Due to more people than ever working from home, high leverages, low deposits and very liquid markets, forex trading has exploded in popularity over the last few years. Worldwide there are now millions of forex traders trying to tame the financial markets. Although this is amazing for the industry, this has caused regulators and governing bodies to crack down on foreign exchange trading and brokers. So much so that forex is now illegal in some countries. So, is forex trading legal in Kenya?

Forex trading is legal in Kenya. Trading is regulated by the Capital Markets Authority of Kenya and Kenyan traders are allowed to trade with any broker that accepts residents, although very few brokers are actually licensed within Kenya.

Forex Trading In Kenya – The Law

Forex trading is legal for traders in Kenya, which is great news! Not only is forex trading legal in the country, it’s also regulated and controlled by the CMA

Traders in Kenya have access to brokers around the world and leverage up to 1:500. This is of course extremely risky and I wouldn’t advise using 1:500 leverage, but having leverage can allow you to grow capital much faster and make a huge amount of profit, compounded!

Whereas some countries are only allowed to trade currency pairs containing their base currency, traders in Kenya are allowed to trade any currency pair or commodities. This is massively beneficial for traders, having access to a wide range of markets and pairs to choose from.

Tax For Forex Traders In Kenya

When it comes to paying tax, we never really give out advise as we are not tax specialists or accountants and would not want to risk giving out false information. Our only advise is to seek the help of an accountant when you are consistently earning profits within the forex markets, to decide the best and most efficient way to structure your business and declare your earnings. However, it’s important to know that income from trading is taxable in most countries around the world.

Choosing A Forex Broker In Kenya

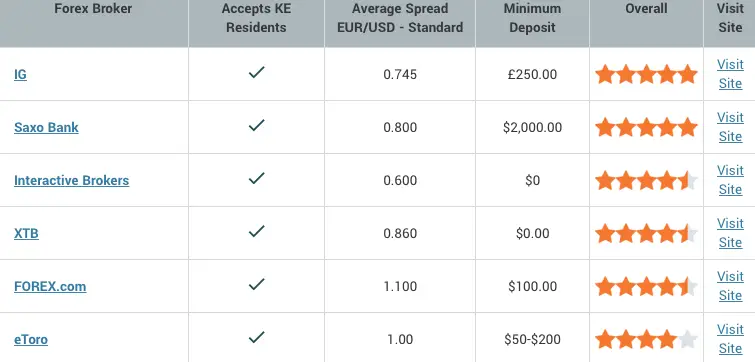

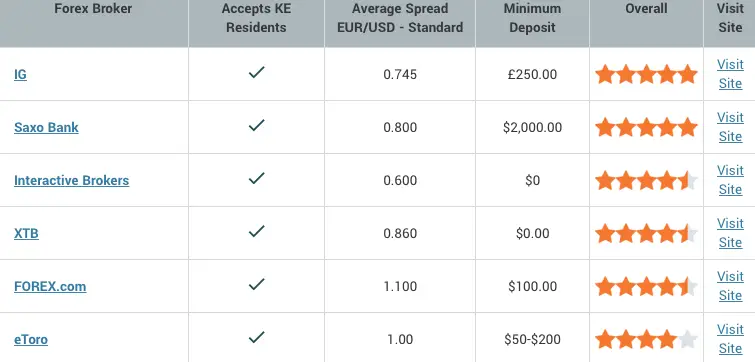

When it comes to choosing a forex broker you need to be very careful. With thousands of brokers out there, all offering different trading conditions, it’s more important than ever to check the company you are trusting your orders with.

Many traders in Kenya are choosing to go with unregulated brokers, offshore, that accept bitcoin transactions for deposits. Now although this is a viable option, most unregulated brokers charge higher spreads, are much less secure and can literally disappear with your money overnight – so a regulated broker is always the safest option.

In Kenya you are not required to trade with a broker that is actually based in, or licensed in Kenya meaning you open up the whole world in terms of which broker you can use!

I would personally recommend IC Markets

The Best Prop Firm For Traders In Kenya

As long as you are taxing your income properly, prop firm forex trading in Kenya is completely legal! This is great news as prop firms are by far the best way to grow your trading capital and be able to trade full time. Physical prop firms require licenses and there are many hoops to jump through, so I’d recommend using an online based prop firm like MyForexFunds

Currently none of the best prop firms in the industry

I would definitely recommend a funding company with staff working around the clock, to allow for the time differences if they are based outside of Kenya. My options would be FTMO

In Summary – Can You Legally Trade Forex In Kenya?

In conclusion, forex trading is completely legal in Kenya. The 100,000 traders in the country are able to use any broker that accepts Kenyan traders, not just brokers licensed in the country by the CMA. Online prop firm trading is also completely legal in the country.

If you have any questions please do let me know and I’ll try my best to answer!