Are you thinking about trading with VT Markets? With thousands of regulated and unregulated forex brokers online, it can be hard to find the best broker to complement your trading!

Thankfully, we’ve extensively researched and tested VT Markets over the last few weeks, looking at everything from account types to spreads and awards.

So, let’s take a deeper look to find out if this is the broker for you!

Who Are VT Markets?

VT Markets

With regulation in multiple jurisdictions and a flawless track record, it’s clear to see how VT Markets has amassed over 200,000 client accounts over the last 8 years.

Despite having 1000+ instruments to trade, VT Markets are most well known for their forex offerings, so that is what we will be focusing on as this is where our experience also lies. On a surface level, this seems like a perfect brokerage to be trading with. So, let’s find out more…

VT Markets Trading Conditions

Trading conditions really make or break a broker that you’re looking to trade with. This can be simply broken down into a few variables:

Leverage – The leverage offered is up to 1:500, which is huge! For many traders, this may be too high and cause too much additional risk in positions so you’re able to manually change your leverage as low as 1:100 if you desire.

We’d definitely recommend reducing leverage if you’re unprofitable or inexperienced in the markets.

Spreads – The spreads vary depending on many factors including the time of day and the pair in question. The spreads are fairly low, with GBPUSD coming in at 1.2 pips spread at the time of writing this and EURUSD coming in at 0.4 pips spread.

We’ve certainly seen much lower spreads in the industry but on the flip side, we’ve also seen much higher spreads.

We’d recommend using an ECN account rather than STP to avoid these spreads!

Execution Speed – VT Markets leverage the Equinox Fibre Optic Network to provide lightning fast execution on trades. We’ve tested execution speed and regardless of the currency pair or order size, we’ve had consistently great results!

Trading Hours – The forex market is open 5 days a week, 24 hours per day. Therefore, VT Markets allows you to trade all available hours.

VT Markets Account Types

VT Markets has 3 different accounts for traders to choose from, depending on your style of trading within the markets.

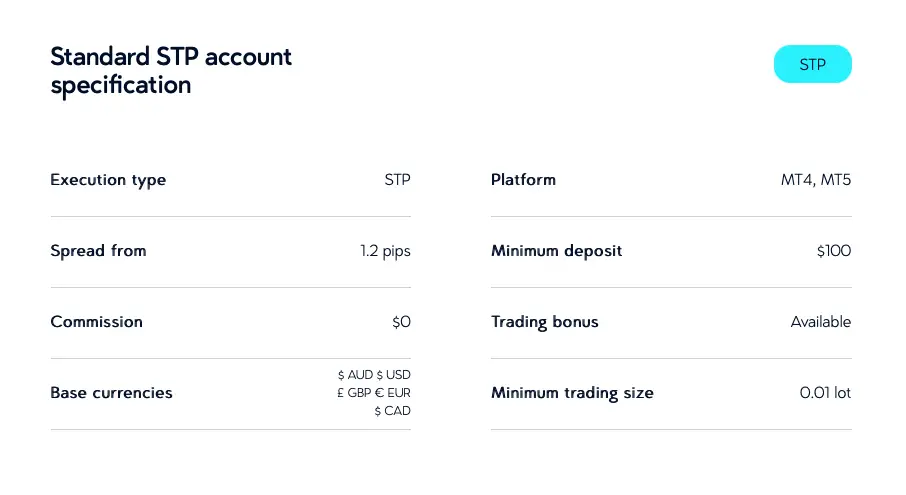

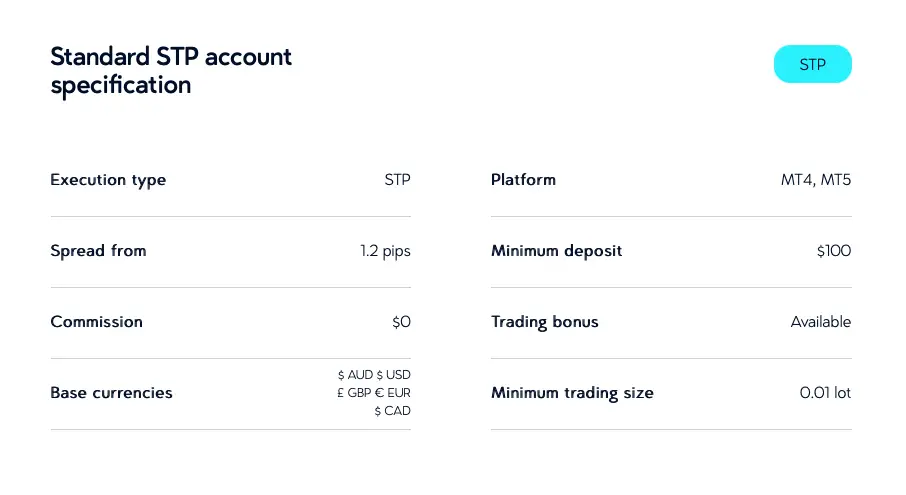

Standard STP Accounts

Standard STP accounts are exactly what they say on the tin! These orders are routed ‘Straight Through’ to the liquidity providers in the markets. This means you’re A Booked and the brokers are not trading against you, as with B Book brokerages.

With the standard accounts, you pay no commission per trade but you will have spreads on currency pairs. These spreads will depend on the currency you’re trading. Major pairs like EURUSD will have smaller spreads whilst Minor pairs like GBPNZD will have fairly large spreads.

These accounts are great for swing traders, position traders and even day traders!

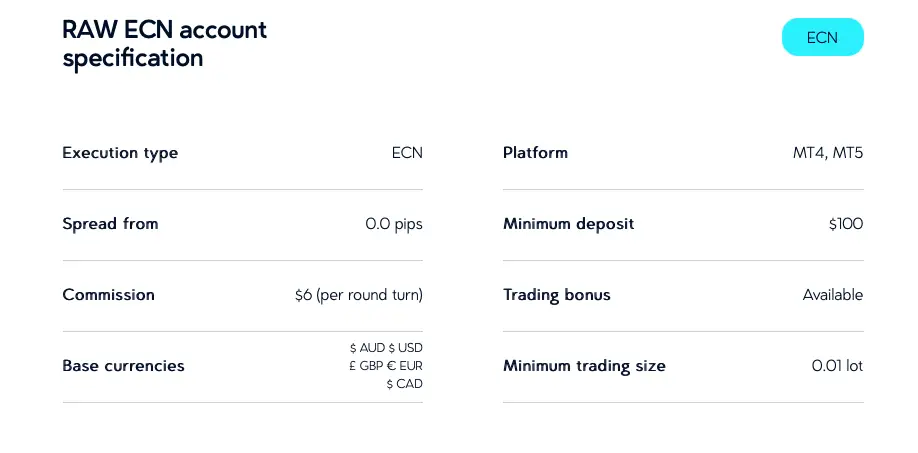

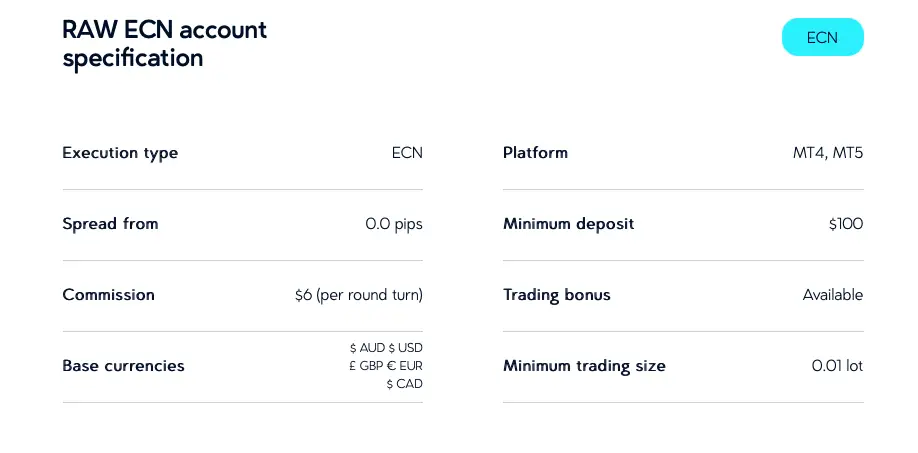

Raw ECN Accounts

Raw ECN accounts are perfect for intraday traders and scalpers looking to enter the market with tiny or even no spreads.

Instead, a commission is paid on opening and closing the trade, depending on the lot size used. This works out at $6 per lot traded.

Price wise, the difference between a lot traded via standard STP or ECN can be negligible but if you’re working with tight take profits and stop losses in the markets, knowing you don’t need to worry about spreads is a huge advantage.

When scalping or using trading bots, we have always used this account type.

Swap Free Accounts

Swap free or interest free accounts are tailored for muslim traders to allow traders to enter the markets without incurring any interest on positions.

Traders are able to use the Islamic accounts for either Raw ECN trading or Standard STP trading, depending on your preferences.

Both of these options have:

- $100 Minimum deposit

- Up to 1:500 Leverage

- Low commissions and spreads

- All trading platforms offered

- Deposit bonuses allowed

- AUD, CAD, USD, GBP, EUR account currencies

Are VT Markets Regulated?

Regulation is incredibly important to consider when choosing a forex broker to be working with. If you’re taking this seriously and depositing a relatively large sum of money, why on earth would you want to trust a broker that doesn’t have a regulatory body watching them?

We’ve seen time and time again, brokers manipulating prices and not paying out traders because they’re unregulated and no one is looking at their commercial practices.

So, is VT Markets regulated? Yes!

VT Markets is an umbrella company of different entities that are operating in various countries. For example, in Australia, they’re known as VT Global Pty Ltd.

Regardless, VT Markets are regulated in the 4 jurisdictions shown above. This is very interesting to see and actually provides a wealth of opportunities for traders that favor using larger leverages within the markets.

This tells us that high leverage levels are possible in all of the regulated jurisdictions VT Markets works within.

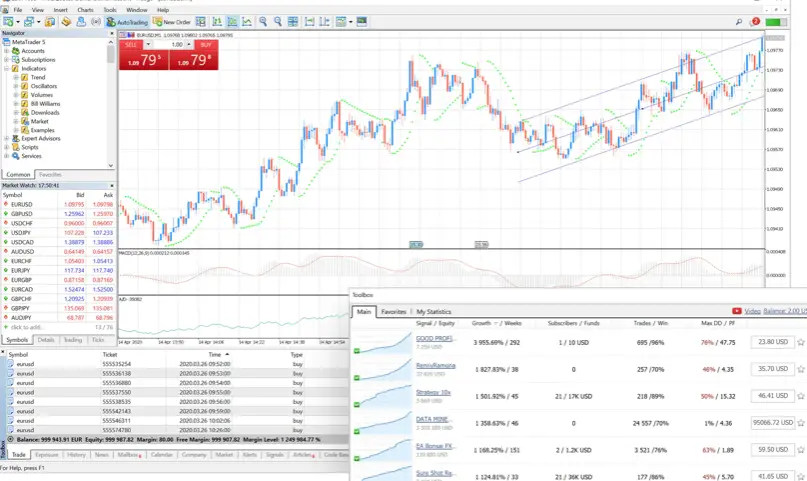

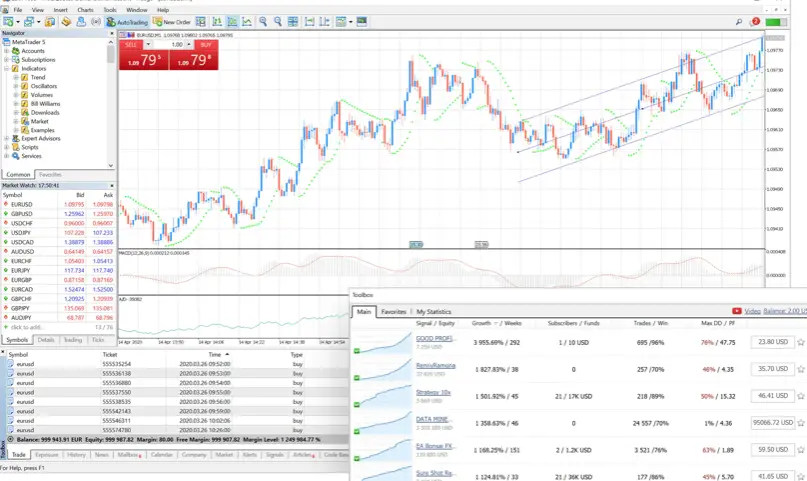

Trading Platforms Offered

The choice of trading platform is something that divides many traders in the online trading community. The most popular platform, by far, is still MetaTrader 4.

Luckily, VT Markets does offer MT4 to traders!

When it comes to trading platforms, you’ve got a number of options at your disposal…

- MetaTrader 4 (And Mobile App)

- MetaTrader 5 (And Mobile App)

- WebTrader Plus (TradingView Partnership)

- WebTrader (Web Version Of MetaTrader)

- VT Markets App (It’s Like A Cross Between TradingView & MT5 App)

These platforms give traders a huge range of options to choose from. Personally, we stuck with WebTrader and MT4 as these are more familiar to us and we’re fans of algorithmic trading.

For manual traders, MT5 or WebTrader Plus would most likely be the best options.

It’s worth noting it’s possible to set up MAM or PAMM accounts on these platforms, if needed. You will need approval from VT Markets though, to ensure traders are protected.

Deposit Bonus Offered

At the time of writing this review, there is currently a 50% deposit bonus on the first deposit. There is also a deposit bonus of 20% on any deposit over $1000.

This can be a huge difference for new traders coming into the market with a small deposit! This may not be an offering that sticks for the long term but for now, it’s worth making use of it possible.

Many brokers do offer deposit bonuses on the first deposit but 50% is certainly one of the best we’ve seen in a while from a regulated broker.

You’ll often see completely unregulated brokers offer 2000% deposits and promising ridiculous offerings, but they very rarely work out in favor of the trader.

Setting Up A VT Markets Account

Sometimes it can be incredibly frustrating setting up and verifying a trading account with a broker. This can be even worse for beginners that have never been through a brokerage setup before.

Typically speaking, the leverage settings and KYC can be tricky to navigate! However, the experience with VT Markets was painless.

The setup is initiated with the simple form shown above where you fill in basic details and choose whether you’re a company or trading as an individual.

Once you’ve submitted the information, we had to submit KYC documents. This was extremely simple but bear in mind that we have signed up to hundreds of brokers in our time.

It took a few hours for the account to then be approved. Once approved, you’re able to deposit funds and start trading!

All in all, this process will take around 5 minutes of work and a few hours to get approved and start trading.

Compared to some of the other best forex brokers, this is very good!

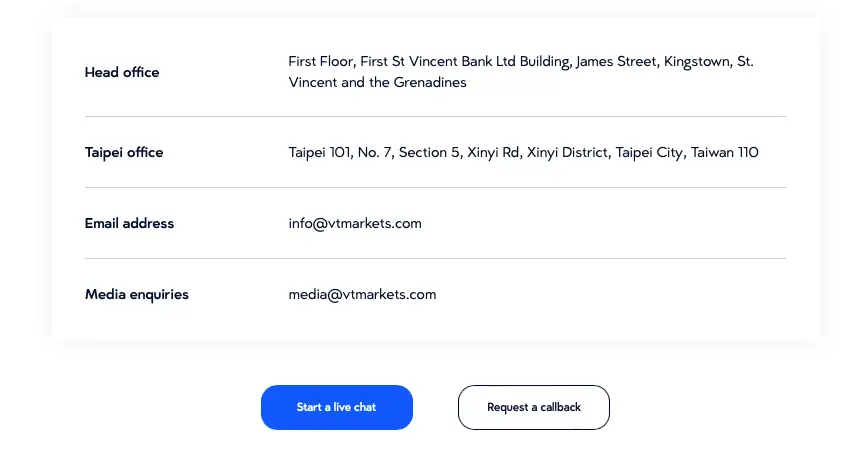

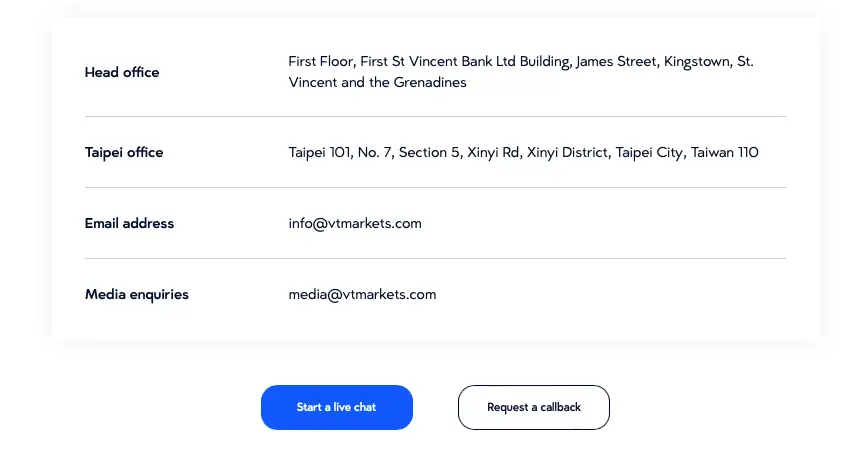

Support Offered By VT Markets

In the forex markets, there’s no denying that it can be stressful and sometimes you need a quick answer from a broker! Many brokers offer very subpar support to traders, which we always see as a huge red flag.

VT Markets has a great support offering and we’ve tested this periodically over the last few weeks. We’ve had quick responses from various members of the team and typically our queries are answered on the first response.

You’ve got multiple contact options. These include multiple addresses, an email address, a callback feature and a live chat. It’s worth noting that we have not tried to send post to the physical addresses as we couldn’t imagine many traders would try this if they were looking for a fast support response!

If you’ve had a different experience with the support team, we’d love to know about it.

VT Markets Reputation

If you’ve read any of our prop firm reviews or even our broker reviews, you’ll know that we like to use Trustpilot and Third Party Reviews to gauge the experience other traders are having with a company we are working with.

VT Markets currently has an average rating on Trustpilot with over 369 reviews at present. It’s worth noting that this has taken a hit recently, from what we can see, due to an influx of fake reviews.

These fake reviews are being monitored and removed by Trustpilot apparently, so we should see a fair representation once these are all removed!

Of course, 36% of reviews being 1 star isn’t great, so we’ll wait and see how this looks once the fake reviews are removed.

In Conclusion – Is VT Markets Legit?

In summary, VT Markets are a great forex broker with a comprehensive offering for all traders. With regulation, high levels of leverage, multiple platforms and great spreads, it’s not wonder they have over 200,000 client accounts.

The regulation alone put VT Markets in the same bucket as some of the largest players in the industry like IC Markets, for example. If you have any questions about VT Markets before signing up, please feel free to get in touch and we will share the experience we’ve had.