If you’re tuned into the online forex trading and prop firm scene, you’ve likely heard the buzz surrounding MyForexFunds and its recent asset freeze, courtesy of the CFTC.

MyForexFunds, once a major player in the prop trading industry, now finds itself in hot water with regulators.

In this article, we’ll delve into the charges against MyForexFunds, the reasons behind this predicament, what the future holds, and crucial tips to avoid falling prey to shady prop firms. Let’s dig in!

MyForexFunds Assets Frozen – The Why and How

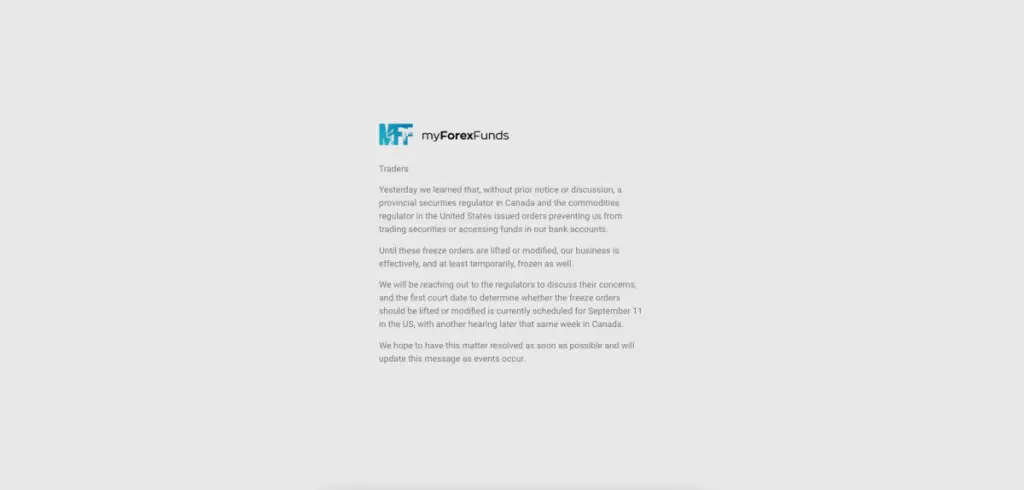

As of August 29, 2023, MyForexFunds, operating under Traders Global Inc and led by forex industry figure Murtuza Kazmi, had its assets frozen and its books subjected to scrutiny by the CFTC.

The findings of this investigation will be revealed after a preliminary injunction hearing scheduled for September 11, 2023.

According to the CFTC’s complaint filed before the UNITED STATES DISTRICT COURT FOR THE DISTRICT OF NEW JERSEY, here are the charges against MyForexFunds:

- False Claims: MyForexFunds allegedly made misleading claims such as “we only make money when you do,” when, in reality, they acted as the counterparty to all customer trades.

- Manipulation Tactics: The firm is accused of using tactics to minimize customers’ chances of profitable trading. This includes terminating customer accounts, deceptive trade commissions, and custom software designed to ensure trades are executed at unfavorable prices with larger spreads, resulting in increased customer losses.

Two Types of Prop Firm Business Models

In the world of online prop firms, there exist two fundamental business models, and MyForexFunds belonged to the first category:

1. Ponzi/Pyramid Model (MyForexFunds): This model redistributes losing traders’ fees to profitable traders looking to withdraw. It relies on a constant influx of new traders to pay out profitable traders.

2. Real Money Model: This model operates based on real market activities, using actual trading capital. Profitable traders are paid from the profits generated by their trades, not from losing traders’ fees.

MyForexFunds Business Model Demystified

MyForexFunds lured in approximately 135,000 traders since November 2021 and collected over $310,000,000 in trading fees.

However, many traders were unaware of the slim chances of success with this firm.

MyForexFunds adopted a Ponzi-style business model, which can be broken down as follows:

- You sign up for a trading challenge, hoping for funding.

- If you succeed, you receive login details for a demo account.

- You trade profitably on the demo account and request a withdrawal.

- MyForexFunds pays your withdrawal using the fees collected from new sign-ups.

This model forces MyForexFunds to continually attract new traders to pay out profitable ones, making withdrawals a costly affair for the company. Manipulative practices, like altering spreads, misleading commissions, and account terminations, were allegedly used to boost the firm’s profits.

Real Money Prop Firms use this business model:

In contrast, firms that offer real trading capital follow a different path:

- You sign up for a trading challenge.

- If you succeed, you receive login details for a real-money-funded account.

- You trade profitably on the live account and request a withdrawal.

- The firm pays you your share of the real profits from the brokerage account, without any loss incurred to the firm.

This model aligns the prop firm’s interests with the trader’s success, as there’s no redistribution of losing traders’ fees.

Reducing Risk with Real Money Prop Firms

To safeguard your trading endeavors from shady prop firms, consider trading with real-money prop firms exclusively. Many large prop firms utilize the Ponzi-style model, making regulatory intervention a looming threat. Real-money prop firms offer a safer haven for traders.

In Summary – Why MyForexFunds Got Frozen

In closing, MyForexFunds is under investigation for allegedly engaging in unethical business practices, leaving some 135,000 traders disillusioned. While regulatory actions against such firms may not be surprising, they serve as a cautionary tale for all demo/pyramid-style prop firms in the industry.

If your aim is to become a funded trader with a prop firm, opt for real-money prop firms. Compliance won’t be an issue for firms that offer traders real capital, aligning their success with the trader’s profitability.

When regulatory scrutiny intensifies, traders with real-money prop firms will be better positioned to thrive.