It’s no secret that the forex market is a very liquid market and provides a huge amount of opportunities for traders to take advantage of. The drawback is that it can take a huge amount of time to learn to trade forex and investors are usually put off by the years it can take to get consistent in the industry. This leads investors to start looking at hiring forex traders to manage their money for them and pay a fee for the privilege. With that in mind, can you get someone to trade forex for you?

You can legally get someone to trade forex for you, providing they are licensed to manage money. Contracts need to be in place to keep both parties safe and the trader is usually paid from a performance fee. You must use due diligence when selecting a trader to invest with, as the majority of profitable forex traders will not be interested in management of individual investor funds. Let’s find out more…

Can You Hire Someone To Trade Forex For You?

You can legally hire a forex trader to trade forex for you, but that doesn’t mean you should. If you are planning on working with a forex trader, as an investor, you will need contracts in place and for the trader to be licensed to trade other peoples capital. I would say that 99% of traders will not be licensed and you should exercise a huge amount of due diligence when picking traders, to avoid being scammed.

The most typical setup is going to be through a PAMM/MAM account, with contracts in place. By investing in a MAM account, the forex trader you have hired is able to trade your funds and charge a performance fee – without you giving the trader all of the funds. The funds will technically stay in your name, which is definitely safer for you and easier for the trader, legally.

DayTrading has a list of the best forex brokers offering PAMM accounts

Many investors have been scammed when trying to invest in forex traders over the last few years – especially through social media. I shouldn’t need to say this but please do not randomly send forex traders on Instagram money – successful traders are not asking for money on Instagram. With forex prop firms like DT4X Trader offering $50,000 in instant funding

The Benefits Of Hiring A Forex Trader

Getting someone to trade forex for you can be risky, but can also very much pay off in the long term if done correctly. There are some really large benefits of choosing to hire a forex trading…

1. Learning Forex Is Hard

It’s no secret that learning to trade forex can take a long time. Even after months of studying with some of the best forex education courses

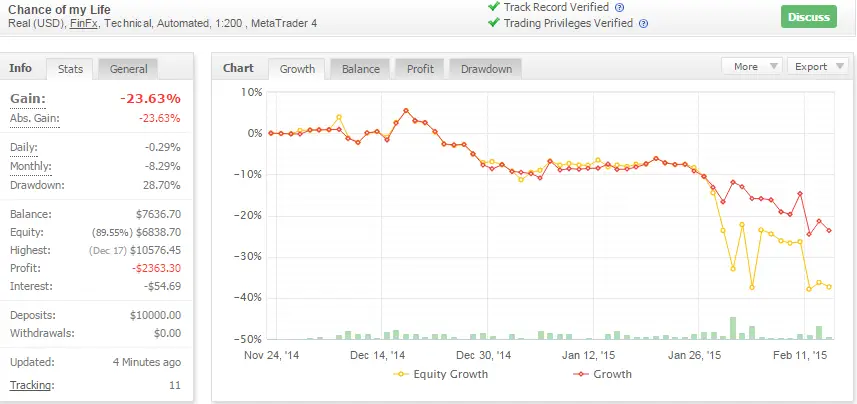

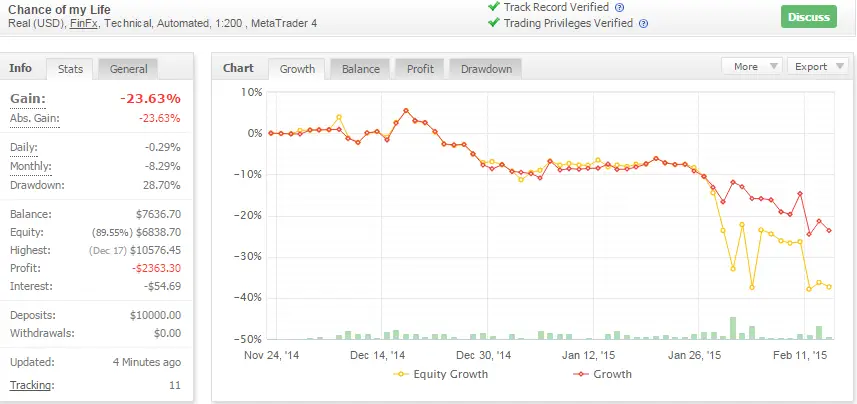

Hiring a profitable forex trader to trade for you can obviously remove a lot of that learning process and duration needed to reach profitability within the markets. On the flip side, forex is still very hard and you need to ensure that you’re working with a trader that has years of proven track record. I don’t mean screenshots, I mean audited track record on a third party website.

2. Leveraging The Traders Knowledge

By hiring a forex trader to trade for you, you can learn a huge amount about the markets. From looking at the traders analysis and trades taken, you can start to understand how the market functions and start picking up the skill for yourself.

Learning the ropes and understanding what your trader is doing is going to be very much worth doing. Even if you aren’t going to be trading yourself, having access to a profitable traders brain is not something everyone can do – so use it wisely!

3. Get Better Returns Than The S&P 500

The S&P 500 is probably the most popular form of investing for passive, hands off investors. As broken down by Investopedia

5% per month compounded from investing with a forex trader is going to yield much higher yearly results than just throwing money into the S&P 500. Of course, this is a huge benefit for investors but forex is much riskier than other markets. The forex market is extremely liquid and even consistently profitable traders do have large drawdowns and I would advise only using forex as a portion of your portfolio, not the whole portfolio.

The Drawbacks Of Hiring A Forex Trader

There are definitely benefits of hiring a trader to trade the forex markets for you. However, there are also some serious drawbacks we need to consider before investing your money with a trader…

1. Most Traders Lose Money Over The Long Term

Before investing, it’s important to realise that most traders do not actually make money in the markets. In fact, in this article by ForexGuy

Typically, you are going to find traders trying to find investors by showing their lifestyle and potentially a few MT4 screenshots on a demo account with thousands of profits floating. I have to say, these ‘traders’ are not traders, they are scammers.

Real forex traders are going to have a track record on MyFxBook

2. You Aren’t In Control Of Losses

By hiring a forex trader to trade for you, you cannot control the levels of losses taken. Meaning, the drawdown is completely out of your control. Even if you tell the trader not to violate a maximum drawdown of 5%, there is no guarantee that they will honour this and stick to that level of risk. Especially when traders are paid in profit commissions, it’s in their best interest to trade aggressively with your money in order to generate larger commissions.

3. Learning To Trade Yourself Is Much Better

When you hire a forex trader to manage your capital, you’re relying on that trader to get your monthly returns. Although this can be a good thing, you’re also limiting yourself by not learning to trade forex yourself. If you have the time and the capital, I would definitely recommend not limiting your potential returns and learning to trade forex yourself. I have compiled a list of the best forex education courses

Let’s say you spend 6 months learning to trade from Trading Masterclass

4. Profitable Traders Typically Don’t Look For Investors

Over the last few years, there have been a huge amount of opportunities coming up for profitable forex traders. For example, just take a look at forex prop firms

With this in mind, why would a trader want to manage your $10,000 of capital for a small fee? In reality, any profitable and legitimate traders will have no interest in working for investors when prop firms pay so much better. Prop firms also don’t require any kind of licensing or regulation, which makes it much safer for traders to operate in that space.

5. Traders Managing Capital Should Have Licenses To Do So

When traders are managing investors capital, unless they’re doing this through the framework of a prop firm like MyForexFunds

Always be cautious of traders that don’t operate within the regulatory framework or do not have licenses. This is the fundamental issue of hiring a trader to trade forex for you – you cannot prove that they actually know what they’re doing and most likely they’re breaking the law. This risk ultimately falls to you.

In Conclusion – Can You Hire A Forex Trader To Trade For You?

In summary, you can hire someone to trade forex for you as a way to diversify your portfolio. The forex market is extremely risky and liquid, meaning drawdown can be large compared to other forms of investing. I would recommend using a huge amount of due diligence when selecting a trader to invest with. The majority of profitable forex traders are not going to want to manage small single investor funds, especially with prop firms like FTMO offering profitable traders hundreds of thousands

In my opinion, you would be better off learning to trade forex yourself, then getting funded. Although the potentially higher returns of hiring a forex trader is appealing, there are a huge amount of issues hiring a trader, from the licenses to contracts and payment. It is a very risky way to invest and cannot be recommended.

If you have any experience hiring a forex trader please do let me know in the comments down below, I’d be very curious to see how it went for you.