The majority of forex brokers are offering free demo accounts, to allow beginner traders to get a feel for the financial markets without risking any capital. This is a great way to get started in the markets, but sometimes it makes trading forex almost seem too easy! With traders making huge amounts of money on demo, investing some real cash and taking a huge loss straight away. This leads to the question, are forex demo accounts rigged?

Forex demo accounts are not rigged, they give traders an accurate representation of what it is like to trade the forex markets on a live account. However, demo trading can seem much easier due to there being no emotions or risk involved. Psychology and emotion is the hardest part of trading forex, removing that on a demo account makes the whole process much easier, which is why traders may think it’s rigged.

Forex Demo Accounts Are Rigged?

Over 90% of forex traders lose money

The idea of a demo account is to get traders ready to trade real money, whilst incubating them for signing up with a certain broker. It’s a very transactional situation, the broker gets a client and you get to practice trading forex with no risk.

However, the problem lies when traders move from trading a demo account to trading live funds. Many traders are ‘profitable’ and making money on demo accounts, only to get destroyed in the live markets. This leads to traders thinking that the demo accounts are rigged, or showing fake prices or even just inflating their profits.

The reality is this is far from true and demo accounts are not rigged at all – they provide a near carbon copy of live trading conditions. There is a whole list of reasons why demo accounts may seem easier than live accounts but fundamentally it comes down to emotions, psychology and risk management (or a lack of).

1. Prices

When it comes to pricing on a demo account, there should be no difference to a live account. Live account pricing can fluctuate depending on the liquidity providers, broker and pairs you’re trading but the demo account with the same broker should be the exact same price.

There is always going to be the potential for the price to be slightly out by a few micro-pips but the price data will be coming from the exact same providers, whether your account has real money or fake money in – so this won’t be making any kind of difference to performance.

2. Execution Time

When it comes to actual execution time on a trade, the large majority of brokers

Execution time will be exactly the same on demo as it would be on a live account, unless you have a huge account balance. If you’re opening 200 lot positions

3. Emotions

Psychology and emotions are the hardest part of forex trading. Anyone can buy a leading forex course

When you’re trading a demo account, the emotional and psychological aspects of trading are completely removed. There is no risk, no fear, no greed. Therefore, you let losses run, you aren’t in a hurry to lock profits in, you aren’t scared of taking a trade – nothing matters, you’re just playing around with patterns on a chart.

This is a great thing to begin with as you need to be completely void of emotions to focus on just learning the strategies. Once you have strategies for the markets, this is when you need to be learning the phycological aspect of forex, rather than just technical aspects.

For this reason, forex demo accounts seem rigged as they’re much easier. They’re much easier because you aren’t trading like you care about losing the money, because you don’t!

The way to combat this is to use a live trading account with small capital. Even just starting with $200 is much better than trading a demo account, in my opinion, as you’ll be somewhat invested emotionally in the outcome of every trade.

4. Account Balance & Drawdown

One of the main reasons that forex demo accounts can seemed easier than live trading is due to the account balance. When you start a demo account, there is usually a huge amount of options when it comes to the starting balance. The majority of traders are going to be on demo accounts starting with $100,000 balance, which is of course extremely unrealistic.

Forex traders typically start with just a few thousands dollars, at the high end, so you’ll of course be trading much smaller lot sizes than you would do on a $100,000 account. Not only that, if you’re in $500 of drawdown on a $100,000 account, you really aren’t going to mind. This won’t be stressful and you know that you can easily hold that trade with no issues. If you’re in $500 of drawdown on a $2500 account, you’ll be running out of margin, panic mode will set in and you will start making emotional trading decisions.

If you are going to use a demo account to learn forex trading before even going live, I’d recommend that you use a demo account with the same amount of balance as your live account will have. E.G if you’re planning to start forex trading with $1500, your demo account should match that balance. This way you’re going to get the most realistic experience of managing trades and drawdown.

Treating A Demo Account Like Real Money

The main mistake traders make on demo accounts is to not treat the accounts like real money. Traders aren’t emotionally attached to fake money, so they don’t try to preserve the trading account at all. The MAIN objective in forex trading is to keep the balance, keep cash and just manage risk. This isn’t done on demo accounts though, as of course there is no actual consequences of losing money.

To treat a demo account like a real account, you need to:

- Use a stop loss in every trade, risking 1-2% of capital

- Only take high quality opportunities

- Manage risk

- Take fundamental factors into account

- Journal all trades taken

- Monitor drawdown and keep it below X amount

If you’re trading like this on your demo account, transitioning to a live account will be straightforward and you’re likely to already be a profitable trader. What you want to avoid is being profitable on demo, with no risk management, then moving to a live account with risk management and having no idea what’s going on.

Conclusion – Are Forex Demo Accounts Legit?

In summary, forex demo accounts are completely legit are show an accurate representation of live trading in the markets. The reason demo accounts appear ‘easier’ is there is no emotion or psychology involved, which is the hardest aspect of live forex trading. When no money is at risk, there will be no strict risk management or consequences for subpar trades.

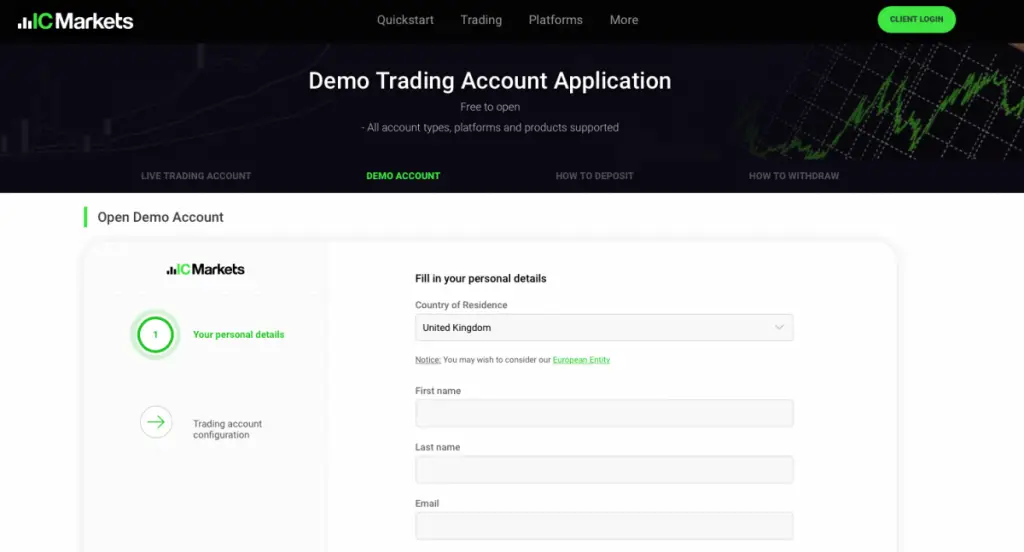

I would recommend trading a small live account, with a broker like IC Markets