People typically choose forex other other forms of investing because it seems like a very easy way to make a living. Social media portrays forex as a skill you can learn in a few days, trade from your laptop and make great wealth.

The realties of trading forex are completely different and not at all as the marketers lead you to believe. With that being said, let’s in this article we are going to take a look at how long it actually takes to learn to trade forex.

It will typically take on average around 1 year for someone to learn to trade forex. The technical side can be learned within a few weeks, but the risk management and psychology will take around a year to come to grasps with. The majority of traders give up before ever learning to consistently trade the markets.

ForexSignals.com

Forex Signals, ran by Nick McDonald is one of the largest forex education courses in the world, with over 500,000 students and a whole team of mentors.

The courses teaches the A-Z of trading, risk management, psychology and multiple strategies to trade including trend surfing, Fx propulsion and naked trading.

- Cheap

- Very reputable

- In-depth training for traders

- Mentors available for constant support

- Highest rated

Learning To Trade Forex – It Takes A Long Time

Forex, although it’s made to look easy online, is extremely hard. Forex is a zero sum market, meaning you need to have an edge to actually make money. It’s also a very liquid and complex market. This means it’s renowned for taking money from retail traders as around 70-90% of forex traders lose money.

If we ignore the 70-90% of traders that lose money trying to trade forex, how long does it take the other 10-30% to actually learn the craft? Well, around a year on average is how long it will take a dedicated student to learn to trade forex.

You never finish learning when it comes to the markets. There is always adjustments to be made, things to be tested, new market conditions, new strategies – it really never ends. After about a year you should be at least profitable within the market (not loosing money). I’d expect that after another 6 months to a year you will be starting to get a nice level of consistency month on month.

As with anything, you need to take learning forex with a pinch of salt as there are many factors that influence the duration of time it’ll take each person. Let’s take a look at some of these reasons…

1. How Long Does It Take To Learn Forex Without Buying A Forex Course?

Some people think that you have to pay for trading education from professional traders in order to learn properly. Is this true? Well, no.

You can easily become a self taught forex trader

If you learn to trade from free resources like Babypips

I’d say that if you want to learn without buying a top forex course

2. How Long Does It Take To Learn Forex Trading If You Buy A Forex Course?

Buying a trading course can definitely reduce the length of time it takes to learn to trade forex. With buying a good course, you would expect to learn trading in around 1 year. This is of course fairly nuance. There are a lot of factors that can influence how fast you learn including…

- Your dedication

- Your intelligence (I know, not a popular opinion)

- Which course you buy

- The quality of teaching

- How much time you can spend learning

- Your background in investing

These are just some of the factors. If you can afford to learn forex from a mentor, I’d advise checking out our top forex education courses list

3. Learning Technicals

Learning the charting aspects of forex (support and resistance etc) will only take you a few months. Of course you will get better over the years and be able to find levels faster and react to situations better but the basics of price action are fairly simple to understand.

I’d definitely recommend getting started with Tradingview

4. Learning The Psychology And Risk Management

Learning the psychology and risk management aspect of forex will take you a year, if not longer. This is something that requires a huge amount of work and personal reflection. I highly recommend journalling all of your forex trades and advances in psychology to help speed up the process.

Controlling your emotions and making objective decisions will take time. It takes putting yourself in the situation a huge amount of times to ensure you handle the decision correctly. This becomes even more important when you’re trading a large amount of capital.

Skipping this step is guaranteed to lead to you blowing your forex account over the long run. Risk management and rock solid psychology is the only thing that sets profitable traders apart from those traders that lose a huge amount of their accounts.

5. Learning To Trade Large Forex Accounts

New forex traders like to speed through the learning process because they think they need to get started trading live. Years spent on education is years wasted, right? Well, no.

With the rise of forex prop firms, traders can literally get an instant funded $50,000 account

Let’s take MyForexFunds

I’d highly recommend taking those few extra months on a demo account learning to trade properly. Once you’ve learned, then apply for prop firm funding from one of the worlds leading prop firms

Avoiding The Common Mistakes That Increase Time Taken To Learn Forex

1. Changing Strategies

The MOST common mistake that drags out the learning process is changing strategies constantly. I would have been profitable years earlier if I had stuck to one forex trading strategy. If you spend 2 months learning a supply and demand trading strategy, to completely abandon that and trade support/resistance, you’re just delaying your own success.

I recommend trying to stick to one trading strategy and maybe just making small refinements, if any. You’ll find that most forex trading strategies are actually profitable, you just need to manage expectations. If you are expecting to take 8 1:4 RR trades per day, of course you will change if you’re only getting 2 per week. Management of your expectations is a crucial part of forex trading and so is avoiding shiny ball syndrome.

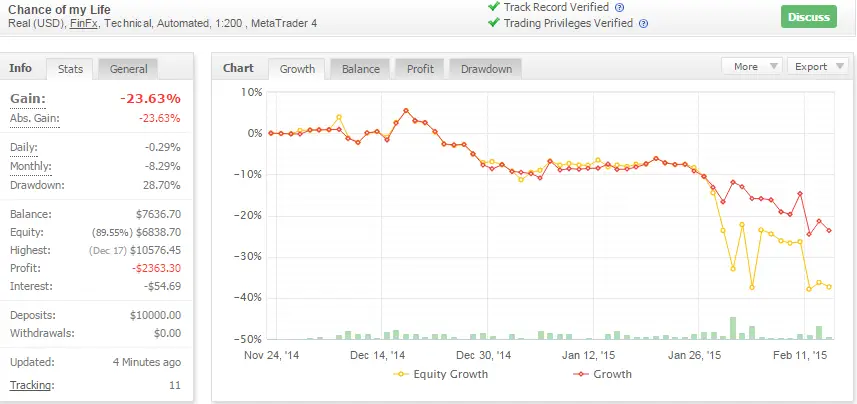

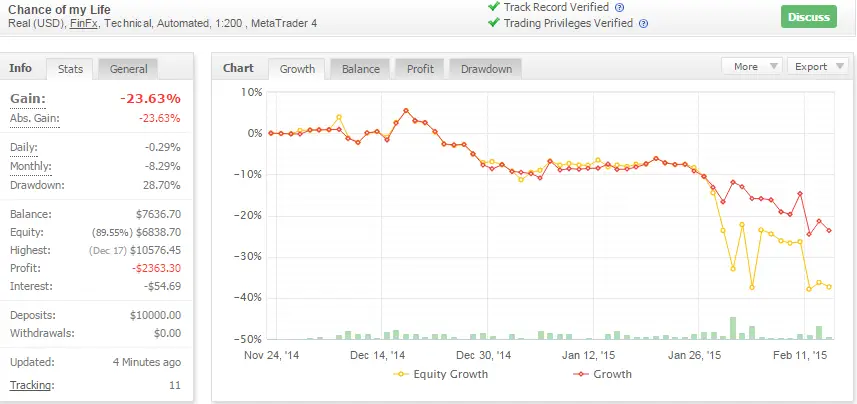

2. Over-leveraging and Lack Of Risk Management

One of the largest mistakes that causes people to take a lot longer to learn forex is only focusing on technical analysis. Traders tend to believe that once you can draw some lines on a chart, you’re ready to trade the markets. This is fundamentally not true. The majority of basic forex trading strategies would be profitable over the long term if you exercised proper risk management and didn’t over leverage your forex accounts.

Instead of looking to 10x your trading account and make $5000 per month, focus on making 5% per month risking 1%. Once you can do this and your risk management is perfect, get funding from FTMO

3. Not Backtesting Your Strategies

One of the largest mistakes made by people trying to learn to trade forex is not backtesting a strategy. Backtesting is absolutely crucial to the success of a trader in the markets. Without knowing the objective facts about your trading strategy, there is no proof the system is profitable. If you aren’t 100% sure that a strategy is profitable over the long term, as soon as you have some drawdown, you will completely lose faith in what you’re trading.

When backtesting, you need to be completely objective and critical in the results. For people learning a forex trading strategy, I would recommend getting at least 5 years of backtested results. This should all be displayed in a spreadsheet with comments, percentages, times, days, drawdown and screenshots. You should have complete faith in a strategy once a backtest is complete. This process massively speeds up the learning process too, as you expose yourself to the same setup thousands of times.

In Conclusion – How Long Does It Actually Take To Learn To Trade Forex?

In summary, it takes traders around 1 year of intense study to learn to trade forex. The chart work can be learned very fast, in a few weeks sometimes, but the risk management and psychology aspects will take many months longer. Learning to trade forex can be sped up by paying for a trading course, journalling everything, focusing on risk management, not hopping strategies and backtesting your trading strategies.

If you have any questions or want to share how long it took you to learn to trade forex, please do drop a comment down below.