Are you looking for a new forex broker? Considering BDSwiss as a viable option? With literally thousands of brokers online now, finding the perfect option you for can be quite a tricky challenge. Luckily, that’s why we are here. We have done extensive testing of BDSwiss and research into the trading conditions, company, regulations and much more. Is this the broker for you? Let’s find out…

[WPSM_AC id=853]

Who Are BDSwiss?

Founded in 2012 under the company BDS Markets, BDSwiss

Traders have an option of four accounts to choose from and the brokerage boasts an award for the Best Trading Conditions by World Finance in 2020

Trading Conditions At BDSwiss

As always, lets have a look at the trading conditions of BDSwiss. This broker is based out of Mauritius and like I mentioned earlier, is regulated by a few different companies, including CySEC

| Leverage | 1:500 Maximum |

| Forex Pairs | 50+ |

| Shares & Indices | Yes |

| Spreads | Ranging From 0.3 Pips, depending on account type |

| Execution Speed | Instant |

| Regulation | Yes, CySec and more |

| Cryptocurrency | Yes |

Like a lot of brokers you have access to more than 50 major and minor forex currency pairs (including EURGBP, EURJPY GBPUSD), commodities, shares, indices, cryptocurrencies and ETF’s, so there’s a bit there for everyone. On the website you can easily find out the leverage

As I mentioned above, BDSwiss offers a leverage of up to 1:500 on three out of five of its trading accounts aside from the InvestPLUS account which has leverage of up to 1:5. The accounts have spreads starting from 0.3 which makes this a fairly cheap broker and therefore viable for a lot of traders. In summary it seems so far that BDSwiss has some competitive trading conditions with several options to suit all styles of trading.

BDSwiss Has 4 Different Account Types

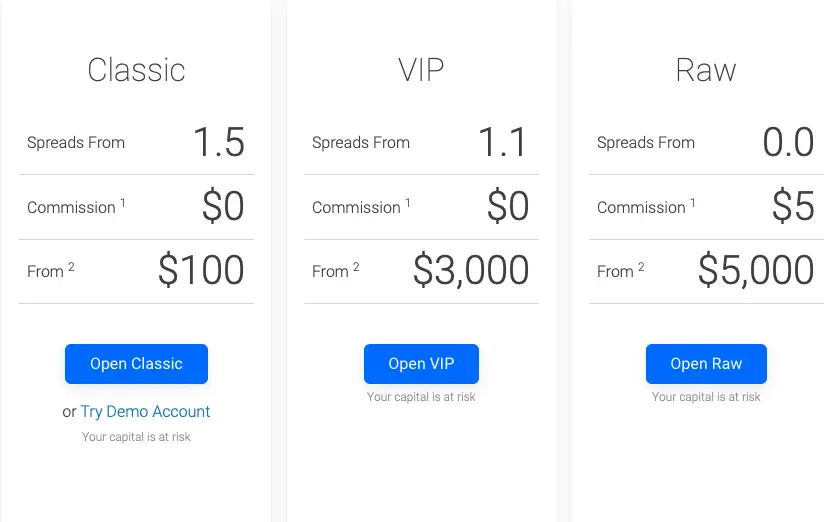

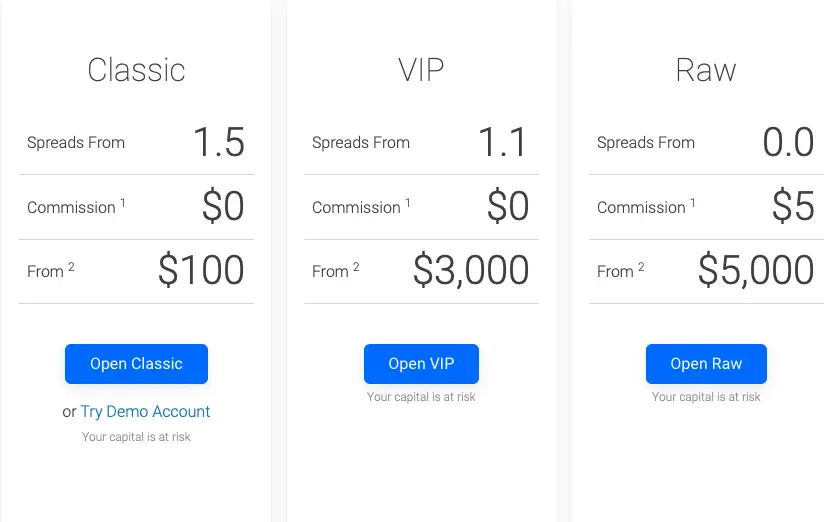

There are 4 different account types to choose from when setting up with BDSwiss, including Classic, VIP, Raw and InvestPLUS.

Classic Account

This is probably their most standard account. With spreads starting from 1.5 and leverages of up to 1:500 it seems to be a great account for traders of any experience to either develop their skills in forex or take full advantage of the conditions and grow an account quicky. Alongside the currency pairs there are several instruments to trade with, making over 250 CFD’s available, including shares, indices, commodities and cryptocurrencies. There’s a minimum deposit of $100 and $0 commission on all pairs.

VIP Account

The VIP account seems to be the best account for experienced traders who are looking to expand their funds even further. Spreads start from 1.1 and the leverage goes up to 1:500. Like the Classic account traders have access to over 250 CFD’s including forex pairs, shares, indices, commodities and cryptocurrencies. The minimum deposit for this account is a bit pricier at $3,000.

Raw Account

A Raw account with BDSwiss has very low spreads starting from 0.3. Again, the leverage goes up to 1:500 and there are the same amount of instruments as offered in the previous two accounts. The minimum deposit for this account is $5,000.

InvestPLUS Account

Finall we have the InvestPLUS account which is specifically for traders looking to use shares and ETF’s– with over 1000 different CFD’s. Leverage only goes up to 1:5 and the minimum deposit is $5,000 like the Raw account.

Looking at all the different options I’d say the most applicable to a wide range of different traders would be the classic account. It has great leverages and a nice range of instruments so you’re catered to regardless of what you prefer to trade with. It also has a manageable minimum deposit of $100 so a lot of traders can access this type of account without breaking the bank.

Are BDSwiss Regulated?

Fortunately for you they are indeed regulated and by a few different regulators at that! BDSwiss are regulated by the NFA (license no. 0486419)

| Regulation | Strong, Multiple Regulators |

| Risk | Low |

We all know that regulation can be one of the deal breakers when it comes to choosing which broker to set up an account with as we all want the peace of mind that ultimately our money is safe and not subject to unfair trading conditions.

As I mention in most of these blog posts, if you are from the USA and are looking to start trading I’d recommend setting up an account with either a USA based broker or an unregulated broker like Hugosway

Trading Platforms Offered

This broker has a few different platforms for retail traders, including MT4, MT5 and their own platform available both as a mobile app and on a desktop.

MetaTrader4

MetaTrader5

| MetaTrader 4 | MetaTrader 5 |

| Free to use | Free to use |

| Easy to use, very basic | Easy to use, more advanced |

| Limited tools | More range of tools |

| Basic execution methods | Basic and advanced execution methods |

Like I said BDSwiss offer their own trading platform, advertised as a user-friendly interface where you can access a wide range of instruments. Like MT4 and MT5 its available on both desktop and mobile apps which means it can cater to lots of different people depending on how they prefer to trade.

What Are The Deposit And Withdrawal Methods?

You’ll probably find nowadays that most brokers offer a lot of different deposit and withdrawal methods which is great if you have a particular reference over another. BDSwiss are no different, they actually boast over 151 deposit methods, which is absolutely huge! There are also a whole range of accepted currencies including EUR, GBP, USD, CHF, DKK, SEK NOK – here are their most popular deposit methods:

| Deposit Method | Fees On Deposit |

| Bank Transfer (VISA, MASTERCARD, MAESTRO) | $0 |

| GiroPay | $0 |

| Sofort | $0 |

| EPS | $0 |

| iDeal | $0 |

| DotPay | $0 |

| Skrill | $0 |

| Neteller | $0 |

| Bank Wire Transfer | $0 |

| Online Banking | $0 |

Their withdrawal methods are slightly more limited so be aware of this, however they do include:

- Bank transfer (including VISA, mastercard)

- Skrill

- Neteller

- Bank wire transfer

All methods are extremely fast and are typically processed within 24 hours, however bear in mind that bank wire transfers may take a little longer.

There are also no fees when funding or withdrawing from your account which is always good news. I picked bank transfer and no issues whatsoever but please contact the support team if you’re struggling with anything and need help!

Set Up A BDSwiss Account

There are a few painless steps to set up your account with BDSwiss. In fact, it takes less than 1 minute to sign up with this broker!

Of course there is the option of setting up a demo account first

Client Support Offered

I personally think its always essential to be able to get in touch with your broker if you’re experiencing any problems. BDSwiss has several ways that you can reach out if you’re having any difficulties, including:

| Support@bdswiss.com | |

| Compliants@bdswiss.com | |

| 24/5 Live Chat | (Multilingual) |

| Request Call Back |

I think its worth noting too that the customer support team are multilingual so they’re able to cater to most people from all across the world! It is a bit of a red flag that there isn’t a normal support number you can ring, but at least you are able to request a call back. Also some other brokers like IC Markets

I have seen that BDSwiss support team seem to be active on forums like FPA

Does BDSwiss Have A Good Reputation?

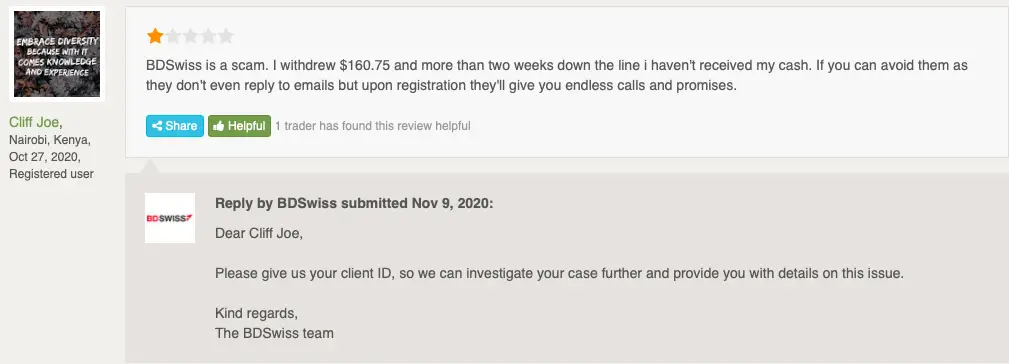

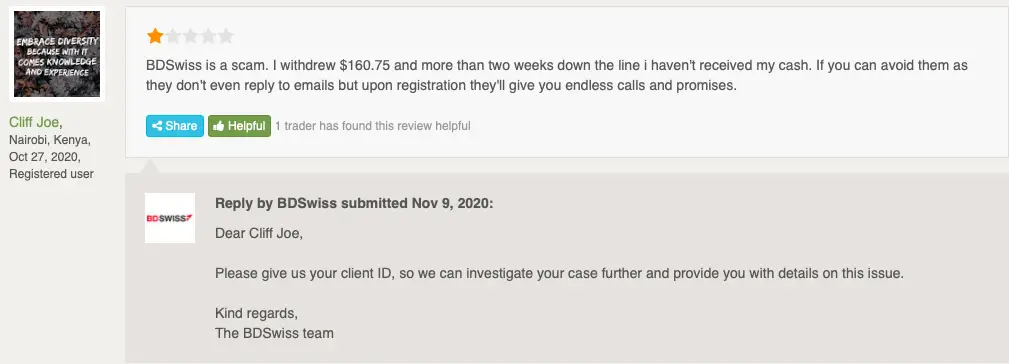

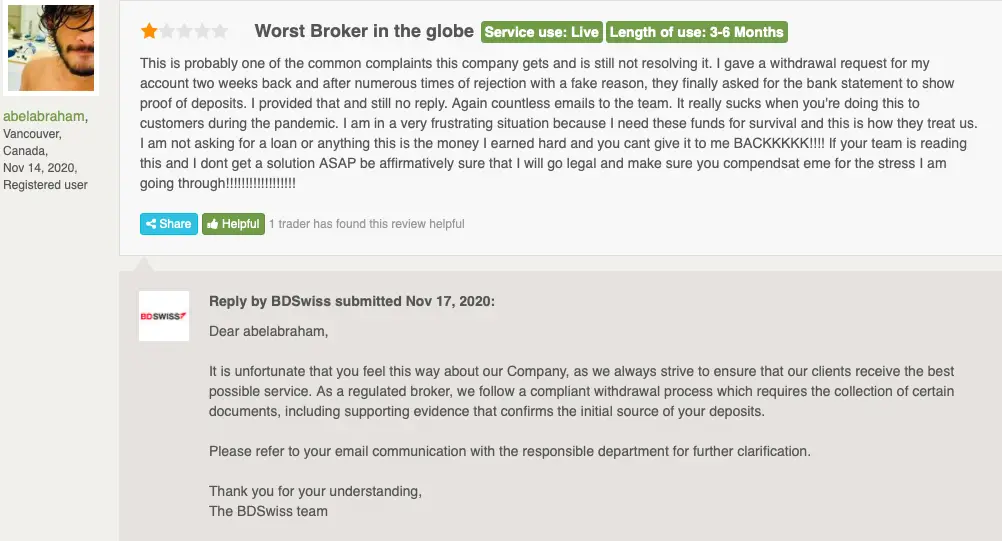

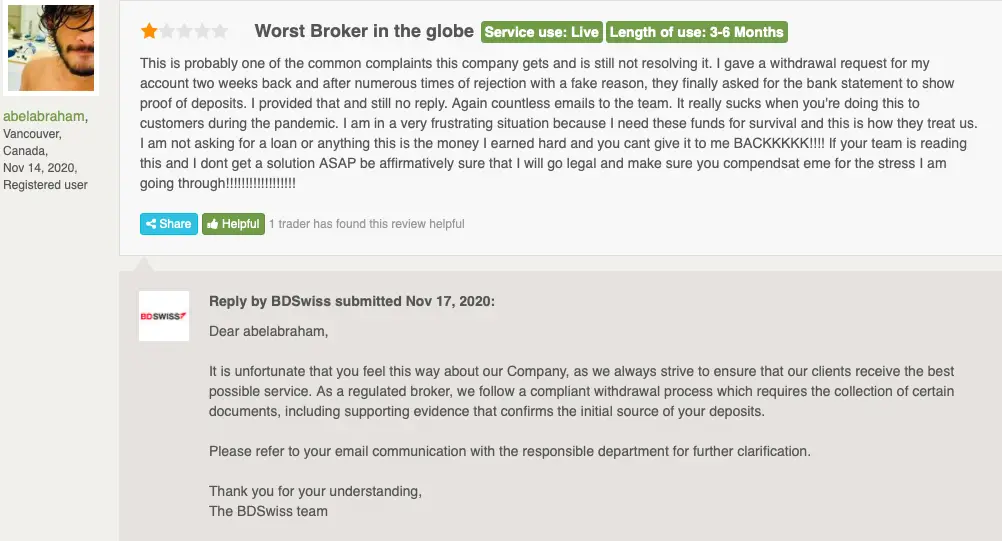

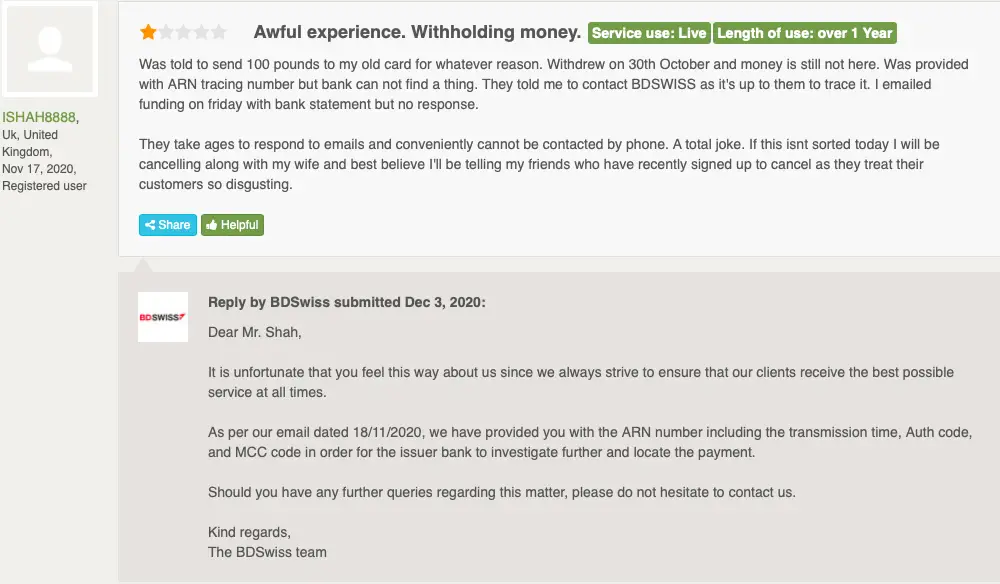

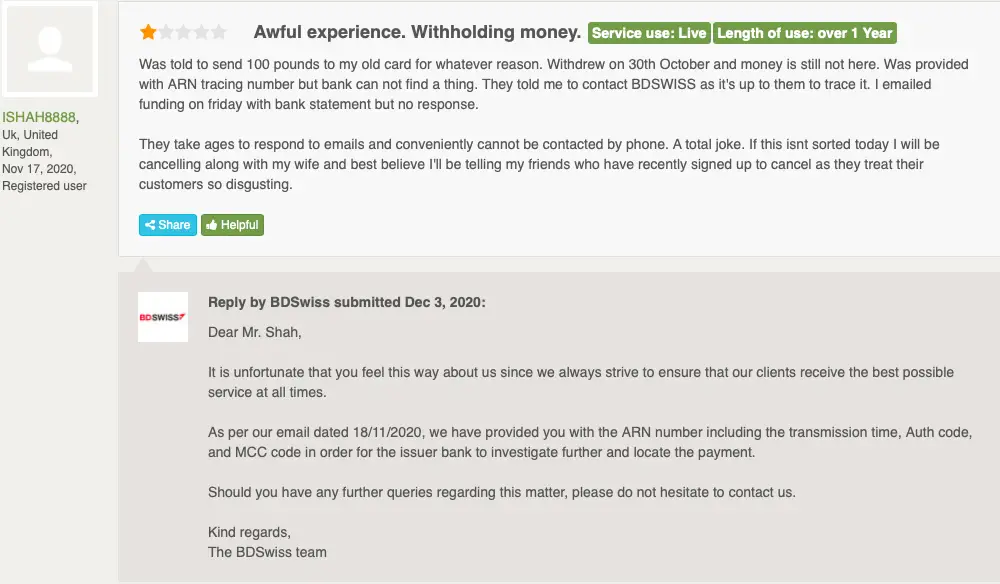

Below I’ve included a few different reviews about BDSwiss where you can easily see what thousands of other traders are saying about the broker. Often they’re just as important as dedicated blog posts as you can access a lot of different experiences and opinions quickly.

Sadly, although the trading conditions and BDSwiss are amazing for traders, their reputation isn’t great. On ForexPeaceArmy

In 2017, BDSwiss had to pay CySec (the regulators) a $150,000 settlement due to violating certain conditions, which can be seen here

In Conclusion, Are BDSwiss A Good Broker?

BDSwiss are clearly a very good broker, hence why the have over 1.8 million registered traders and a monthly volume of over $84 Billion. They offer great 1:500 leverage, across a range of account types with 3 platform choices. The range of over 250 products offered and 151 deposit options really does cater to traders all around the world, unlike some brokers.

The one thing that lets this broker down is their lack of positive reviews. As mentioned in this article, BDSwiss got fined by CySec for a regulation violation and in the forums a lot of traders are having trouble with withdrawals taking a long time from the broker. This is a red flag for me but please make your own decision. There are other very similar brokers but with much better reviews like BlackBull Markets