With most profitable forex traders making 3-5% gain per month, on average, it can be really hard to reach the level where you are able to trade full time. Although the barrier of entry in forex trading is very low to get started, you will need a large amount of capital to take this industry seriously if you are getting average returns in the market.

This is where prop firms come into the mix, offering funded accounts to forex traders getting consistent returns…

True Forex Funds is a relatively new prop firm offering funded accounts to forex traders, ranging from $10,000 to $200,000. The accounts come with an 80% profit split and great trading conditions – it’s clear to see why the company is now on our top rated prop firms list

Lux Trading Firm

Lux Trading Firm are a highly rated prop firm offering initial funding of up to $150,000 with a 75% profit split.

As well as the initial funding, there is no time limit on hitting profit targets, weekend holding is allowed and they offer an amazing scaling program up to $10M, making it a perfect funding option for swing traders and day traders.

- Real Money Funding

- Brick & Mortar Business

- Great Reputation

- Funding Up To $10,000,000

Who Are True Forex Funds?

True Forex Funds

Although the company is funding traders worldwide, they are based in Hungary. There seems to be more and more prop firms coming out of eastern european regions, which is something to keep our eyes on in the future.

True Forex Funds offer traders funded accounts ranging from $10,000 to $400,000, with the option to scale to $400,000 for those traders getting extremely consistent results.

The trading conditions and rules are very similar to some of the world’s leading prop firms like FTMO

Sounding good? Let’s find out some more…

MyFundedFx

MyFundedFx is proving to be one of the worlds most popular prop firms, taking over the industry in the last few months. MyFundedFx offer an innovative 1-step funding process, allowing traders to get funded from just 1 trade, potentially!

- Great Reputation

- High Levels Of Funding

- 1 Step Funding

Getting A Funded Account From True Forex Funds

When it comes to getting funding from True Forex Funds, it’s a very simple process and a process that you will be very familiar with if you have ever looked into some of the industries largest prop firms

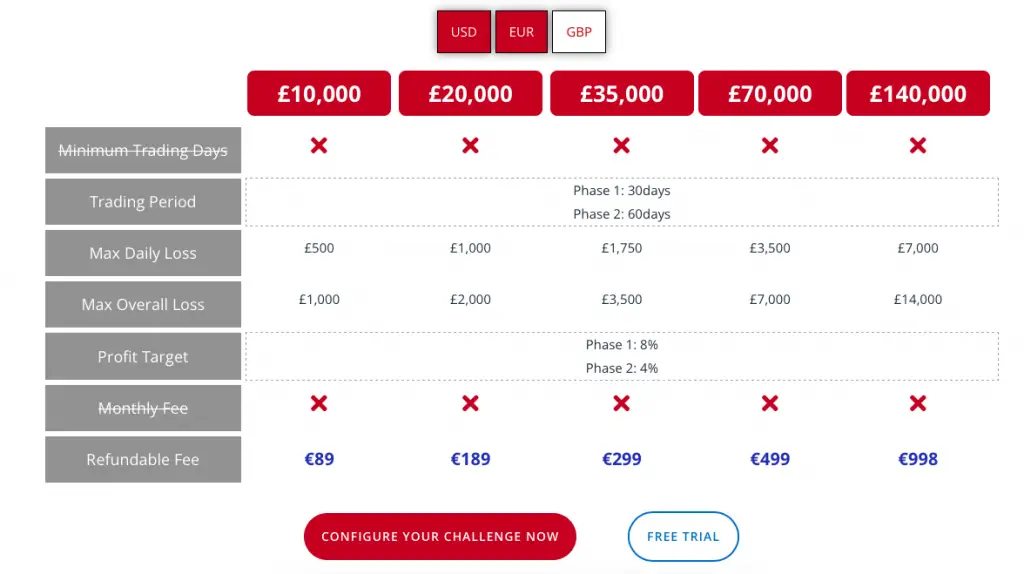

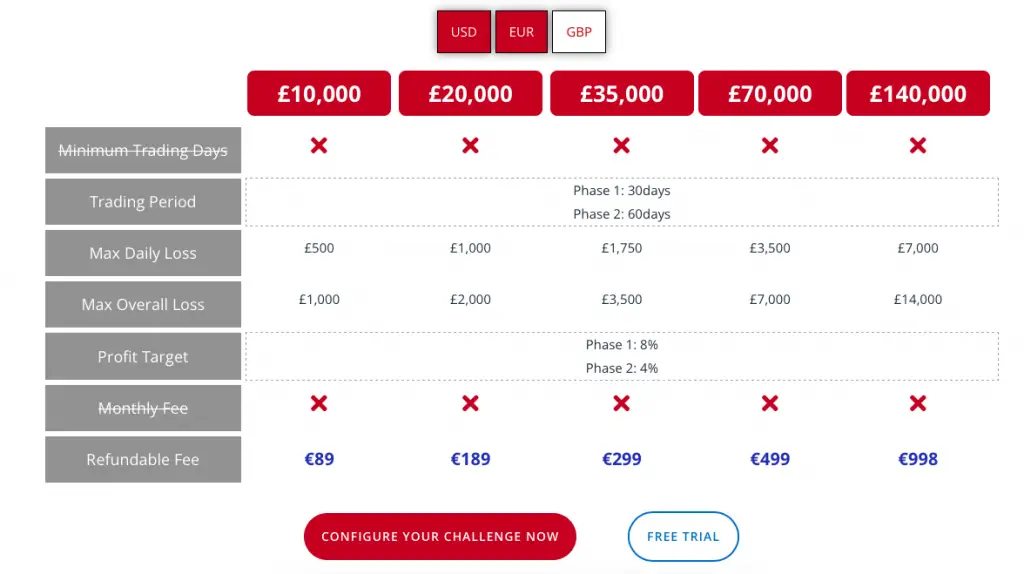

The funded accounts come in either USD, EUR or GBP and they range from $10,000 to $200,000 in capital. To actually receive funding from the company, you will have to pay a fee to take a 2 step challenge.

Once you have successfully passed the 2 step challenge, you will no longer have a profit target and be able to freely trade the account.

You will still have a maximum drawdown rule in place on the account though, so you’ll still need to be trading very carefully.

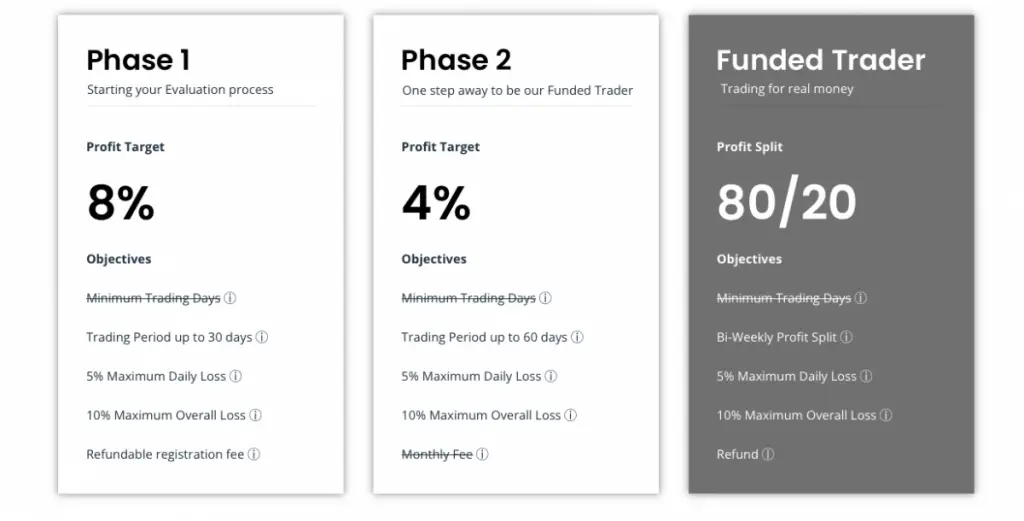

During the first step of the challenge, you will need to reach a profit target of 8% within 30 trading days, without violating the maximum daily and total drawdown. If you fail, you will lose your fee and will not get another chance, without paying again.

If you are successful, you will have to reach a profit target of 4% on the same demo account, within 60 trading days, without violating the drawdown rules again, just to prove that it was not a fluke.

Once both challenges are passed, you will receive a refund for the initial fee and get live trading account details sent to you.

You will be able to trade this account like it’s your own, just making sure not to violate the drawdown rules. You will receive an 80% profit split every 2 weeks for your trading efforts. If you violate the maximum drawdown during this process, you will have to retake the challenges and pay the initial fee again.

True Forex Funds Pricing – How Much Does It Cost?

When it comes to pricing, TFF is fairly average in terms of the initial fee. There is no monthly recurring subscription to be able to keep your funding account, so the only fee you’ll pay is that initial fee when taking a challenge.

A $10,000 trading account is going to cost you €89, which is extremely cheap and I would definitely recommend this even if you aren’t the most consistent trader yet. Being forced into good trading habits whilst trading a funded account challenge is usually great for traders development.

For already profitable traders that are looking to get larger capital from the get go, a $200,000 trading account challenge is going to cost you €998.

This seems very pricey, but in terms of how much capital you’re getting to trade with, a profitable trader averaging 5% return on their first month of trading will be able to recoup the initial fee easily within month 1.

The fee is also refunded once you pass the challenge, so it only affects traders that are failing challenges.

Surge Trader

Surge Trader is a highly respected US prop firm offering forex traders a 75% profit split and funding of up to $1,000,000 after the challenge stage.

Unlike most prop firms, the company offer trading on all forex and cryptocurrencies, making it a great option for those traders that like to diversify.

- Great Reputation

- Funding Up To $1M

- 75% Profit Split

True Forex Funds Scaling Program

TFF does not currently have a scaling program unlike some other prop firms. You are able to purchase multiple funded account challenges, meaning the total capital allowance per trader sits at $400,000. The largest account you’re able to trade is $200,000, meaning you could have 2 of the largest account sizes running simultaneously.

It would be nice to see a capital scaling program added in the near future.

I’m assuming as the company is extremely new, this will be added as the demand for funding increases and more profitable traders are earning percentage gains each month for the firm.

I will be keeping my eyes on True Forex Funds growth over the next few months and update this when a scaling program is added for traders.

What Makes True Forex Funds Different From Other Prop Trading Firms?

There is nothing that really sets TFF apart from any of the other prop firms in the industry, yet. The company is extremely new so we may see different USP’s develop over time but as of right now, the business model is fairly similar to what we see across the board.

This isn’t actually a bad thing though. Having the same business model as the most successful and well loved prop firms in the industry means that we can assure consistency across our funded accounts.

I would much rather know I can obtain funding from TFF and get the ball rolling, rather than try to spend 2 days trying to figure out their complicated account system, like Funding Talent

The Drawbacks Of Using True Forex Funds For Your Funded Account

From looking at the trading conditions and everything being offered by the company, it’s clear to see there really aren’t many drawbacks of getting your funding from True Forex Funds

If we are being critical, the only drawback is the fact that the company is extremely new and doesn’t have much of a track record within the industry. This doesn’t necessarily mean they are going to fail, or scam traders by any means, but it is certainly deemed more risky than using a firm that has been around for many years.

If you’re still looking to get funding from True Forex Funds, I would advise using a trade copier to reduce the risk of losing capital. We have a whole list of the industry leading trade copier software

This way you can still be trading your own capital, or another firm’s capital, whilst automatically copying traders over to your TFF funded account. This massively mitigates any potential risks as your capital and profits are split between multiple brokers and accounts, not just the one account.

Is Getting Funding From True Forex Funds Realistic?

There is no point in trading with a prop firm that offers you millions of dollars in funding, if they make it literally impossible to achieve.

For this reason, it’s extremely important to look at the criteria of the trading challenges to see if you’d actually be able to get funded, then maintain that funding.

It’s very realistic to get funding from True Forex Funds. They have a 2 step challenge, exactly like FTMO does. In the first challenge, you must reach an 8% profit target, within 30 trading days. This is without violating a 5% maximum daily drawdown and 10% maximum total loss.

If successful, in the second challenge you must reach a 4% profit target, within 60 trading days. This is, again, without violating a 5% maximum daily drawdown and 10% maximum total loss.

For any profitable trader, this is going to be fairly easy to do and it’s slightly easier than the FTMO challenge

The only ‘easier’ way to get funding is to work with a firm that doesn’t require you to do any challenges to get funded.

These accounts would typically cost more but you would be able to get going on a funded account overnight. For this type of account, I’d recommend MyForexFunds

True Forex Funds Reviews – What Do Traders Think?

When deciding which prop firm to get funding from, it’s important to look at the reviews from other traders, not just looking at the trading conditions being offered.

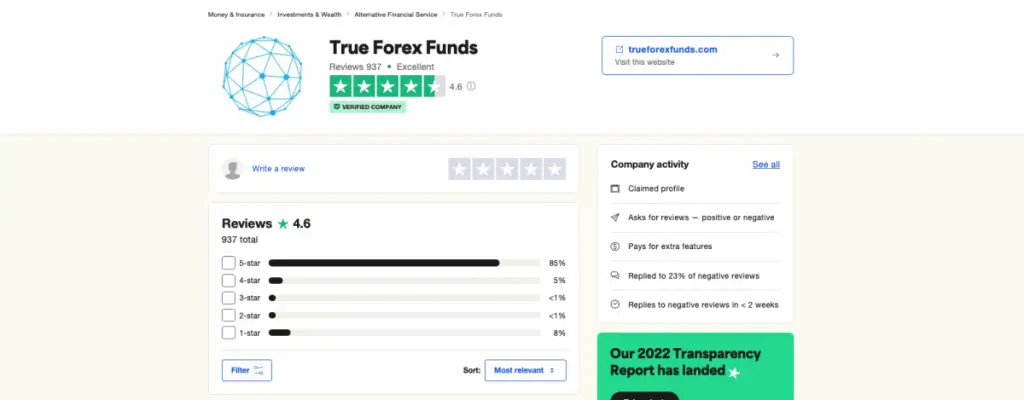

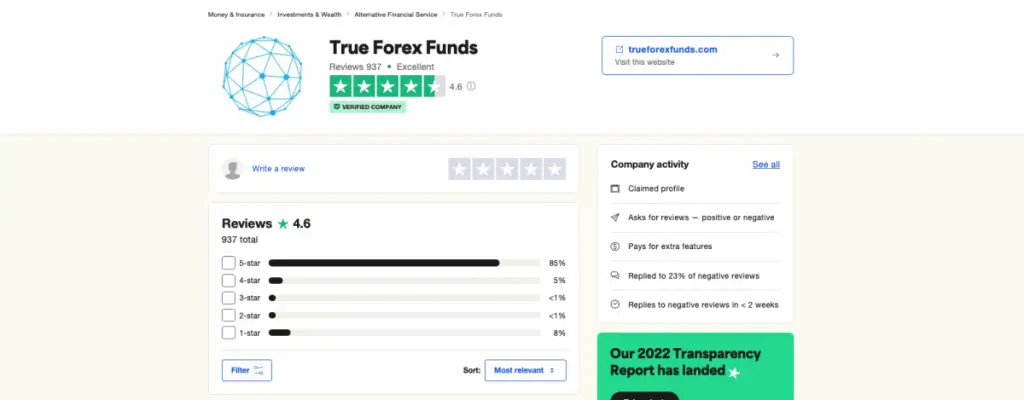

On Trustpilot, we can see that the company has a 4.5/5 star rating, with nearly 1000 reviews at present.

When I first made this review in 2022, the company had just 14 reviews, some positive and some negative. Since then, the company has exploded in growth and seen a huge amount of positivity from traders around the world – which is great to see!

This fills us with a lot of confidence that the company is legitimate and operates as such.

In Conclusion – Is True Forex Funds Legit?

In conclusion, True Forex Funds is legit and provides a legitimate way for traders to take on additional trading capital. The offering is strong, the cost is competitive and I genuinely believe the company will do very well over the coming years.

When I first wrote this review, I said to sit on the fence and don’t commit yet. Now, I have changed my mind and I think it’s the perfect time to take another look at TFF and see if they’re the right company for your funded trading account!

If you have any experience with True Forex Funds please do let me know in the comments down below, I’d love to hear your opinion and experience.