With so many forex brokers popping up in the recent years, it’s hard to know who you can actually trust to take your orders to market. But then again, if forex is literally just exchanging foreign currency and it’s completely decentralised, do you even need to trade with a forex broker?

Forex is essentially just trading one currency for another, which you could without a broker, in theory. However, if you’re looking to have access to low spreads and instant execution to ensure the best prices for your currencies, you would need to trade with a regulated forex broker.

Trading Forex With No Broker

Foreign exchange trading is as simple as it sounds. You’re exchanging one currency, for another form of currency. This form of trading has been going on for hundreds of years and it was started way before the days of online forex brokers.

The forex market is completely decentralised. This means that there isn’t one governing body or exchange that you would need to go through, to participate in the market. You could go to your local post office to trade currency. You could go to the bank, or even the airport. Currency can be exchanged in a huge amount of different ways, essentially meaning you don’t need to go through a forex broker to execute a trade!

Disadvantages Of Trading Forex Without A Broker

Just because you can trade forex without a broker, doesn’t mean that you should. There are a huge amount of reasons why you actually need a broker to trade forex properly and profitably. Let’s find out more…

1. Brokers Have The Best Spreads

When it comes to trading any markets, the spread is crucial. The spread is essentially the difference between the price people with buy at and the price people are selling at. Read this Investopedia article

If a spread is very high on a currency pair, you aren’t going to be buying at the actual price you wanted to buy at. Likewise with selling. This eats away at any potential profits you were hoping to obtain from your forex trade.

Brokers have direct access to liquidity, interbank rates and the market. This means that they are able to get the best spreads in the world and if you went elsewhere, say to an airport, you’re going to be getting a completely different price.

Therefore, if you’re looking to make the most profit as possible and get the closest prices, you would want to trade with a regulated forex broker. Click here for a list of regulated forex brokers

2. Brokers Have All Currencies

When it comes to forex, there is more than just the major pairs. Major pairs consist of the highest volume currencies like GBPUSD, EURUSD, USDJPY etc. All major pairs have a USD pairing in them but they aren’t the only pairs.

There are also hundreds of minor pairs, like EURCAD, and exotic pairs that have currencies from all over the world with much lower volumes. There is endless trading opportunities if you’re going though a proper forex broker.

If you decided to trade without a forex broker, you’d most likely be limited to just a handful of the major pairs, which you would be paying a horrible exchange rate on.

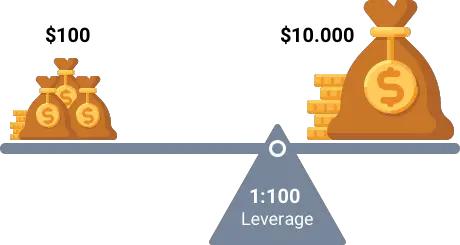

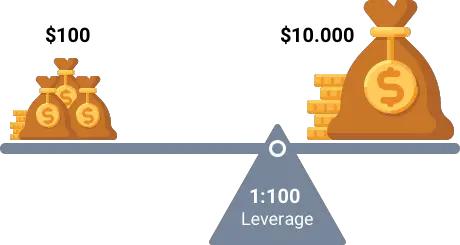

3. Brokers Have Leverage

One of the main perks of using a forex broker to trade is the leverage. If you’re unsure what leverage is, have a read of my article here talking about trying to trade without leverage

Leverage offered by brokers will allow you to use 100x or even 200x your own trading capital. This means you can get much more of a profit on your trading idea. It has to be said that leverage is extremely risky and you can blow through accounts as fast as you can grow them but trying to trade without leverage is more or less impossible for retail traders.

4. Brokers Have Support In Place And Hard Stops

If you choose to trade forex without a broker, you’re going to forfeit the support and peace of mind that trading with a regulated broker brings. Brokers have so much education, 24/7 support teams, algorithms in place to mitigate huge spikes and systems in place to monitor volatility. All of this alongside hard stops and margin stops, meaning they won’t let you lose all of your capital in one position.

In forex, staying safe and staying cash is the main objective, always. By forfeiting these benefits you’re taking on a huge amount of additional risk, when you’re already playing in the riskiest and more liquid market in the world.

Advantages Of Trading Forex Without A Broker

Now that we have looked at the advantages of using a broker, is there any benefits of not using one? Well, not really. There is actually no benefit for the average retail trader, of using another way to exchange currency or trade forex, rather than just using a normal forex broker.

The saying ‘don’t reinvent the wheel’ comes to mind when traders try to overcomplicate their systems and avoid using brokers. There is no central hub for forex and retail just cannot get a seat at the table to get direct market access like the hedge funds and banks do, so there’s no harm in using a middleman in the form of a forex broker!

Finding A Good Forex Broker To Trade With

Now that we have concluded using a forex broker is the only way to really trade forex, at scale, it’s important to find a good forex trading broker. The most important thing you need to be looking for is regulation. Governing bodies regulating brokers keeps us traders safe and I highly recommend using a regulated broker if you are serious about trading, or want to put a lot of capital into your trading account.

For a full list of regulated brokers, I would recommend Compare Brokers

In Conclusion, Could I Trade Forex With No Broker?

In summary, you can trade without a forex broker as forex is simply exchanging foreign currencies. This can be done in many different ways such as at a post office or in an airport, not just through a forex broker. However, there are a huge amount of benefits of using a broker for your forex trading.

If you have any experience of trading forex without a broker, please do comment below, I’d like to hear your experience.