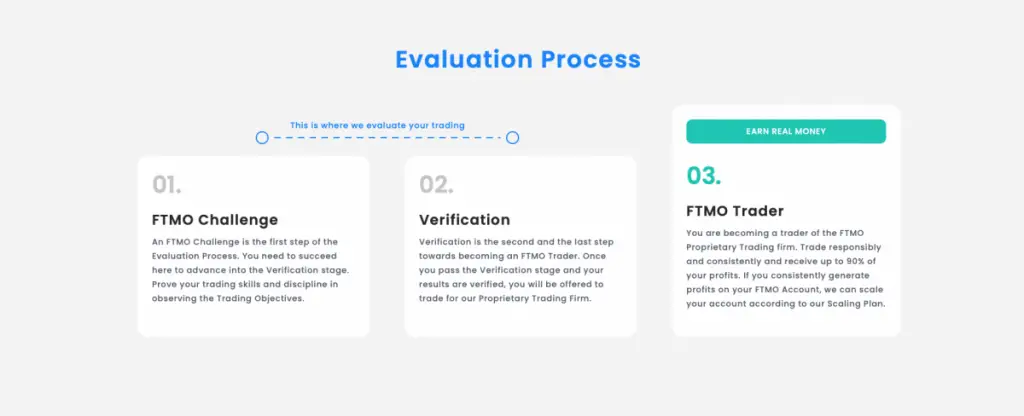

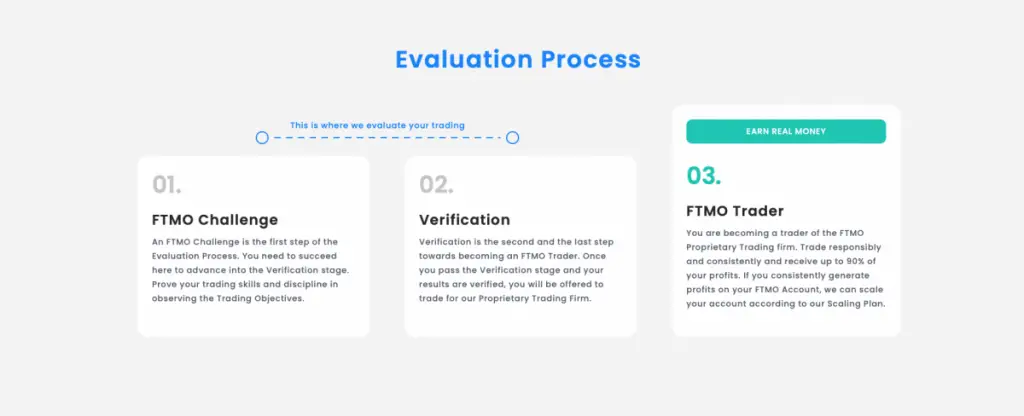

The FTMO Challenge is an extensive trading program designed to identify and certify talented traders. The challenge involves rigorous testing that measures a trader’s knowledge, skill, and aptitude in the financial markets.

This article aims to explore what percentage of those who attempt the FTMO Challenge are able to successfully pass it.

It’s estimated that around 5-10% of traders manage to pass the FTMO Challenge. This means 90-95% of traders that attempt the challenge will fail and not get funded. This is also represented amongst other prop firms in the industry.

By examining this data, traders can gain valuable insight into their chances of success when attempting the FTMO Challenge. Additionally, this information can provide individuals with greater understanding of the expectations and demands associated with such a trading program.

FTMO

FTMO is the worlds leading prop firm and has really taken the industry by storm over the last few months with the famous $100,000 account challenge. FTMO have the best reputation in the industry, great support for traders, a 70% profit share, a range of top brokers to choose from, simple trading rules and funding up to $400,000 for top traders!

- Industry leader

- Established prop firm

- 70% profit split

- No time limit on challenges

- Funding up to $400,000

Around 10% Of Traders Pass The FTMO Challenge

The FTMO Challenge

Strategies for passing the FTMO Challenge include developing a trading plan, understanding risk management and trading psychology, and regularly reviewing and reflecting on trades. Other strategies include having an understanding of the markets, honing technical analysis skills, and understanding the rules of the challenge.

Additionally, having a clear and concise risk management strategy and trading plan is vital to passing the FTMO Challenge.

Lastly, traders must be disciplined, patient, and consistent to pass the FTMO Challenge.

Note, we have been trading with FTMO since 2020 and have multiple FTMO payout proofs

Ftmo Challenge Overview

The FTMO Challenge is an intense trading competition that requires traders to develop their skills, trading knowledge and risk management. It also tests the psychology control of the trader by forcing them to take calculated risks in order to make a profit.

The challenge consists of two levels with different challenges for each one. During these challenges, traders must analyze the market using technical analysis and fundamental analysis in order to identify profitable opportunities. Traders can then use this information to make informed decisions about when to enter or exit trades.

Overall, it is estimated that around 10% of traders pass the FTMO Challenge successfully due to its difficulty and high success criteria. In order to be successful in passing the challenge, traders must possess good discipline, dedication and an understanding of both technical and fundamental analysis techniques.

Difficulty Of Passing The Ftmo Challenge

The difficulty of passing the FTMO Challenge is due to its strict criteria and high success rate requirements. To pass this challenge, traders must possess trading knowledge, risk management skills and a sound psychology control in order to make consistent profits.

A comprehensive trading plan that includes capital management, market analysis and a thorough understanding of both technical and fundamental analysis techniques are all essential parts for any trader seeking to successfully pass the FTMO Challenge. Moreover, it requires discipline and dedication from the trader as they will need to take calculated risks in order to gain a profitable outcome from their trades.

In summary, only those who have been able to develop these required skills can hope to succeed in the FTMO Challenge, with most traders not being able to meet the high standards set by this competition.

Strategies For Passing The Ftmo Challenge

In order to successfully pass the FTMO Challenge

Knowing how to spot potential market opportunities and properly analyzing them is an essential skill that all traders should possess when attempting to pass this challenge.

Additionally, psychological preparation is key for traders seeking to succeed in any trading environment as it allows them to maintain discipline during volatile markets.

Lastly, developing a set of rules or regulations can help ensure consistency across trades and will lead to better outcomes over time.

All these skills are necessary components for traders who wish to achieve success on the FTMO Challenge and ultimately become profitable traders.

FTMO

FTMO is the worlds leading prop firm and has really taken the industry by storm over the last few months with the famous $100,000 account challenge. FTMO have the best reputation in the industry, great support for traders, a 70% profit share, a range of top brokers to choose from, simple trading rules and funding up to $400,000 for top traders!

- Industry leader

- Established prop firm

- 70% profit split

- No time limit on challenges

- Funding up to $400,000

Why Do 90% Of Traders Fail The Ftmo Challenge?

Poor risk management is a common factor in why traders fail the FTMO Challenge. Traders must have a well-rounded knowledge of risk management principles and understand the risks and rewards associated with trading in order to successfully pass the challenge.

Unrealistic expectations are also a major contributor to why traders fail the FTMO Challenge. Traders must have realistic expectations about the amount of profit they can generate and the amount of time it will take to achieve the desired results.

Lack of knowledge is another major reason why traders fail the FTMO Challenge. Traders must have a good understanding of the markets, trading strategies, and other factors that can influence trading success. In addition, traders must be able to interpret market data and plan their trades accordingly.

The percentage of traders that pass the FTMO Challenge is estimated to be around 10%.

Poor Risk Management

The prevalence of poor risk management is one of the primary reasons why 90% of traders fail the FTMO Challenge.

Many traders tend to overlook or underestimate the risks associated with trading and focus too heavily on profits alone, leading to over-trading and high loss ratios.

Poor money management, such as insufficient capital allocation for a strategy and not sticking to predetermined stop losses, can also lead to failure in completing the challenge.

Furthermore, inadequate trader psychology often leads to careless decision making that may result in significant financial losses. This includes having unrealistic expectations when entering into trades without properly researching potential outcomes or relying solely on technical indicators instead of using multiple trading tools like fundamental analysis to identify market trends.

Without proper risk mitigation strategies coupled with effective capital management techniques, it is almost impossible for traders to pass the FTMO Challenge successfully.

Ultimately, given these factors, it is no surprise that only 10% of participants are able to complete it satisfactorily.

Unrealistic Expectations

The presence of unrealistic expectations is another major factor that contributes to the high failure rate in completing the FTMO Challenge.

Many traders enter into trades without sufficient research to back up their decisions, leading them to set goals that are too ambitious and difficult to reach given the challenging requirements of the challenge.

Similarly, they might underestimate the stakes involved due to lack of financial knowledge or experience, making it harder for them to handle any potential losses and succeed under pressure.

Consequently, this can lead to poor decision-making as well as an inability to meet the difficult criteria established by FTMO in order to pass the challenge successfully.

Without a sound understanding of realistic outcomes based on market trends and careful consideration of risk versus reward scenarios, traders stand little chance of passing with flying colors despite having met all other necessary conditions.

Lack Of Knowledge

In addition to setting unrealistic expectations, lack of knowledge can also be a major cause for the high failure rate in completing the FTMO Challenge.

Many traders are simply unaware of the unknown risks and psychological barriers that come along with trading financial markets, making it harder for them to handle volatile situations or losses.

Furthermore, having inadequate financial literacy and not being able to properly apply trading strategies in order to maximize profits while minimizing risk is another common issue among those who fail this challenge.

Without proper understanding of risk management principles, traders cannot make sound decisions which will inevitably lead to an unsuccessful attempt at passing the FTMO Challenge.

As such, these factors form a crucial part of any trader’s success journey, and should never be underestimated before entering into trades.

How To Pass The Ftmo Challenge

Understanding the FTMO Challenge is essential for traders looking to pass the challenge.

It is important to understand the rules and regulations of the challenge, familiarize oneself with the different challenge accounts, and become aware of the timeframe for completion.

Preparing for the FTMO Challenge involves researching trading methods and strategies, setting realistic goals, and staying disciplined in order to succeed.

The success rate of traders passing the challenge is unknown, but traders who approach the challenge diligently and have a strong understanding of the market are more likely to pass.

Understanding The Challenge

The FTMO challenge is a process designed to evaluate and select traders who are capable of trading with the capital provided by FTMO.

To become an eligible trader, one must possess the necessary skills required for achieving financial success in the world of trading.

Risk management, trading strategies, capital allocation, psychology trading, and financial analysis are all important aspects that have to be taken into account when attempting to pass the challenges posed by FTMO.

Knowing how to maximize profits while limiting losses is key in order to stay afloat in this highly competitive environment.

Furthermore, having control over one’s own emotions is essential as it can affect decisions that may have serious implications on one’s performance.

Therefore, understanding these concepts and developing them through practice will undoubtedly improve chances of passing the FTMO challenge tests successfully.

Overall, only those who demonstrate mastery of such knowledge and proper application of their learned skills can expect to attain favorable results during the evaluation period and potentially become part of the exclusive group approved by FTMO.

Preparing For The Challenge

In order to pass the FTMO challenge, aspiring traders must prepare themselves thoroughly.

Taking risks is an integral part of trading and risk management strategies should be employed in order for one to remain profitable over time.

It is also important that proper mental preparation is done in order to stay focused on the task at hand while remaining composed during market fluctuations.

Additionally, knowledge of various trading strategies including capital allocation as well as understanding of trading psychology are essential aspects which will help traders achieve their desired goals.

Thus it can be seen that adequate preparation before embarking on this journey is key for achieving success with the FTMO challenge.

There Are Easier Prop Firms To Work With

- There is a wide variety of Prop Firms available, offering different features and benefits.

- Easier Prop Firms typically require less capital, less stringent prerequisites, and allow more flexibility in terms of trading styles.

- These Firms can provide new traders with the opportunity to gain valuable experience while minimizing the risk of significant losses.

- However, these Firms may not provide the same level of support and advice as more established Prop Firms.

- The challenge of working with an Easier Prop Firm is to ensure that the trader is able to remain profitable and successful in the long-term.

- The percentage of traders who pass the FTMO Challenge is not publicly available, but it is known that success rates vary depending on the Prop firm chosen.

Variety Of Prop Firms

When it comes to alternative prop firms

Such firms might offer less stringent terms while providing access to the same trading strategies and market analysis as the bigger names. Traders must ensure they choose a firm that offers resources geared towards risk management and psychology preparation.

These two elements play an important role when it comes to being successful in the markets; without them, even experienced traders can fall into traps set by volatile prices or become overwhelmed by emotions when dealing with losses.

A good firm will provide guidance on how best to approach both these aspects so that traders can maximize their potential profits from trades. In addition, prospective traders need to ascertain which type of trading strategy fits their goals and objectives best before making any commitments.

Some firms specialize in scalping techniques while others encourage swing trading; yet another option is day trading where multiple positions may be opened within a 24 hour period based on technical indicators or fundamental news events.

It is essential for each trader to be knowledgeable about his/her desired style of trading prior to joining any particular firm so as not make ill-informed decisions later down the line. Finally, it is also necessary for those looking at working with one of these alternate prop firms understand what percentage of traders typically pass the FTMO challenge – this metric helps gauge whether or not they could benefit from joining up with said company.

Fortunately, most reputable firms should provide data regarding previous success rates which would allow prospective traders get an idea of how likely they are going to succeed if they pursue that path.

We’ve worked with other firms such as MyForexFunds

Benefits Of Easier Prop Firms

The benefits of choosing to work with an easier prop firm are many, and range from greater accessibility advantages due to lower account size requirements, to refund guarantees and risk management tools.

These firms also provide a way for traders to automate their trades more easily than in other environments, allowing them to focus on the bigger picture behind their investments.

Furthermore, these trading options often come with additional educational resources that help traders stay up-to-date with market trends and potentially increase their return on investment.

The ease of access and flexibility provided by such firms make them ideal for both novice and experienced traders alike who want increased control over their finances without sacrificing safety or security.

Challenges Of Easier Prop Firms

Although there are many advantages to choosing an easier prop firm, such as greater accessibility and automated trading options, it is important to consider the potential challenges that come with these firms.

Getting funded can be difficult for those who do not have enough capital to open a larger account or meet minimum requirements.

Additionally, risk management tools may need further investment in order for traders to receive full protection against losses.

Trader psychology also plays an important role when using financial instruments; if the trader’s emotional state compromises his decision-making process, they will likely end up making more costly mistakes than planned.

Finally, without access to advanced trading tools or proper financial planning guidance, traders could find themselves taking on too much risk and suffering significant losses as a result.

Conclusion

The FTMO Challenge is a difficult proposition for many traders. The success rate of those attempting the challenge is low, with only 10% passing. This can be attributed to the high standards and requirements that must be met in order to pass.

Knowledge, experience and understanding of trading are key components needed to gain acceptance. While other prop firms may not have as stringent requirements, they still require dedication and commitment from their clients.

For those looking to succeed at trading, it is important that they understand what they need to do in order to pass the FTMO Challenge or any similar tests required by a prop firm before committing themselves financially.