The bearish engulfing is a candlestick pattern that is widely known in the forex trading industry. You’d be hard pushed to find a trader that didn’t try to enter a trade based off a bearish engulfing pattern at some point in their career. Whether you’re a swing trader, a day trader or even a cryptocurrency trader, there is always a place for the bearish engulf.

A lot of traders don’t find success trading the bearish engulfing and that’s simply because they follow the candlestick blindly! The pattern alone isn’t enough of an edge to trade the markets profitably or successfully over the long term.

In this article we are going to break down everything you need to know about the bearish engulf so you can decide whether or not to use it in your trading!

What Is The Bearish Engulfing Pattern?

The bearish engulfing is one of the most widely used candlestick patterns by traders. The actual pattern is very simple too and it’s repeated in the charts constantly on all pairs and all time frames.

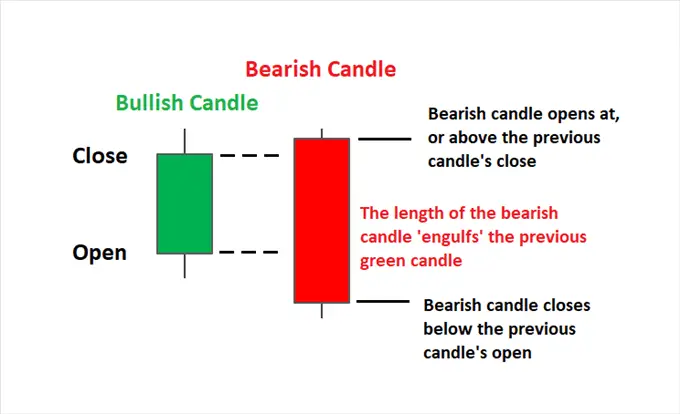

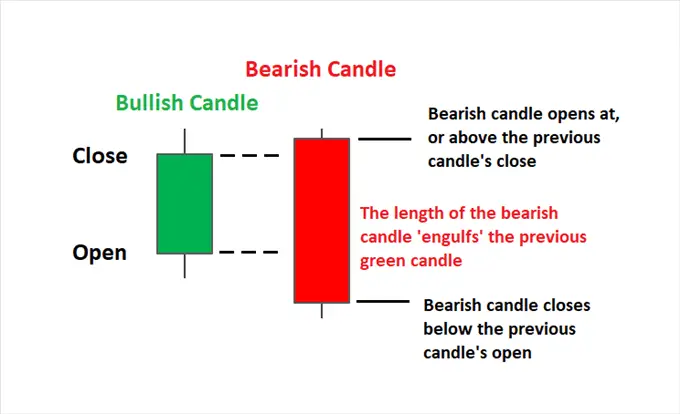

You need 2 things to form a valid bearish engulfing:

- A bullish candle first, whether large or small.

- This will be followed by a bearish candle that is larger than the bullish candle. The bearish candle will close below the open price of the previous bullish candle, hence ‘engulf’. It must cover the candle body and wick.

These are extremely easy to spot and traders on the lower time frames will see hundreds of these candlestick formations each day in high volume markets.

It’s worth noting that this is the exact kind of strategy that could be turned into a forex trading bot

How To Use The Bearish Engulfing Pattern In Your Trading

There are multiple ways to use the bearish engulfing pattern to enter forex trades. Let’s take a look at 2 ways I use the candlestick to gain an edge in the market…

1. Bearish Engulf At Support/Resistance

One way to use the bearish engulfing pattern is to utilise it at support and resistance levels, with the trend. This is a very simple way to trade the markets but with the correct risk management it’s a great way to get started…

In this example on AUDCHF, you can see multiple confluences coming together to form a trading setup. Firstly, price is trading underneath the 200 EMA

This is the perfect example of using a bearish engulfing candle alongside a resistance level to create a trading setup.

2. Bearish Engulf Scaling Into Trades

One of the most useful things about bearish engulfing candlesticks is the fact they’re very common. This means that during a long move, you could use the engulf to enter multiple times.

On the AUDJPY chart shown above, we are selling from a weekly high, using the daily time frame. After the initial entry (somewhere around the high), we could have scaled into the position 6 more times using bearish engulfing candlesticks for entries!

This is a very advanced trading technique because it’s really not as simple as it seems. The logic/idea behind it is to add positions without ever increasing risk in the trade. Essentially, you bring your top positions stop losses in, reducing risk, then add that risk back into the market with a new position when a bearish engulf entry signal appears.

This way, you can greatly increase your take profit value without ever increasing your stop loss value. It’s a very good technique for serious traders to capitalise on and bearish engulfing candlesticks could be an easy way to time your scale ins!

I Took 100 Bearish Engulfing Trades – The Outcome

Back in early 2021 I decided to see if the bearish engulfing had an edge, on it’s own, once and for all. I assumed there was no edge and I would be sitting around breakeven if I took 100 trades, but is this what happened?

The rules:

- 4H chart

- If below the 200 EMA, sell signal on bearish engulfing

- If above the 200 EMA, no sell signal on bearish engulfing

- Stop loss placed at the high of engulfing candle

- Take profit placed at 1:2 RR

I took 100 trades and ended up in a small loss.

I would have short winning streaks, only to be beaten down by a long string of losses, even with a 1:2 RR. To me, this is exactly what I was expecting and proves that candlestick patterns on their own have absolutely no edge in the market!

I’d very much encourage you to try this one at home on Tradingview

Why The Bearish Engulfing Candlestick Pattern Is Useless To Traders

There is a fundamental issue with any type of candlestick pattern, including the bearish engulfing. If we are looking at price, the actual movements in price, then a candlestick has no meaning at all. A candlestick cannot have any power or influence in the price of a currency as we are only seeing the result of price movement during that set time.

What do I mean by this?

Well, on the NZDJPY daily chart here, there is a huge bullish engulfing candle indicating a massive amount of buying pressure, right?

If we break that daily candlestick down into what it’s made of, there is just some consolidation and no push up in price at all. The daily chart is showing a bullish engulfing purely because of what time the candle closed and it’s got nothing to do with price movement.

This example proves how you can be under the impression that there is momentum in the markets, due to a bearish or bullish engulfing, when in reality there isn’t any momentum at all. This is the same across the board with all candlesticks, so it’s something to bare in mind.

What NOT To Do With A Bearish Engulfing Pattern

Building on my last point in the section above, there is a lot of trades with bearish engulfs that should be avoided. It’s important to understand that bearish engulfs are not powerful. When you have institutional players moving the currencies, or economic factors moving currency, what are the chances that will get stopped by a bearish engulfing candlestick? Literally none!

Don’t just trade a bearish engulf, for the sake of it!

You can stack confluences and get good trading opportunities out of using bearish engulfs, if done properly. However, if you open trades with just the confluence of having a bearish engulf, you will have a horrendous win rate and a low risk to reward.

In Conclusion – How Do You Trade The Bearish Engulf?

In summary, the bearish engulf is a candlestick pattern used by forex traders (Like Karen Foo) in all kinds of markets. The candlestick pattern, on it’s own, has no edge, so I would recommend stacking it with a range of different confluences and analysis factors to make it worth trading.

In this article, we have learned:

- What a bearish engulfing pattern is

- How to trade a bearish engulfing

- Using the bearish engulfing with support and resistance

- Using the bearish engulfing to stack trades

- Why the bearish engulfing isn’t powerful

- What NOT to do with a bearish engulfing

- The result of 100 bearish engulfing trades

If you have any questions or any experience trading the bearish engulfing, please do leave a comment down below – I’d be very curious to hear your feedback!