Prop firms can be an absolutely great way for retail traders to reach that next level in their trading, from making small profits as a hobby, to managing large capital and trading for a living. With that being said, there are so many different companies with pros, cons and different perks that can make a huge difference to your success.

In this article we are going to be looking at The Prop Trading, a relatively new Australia prop firm offering funding for forex traders of up to $200,000. Let’s find out if this is the best company for you to be trading with…

NOTE: The Prop Trading has now been shut down and ceased trading, as of 2023! The below review is left up for completeness but please refer to our Best Prop Firm list

Lux Trading Firm

Lux Trading Firm are a highly rated prop firm offering initial funding of up to $1,000,000 with a 75% profit split.

They offer an amazing scaling program up to $10M, with multiple industry-leading features such as their unique offering to trade on TradingView’s charts, large selection of CFD’s, 500 Crypto’s, 12,000 Stocks, Elite Packages, and no time limits make it the perfect funding option!

Lux Trading is one of the few online prop firms offering real trading capital, and trading with a regulated A-book broker!

- Real Money Funding

- Brick & Mortar Business

- Great Reputation

- Funding Up To $10,000,000

Who Are The Prop Trading?

The Prop Trading

Along with the amazing profit split they are offering refundable fees for those traders passing the challenge stage, retries for traders that get close, and 1:200 leverage making it very possible for you to pass your funding!

Every 3 months, if you’ve had a minimum of 6% growth with an average of minimum 2% gain per month, an additional 25% of funding is added to your account, to reward you for your trading consistency!

With all of this being said, it sounds like a no brainer to get funding from The Prop Trading right now, doesn’t it? Well, let’s have a further look before we make any decisions.

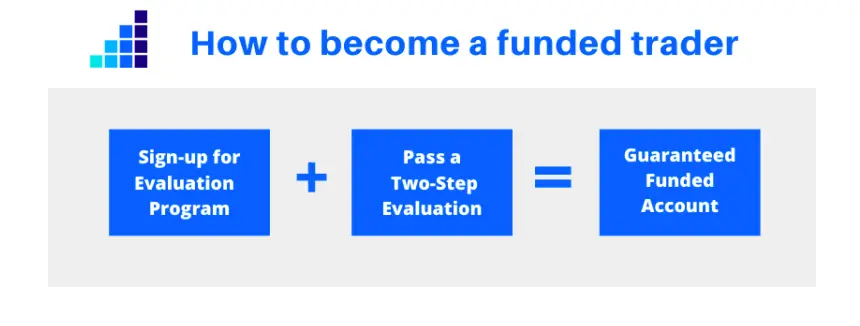

Getting Funding From The Prop Trading

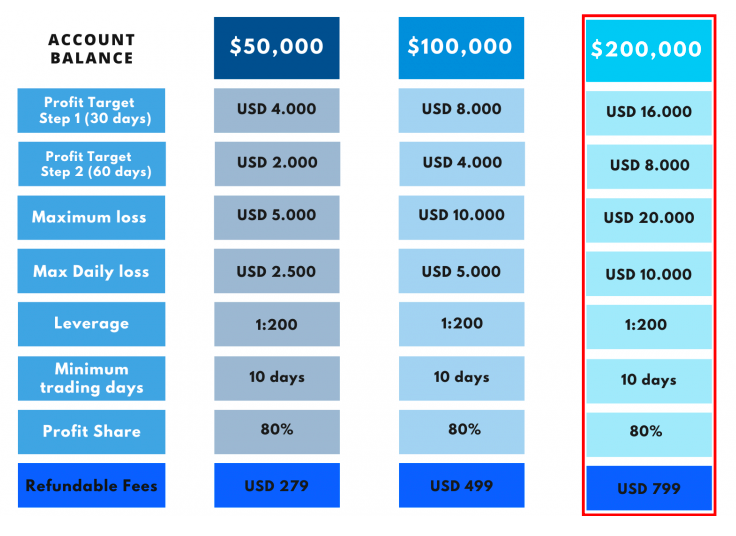

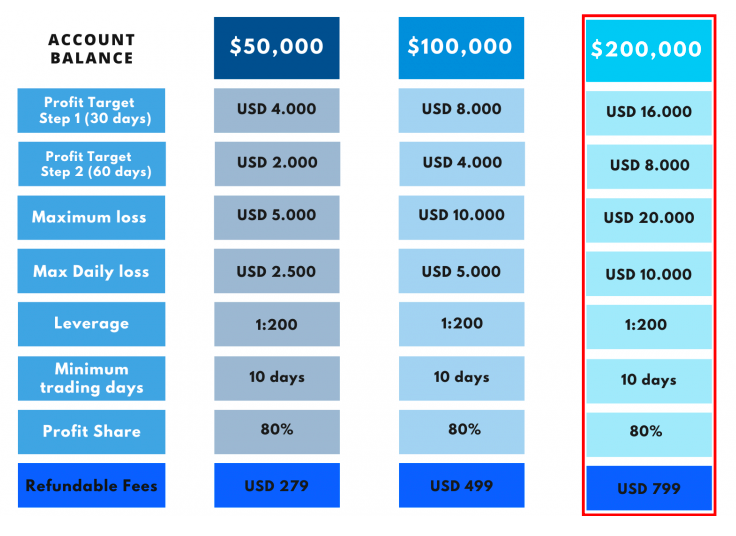

They offer funding for traders from $50,000 which will cost you $279, all the way to $200,000 which will set you back around $800. These fees are completely refundable if you pass the challenge and actually get funded. Like many of the firms in the industry right now, there is a 2 step verification and challenge process.

The profit share offered is 80%, one of the highest in the industry and withdrawals are processed monthly providing that you are flat on trades on the last trading session of each month, at midnight. 80% is a huge profit share, for example, Lux Trading Firm

What Makes The Prop Trading Different From Other Prop Firms?

The Prop Trading is fairly similar to a lot of the other leading prop firms in the industry. I have actually compiled a list of the best firms here

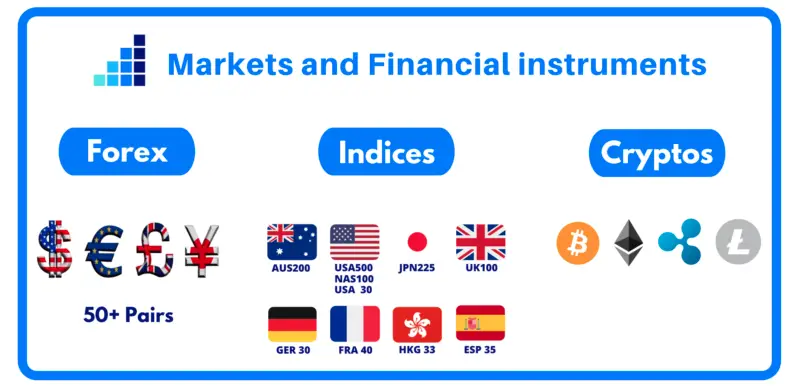

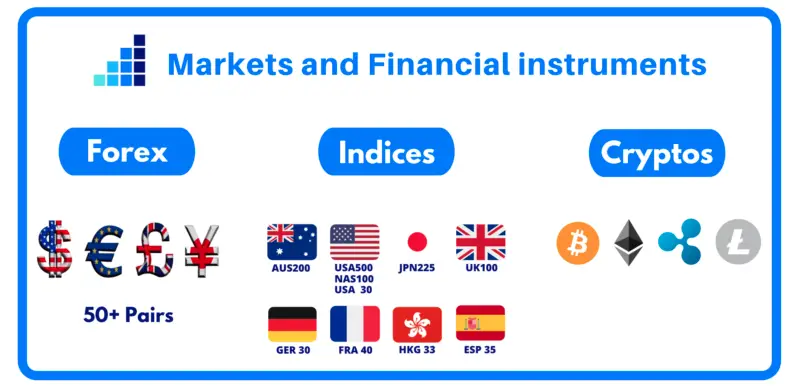

The main difference is the fact that The Prop Trading offers a range of indices and cryptos to trade, which most companies do not offer. Most of the popular firms offer a range of forex pairs, major and crosses, along with a few metals and that’s about it. This makes The Prop Trading a potentially much better choice for traders that like to stick with more volatile instruments like Indices and Crypto.

Another difference is the fact that they are offering a free trial to test the trading conditions and sharpen your skills before purchasing a paid trial. This is something that FTMO

MyFundedFx

MyFundedFx is proving to be one of the worlds most popular prop firms, taking over the industry in the last few months. MyFundedFx offer an innovative 1-step funding process, allowing traders to get funded from just 1 trade, potentially!

- Great Reputation

- High Levels Of Funding

- 1 Step Funding

Is Getting Funding From The Prop Trading Realistic?

Getting funding from The Prop Trading

Whether you choose the $50,000 funding, the $100,000 or the $200,000, the rules stay exactly the same…

- You have a 8% profit target in the first 30 days. There is a maximum loss of 10% and a maximum daily loss of 5%.

- If you’re successful, you then have 60 days to achieve a 4% profit. The same maximum daily loss and total loss rules apply.

This is going to be very achievable for most profitable traders in a good month and very closely mirrors the difficulty of the FTMO $200,000 challenge

If you think you are going to struggle hitting that 8% profit target in 30 days, don’t worry because there are firms offering instant funding with no challenge or verification needed! Check out my full reviews on DT4X

The Prop Trading Capital Scaling Plan

With some of the more well known trading firms in the industry, they are offering a capital scaling plan. This is a way to reward profitable and consistent traders, by increasing their account balances every milestone. The milestones are typically either every 4 months, or every 10% gain on the account.

The Prop Trading has a capital scaling plan, but it is extremely vague. All we know is that every 3 months, capital is increased by 25% for profitable traders. At the moment we don’t have any further information on the specifics of what is actually required to be eligible for compounded growth.

Even with our limited information, it’s great to see that TPT is offering any type of capital scaling. If we compare the percentage gain to the likes of DT4X’s scaling plan, The Prop Trading is still offering something much lower than the rest of the competitors in the market. Nevertheless, it’s nice to have!

The Prop Trading Reviews – What Are Traders Saying?

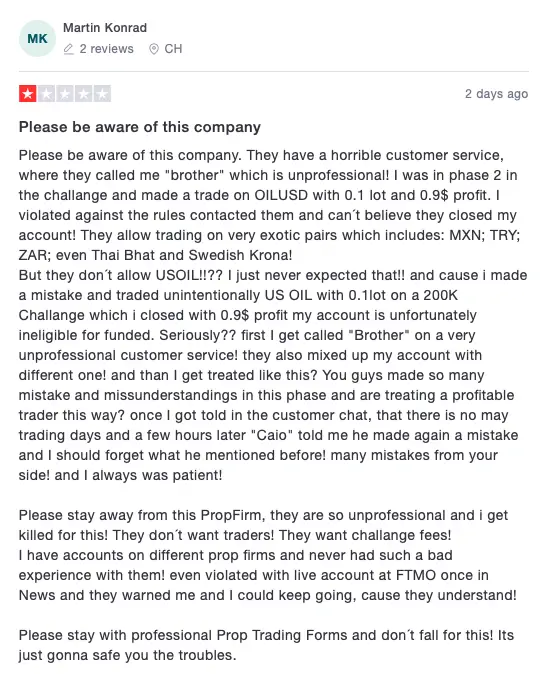

If a company in the forex trading industry, especially retail, scams people or does people out of a service, typically traders are very happy to speak out about it. This works in our favour as we can tell the general trustworthiness of a company by looking at the public reviews of traders all around the world who may have a different experience from ourselves. If you’ve read some of our best prop firm reviews, you’ll know we have saved ourselves a lot of potential issues by using traders experiences!

The Prop Trading is rated as Average on Trustpilot

From looking over the 397 reviews

I would encourage you to look over all of the comments in the reviews on Trustpilot

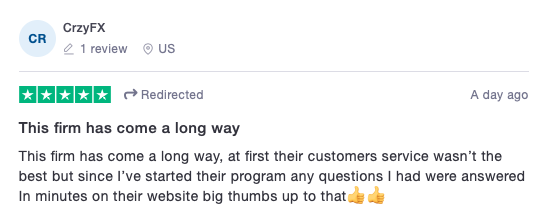

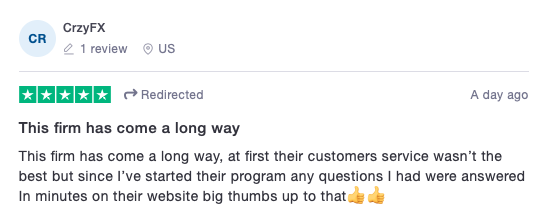

From consistently monitoring the reviews over the last few months, we are noticing that the company is gradually gaining a better reputation within the industry. The number of reviews are certainly slowly increasing which is a great sign, alongside the score gradually increasing too. This shows that the company is definitely working on all areas of the prop funding program that needed to be addressed.

Diversifying Risk From The Prop Trading

The reviews from traders

Using Multiple Prop Firms

The best way to reduce the risk, is to use multiple prop firms at once – this way, if one prop firm goes down or doesn’t pay out, you haven’t wasted months of trading on one account. For instance, using MyForexFunds and The Prop Trading

I would recommend using a forex trade copier

If you’re going to be taking our recommendation of using multiple prop firms to reduce your risk, I would definitely checkout our forex trade copier list

Summary – Is The Prop Trading A Scam?

In short, The Prop Trading

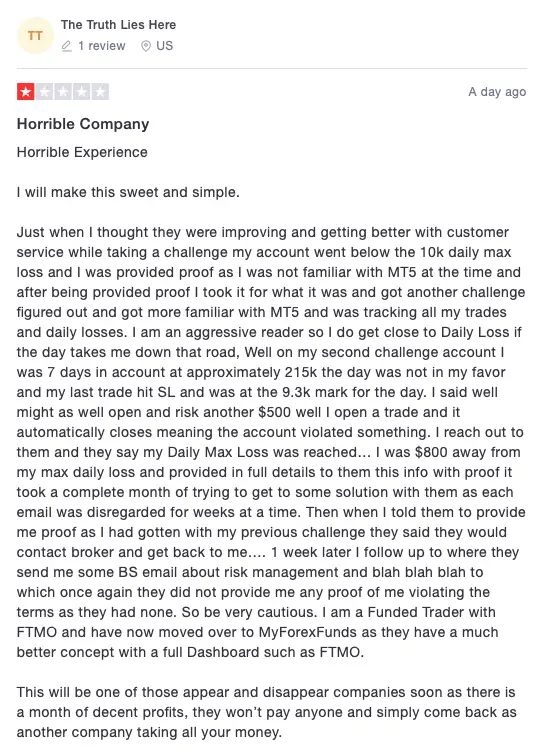

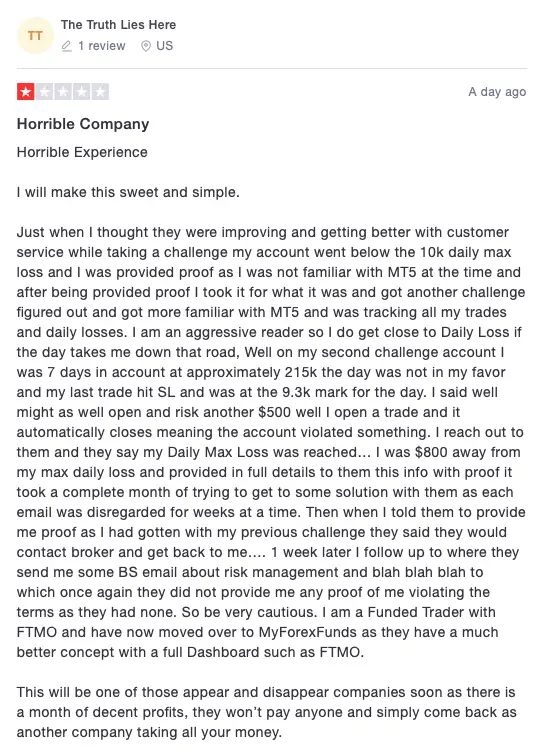

Although the company is offering a lot of perks and a great profit split, the bad reputation and awful reviews on forums is something we need to be careful with.

Any funding service that appears to be catching traders out and unfairly failing challenges is one that we want to stay away from, which appears to be happening by looking on the Trustpilot reviews

I would however recommend The Prop Trading if you’re an indices or crypto trader looking to take on additional capital and willing to take on the risks.

Most of the high rated prop firms

If you have any experience with this firm please do let me know in the comments down below. I do truly believe that the company is turning around and certainly one to look at for the future, but this so many strong competitors in the industry I wouldn’t say the risk is worth us taking, yet.