Have you ever wondered how day traders make money? Are they using state-of-the-art technology to stay ahead of the competition?

The answer is yes – and it’s called bots. Bots are automated software programs that can trade stocks, options, futures, and currencies without any manual intervention.

Day trading is a highly competitive field, and those who want to succeed need the best technology available. That’s why more and more traders are turning to bots to give them an edge in the markets.

Bots can monitor the markets for opportunities, analyze data quickly, and execute trades in milliseconds – far faster than any human trader could manage.

The use of bots in day trading is on the rise, but there are still many unanswered questions about their effectiveness and legality.

In this article, we’ll take a closer look at how these automated software programs work and what they mean for traders today.

We’ll also explore whether or not they’re actually helping day traders make money or if they’re just another tool to help investors lose money faster.

In short, day traders do use bots to trade as this helps to generate consistent returns alongside manual trading. All institutions also use algorithmic trading, alongside manual position taking.

Day Traders Often Use Bots To Assist In Generating Consistent Profits

Day trading is a challenging but potentially lucrative activity for those who are willing to put in the time and effort to learn the ropes.

Many day traders use bots to increase their chances of success – these bots can help them identify patterns, predict trends, and make trades with greater accuracy.

Bots provide an extra layer of automation that helps day traders stay on top of their trades and make decisions faster than ever before.

By using bots, traders can take advantage of market opportunities without having to constantly monitor their positions. This allows them to focus on other aspects of their trading strategy while still being able to stay on top of any new developments.

The use of bots also helps day traders generate consistent profits. By relying on automated processes, they’re able to minimize risk and maximize profit potential.

Bots can also help traders identify profitable opportunities in the market more quickly, allowing them to act faster than if they were manually monitoring their trades.

Overall, bots offer a range of advantages for day traders looking to increase their profitability and efficiency.

With the right strategies in place, they can be incredibly useful tools for improving your trading performance. As we transition into discussing the benefits of using a bot in your trading, it’s important to consider how this technology could benefit you as an individual trader.

The Benefits Of Using A Bot In Your Trading

Using a bot to trade on the stock market offers numerous advantages. Firstly, bots are able to trade much faster than humans.

They can make decisions and execute trades in a fraction of the time it takes a human trader to do the same.

This means that day traders who use bots can take advantage of market opportunities quickly, allowing them to capitalize on short-term price changes and maximize their profits.

Secondly, bots are able to analyze large amounts of data quickly and accurately. They can identify patterns and trends in the markets that may be difficult for humans to detect.

This allows traders to make more informed decisions about when and what to trade, improving their chances of success.

Thirdly, bots are able to manage multiple trades simultaneously without any errors or delays. This helps traders save time as they no longer have to manually enter each order one at a time.

Additionally, using a bot eliminates the possibility of human error which could lead to costly mistakes and losses.

Finally, day trading bots provide traders with an additional layer of security as they protect against fraudulent activities such as insider trading or pump-and-dump schemes.

provide traders with an additional layer of security as they protect against fraudulent activities such as insider trading or pump-and-dump schemes.

Using a bot reduces the risk of these activities taking place as it is programmed with certain rules which must be followed before any transactions take place.

Thanks to these advantages, day trading bots have become increasingly popular among active traders who want to maximize their profits while minimizing their risk.

As such, exploring the world of day trading bots is something every trader should consider doing if they want to succeed in the stock market!

Day Trading Bots

Yes, day traders do use bots to trade. A bot is a program that automates the trading process and helps traders make decisions in real time.

This type of trading technology has become increasingly popular among day traders as it can help them save time and money.

Day trading bots are designed to analyze market data and generate buy or sell signals based on specific criteria. They can also execute trades on behalf of the trader, allowing for a more efficient trading experience.

Here are some of the main benefits of using a day-trading bot:

- Cost savings – By automating the process of analyzing and executing trades, day-trading bots can save you both time and money by eliminating manual analysis and execution costs.

- Increased accuracy – Day-trading bots can be programmed with specific parameters to ensure they only make trades that meet your risk tolerance level. This eliminates human error from the equation, which could otherwise lead to costly mistakes.

- Reduced emotion – Trading can be an emotional roller coaster ride, but using a bot eliminates this factor as it will only follow predetermined rules without any emotions involved in the decision-making process.

Day trading bots have certainly revolutionized the way we trade, making it faster, easier and more profitable than ever before!

With these powerful tools at our disposal, we have access to better information and more accurate analysis than ever before – allowing us to take advantage of even the most subtle market movements for maximum profits!

As such, these automated systems are becoming increasingly popular amongst experienced traders looking for an edge over their competition in today’s ultra-competitive markets.

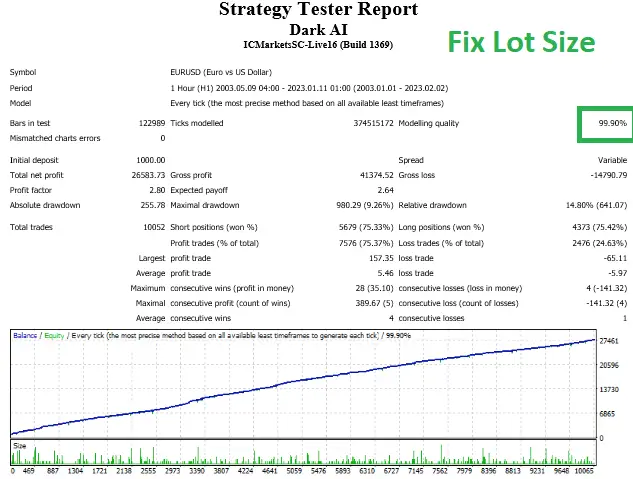

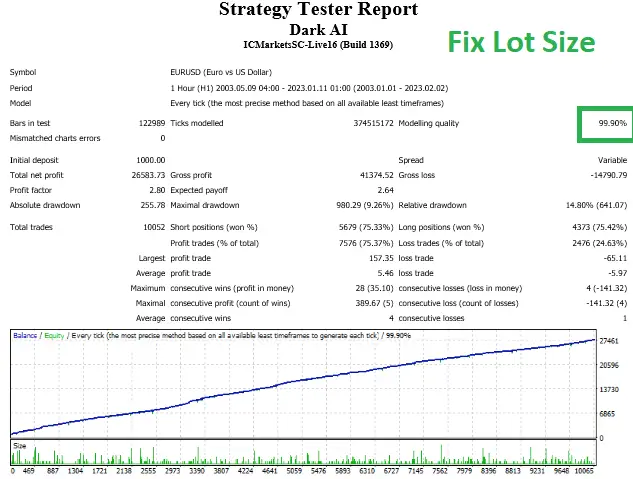

I would just note that it’s incredibly hard to create a profitable trading bot

Swing Trading Bots

Swing trading bots are becoming an increasingly popular tool for day traders. These robots use algorithms to identify and analyze market trends.

They can quickly execute trades based on their analysis, enabling traders to capitalize on long-term opportunities that they might otherwise miss.

These bots are designed to be user friendly and do not require a high level of technical knowledge or experience. They provide a wide range of features that allow users to customize their trading strategies, such as setting the frequency of trades, the size of each trade, and the types of assets they want to target.

Additionally, some bots have built-in risk management features that help traders maximize their profits while minimizing losses.

The main advantage of swing trading bots is that they enable traders to take advantage of long-term price movements. This allows them to focus on other aspects of their lives, such as work or family responsibilities, while still taking advantage of profitable opportunities when they arise.

Furthermore, since these robots can be programmed with different parameters and strategies, traders can tailor them to suit their individual needs and preferences.

By harnessing the power of technology and automation, swing trading bots provide an effective way for day traders to increase their chances of success while freeing up valuable time.

With this in mind, it’s no wonder why these robots are becoming increasingly popular among seasoned day traders.

As we move forward into a more automated world, it’s likely that swing trading bots will become even more commonplace in the near future.

Taking this into consideration, it is clear why these automated solutions can be so beneficial for day traders looking for efficient ways to manage their portfolios and maximize profits.

Ready for a closer look at scalping trading bots?

Scalping Trading Bots

Yes, scalpers often use bots to trade. These automated trading bots are known as scalping trading bots, and they can be incredibly useful for traders looking to optimize their profits.

Scalping trading bots have a number of advantages:

- They provide fast access to the market, allowing you to make quick trades with minimal effort.

- They’re also able to analyze data quickly and accurately, helping you stay ahead of the market.

- Lastly, they can be programmed with specific parameters, such as risk tolerance and market trends, so you don’t have to manually monitor every trade.

Using scalping trading bots has its drawbacks as well. Since these bots are automated, they may not always make the right decisions or catch the best opportunities in time.

Additionally, relying on scalping trading bots may lead to overtrading if your parameters are set too widely. This could result in significant losses if you’re not careful.

It is important for day traders using scalping trading bots to take precautions and understand their limits and capabilities before investing any money.

Scalping trading systems typical have a great win rate for forex bots,

That way you can maximize your profits while minimizing risks associated with automated trading.

In Summary – Do Day Traders Use Bots To Trade?

In conclusion, using bots for day trading can be a great way to generate consistent profits. The advantages of using a bot are numerous, from increased speed and accuracy when executing trades to the ability to monitor multiple markets all at once.

Some of the more popular types of bots used by day traders include Day Trading Bots, Swing Trading Bots, and Scalping Trading Bots. These bots can earn great money

All of these can enable traders to make decisions quickly and accurately in order to take advantage of market movements.

I personally believe that bots can be an incredibly useful tool for day traders who have the knowledge and experience to use them effectively.

With the right programming knowledge or automated solution, bots can help traders make trades faster and more accurately than they could ever do manually.

They also free up time that would otherwise be spent analyzing markets and allow traders to focus on other aspects of their trading strategy instead.

At the end of the day, it’s important for traders to remember that while bots can certainly help them become more profitable, they still need to understand how they work in order to maximize their efficiency.

Ultimately, it comes down to having good trading knowledge and being able to manage risk appropriately in order for any type of automated trading system – including bots – to be successful.