Are you looking for a way to generate passive income? Have you heard about Forex trading bots and are wondering if they make money? It’s probably crossed your mind that making a profitable Forex bot could be difficult, but it doesn’t have to be.

In this article, we’ll explore the challenges of creating a successful Forex bot

Is It Hard To Make A Profitable Forex Bot?

The concept of automated trading has been around for quite some time now, with many traders using trading bots in order to help them increase their profits on the Foreign Exchange (Forex) market.

However, not all bots are created equal and some can actually end up losing more money than they make. So what does it take to create a successful and profitable Forex bot?

At its core, creating a profitable Forex bot requires an understanding of the markets, knowledge of various strategies, as well as access to reliable data sources. You don’t have to be an expert in these areas; there are plenty of resources available online that can help you get started.

But there’s still no guarantee that your bot will be successful; it really comes down to having an eye for detail and using the right tools.

We’ll discuss these tools and trading strategies

1. Finding A Profitable Trading Strategy

Making a profitable forex bot

This is where most traders struggle – finding a system that actually makes them money in the long run.

One way to do this is to look at historical data and backtest different strategies. This will give you an idea of what has worked in the past and what hasn’t, so you can narrow down your choices and focus on those with the best potential. Backtesting

Another option is to try manual trading first, as this allows you to learn from experience and fine-tune your approach over time.

You’ll be able to tell which strategies work for specific market conditions and make adjustments accordingly. Manual trading also lets you get comfortable with the platform before automating it with a bot.

If you’re struggling to find a strategy, try asking ChatGPT! Many traders are using ChatGPT to provide profitable trading ideas and strategies

When finding your profitable strategy, it’s important to balance the trading bots win rate

Once you’ve found a profitable strategy, the next step is making it completely rule based. That’s when things get really interesting!

2. Making That Profitable Strategy Completely Rule Based

Making that profitable strategy completely rule based is a daunting task. It requires an understanding of Forex markets, the ability to interpret data accurately, and the skill to create rules that will work in real-time trading scenarios.

Here are some key points to consider when making this transition:

- Have a deep understanding of technical analysis and chart patterns.

- Develop robust risk management strategies to protect your capital.

- Use automation tools to maximize efficiency and accuracy.

Taking these steps can be intimidating for new traders, but it’s worth noting that with proper guidance, the process can be made much easier.

By learning from experienced traders, you can quickly develop the necessary skillset needed to make sound decisions in volatile markets.

The guys over at Profectus AI have some really good videos discussing how to make your strategy completely rule based – this is where I learned!

Once you have developed a clear set of rules around your trading strategy, it’s important to test them thoroughly before implementing them live in your trading account. Backtesting helps you identify potential flaws in your plan so you can make adjustments before deploying it for real money trades.

The next step is to turn those rules into automated code which will execute trades according to predetermined parameters.

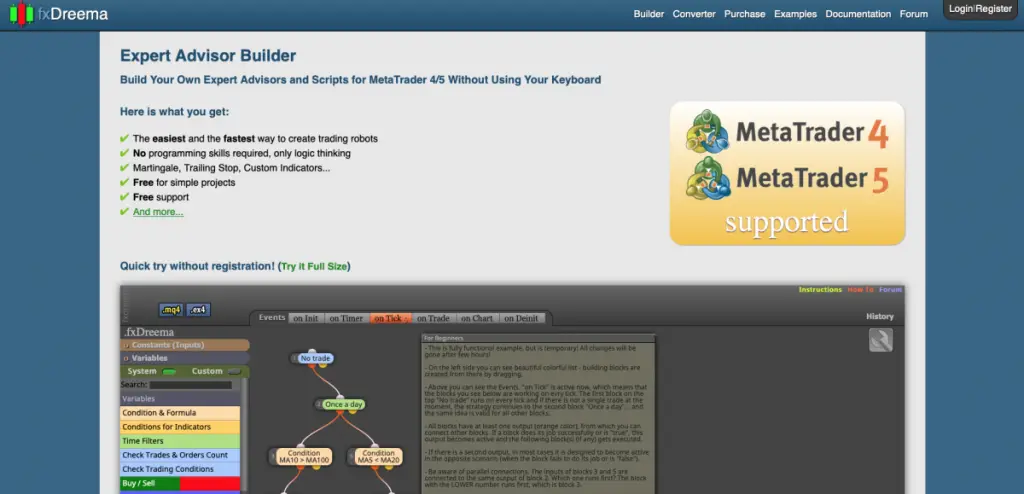

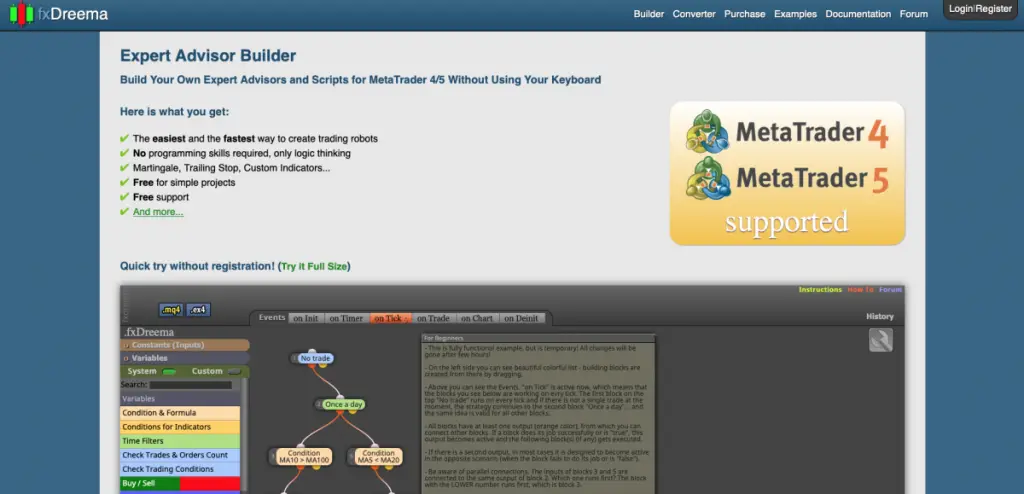

This could involve either learning how to code Forex bots yourself or paying someone else to build one for you – both options have their own pros and cons depending on your resources and time constraints. If you’re looking to build a bot yourself, FxDreema

Either way, building a reliable automated system requires an immense amount of dedication and hard work if you want it to be successful in the long run.

I’ve noticed a lot of traders trying to build strategies using Renko charts

3. Learning To Code Forex Bots Or Paying To Build It

Making a profitable forex bot is no easy feat. There are two main ways of going about it: learning to code it yourself or paying someone to build it for you.

Learning to code your own bot may be more time consuming, but it makes sense if you have coding experience and are comfortable with the language being used.

On the other hand, if you don’t have any coding knowledge, then paying for a bot may be the best option for you.

When deciding which route to take, there are several factors to consider. First, how much money do you want to invest? If you’re looking for a cheaper solution and have enough time on your hands, then coding the bot yourself is probably the way to go.

However, if money isn’t an issue and you want something that’s up and running quickly then paying someone else may be better suited for your needs.

Another factor is the complexity of your desired bot. Are you looking for something simple or something that has lots of features? If it’s just a basic bot then coding it yourself should be relatively straightforward as long as you know what language to use and have some guidance from experienced developers.

However, if you’re looking for a more complex system then hiring someone who already knows what they’re doing will save you time and money in the long run.

Paying someone to build your forex bot can be beneficial since they will likely have experience with developing such bots so they’ll know exactly what needs to be done in order to make yours successful.

They also might have access to resources that would otherwise be unavailable if attempting this project yourself, such as data sets or trading algorithms that could give your system an edge over competitors in the market.

Ultimately, which route one takes depends on personal preference and financial situation – both options can lead to success but require diligence throughout the process regardless of which path is chosen.

With either route, backtesting the bot with many years of data is essential before implementing it into live trades!

It’s worth us clarifying that it usually costs a lot to create a forex trading bot

4. Backtesting The Bot For Many Years Of Data

Backtesting a trading bot is an essential step for any trader looking to make profits. It allows them to test the strategy of their bot and measure its performance over long periods of time, allowing them to make sure it will be profitable in live trading.

To do this, traders need access to historical price data covering many years. This can be obtained from various sources, such as brokers or third-party providers.

Once they have all the data they need, traders can run backtests on their bots. They can then compare these results with their expectations and determine if the strategy is viable or needs further tweaking.

By doing this, they can avoid making costly mistakes due to an ineffective strategy in the future.

In addition to testing the accuracy of a trading bot’s strategy, backtesting

This includes optimizing risk management settings, adjusting parameters and testing different entry and exit strategies. All of these tweaks can help a trader minimize losses and maximize profits over time.

Having confidence in a trading bot’s performance is important for any trader who wants to make money in Forex trading.

Backtesting helps ensure that a robot performs as expected before it starts executing trades in real time. With this knowledge, traders can move forward with more confidence knowing that their robot is ready for success.

From here, it’s just a matter of optimising and tweaking the trading bot so that it runs smoothly and makes consistent profits over time.

5. Optimising And Tweaking The Trading Bot

Optimising and tweaking the trading bot is a necessary step to making it profitable. This is because no matter how well you design a bot, even with the best algorithms and strategies, there will always be some level of risk involved in trading with real money.

To minimise this risk, it’s important to take the time to optimise and tweak your bot until it’s running as smoothly as possible.

First, you’ll need to understand what variables you can adjust in the bot, such as the entry and exit points, stop loss levels and other parameters. Once you’ve identified these settings, you’ll need to test them out on demo accounts or paper trades first.

This will allow you to see how the bot performs under different market conditions before committing any real money.

You should also use backtesting tools

The next step is to fine-tune your settings. This involves experimenting with different combinations of parameters and seeing what works best for your particular strategy.

You may also want to consider using technical indicators such as moving averages or support/resistance levels to help pinpoint entry points and exits more accurately.

Finally, once you’re satisfied that the robot is performing well on paper trades, it’s time to move on to running it on live markets.

Doing so requires an extra layer of caution; proper risk management is key here in order ensure that any losses are kept at an acceptable level.

By taking these extra steps to optimise and tweak your forex bot before risking real money on live markets, you have a better chance of achieving profitable results in the long run. With that said, let’s move on to running the forex bot on live markets…

6. Running The Forex Bot On Live Markets

Running the forex bot on live markets is a daunting task, even for experienced traders. It requires a lot of time, effort and dedication to make sure that your trading strategies are working as expected.

The good news is that there are many tools available to help you with this process. From automated trading software to charting platforms, you can find all the support you need to get the most out of your bot.

Live market trading is risky, so it’s important to understand the risks before diving in. Make sure you understand all the different types of orders and how they work in order to avoid costly mistakes.

You should also ensure that your bot is able to handle rapid price changes without crashing or freezing up. Finally, it’s essential that your trading strategy works on multiple exchanges and is able to react quickly to changing market conditions.

To run a profitable forex bot on live markets, you need constant monitoring and maintenance. Make sure you keep an eye on the performance of your bot and adjust its settings whenever necessary.

Monitor the performance of other bots in your network as well – this will give you an idea of what kind of strategies are successful and which ones are not performing well at all times.

Additionally, make sure that you keep track of any fees or commissions associated with each trade and adjust accordingly if needed.

It’s possible to create a profitable forex bot when done correctly but it takes time and effort. To maximize returns while minimizing losses, it’s important to stay up-to-date with market conditions and trends, have a solid risk management plan in place, use reliable technology tools and have patience when things don’t go according to plan.

With these tips in mind, anyone can create their own successful forex bot!

In Conclusion – Is Making A Profitable Forex Bot Easy To Do?

Making a profitable forex bot is not easy. It takes a lot of hard work, dedication and skill. To be successful, you must find a profitable trading strategy and make it completely rule based.

You need to either learn how to code forex bots or pay someone else to do it for you.

In addition, you must backtest the bot for many years of data in order to ensure that it’s actually viable and then optimise and tweak it as necessary. Finally, once everything is ready, you can run the forex bot on live markets.

Overall, creating a profitable forex bot requires considerable time and effort but it can be done with the right knowledge and tools. It’s worth noting that most forex bots lose money

I would recommend that anyone interested in this endeavour should research the topic thoroughly before diving into development, as there are many things that could go wrong throughout the process if you don’t know what you’re doing.

If done correctly though, making a profitable forex bot can be very rewarding and result in great profits over time!