Using forex prop firms to boost your trading capital is a great option if you’re already profitable. However, different firms and funding options suit different traders, styles and situations. A trader may do amazingly with one prop firm, then completely blow their capital with another – it’s very important to play to your strengths and research which firm would suit you best…

In this article we are looking at Corp Equity Capital, a brand new prop firm offering a 90% profit share and instant funding to traders around the world. The company doesn’t have a great reputation yet, but let’s dive into everything you need to know about CEC…

[toc]

Who Is Corp Equity Capital?

Corp Equity Capital is a new prop firm, launched in July 2021 that offers forex accounts to profitable traders. The company offers a 90% profit split, allow any trading style, claim to have amazing trading conditions and offer bitcoin as a payment method.

CEC offers funding up to $5M and boasts one of the fastest scaling methods in the industry. With two funding methods and a range of capital sizes to suit all traders, could this be a new placer in the market? Let’s find out more…

Getting Funding From Corp Equity Capital

Corp Equity Capital

CEC offers 2 funding methods for the majority of traders – either a one step challenge, or an instant funding model…

The one step challenge is pretty much as simple as it sounds. It’s like the FTMO challenge but half as long and the rules are slightly tweaked. In terms of numbers, the profit target will be 7%, with a daily drawdown limit of 3% and a maximum drawdown of 12%. You’ll have access to 1:100 leverage, 90 trading days and be allowed any style of trading. Once successful, you’ll receive a refund for the initial fee and have a bi-weekly profit split from that point onwards, with the same rules on losses.

The instant funding model is as it says on the tin. You pay a higher fee but you’ll have instant access to a funded trading account. The account will have the same strict rules on drawdown and management. If you violate the rules on the instant funded account, you’ll have to pay for another funded account as you’ll lose access to your account.

What Sets Corp Equity Apart From Other Prop Trading Firms?

Corp Equity currently doesn’t really have any attributes that sets it apart from other prop firms in our best prop firms list

The rules are fairly typical and can be seen across the majority of the industry leading firms. The withdrawals/payments methods are also very typical. In terms of the actual funding, CEC offers a one step verification and an instant funding model. Across the board, the one step funding model is less popular than the typical ‘FTMO Style

The instant funding method is also becoming very popular, as shown by MyForexFunds

The fundamental issue with Corp Equity Capital, for traders, is the fact that it has the same features as other firms, but much less of a good reputation. Why would you, as a trader, pick the same trading conditions but from a brand new firm, with negative reviews? You wouldn’t, right?

Is Getting Funding From Corp Equity Capital Realistic?

Getting a funded account from CEC

The one step challenge has a profit target of 7% and a daily loss of 3%, with 12% maximum loss. The maximum loss is fairly lenient here and the profit target is nice and low, so both of these are achievable. The 3% maximum daily loss isn’t great due to spreads and slippage, this may not give traders a huge amount of leeway and margin for error.

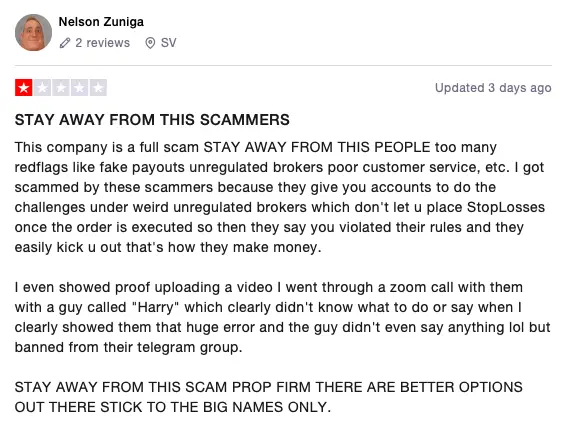

Whether it’s true or not, I cannot be sure, however, traders on the forums are complaining of strange rules with stop losses and entries which make it much harder to get funded. For instance, one Trustpilot, one trader is claiming that you must have a stop loss on the order within the first minute or you’ll get failed. This, if true, will definitely make it impossible for traders that like to trade with fluid risk.

The Scaling Plan

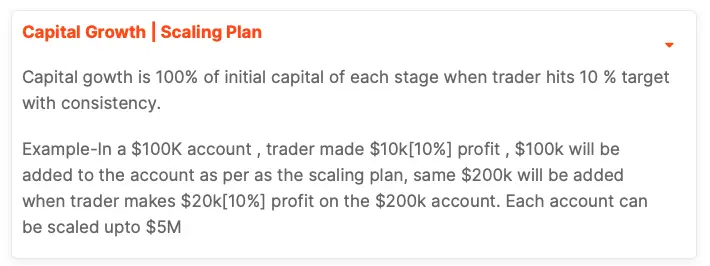

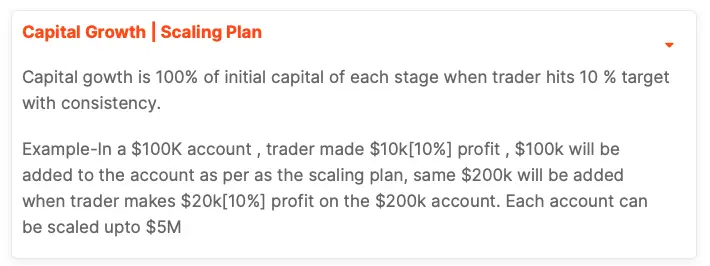

Scaling plans are becoming a hugely important part of prop firms as you need to ensure your capital is going to keep increasing, as it would if you were compounding your own profits.

Corp Equity does have a scaling plan, but I would be cautious. On the homepage, it mentions that traders can have two accounts with a maximum value of $2.5M each. On the scaling plan FAQ section, it contradicts this and says that each account can be scaled to $5M.

Typos, mistakes and contradictions aside, the scaling plan is 100% growth for every 10% of profit gained on our side. This means if you manage to make a 10% profit, the company will double your funding.

This is the scaling plan that Lux Trading Firm

Corp Equity Capital Reviews – What Do Traders Think?

When you’re choosing the best prop firm to be trading with, it’s good practice to always check reviews that other traders have left. No matter how promising an offering may be, if other traders are finding issues with the company, we are safer to just stay away!

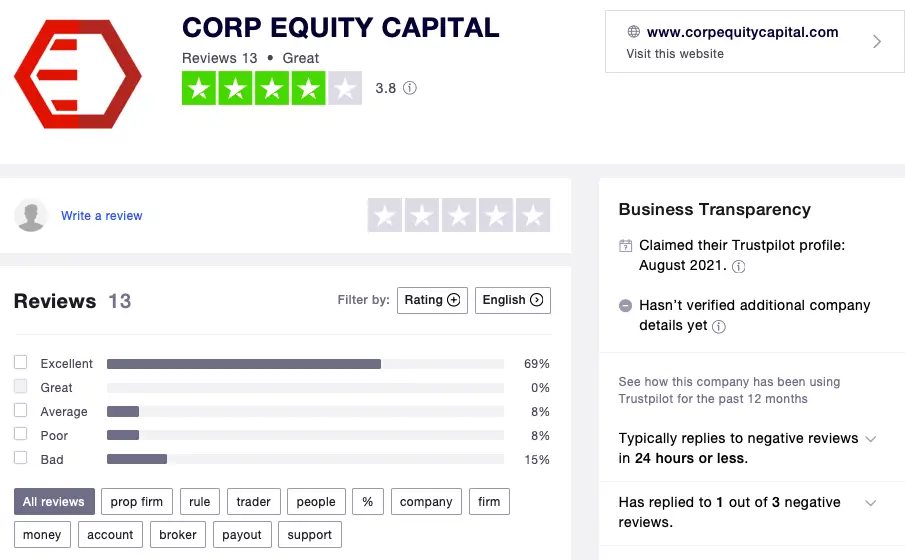

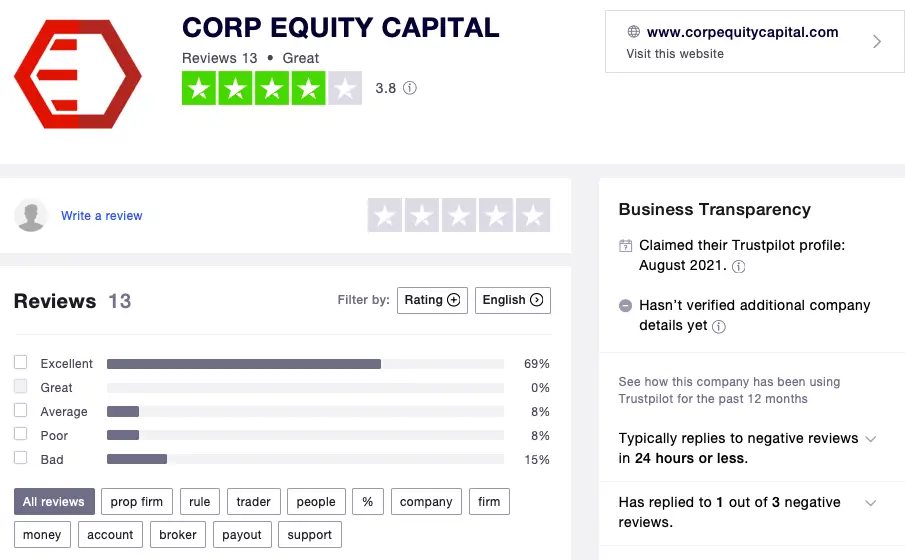

With that being said, Corp Equity Capital has a 3.8 star rating on Trustpilot

Some of the individual reviews paint a slightly less positive picture with traders claiming that the company is a scam. There is also claims of ridiculous rules, no dashboard, bad customer support and the company is allegedly run from India, just using a U.K address.

It’s hard to gauge how much of this is true, however, it’s more than enough for us to step away and watch from the sidelines. With a whole list of good prop firms

In Summary – Is Corp Equity Capital A Scam Or A Legit Forex Prop Firm?

In short, it’s too early to trust Corp Equity Capital as a prop trading firm. The company certainly doesn’t have the best reviews and there are a huge amount of mistakes and contradictions on the website that make me very cautious. The reality is, they aren’t offering anything that we cannot get from bigger names in the industry that have good reputations.

I would recommend sitting on the sidelines for now and watching how CEC plays out over the next few months. I am hopeful that the company isn’t a scam and the value will be there for us, as traders, however, we cannot afford to take the chance. I’d recommend taking a look at our top prop firms list

If you have any experience trading with Corp Equity Capital please do let me know in the comments down below.