With so many new prop firms coming into the market and offering forex traders funding of up to $1,000,000, it can be a tricky task to figure out which firm is going to be the best for you to be working with. Each prop firm has their own pros, cons and rules which can make or break them for forex traders, depending on how you like to trade the markets!

In this article, we are going to be looking at MyForexFunds

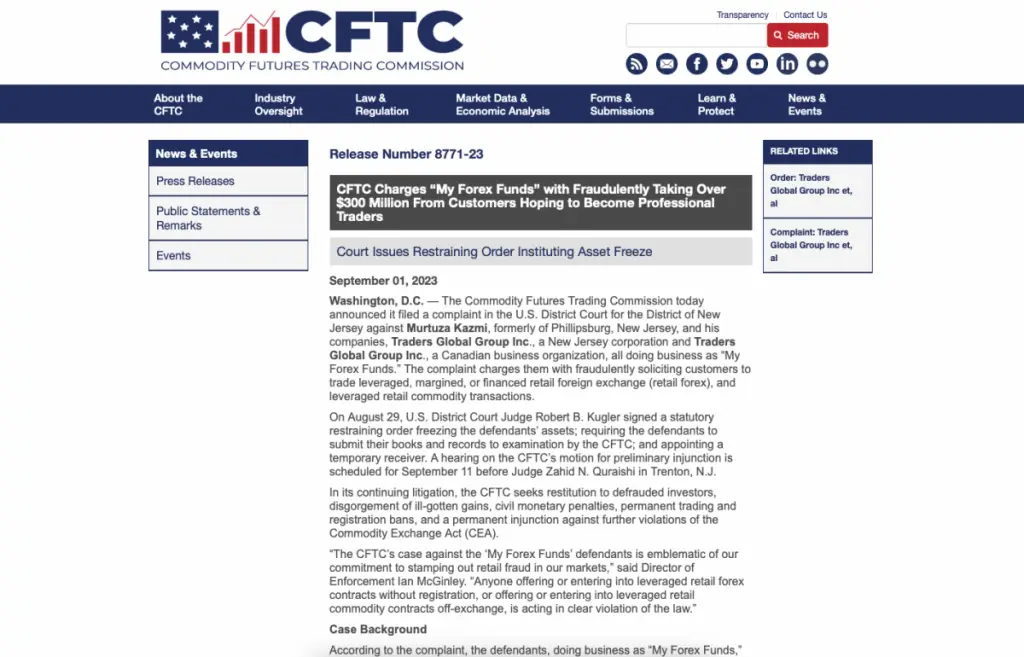

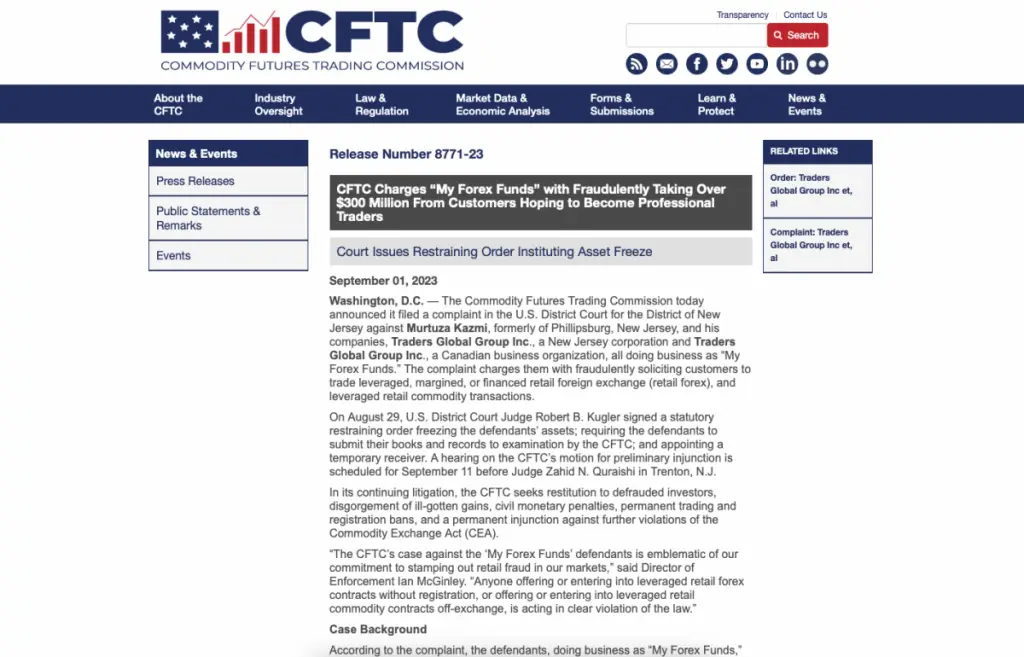

IMPORTANT UPDATE! MyForexFunds has now had their assets frozen by the regulators. They have halted all trading operations as of September 2023. Please see the full breakdown on the CFTC website here.

My Forex Funds

MyForexFunds is a new prop firm founded in 2020, offering traders up to $50,000 in instant funding with no challenge needed! If you fancy taking on a performance challenge, you can obtain up to $200,000 of initial funding and a profit split of up to 85% with no maximum daily drawdown limit!

- Very Established Prop Firm

- Huge Payouts

- 85% Profit Split

- Instant Funding

Who Are MyForexFunds?

MyForexFunds

As I keep updating this article every few weeks, it’s becoming clear that this was the fastest growing prop firm in 2022 and is still holding strong in 2023!

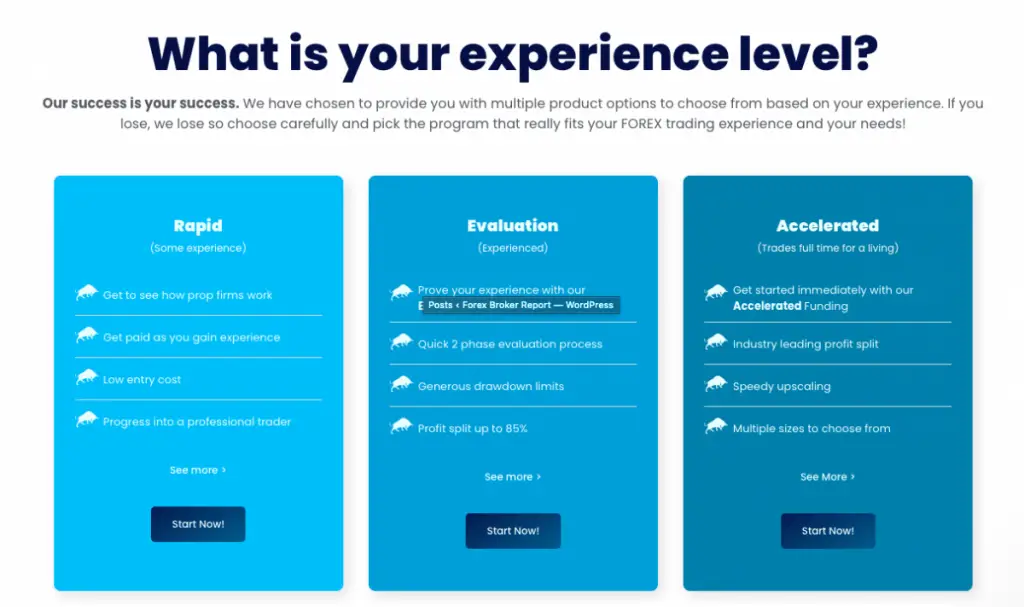

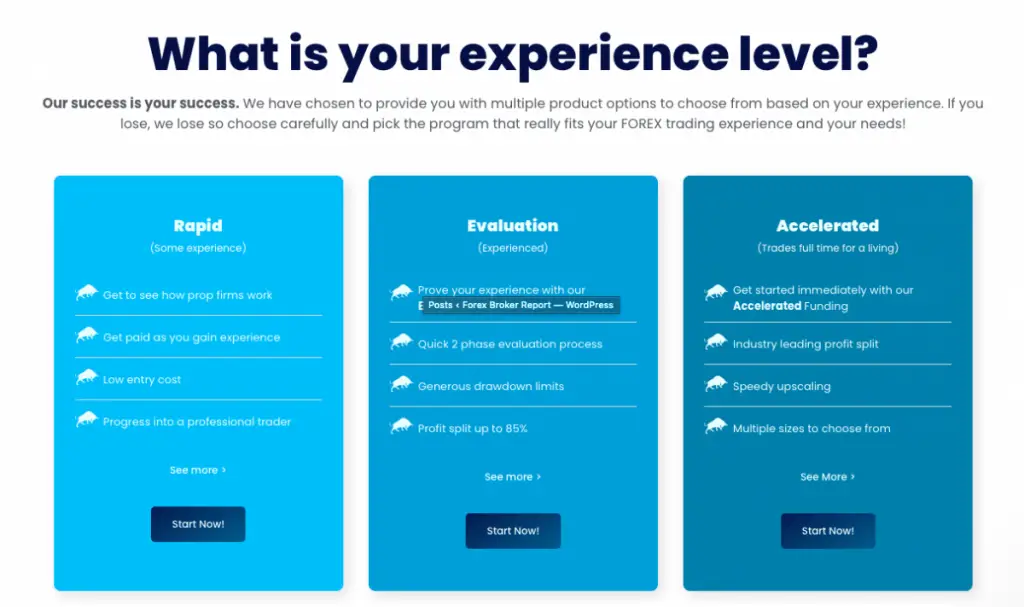

Unlike a lot of companies offering to fund forex traders, they have 3 different levels or structures, depending on your experience as a trader, ranging from brand new to full time traders!

If you’re looking to grow a large trading account and potentially pull large profits out of the markets, this could be the company for you… Let’s find out more about the pros and cons and how MyForexFunds

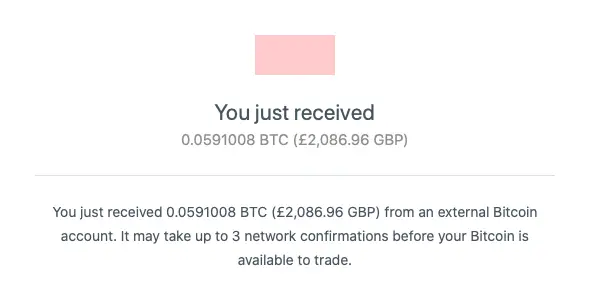

Payment Proof – My Withdrawal From MyForexFunds

Whenever I am looking at prop firms and brokers, I really like to see payment proof. Without payment proof from other traders, even with good reviews it can be hard to trust a company that seems too good to be true.

Luckily, MyForexFunds are consistently paying my withdrawals! I contact the live support team at the end of the month to request a withdrawal.

At the time of my latest withdrawal, they mentioned that they usual payment processor was having a few delays but I could either wait 3-5 days, or take a crypto withdrawal instantly if I wanted. I opted for the crypto withdrawal and they paid me my profits the same day – I’m very impressed with how quickly the payment actually arrived.

The Withdrawal Process

I have now had 4 withdrawals from MyForexFunds, all of which were paid on time and in full. I contacted the support team for assistance and they were extremely helpful. In terms of the bitcoin withdrawals, it seemed to work within 2 stages…

- Your withdrawal gets approved. This stage has been taking on average 2 days for me in the last few months.

- Your withdrawal gets processed. From the actual time of processing, to arriving in my cryptocurrency wallet was about 30-45 minutes.

I have now started taking withdrawals directly to my bank, instead of using Cryptocurrency wallets. This is a big relieve for me and many other traders, I’m sure, as Crypto is a bit of a hassle when you’re dealing with company accounts.

Getting Funding From MyForexFunds

As mentioned previously, they are offering 3 different types of account depending on your experience levels, which is great. Throwing a new forex trader in with a $100,000 live account and very strict rules is quickly going to end in disaster, so breaking down the different categories depending on experience seems like a really nice idea and that makes MyForexFunds quite unique from other forex prop firms

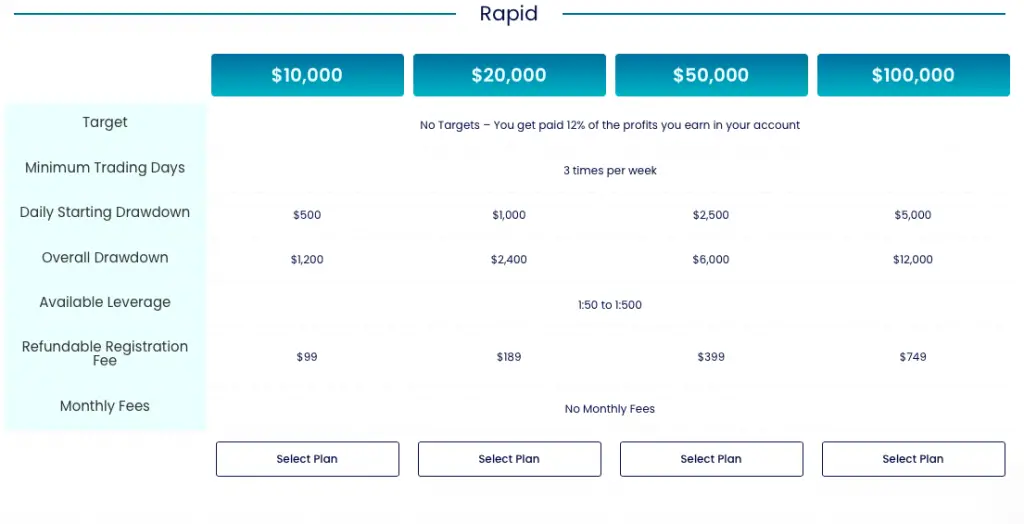

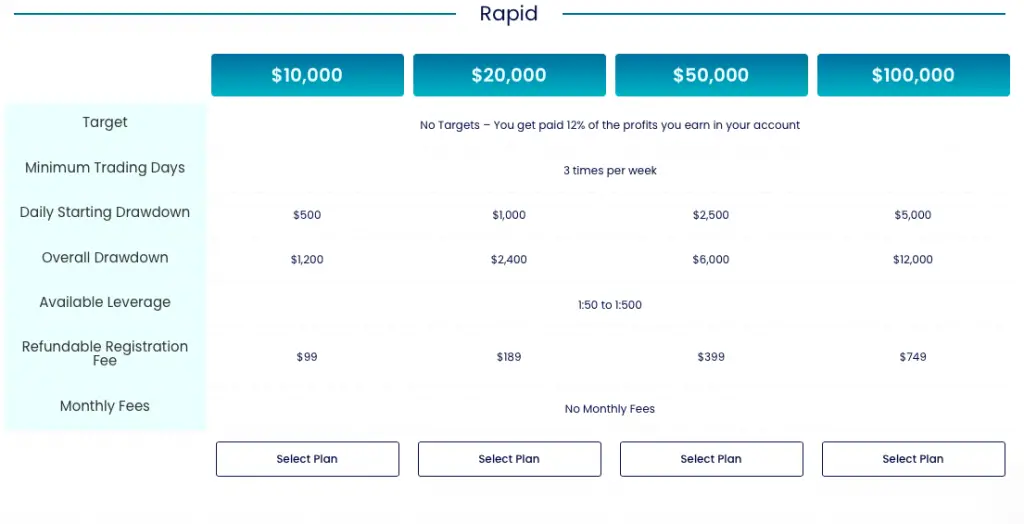

Rapid Account

The rapid account option is for traders that are either just reaching consistency, or haven’t been in the markets for too long. With a rapid account, you will pay a one time, refundable fee (depending on if you are profitable or not), which allows you to trade a demo account for the company.

You have very relaxed rules on these accounts, for instance a maximum daily drawdown of 5%, with a total maximum drawdown of 12%. Leverage ranges from 1:50-1:500 and you must trade at least 3 times per week. The best thing is that you don’t have any profit targets! However, 12% of what you make on the demo account will be paid into a live account for you.

This means you can literally trade a demo account, practice in the markets, grow your trading experience and they will pay you real profits for the privilege!

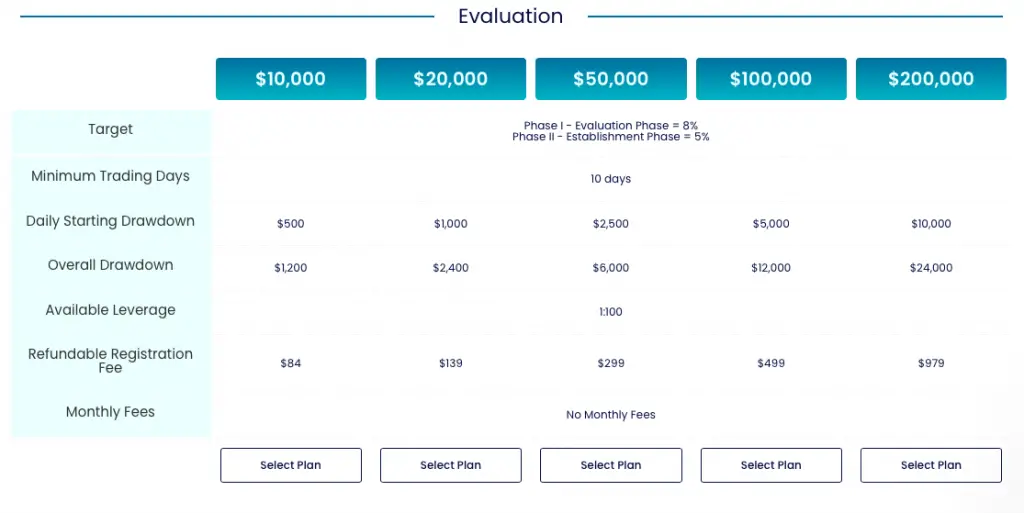

Evaluation Account

Next we have the evaluation accounts, ranging from $10,000 to $200,000 in funding. This is going to be for profitable traders that experienced within the financial markets. You will be paying a one time fee for a 2 step challenge, very similar to FTMO

The profit split will be up to 85%, should you pass the challenge process, which is industry leading! You have to trade for a minimum of 10 days during the 30 day process and through the 60 day stage 2 challenge too. You’ll have a maximum daily drawdown of 5%, with an overall maximum drawdown of 12%. The profit target is 8% in stage 1 and 5% in stage too, which again is one of the easiest to pass in the industry! Leverage for these accounts is fixed at 1:100.

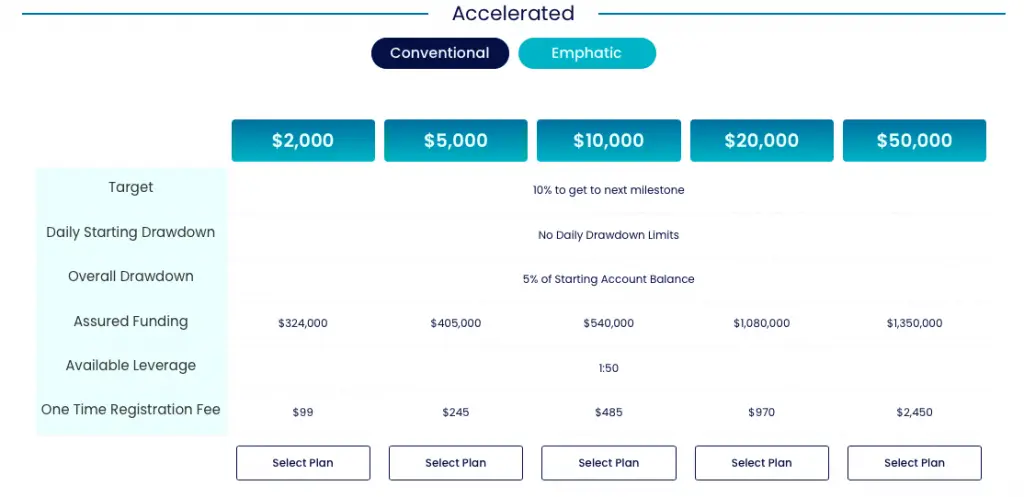

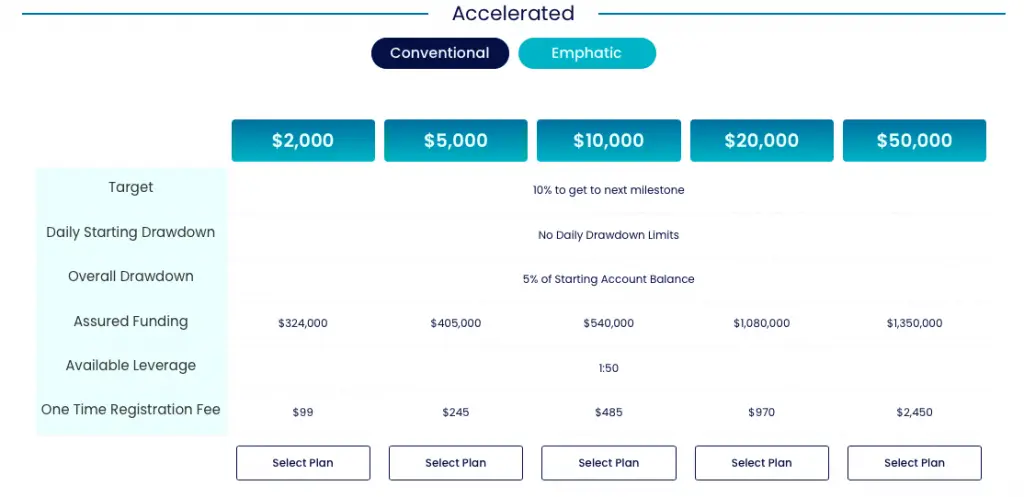

Accelerated Accounts

The accelerated accounts are my favourite funding method offered by MyForexFunds. This is instant funding, with no challenge, no verification and no monthly fee! You will INSTANTLY have access to the trading capital, ranging from $2000 to $50,000. This is more expensive than doing a challenge of course because the company is taking on much more risk than they do by checking your performance first, so that is why the $50,000 account commands such a high price ticket.

Two account types are offered, with conventional and empathic. They are both exactly the same, apart from the fact that the perimeters have been doubled for empathic accounts. This means that the next milestone to increase funding requires 20% gain, rather than 10%, the overall maximum drawdown is 10%, rather than 5% and the initial fee is doubled as well!

This is by far my favourite way to quickly access trading funding, whether you’re looking to test a strategies viability within the live markets or pull profits out to grow your own accounts, instant funding

MyForexFunds

MyForexFunds is a new prop firm founded in 2020, offering traders up to $50,000 in instant funding with no challenge needed! If you fancy taking on a performance challenge, you can obtain up to $200,000 of initial funding and a profit split of up to 85% with no maximum daily drawdown limit!

- Very Established Prop Firm

- Huge Payouts

- 85% Profit Split

- Instant Funding

What Makes MyForexFunds Different From Any Other Prop Firm?

There isn’t much to differentiate MyForexFunds from any of the other leading prop firms

Being similar to other leading proprietary funds really isn’t a bad thing though, especially if you’re a profitable trader. Let’s say that hypothetically you are trading with FTMO and have $100,000 in funding.

You then set up a trading copy system

How Does MyForexFunds Compare To FTMO?

FTMO

It’s extremely hard to pick apart either offering – I’ve been a loyal fan and customer of both prop firms for a long while now and I think they both have their place.

I would agree that FTMO has more of a backend and infrastructure in place as they’re further along their journey into corporate growth. On the flip side, I really don’t see this as an issue and I have always received all the support I needed from the MFF team.

I personally take the stance of, ‘I’d rather work with 2 prop firms, than 1’. This is purely because I setup copy trading tools to replicate my trades onto multiple accounts

Apologies if this wasn’t the clean cut answer you were hoping for – both of the offerings are absolutely brilliant!

How Is MyForexFunds Comparing To TheFundedTrader?

TheFundedTrader

With that being said, which do I prefer?

I have worked with MyForexFunds and TheFundedTrader over the last 6+ months and I would say that their offerings are incredibly similar. Both companies follow the standard challenge model that FTMO created many years ago.

In terms of the capital on offer, both companies are in the same ballpark. I would argue that TFT has better marketing and more on offer for traders, in terms of gimmicks. I believe that MFF offers much less in this arena but I don’t gauge that as being overly important.

As of right now, I am still leaning more forwards MyForexFunds purely as they have stood they test of time and been around for longer. Not only that, they have twice as many reviews on popular forums.

In all honesty, I am funded with both of these competitors and I couldn’t be happier – I would highly recommend reading my full The Funded Trader review

Is Getting MyForexFunds Capital Realistic?

As good and shiny as a new prop firm is, we really need to consider whether the trading objectives and accounts offered make it possible to get capital and get capital quickly.

MyForexFunds is one of the easiest prop firms to get funding from for a number of good reasons…

- The accelerated accounts offer instant funding, with absolutely no verification or performance based challenge needed.

- The rules are very lenient with no daily drawdown limit and a low percentage gain needed.

- The time duration of the challenges are great.

- The rapid program for beginners has no profit target, a great way to start scaling up your forex trading capital and skills.

For these reasons, I would honestly say that if you’re looking to get quick funding and highest chance of actually obtaining forex capital, this company is going to be your best option right now! Beyond TheFundedTrader

Which Brokers Do MyForexFunds Use?

Forex prop firms are completely different from brokers in many respects. They very rarely have access to liquidity or the actual markets, so they will usually rely on reputable forex brokers to host their clients funded accounts, which is exactly what MyForexFunds do.

They are currently using FxPig

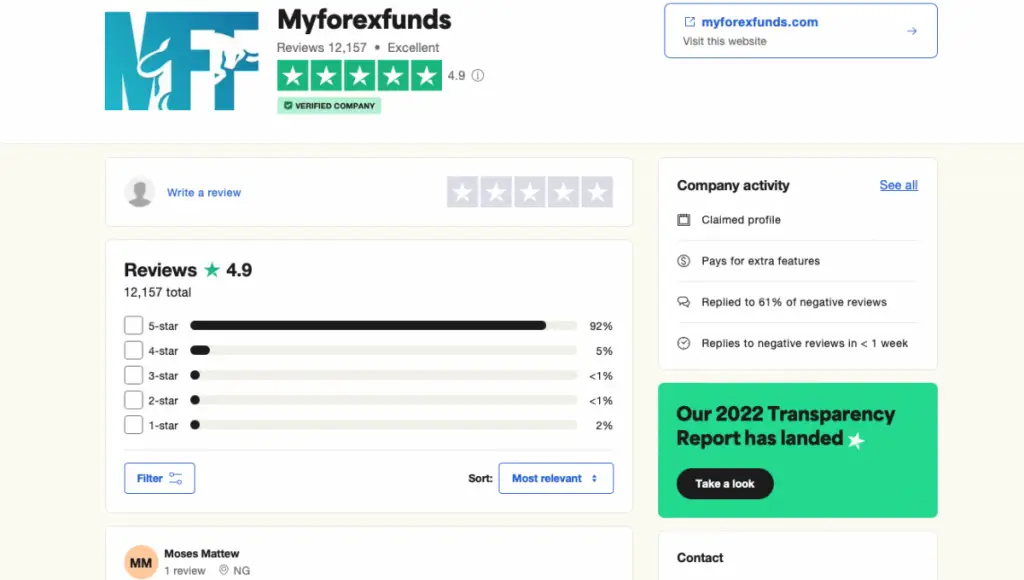

MyForexFunds Reviews – What Are Traders Saying?

MyForexFunds

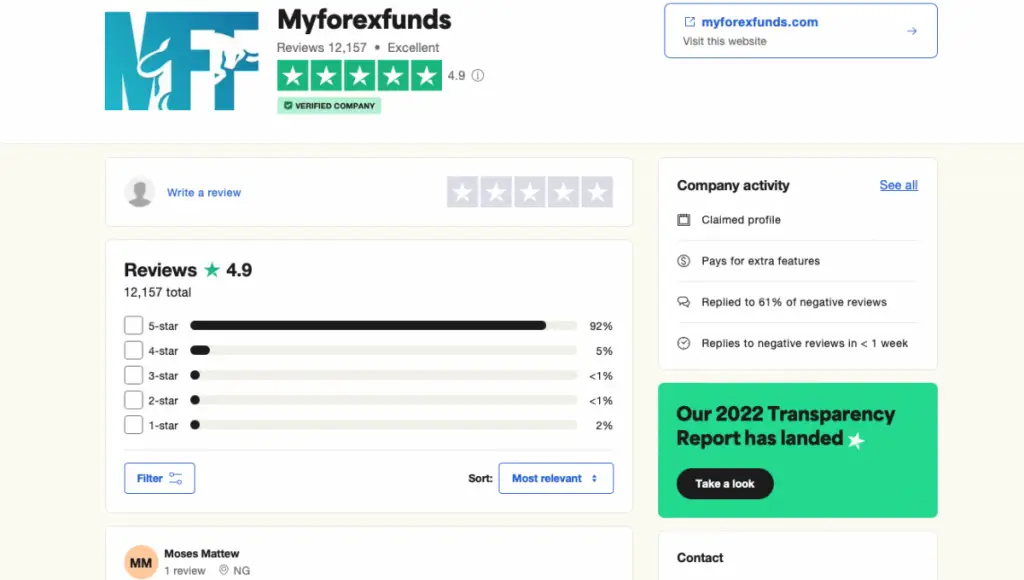

The sustained growth gives me a lot of faith in this firm as a funding option for traders.

The buzz around the company over the last few months has been very much noticeable. When I first wrote this article, back around June 2021, the company bare had any reviews. Within the last few years there has been literally thousands of reviews from traders using MyForexFunds every month – which is amazing to see!

On Trustpilot

Like I said, the company is growing at an amazing rate – there’s really been a huge increase in attention for the company and therefore reviews from traders.

One aspect that traders seem to be absolutely thrilled with is the high profit splits! MFF currently have the largest profit split out of all the prop trading firms in the industry and traders are really loving it – if the forums are anything to go by!

Education & Support For Traders

If we are looking at the education side of things, you’ll know that I am a big believer in learning elsewhere using the free resources that are online. Places like Babypips

With that being said, MyForexFunds is soon to be offering a trading academy, which will be packed full of educational content for us to consume. I cannot fully critique this as it’s not actually out currently, but I will update this section once the academy has been launched.

In regard to supporting traders, they are offering a Discord server, live chat and email support 24/5, in order to get to your query as fast as possible.

The trading volume per month is now sitting at over 100,000,000,000+, which is great to see! Since I have been trading with the company over the last few months, with the increase of new traders, I’ve noticed a huge increase in the quality of support for traders. The time in which is takes to get a response from the team has decreased massively, there is also now a live chat function which can help answer any small queries you may have.

Successful Trader Interviews

Over the last few months, MyForexFunds has started interviewing some of the most successful traders using the funded accounts. This is something that FTMO

This interview was done by Irma, a trader using the Rapid accounts available as she wanted to start trading faster, without having to go through a long challenge process. Irma trades using the previous days highs and lows to decide her trades for the day, boasting a hugely impressive 9/10 win rate. Irma mentioned in the interview that MFF have never missed a withdrawal (likewise with me) and she cannot fault the company at all!

I’d definitely recommend having a read of some of the other traders interviews

The Founder Of MyForexFunds – The Man Behind The Brand

It’s lovely to see that MFF isn’t some faceless brand like many of the other competitors within the industry. The prop firm is fairly open about the founder, Murtuza. He has actually been kind enough to partake in various interviews with influencers within the forex trading space, as shown below.

If you’re interested in hearing more about how the worlds fastest growing funding option was founded, I’d certainly give this interview a listen.

In all honesty, I didn’t find too much value in this as I’m not overly worried about the backstory and the behind the scenes. In my opinion, as long as everyone is getting paid and the trading conditions are fair, that’s all I’m worried about!

Conclusion – Is MyForexFunds Another Clever Scam?

So, now it’s time to make a decision at to whether or not this company is worth getting forex funding from…

MyForexFunds is a legitimate prop firm and frankly, one of the best in the industry. The whole unique selling point of offering an instantly funded trading account, an account specifically for beginner traders, a relaxed trading challenge, 1:50-1:500 leverage and a great profit share is sure to attract more traders to the company over the next few years.

I would personally recommend the accelerated account, as this is the fastest way I have ever seen to obtain a large amount of trading capital, without having to do any type of performance based challenge for weeks at a time.

As shown in this review, I have received multiple withdrawals from MyForexFunds so I can say without a doubt that the company is legit and paying traders.

MFF is essentially a perfect blend of BluFx and FTMO