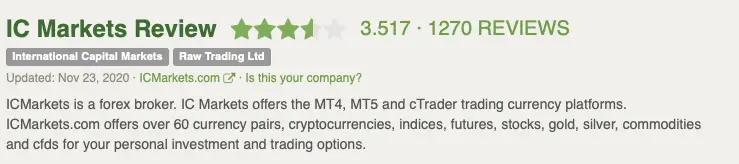

Reputation & Reviews

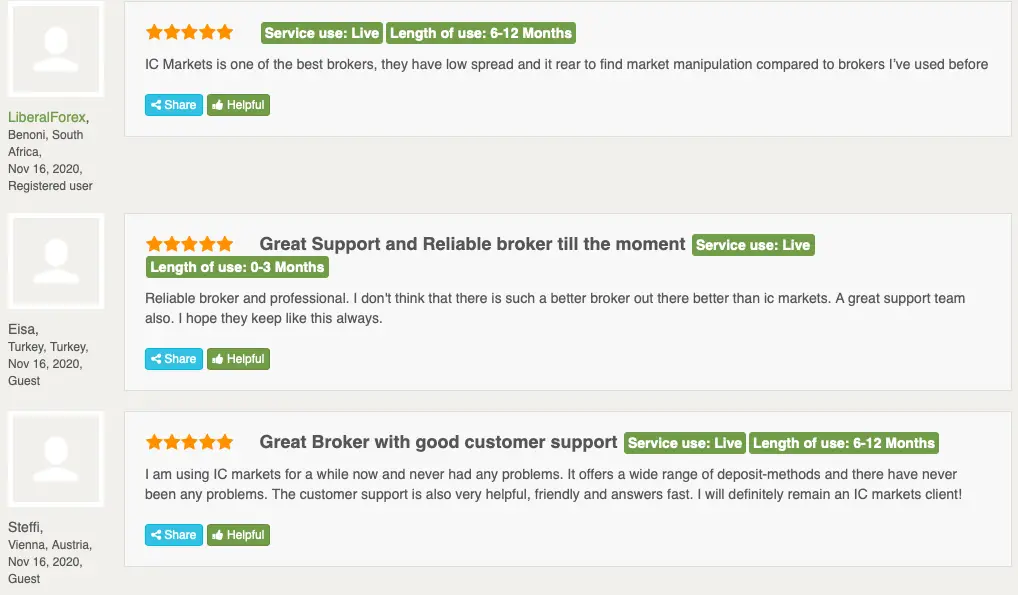

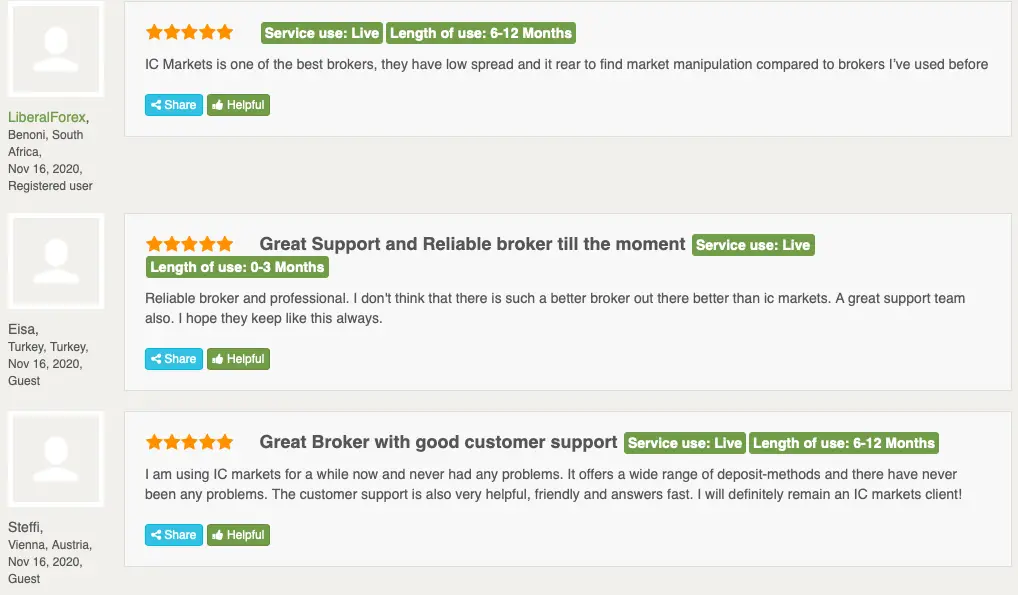

Looking at reviews of a forex trading broker is extremely important, both from reviewers and traders all across the world. There are a few major forums like ForexPeaceArmy where you can see what thousands of traders are saying, with their pros, cons and experiences of IC Markets. IC Markets have been in the business for a very long time so they have a huge amount of reviews to look through, luckily for us! IC Markets have an excellent reputation online for being a great and honest forex trading broker. On Trustpilot

On FPA, IC Markets have over 1200 more reviews from clients across the globe, with an overwhelming positive response.

| Website | Rating |

ForexPeaceArmy       | 3.5/5 |

TrustPilot       | 4.7/5 |

I actually first started trading with this broker nearly 5 years ago now purely because of it’s great reputation within the online communities, well, that and the 1:500 leverage! All these years on and they have never messed me around on a withdrawal and the perfect reputation they once had, still stands strong! If anything changes, I’ll be sure to update this article but as of the time of writing this, they are one of the best forex trading brokers online.

Conclusion

In summary, IC Markets are a low risk forex trading broker. In this IC Markets Review, we’ve covereed They have unbeatable conditions for traders, amazing 1:500 leverage, the cheapest pricing, fastest execution and a whole range of trading products fit for any retail or professional trader.

If you have any questions about this broker before signing up, please do get in touch with me and I’ll strive to help you out.