Are you looking at potential forex brokers to trade with? Choosing the right broker with so many scams online can be such a challenge. In this article we will be looking at the broker Alpari. With over 2 million clients, they are one of the most well known forex brokers in the industry but are they the broker for you? Let’s find out now…

[WPSM_AC id=977]

Who Are Alpari?

This time ALPARI

Fully regulated by the Financial Services Commission

Offering a high variety of trading instruments, ALPARI seems to cater trading conditions to suit all styles of trading, whether you’re less experienced, a scalp or a swing trader, or you’re the manager of a hedge fund. From first glance this seems to be the perfect broker but let’s go into a bit more depth and pick apart the aspects of ALPARI…

Trading Conditions

There are a few things to consider when looking at the general trading conditions of a broker. Because of its regulation, ALPARI offers traders leverages up to 1:1000, which is ideal if you’re looking to grow your account pretty quickly, however you are able to reduce this right down to 1:1 if you’re more comfortable with a lower leverage. Some accounts with ALPARI either have fixed or floating leverages. Fixed leverages remain the same even though the prices are changing, however floating leverage usually follows the market dynamics and will fluctuate within a certain range. This is definitely something to be aware and make sure to be clued up on before you open an account! Below in the Account Types section you can see which accounts offer floating or fixed leverages.

| Leverage | 1:1000 Maximum |

| Regulation | Yes |

| Spreads | Dependant on account type, starting at 0.4 on ECN |

| Trade-able Products | 250+ |

| Metals | Yes |

| Minimum deposit | Varies per account, £5 on the micro account |

| Execution | Instant |

| CFDs | Yes |

| Platforms | MT4 & M54 |

Spreads with ALPARI start at 0.4 as a minimum which is fairly low. Highest minimum spreads are with the forex micro account, which starts at 1.7. Of course forex trading isn’t completely cost free as all brokers include spreads and commissions, but these spreads are competitive within the forex market.

There are a range of instruments available to trade with, and the options do vary with each account type, but with ALPARI you’re able to trade both major and minor currency pairs, Metals, CFD’s and cryptocurrencies. Overall there’s a good variety of trading instruments which indicates that ALPARI can cater to a wide range of traders.

Alpari Account Types

APLPARI offer four different account types to choose from when setting up with the broker which each offer different trading conditions. Having a variety of accounts to choose from is beneficial for many reasons but most importantly I think it makes the brokerage more inclusive as it can cater specifically to different levels and styles of trading. Register your account now!

Forex Standard Account

A classic forex trading account, this is ideal for traders of all levels to gain experience in the financial markets. It offers over 80 instruments to trade with, including major and minor forex pairs, metals and CFD’s. The leverage on this account is floating from 1:1000, which means that the leverage will change as the volume of the open position grows, and spreads from 1.2 a standard account with ALPARI caters to traders from all types of experience. The minimum deposit is £100.

Forex Micro Account

According to ALAPRI, they wanted to offer traders an account where they can brush up on their trading skills if they are less experienced without the higher risks that other accounts pose. The Micro account is not too different from a traditional trading account, except that the balance is always displayed in cents. Essentially this means that if you deposit $10 it will appear as $1000 cents in the account. Minimum deposit for this account is £5, which is ideal for traders starting off with less currency in the bank. Leverage is fixed at 1:400 and spreads are from 1.7. Traders are able to use 25 major and minor pairs and 2 types of Metals. Overall this appears to be a great option for someone who is less confident in the financial markets, which I think is a really helpful option to have.

Forex ECN Account

An ECN account with ALPARI offers more flexible trading conditions. Leverage is floating from 1:1000 and spreads start at 0.4. There are a wide range of instruments to trade with, including 56 currency pairs, Metals, CFD’s and crypto currencies. I would say this is the next step up from a Standard account. Minimum deposit is £500. With this account, you can use the MT5 platform, or just stick with MT4.

Forex Pro Account

Finally we have the Pro account, which as you can probably guess is suited for pro traders, institutional traders and hedge fund managers. Leverage is floating from 1:300 and spreads start at 0.4. Traders have access to 54 currency pairs, both major and minor, and Metals. The minimum deposit for this account is £25,000.

Of course this broker also offers a free demo account, should you wish to practise your skills in the markets. Although, this the micro account just having a $5 minimum deposit, I would recommend just using that instead of a demo account, so you can feel what it’s like to trade real capital.

Are Alpari Regulated?

ALPARI are fully licensed by the Financial Services Commission

Unfortunately, ALPARI doesn’t provide services to a couple of countries, including the USA or Japan, so I would suggest that if you’re a resident of any of these countries and are looking to trade to either sign up to an unregulated broker, such as Hugosway

ALPARI also prides itself on working exclusively with reputable banks from a range of different countries in order to maintain safety for its trading clients. You can learn more about this in the deposit and withdrawals section of this post below.

Trading Platforms Offered

MetaTrader4

Both MT4 and MT5 are available to use with a mobile phone as an app, as an app installed on your computer for forex or through your web browser which means you’re able to trade regardless of whether you prefer to be at a desk or trading on the go

These platforms really are suited for beginner traders, looking to do basic technical analysis. There are no real functions within these tools for any fundamental analysis or more advanced technical analysis. I personally advise using MT4 for your order execution (taking trades), then using a third party software like Tradingview

Deposits and Withdrawals

Lets have a look at the deposit and withdrawal methods. ALPARI have no deposit fees and withdrawals are done really quickly which is always a bonus, no one wants to have to pay to fund their accounts. There are several different deposit and withdrawal methods, including but not limited to:

- Online banking in a wide range of different countries

- Bank transfer (VISA, MASTERCARD and MAESTRO)

- Skrill

- Neteller

- WebMoney

- Crypto Wallets

- Wire bank transfer

It’s worth noting that this broker also has a huge range of other funding methods, not here mentioned. They are a lot less common and it’s unlikely that the majority of forex traders would use them, so I have only mentioned the most common. Click here for a full list of funding options.

Once you’ve deposited some capital into your account it should be up and running and funded within 24 hours. Withdrawals are the same, you should get them within 48 hours, however bank wire transfers will of course take a little longer to process. You can check out the full range of deposit and withdrawal methods on ALPARI’s website and from what I can see they cater to people from many different countries with an extensive range of ways to fund and withdraw from your account.

Setting Up An Account

Setting up an account with ALPARI was a painless process and they’ve had over two million customers sign up to them. To start your account, click on ‘Register’

Alpari Client Support

There are several ways of getting support from ALPARI should you need to!

Opening an account:

- Email- documents@alpari.org

- Phone- +442 080 896 850

Client support:

- Email- customersupport@alpari.org

- Phone- +442 080 896 850

Deposits and withdrawals:

- Email- operations@alpari.org

- Phone- +442 080 896 850

Their Live Chat

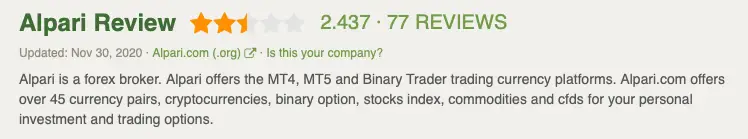

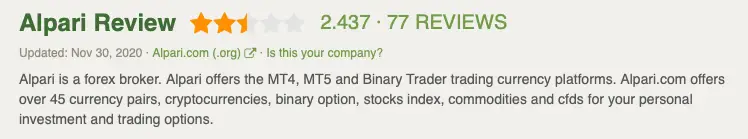

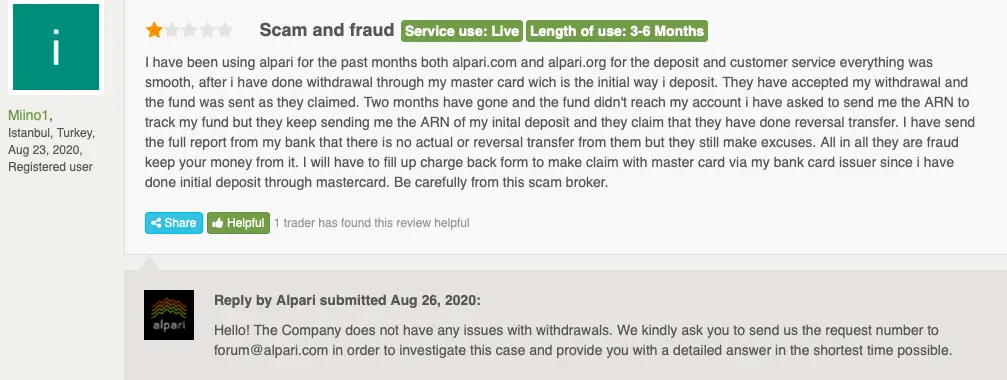

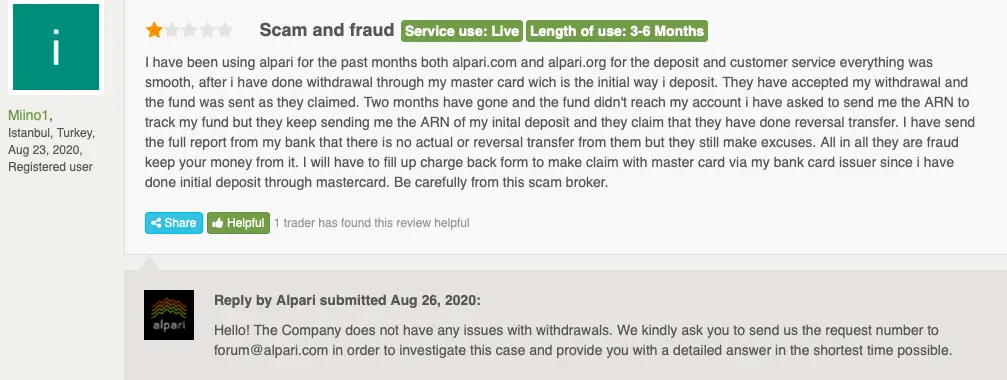

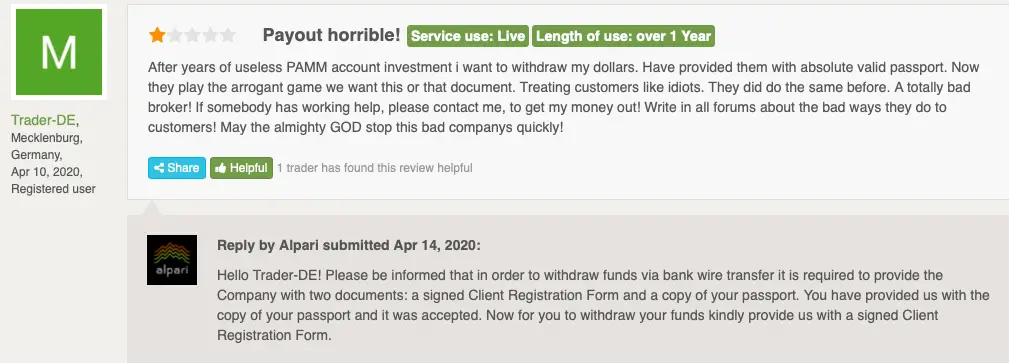

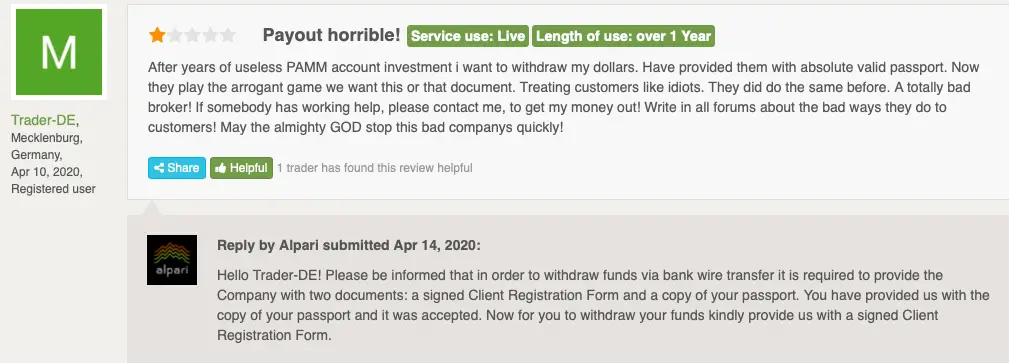

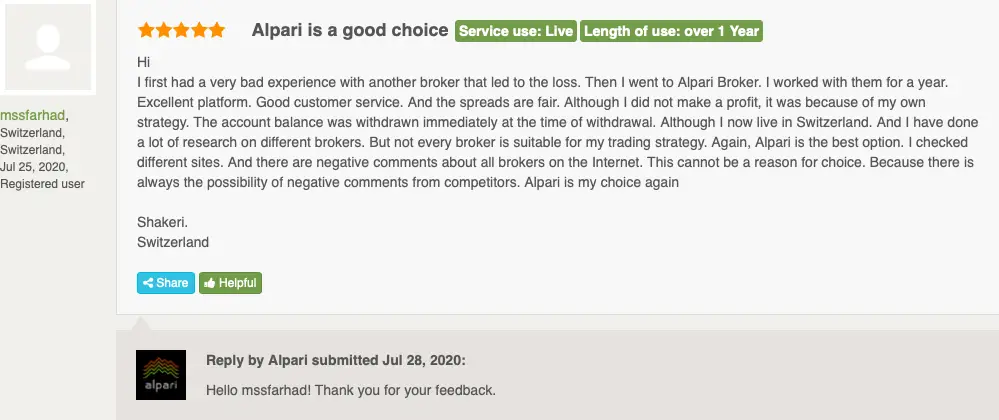

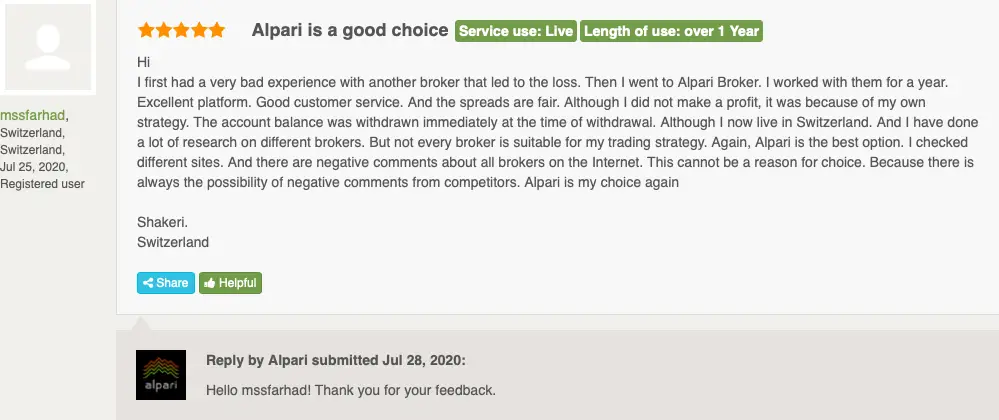

Reputation and Reviews

As always, I’d like to end the post with further details of the reputation that ALPARI has in the trading world. Seeing a range of reviews means you can see what thousands of other traders are saying about the broker and offers multiple personal experiences. ForexPeaceArmy

On FPA

If this low rating on the forums is a concern to you, there are some brokers that have a much higher rating and more or less exactly the same trading conditions as Alpari. I have done full reviews on IC Markets

Conclusion

In summary, Alpari are a great forex trading broker with a huge range of benefits. The huge 1:1000 leverage, paired with good spreads, MT4, MT5 and fast order execution makes it a great choice for traders. As they say on their own website, 2,000,000 traders can’t be wrong!

However, Alpari don’t have the best reputation and their regulation by financial bodies really isn’t the strongest. If you are a newer trader coming in with a small deposit or just learning, this is definitely a great choice! If you are a seasoned trader coming in with large capital, trading with a higher regulated broker like HotForex