The forex industry is becoming much more regulated over the last few years but this doesn’t stop brokers around the world offering huge leverages of up to 1:500. The large leverages and promises of huge returns draw in new investors, with little investing experience. Newer investors and traders tend to have less starting capital and want to ‘test the waters’ with lower deposits. With that in mind, can you start forex trading with just $10?

You can start forex trading with just $10. For many offshore brokers, $10 will be the minimum deposit amount for a live trading account. Although it’s possible, starting with anything less than $1000 will be extremely hard and result in much tougher trading conditions, so it’s not advised. Let’s find out more…

Starting Forex With $10 – What Do We Need To Consider?

It is very possible to start forex trading with $10. With that being said, it’s really not advisable. Although the forex market tends to have a lower barrier of entry than other forms of investing, it is still investing. You’d rarely find an investor trying to get into stocks or indices with just $10 and for good reason. Let’s break down everything you need to consider if you’re trying to trade forex with just $10…

1. Brokers Minimum Deposit

If you’re only going to be starting with $10, sadly this will rule out a lot of the higher quality, regulated brokers. For instance IC Markets

Offshore brokers, like Hugosway

So although it’s possible to start with a minimum deposit $10, it will sadly allow you to only trade with lower quality brokers.

Even if you start trading forex with just $500

2. Leverage Offered To Traders

Luckily for traders with small deposits, a lot of forex brokers off a huge amount of leverage. If you’re unsure as to what leverage is, I’d recommend this Investopedia article here. Essentially, leverage is going to be crucial for traders with less than a few hundred thousand in their trading accounts.

Brokers leverage depends on where you are in the world and the regulations in your area. In Europe, a lot of brokers are only able to offer 1:30 leverage. This is great for swing traders or traders with large capital, but less great for traders with $10. Offshore brokers or CySec regulated brokers are able to offer much higher leverages of around 1:500. This will be perfect for traders looking to grow accounts and risk a lot of their balance per trade – although not advised.

3. Losing A Large Percentage Per Trade

If you’re starting forex with just $10, you’re going to be risking a large amount of your account in every trade. Let’s say you’re going to be trading the H1/H4 time frame. Realistically, you’re going to have a stop loss of around 25-50 pips, in a normal trade.

The minimum lot size most forex brokers will offer you is 0.01. A 0.01 lot size, over 25-50 pips, is going to be $2.50-$5.00 stop out. In short, this means you’re going to be accidentally risking 25-50% of your whole account, PER TRADE. In an ideal world, retail traders risk 1% per trade.

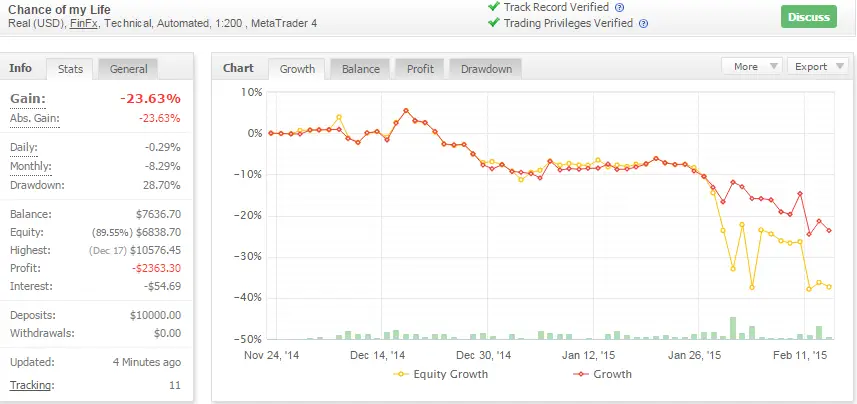

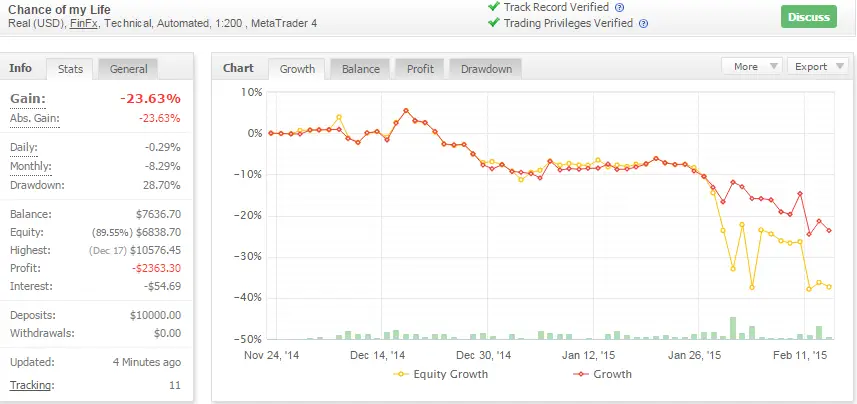

With the risk being so high, due to only having $10, your chance of blowing your account is 100%. You’re guaranteed to blow through your whole account balance and lose it within a few trades. You’re giving yourself about 2 traders before you’re down to an unusable amount of capital. Even the best traders in the world lose 5 or 6 trades in a row…

4. Education

Starting forex with $10 fundamentally doesn’t work for a number of reasons. One of these reasons is the fact that you’re not including the price of learning to trade forex.

There are two fees of education when it comes to forex. The first of which is blowing accounts. The majority of beginners traders pay an education fee in terms of ruining their first few trading accounts due to lack of risk management and generally just a lack of knowledge. The second fee comes in the form of paying a mentor or education provider to teach you how to trade the markets.

If you look at our best forex trading courses list

There are of course a lot of free online resources you can use to learn forex like Babypips

5. Doubling Your Forex Account From $10

If you’re starting forex with $10, presumably you aren’t going to be happy with 5% per month average return. Looking at the average returns of the few profitable forex traders, you’re going to be making around $0.50 per month, before even looking at taxes and commissions. This is a bit pointless, right?

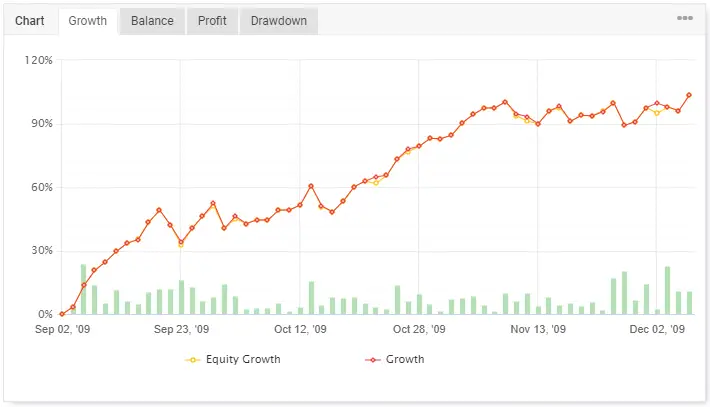

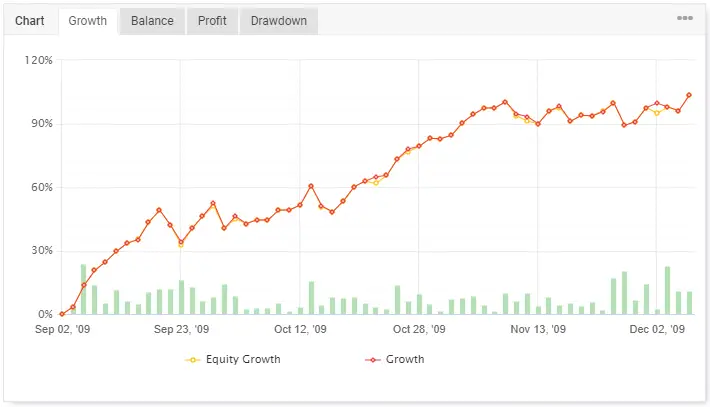

I’m going to assume that you will be wanting to flip your trading account massively and double it, frequently. There’s nothing wrong with this, providing you know the risks and are content with the fact you could blow it at any time. I’d recommend checking out my article here on how to double your forex trading account

How To Get Into Forex With Low Capital?

If you do have a low amount of capital, in this case $10, there are two things I would recommend instead of trading live straight away. Frankly, having only $10 in your trading account is not going to allow you to succeed, at all. As annoying as this is, if you gave the top 1% of forex traders just $10 to play with, I’d bet the majority of them would lose money.

Luckily, there are some good options instead…

1. Prop Firm Funding

You realistically aren’t going to have success with a $10 forex trading account. Even if you had the patience and skill needed to grow a $10 trading account, it’s going to be a long road until you’re trading a 6 figure account. In my opinion, you need at least $100,000 of trading capital to even think about becoming a professional trader.

Prop firms offer forex traders a huge amount of capital to trade with, risk free! You trade the companies money, they give you a profit split. For instance, DT4X Trader off an instant $50,000 funded account

They aren’t the only company offering this – there is a whole list of top prop firms offering funding

2. Demo Account Trading

Demo accounts are free trading accounts that use a simulated balance, on the real market. You’re able to practice trading and risk management in real time and actually track your trading performance. If you have a low amount of capital, I’m guessing you’re fairly young trying to get into forex.

I’d HIGHLY recommend using a free demo account to practice and get a track record for at least 6 months. Use one of the top forex brokers

You may feel like this will slow you down. It won’t slow you down. If you’re trading forex with just $10 you’re guaranteed to blow the account and most likely give up on trading. Spending a few months saving for a larger deposit of around $1000 will be much more valuable for you in the long run.

In Conclusion – Can You Start Forex Trading With Just $10?

In summary, you can start forex trading with $10 as many offshore brokers allow deposits as low as $10 and provide high leverage to traders. However, with a minimum lot size of 0.01, trading with just $10 will be extremely hard and is frankly doomed to fail. The minimum amount you want to have in a trading account is $1000.

If you have any experience trading $10 or have any comments regarding this article please do feel free to leave a comment down below – I’d love to hear from you.