Are you interested in trading forex with NordFx? With thousands of new brokers online over the last decade, choosing the right broker for your needs is always a struggle. We have done extensive research into NordFx, their regulation, trading conditions, deposits, withdrawals and more, to really find out if they’re the best broker for you! So, let’s find out now…

[WPSM_AC id=615]

Who Are NordFx?

Founded in 2008 in Cyprus and with over 10 years of experience in the financial markets, Nord Fx are next up on our list of brokerage reviews. The broker operates under the company name NFX Capital and are licensed by the Cyprus Securities and Exchange Commission, Cysec with a registration number of 310384.

Offering up to 3 types of trading accounts, Nord Fx has a reputable history as reliable and stable way to trade. Traders are able to use MetaTrader4, arguably the most popular platform to trade on, with a choice of 33 currency pairs and a wide variety of cryptos, metals, indices and stocks.

Nord Fx are able to offer leverage up to 1:1000 which means traders are able to grow accounts super quickly. From first glance this broker seems to be perfect, however lets go into some more detail.

Trading Conditions

Nord Fx are based out of Cyprus with a head office in Mauritius and are regulated by the governing body Cysec, meaning they’re able to offer leverages up to 1:1000. Should you wish to, you’re actually able to reduce this right down to 1:1 if you’re less comfortable with the maximum.

Like most other brokers, Nord Fx gives traders access to a wide variety of currency to trade with; 33 in Forex pairs, metals, indices, oil and Cryptocurrencies so there is more than enough to accommodate your trading style. If you’re wanting to trade specific markets I would advise creating a demo account now to test the spread and conditions on that pair, however if you are sticking to standard forex pairs then I can guarantee that the conditions at Nord Fx are more than good enough!

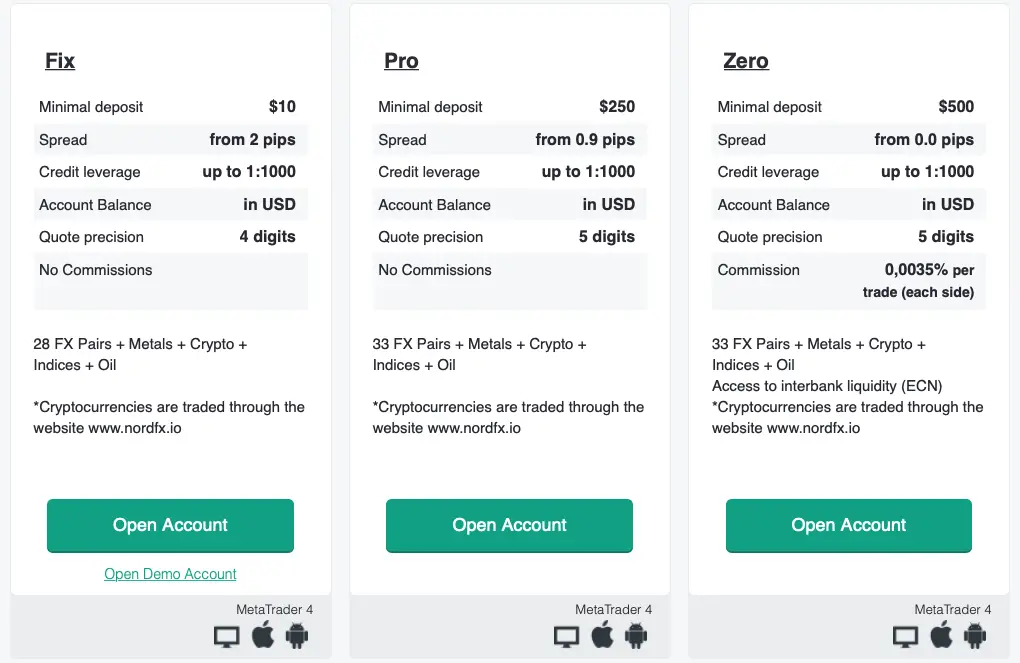

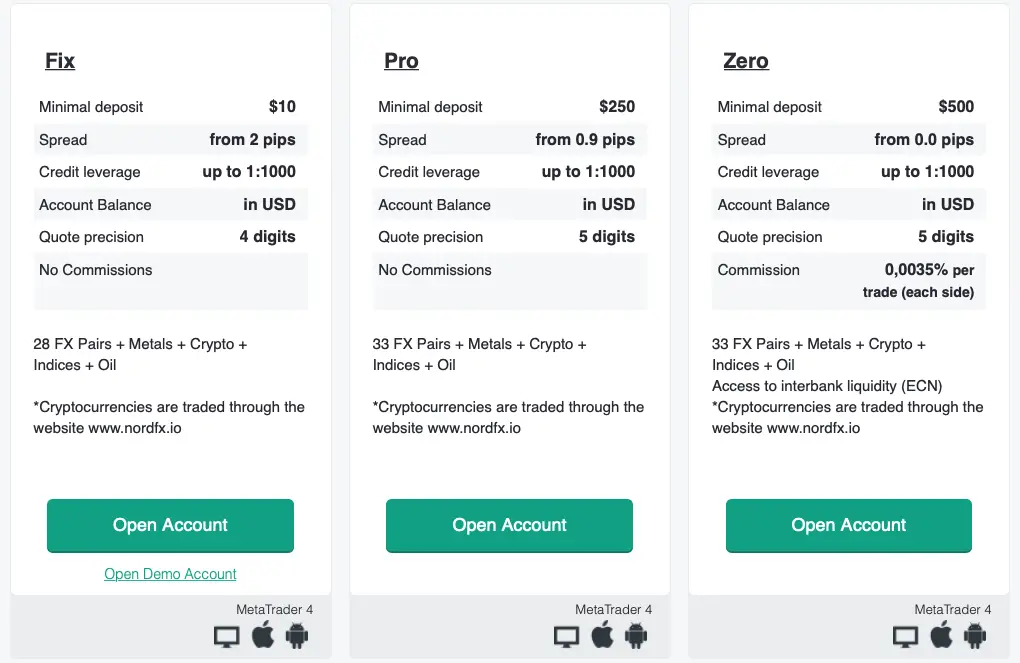

Of course the spreads and commissions that brokers offer are very important to traders. A Fix trading account with Nord Fx can offer a spread from 2 pips and their standard leverage of up to 1:1000. A Pro account has an even lower spread of minimum 0.9 pips and again, leverage here is substantial and goes up to 1:1000. A Zero account has the lowest spread yet of 0.0 pips, hence the name, and includes that fantastic maximum leverage of 1:1000.

| Fix Trading | Spread of 2 Pips | 1:1000 Leverage |

| Pro Account | Spread of 0.9 Pips | 1:1000 Leverage |

| Zero Account | Spread of 0.0 Pips | 1:1000 Leverage |

It’s worth noting that if you’re someone looking to trade stocks, Nord Fx can cater to that too with their Stocks account, leverage of 1:5. So far it’s clear that the broker exhibits some competitive trading conditions, it’s very cheap and is definitely seeming to be a viable option for everyone, from scalpers to swing traders.

Account Types

It’s great to have options when it comes to account types. As I said earlier, Nord Fx offers 3 main account types, including Fix, Pro and Zero.

Their standard Fix account

A Pro account with Nord Fx

Finally we have the Zero account

In my opinion, the best account type for the majority of traders seems to be the Pro account, with a low spread, the potential to have a super high leverage and the accessibility to both beginner and more experienced traders. The only limitation might be the minimum deposit, but the Fix account can be a great alternative for traders starting off with less money.

Overall, Nord Fx seems to offer a great range of accounts for all types of traders. Like the majority of brokers, they do offer a free demo account to practise trading on. If you’re new to trading I would advise trying out one of their demo accounts to perfect your skills or even just to test the trading conditions if you’re already an experienced trader.

Are NordFx Regulated?

Regulation is super important in trading as naturally, part of the job is risking your money. Unregulated brokers are unable to provide a risk-free environment and you can be at risk of falling victim to manipulation and being denied access to withdrawals or fair trading conditions.

Nord Fx are regulated by CySEC under the name NFX Capital under the registration number 310384, meaning that your money is safe, and the markets won’t be manipulated. Due to its regulations by CySEC, they are unable to accept clients from some countries including the USA. If you are in the USA, then trading with an unregulated or US based broker would be your best options, like Hugosway

Trading Platforms

The broker uses MetaTrader 4 as it’s platform which is currently the most popular for online trading due to a wide range of graphical tools and integrated indicators, making it an effective way to trade that most people use and love. Not only is MetaTrader4 available on your computer as an app or web browser, its compatible on both the iPhone and Android, meaning it’s accessible for all types of traders, whether you trade on your laptop or prefer to do it on the go.

I would highly recommend using MetaTrader4

Deposit And Withdrawal Methods

Nowadays brokers tend to offer a large amount of deposit and withdrawal methods. Nord Fx

| Method | Fees Charged |

| Bank Transfer | Deposit = Fees from your bank. Withdrawal = Fees from your bank |

| Visa | Deposit = $0. Withdrawal = 4% Of Amount, +$7.50 |

| Mastercard | Deposit = $0. Withdrawal = 4% Of Amount, +$7.50 |

| Skrill | Deposit = $0. Withdrawal = 1% |

| Neteller | Deposit = $0. Withdrawal = 0% |

| WebMoney | Deposit = 0.8% (Capped at $50.) Withdrawal = 0.8% (Capped at $50.) |

There are no commission fees for account finding, aside from any that you may be subject to from your bank should you use a bank transfer to deposit or withdraw. There is also a small commission of 0.8% if you choose to use WebMoney, but never more than $50. Traders are able to deposit their money in USD or EUR currency too.

However, this wouldn’t be a proper review without including any limitations of the broker, so it’s important to know that generally they charge a withdrawal fee of 4% plus $7.50, though this is lower (1%) if you choose to use Skrill.

Personally, I picked Skrill to avoid that extra withdrawal fee and had no issues whatsoever, but if you do have more questions then be sure to contact Nord Fx’s support team for help- details for this will be listed later in the post.

Setting Up An Account With NordFx

The process for setting up an account with Nord Fx is quick and painless! All you need to do is go to their website at nordfx.com, go to Accounts and choose which one you want to create by clicking ‘Open Account’ under that option. They will ask for details including your name, email, phone, account type, currency you wish to deposit in, and credit leverage you wish to use.

There is also an option to open a demo account under each one; simply click ‘Open Demo Account’. You’ll need to submit a document proving your identity and within 24 hours your account will be verified, and you’ll be able to start trading, it’s as easy as that!

If you have any trouble when signing up, I’d recommend contacting the Live Chat, they’re easy to use and quick to respond.

Client Support

Amongst other things its also pretty crucial to have valuable customer support as there’s nothing worse than not being able to contact your broker when you need help, or a withdrawal has gone missing etc. Nord Fx has amazing customer support with multiple ways to get in touch, including:

| support@nordfx.com | |

| Phone | +91-7303716826 (Bangladesh) |

| +357-25030262 (Europe) | |

| +593-9-80-909032 (LATAM) | |

| +86 108 4053677 (China) | |

| +91-120-4333948 (India) | |

| +91-120-4562896 (Sri Lanka) | |

| +66600035101 (Thailand) | |

| Live chat |

I used their 24/7 live chat function and found they sorted any issues I had quickly and efficiently, it’s a great feature from a broker in case of any emergencies where you need fast assistance.

Reputation & Reviews

Being able to check a broker’s reputation forum is really useful when considering whether to use it or not as you can see what thousands of other traders think and what their experiences have been like. Nord Fx has an extensive range of reviews across multiple forums with a reliable and gold reputation being the main consensus. ForexPeaceArmy

Conclusion

In summary, NordFx is a good forex trading broker to trade with! They offer a huge 1:1000 leverage, with ECN liquidity, 33 forex trading pairs and a variety of deposit and withdrawal options. Alongside these conditions, they are also regulated by CySec

Sign up to NordFx now!