Choosing a prop firm isn’t easy; most individuals want to invest in a company that’s going to take their trading career to the next level whilst knowing that the capital is in safe hands. What’s more, there are a wealth of prop firms out there offering different services with a ton of benefits and disadvantages to consider.

In this article we put T4T Capital to the test so that you don’t have to. We looked at the pros, cons, our experience and everything you need to know about the company. Let’s get into it…

[toc]

Who Are T4T Capital?

With a self proclaimed mission to provide trading opportunities for all retail forex traders, T4T Capital

As well as a wide range of trading accounts, T4T Capital offers traders a range of instruments including forex currency, equities, indices and commodities, meaning that you’re accommodated to no matter your preferred trading style. Seven types of accounts are available to trade, starting at $25,000 and sizing up to $1,000,000. The wide range of account sizes available to traders means that whether you’re happier trading at a safer level or looking to manage a sizeable amount of money, T4T Capital is likely to cater to your needs. Furthermore, profit share ranges from 60% all the way to a huge 80% should you make over 20% profit. Traders are able to use MT4

Additionally, T4T Capital offers a great opportunity to those wanting to learn about how to trade or even just wanting to brush up on their skills. Courses in forex trading can be found at their sister company traders4traders.com

It might be worth noting that leverage is lower than average, at a set 1:10 for all trading accounts. For those looking to scale up quickly, prop firms offering a higher leverage may be a better option for you; see our other articles to access other prop firm reviews!

However, with that being said, at first glance T4T Capital appears to be a great option to those looking for the opportunity to expand their trading accounts. With an undeniably competitive choice of account sizes to choose from and the freedom to trade with a variety of instruments, it’s definitely worth delving deeper into what this firm is all about.

Getting Funding From T4T Capital

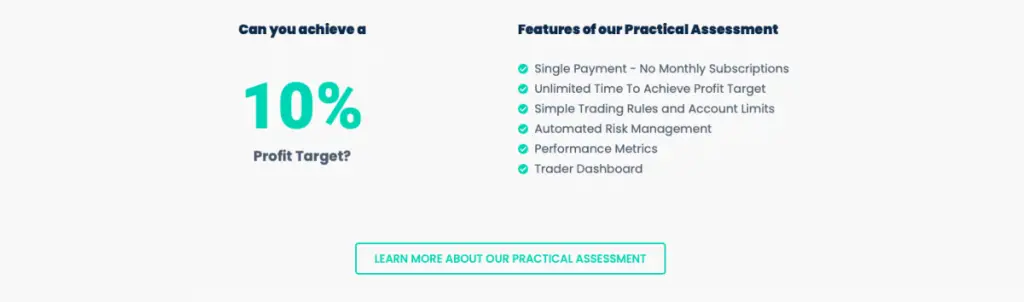

As with all prop trading firms, T4T Capital requires a preliminary Practical Assessment in order to ensure you have the ability to trade live with them. Using a Demo Account, traders will have unlimited time to pass the assessment without breaching the rules in order to set up a Live Trading Account.

Traders will need to achieve a 10% proft target, without:

a) exceeding the Weekly Loss Limit Level (calculated as 2% of the account starting balance subtracted from the week’s starting account balance)

b) exceeding the Maximum Drawdown Level (a trailing Drawdown until reaching the Account Start balance, by which it becomes static. Calculated by subtracting 4% from your highest account balance)

You are required to pay a small fee to take part in the Practical Assessment, a one time payment dependent on the size of the account you wish to use. For example, a Level 1 account of $25,000 would cost $125. Traders who have breached the rules/limits are able to pay a Reset fee (however this is not applicable to Live Accounts).

As with Live Trading Accounts, the wide range of account sizes offered to traders means that individuals with ranging levels of experience are able to take on the Practical Assessment and become able to trade live! Furthermore, the unlimited time to pass the challenge is hugely beneficial to traders by alleviating that stress and therefore lowering the risk of underperforming. Of course, taking a course in trading forex at Traders4Traders will boost your chances of passing significantly!

What Makes T4T Capital Different From Other Prop Firms?

There are several factors to consider when looking at T4T Capital that make it stand out from other prop firms.

Firstly is the lack of time limit of Practical Assessment challenge. Many prop firms like FTMO

When researching the prop firm, we found that another feature of T4T Capital that makes it different is their $1,000,000 Scaling Up Challenge. Achieving a profit target of 10% allows traders to progress to the next account size up. Whilst this is a common feature of most prop firms, what enables T4T Capital to stand out is that traders are able to choose from the 7 options of account sizes. Most other prop firms have a set entry level, however, should you have more experience with trading and are wanting to trade with a larger amount of money, T4T Capital can offer that to you. Even though it’s much faster to get funded with some other prop firms

Not only do T4T Capital offer a prop firm for traders looking to build upon their capital, Traders4Traders

Overall, quite a few factors mean that T4T Capital is a great option for those wanting more freedom over their trading choices.

Is Getting Funding From T4T Capital Realistic?

In short, getting funding from T4T Capital

Of course we’ve mentioned this several times already but the different levels of account types available to traders really does mean that no matter your level of trading, there will be an account appropriate for you. Those wanting to stay on the safer side, who perhaps have less experience are able to enter at a low level- with the option of Scaling Up- however those more confident in their trading abilities and wanting to push themselves further can enter at Level 7 with no restrictions.

The general message communicated by T4T Capital

T4T Capital Reviews- What Are Traders Saying?

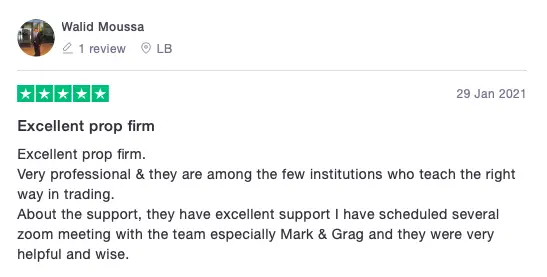

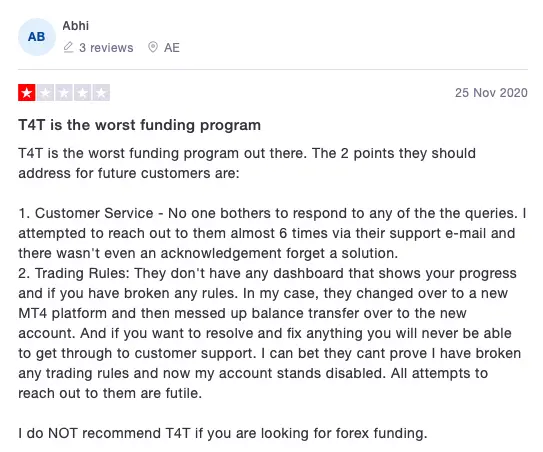

Whilst our reviews are able to give you a comprehensive overview of the prop firm and give you an idea of what it’s all about, we’ve always believed in the importance of the opinions of other traders. Individuals from all over the world, who’ve had their own personal experiences with companies are able to give even more of an idea about whether you should be choosing this prop firm to trade with. Please see the reviews

T4T Capital is rated at average on Trustpilot

The reviews on Trustpilot

It’s worth noting that over the last few months, there have only been 3 or 4 more reviews added. This is slightly concerning that the company isn’t growing as fast as some of the other companies in the industry. It’s important that prop firms are growing consistently as if the company goes bust, we lose our funded accounts. I’d recommend sitting on the fence for a minute, just to see how the company progresses over the next few months and see if that next level of growth kicks in.

Summary- Would We Recommend T4T Capital?

In summary, T4T Capital is a good option when looking at some of the industry leading prop firms

Leverages are fairly low, which may not be suitable for all traders, however the other benefits with this prop firm means that traders at all stages of experience have the ability to to both expand their skills further and make some real capital. In particular, their Scaling Up challenge stood out to us as it’s rare to find a prop firm that makes it easy to enter into the challenge with more than one option.

Mixed reviews give the prop firm a fairly average rating, so we would urge you to read some more reviews from personal experiences, however overall T4T Capital is a great option if you’re looking to sign up with a new prop firm! If you’re looking for a prop firm with a better reputation, please have a read of our ‘Top Prop Firms