Choosing the right forex trading broker is the key to success as a forex trader. The wrong broker with bad conditions, slow execution and untimely withdrawals can be a recipe for disaster! With that being said, are FxPro a good broker? We have done a huge amount of research and testing of this broker, so could put together this extensive review of FxPro. Let’s read on…

[WPSM_AC id=655]

Who Are FxPro?

FxPro were founded in 2006 and have been expanding significantly within the past 14 years, voted as the ‘Best Broker’ by the Financial Times

The broker is regulated by four different services, most notably by the UK’s Financial Conduct Authority with the registration number 509956, which indicates that it’s a safe-place to trade.

Offering over 70 different forex pairs with tight spreads, traders benefit from multiple options of platforms including MetaTrader4, MetaTrader5 and their own creation: FxPro Trading Platform. FxPro offers leverages of up to 1:500 which means traders can grow accounts really quicky.

Trading Conditions

Let’s have a look at the trading conditions of FxPro. They offer a high number of 260+ instruments, including over 70 forex pairs, indices, shares, metals and energies which suggests that you’re able to use this broker no matter what your preferences are. As I mentioned in the intro, leverages go up to 1:500 which makes it easy for traders to increase capital quickly and efficiently. Although that’s the maximum you’re easily able to reduce it right down if you’d prefer to.

| Instruments | 260+ |

| Indices/Shares | Yes |

| Leverage | 1:500 |

| Dealing Desk? | No |

| Execution Speeds | Ultra Fast, Most Orders Filled Under 11 Milli Seconds |

| Spread Betting | Yes |

In terms of commission, FxPro don’t charge any spread for MT4, MT5 and Spread betting accounts. When trading forex pairs and metals using a cTrader account there is a small commission fee of $45 for every $1million on the opening position and upon closing the position, however this is supplemented by lower spreads than other accounts.

If you’re wanting to test the trading conditions further I’d suggest creating a demo account to get a feel for the specific conditions surrounding the pair you prefer to trade, but from what I can see the conditions are more than ideal for all types of traders.

Account Types

In terms of account type, FxPro use accounts based on which platform you decide to use, whether that be MT4, MT5 or cTrader. Overall they have five different account types to choose from.

An MT4 Instant account uses forex, metals, indices, energies, futures and shares. You’re able to open trades from 0.01 pips and upwards and it can be used on all types of MT4 platforms

An FxPro MT5 account

A cTrader account

Finally, you have the EDGE account which has instruments in forex, metals,indices, energies, futures and shares. Like the others, you’re able to enter with a 0.01 minimum lot size and its available for use on the FxPro mobile app, the FxPro EDGE web and MT4 platform ranges.

My favourite would have to be the MT4 account, I’ve used MetaTrader4 consistently throughout my whole trading career and regard it as a reliable platform. However FxPro offer a more than substantial range of account options, all with an extensive range of instruments and a great minimum lot size of just 0.01. The broker offers a free demo account

Are FxPro Regulated?

We know by now that regulation is an incredibly important part of choosing the right broker for you because if you sign up to an unregulated broker your money could be at risk. You may fall victim to manipulation and not being granted withdrawals or fair trading conditions which is why I think it’s vital that we look into the regulation of this broker.

As I mentioned earlier they’re regulated by several different regulators:

FxPro UK Limited is authorised and regulated by the Financial Conduct Authority

FxPro Financial Services Limited is authorised and regulated by the Cyprus Securities and Exchange

FxPro Financial Services Limited is authorised by the Financial Sector Conduct Authority (authorisation number 45052).

FxPro Global Markets Limited is authorised and regulated by the Securities Commission of The Bahamas

The FCA are the best regulators by far and can ensure your money is really safe with the broker. As you can see FxPro is highly regulated, which means they’re not able to accept clients from certain countries, including the USA.

| Risk | Extremely Low |

If you are from America then trading with an unregulated broker is probably your best option. I would recommend checking out Hugosway

Trading Platforms

This broker has a few different platforms for retail traders to use: MetaTrader4

| MT4 Platform | MT5 Platform | cTrader Platform |

| Basic Charting Tools | Basic & Advanced Charting Tools | Advanced Charting Tools |

| Good Execution & Order Types | Great Execution & Order Types | Excellent Execution & Order Types |

| Free To Use | Free To Use | Free To Use |

MT4 and MT5 are both platforms I’ve used before myself and have had really good experiences with so I can also vouch for those, should you want to stick to those. cTrader is personally my favourite platform and I actively use it with my IC Markets account

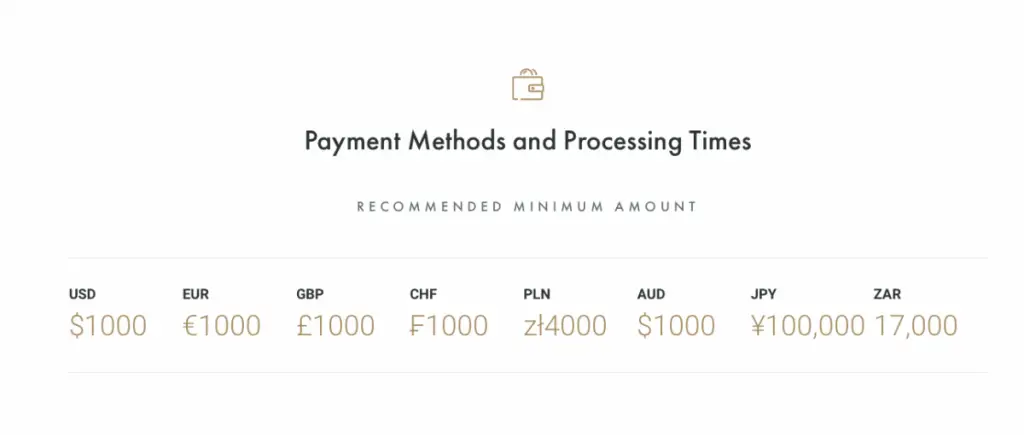

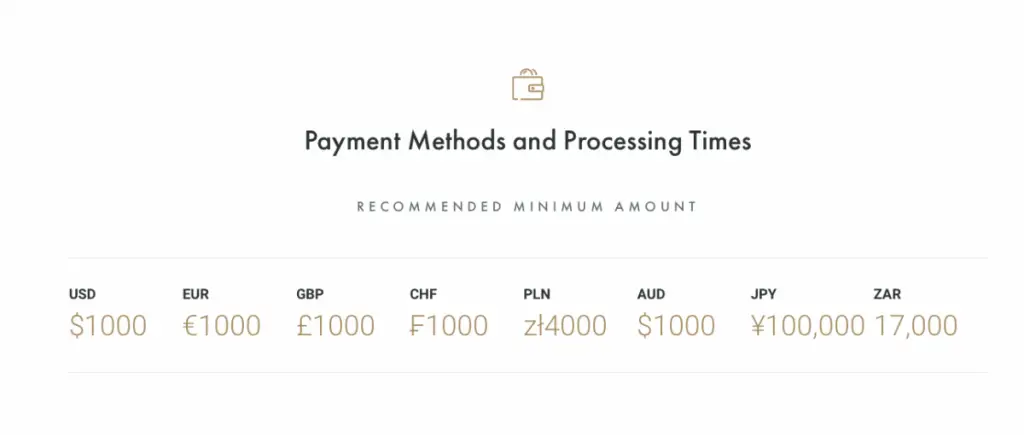

FxPro Deposit & Withdrawal Methods

FxPro accept several methods when depositing funds into your account, including;

| Bank/Wire Transfer |

| Credit Cards |

| Debit Cards |

| PayPal |

| Neteller |

| Skrill |

I should mention that you need to use the same method you used to deposit your funds to withdraw any funds too. All methods are extremely fast and deposits are done instantly, though they do of course take a bit longer with wire transfers.

Typically, withdrawals are processed within 48 hours although usually a bit quicker. There are $0 fees on deposits and withdrawals by FxPro, though there’s a chance you might have to pay a small transfer fee when you choose wire transfer, depending on your bank.

During my research I picked PayPal and had no issues whatsoever but I’d suggest getting in contact with the support team for help if you feel you need it.

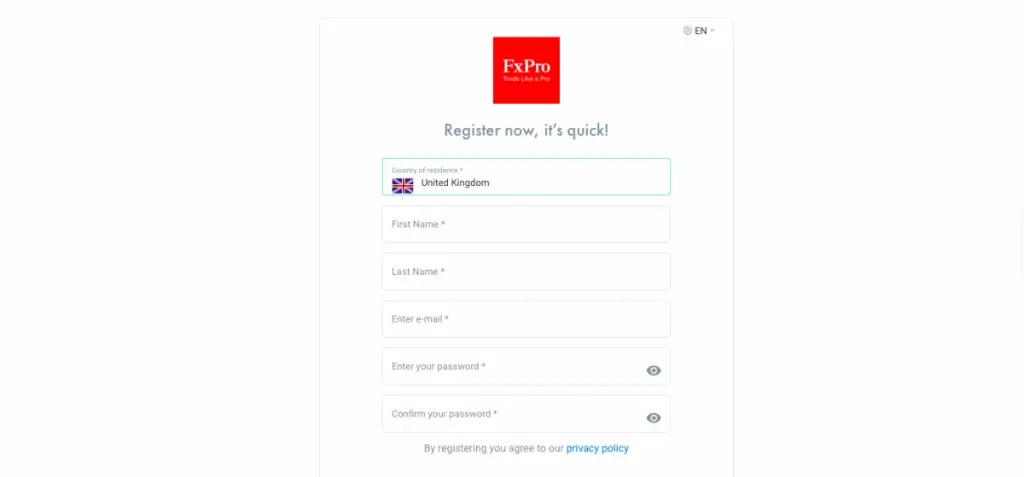

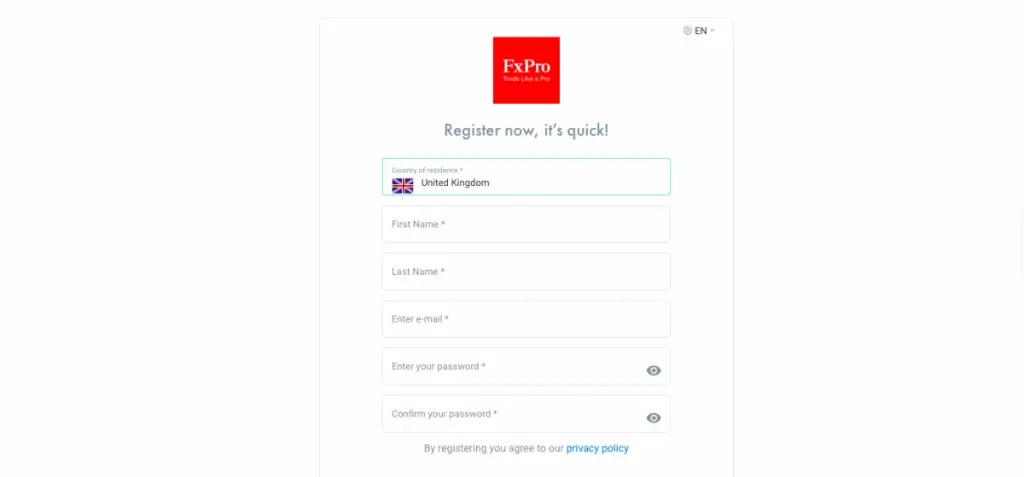

Setting Up An Account

I found setting up an account with FxPro really easy. Click ‘Register’ in the top right hand corner of the screen and you’ll be asked to fill out a few details including your name, email and you’ll have to choose a password. You’ll have to fill out more details including address, date of birth, your trading experience (which I think is a testament to how they cater to individual traders) and finally a small test about financial markets knowledge. You’ll be free to fund your account once it’s been verified.

Click here to sign up with FxPro now!

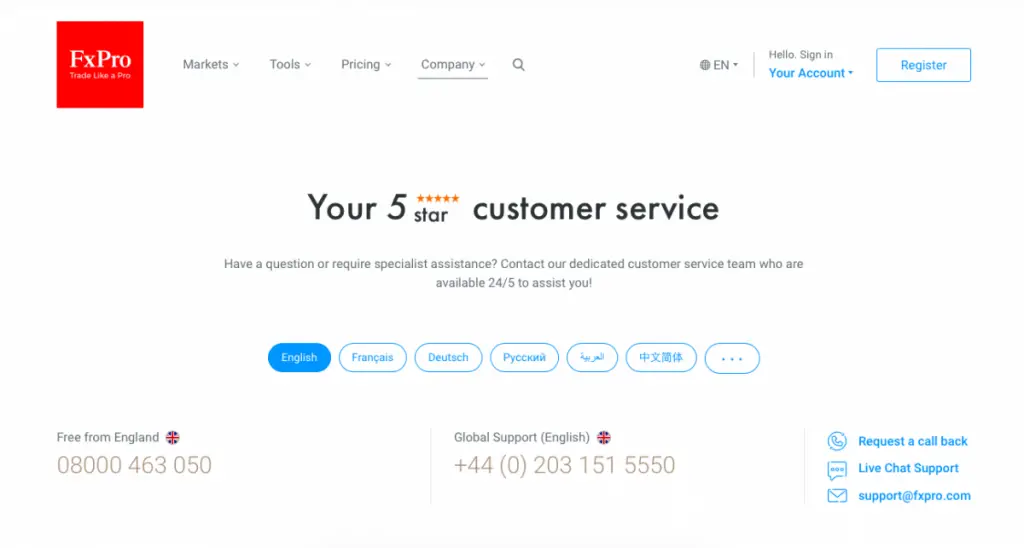

Client Support

It’s essential to be able to access support from a broker if you have questions regarding anything to do with your trading account. FxPro has a really reliable and helpful support team, I used the email to get in touch when I had questions about which account they thought I should use and they were quick to help and guide me in the right direction. You can contact FxPro here:

| support@fxpro.com | |

| Number | 08000 463 050 (UK) |

| +44 (0) 203 151 5550 (Global) | |

| Live Chat Support 24/7 |

You’re also able to request a call back if you want them to give you a call! Overall there seems to be a good range of ways to get in touch with the broker and my experiences with their customer support have been positive.

FxPro Reputation & Reviews

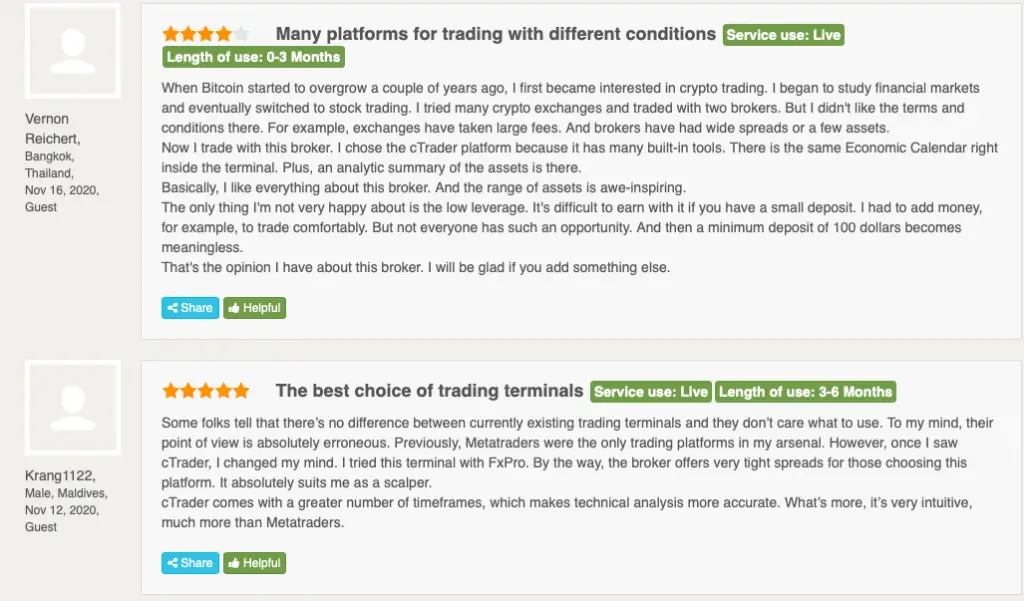

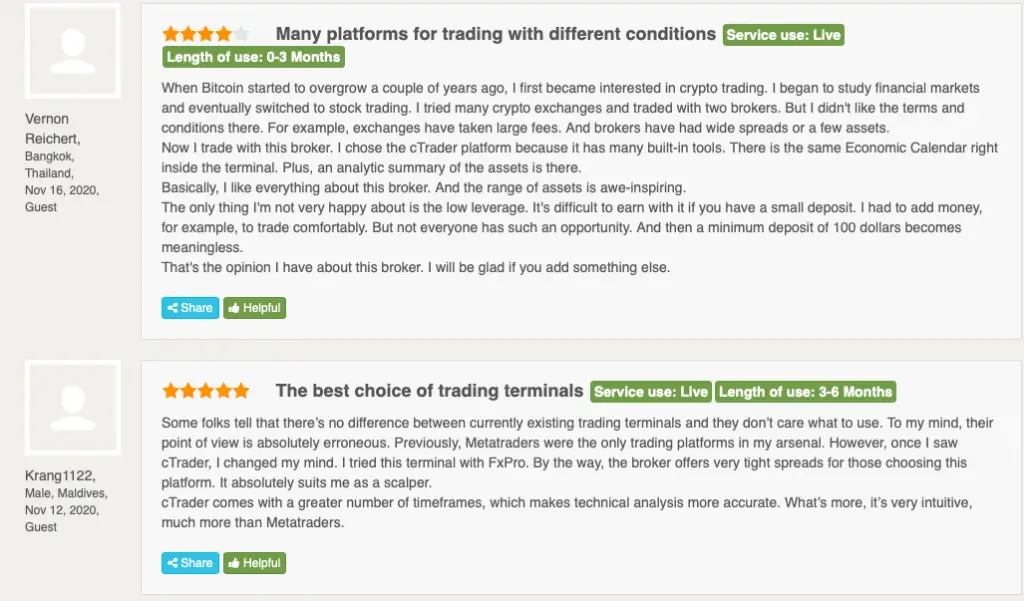

Though I’ve given a pretty in depth review of the broker, it’s always useful to have a look at forums where you can get access to what thousands of other traders are saying about the broker. The general consensus surrounding FxPro seems to be really positive and I’ve included some links/pictures/examples below about what other people have been saying and how their experiences have been with the broker.

Trustpilot                        | 3.9/5 |

ForexPeaceArmy                        | 2.7/5 |

Investopedia                        | 3.8/5 |

Conclusion

In summary, FxPro is a great forex trading broker to use! They’re able to offer up to 1:500 leverage, with great tier 1 liquidity and over 250+ pairs to choose from! They offer great withdrawal and deposit options and have top tier regulation from the governing bodies, including the FCA.

Sign up to FxPro now!